@@@@Forex Trading Mein Bullish Continuation Pattern@@@@

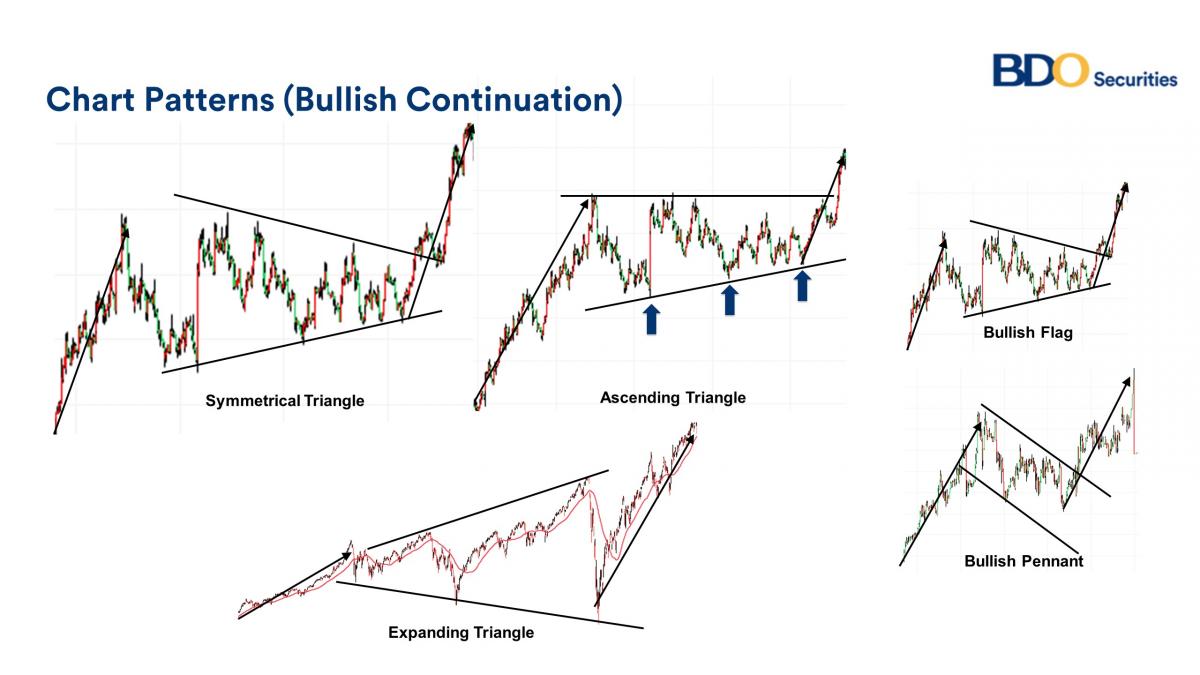

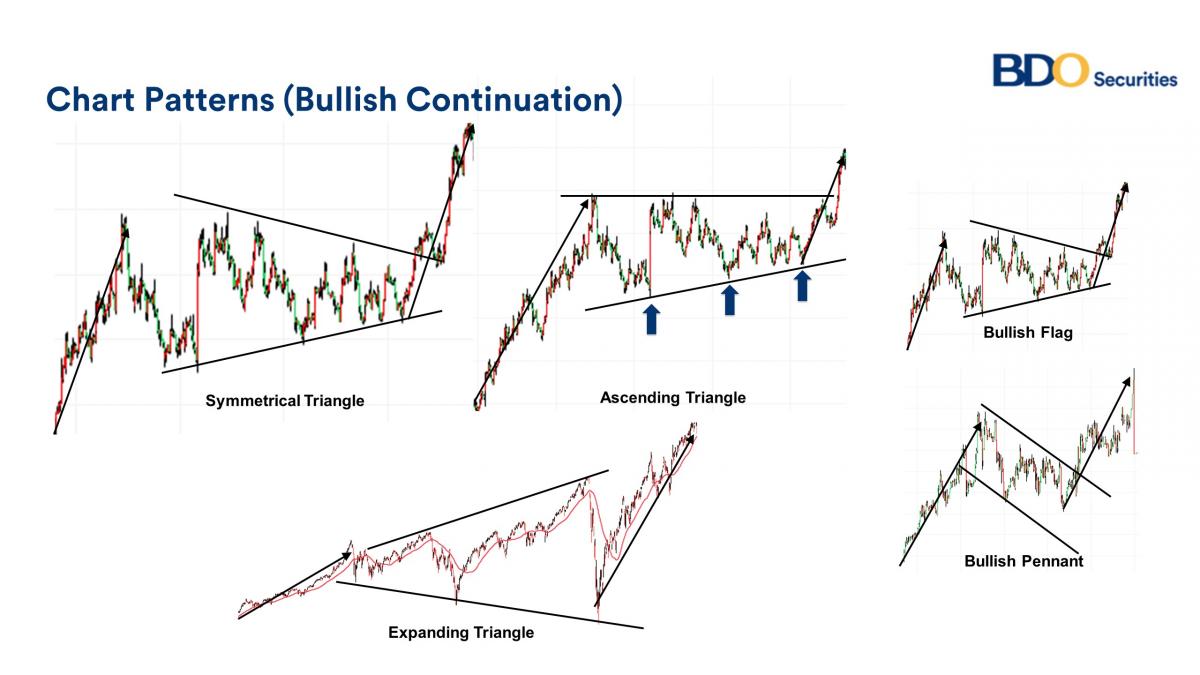

Forex trading mein "Bullish Continuation Pattern" ek technical analysis concept hai jo traders use karte hain market trends aur price movements ko analyze karne ke liye. Is pattern ka use karte hue traders market mein trend ka direction aur future price movements ka idea gain karte hain.

Yeh pattern tab hota hai jab ek uptrend ke baad price consolidation hoti hai aur phir trend continue hota hai. Bullish Continuation Patterns ka matlab hai ki ek uptrend ke baad price mein temporary consolidation hoti hai, lekin fir se uptrend continue hoti hai. Yeh pattern traders ko indicate karta hai ki bullish trend mein buying opportunities hai aur price ka next move up hoga.

@@@@Forex Trading Mein Bullish Continuation Pattern Ke Ehem Nukaat@@@@

main kuch aur important points aur examples provide kar sakta hoon Bullish Continuation Patterns ke baare mein:

Example ke taur par, agar aap ek stock ka chart analyze kar rahe hain aur dekhte hain ki price ek uptrend mein hai lekin ab temporary consolidation phase mein hai, aur chart par Flag ya Pennant pattern form ho raha hai, toh aapko bullish continuation ka signal mil sakta hai. Is situation mein traders price ke breakout ka wait karte hain aur phir uptrend ke continuation ke liye entry points find karte hain.

Har pattern ki validity aur accuracy ko confirm karne ke liye, traders ko aur technical indicators ka bhi use karna chahiye jaise ki moving averages, RSI, MACD, aur price action analysis. Har ek trade ke liye proper risk management aur stop-loss levels ka bhi dhyan rakhna important hai.

Forex trading mein "Bullish Continuation Pattern" ek technical analysis concept hai jo traders use karte hain market trends aur price movements ko analyze karne ke liye. Is pattern ka use karte hue traders market mein trend ka direction aur future price movements ka idea gain karte hain.

Yeh pattern tab hota hai jab ek uptrend ke baad price consolidation hoti hai aur phir trend continue hota hai. Bullish Continuation Patterns ka matlab hai ki ek uptrend ke baad price mein temporary consolidation hoti hai, lekin fir se uptrend continue hoti hai. Yeh pattern traders ko indicate karta hai ki bullish trend mein buying opportunities hai aur price ka next move up hoga.

@@@@Forex Trading Mein Bullish Continuation Pattern Ke Ehem Nukaat@@@@

main kuch aur important points aur examples provide kar sakta hoon Bullish Continuation Patterns ke baare mein:

- Cup and Handle Pattern: Yeh pattern ek rounded bottom (cup) ke saath ek small consolidation phase (handle) se milta hai. Jab price handle ke breakout ke baad cup ke upper level ko cross karta hai, tab traders bullish trend ka continuation expect karte hain.

- Bullish Pennant Pattern: Pennant pattern ke Bullish version mein price uptrend mein hoti hai, fir ek small consolidation phase hoti hai jisme price ek triangle formation mein trade karta hai. Jab triangle ke breakout hota hai, tab uptrend continue hoti hai.

- Bullish Head and Shoulders Pattern: Yeh pattern ek reversal pattern ke saath bhi related hai lekin kai baar bullish continuation mein bhi dekha jata hai. Is pattern mein price ek left shoulder banata hai, fir ek higher peak (head) banata hai, aur phir ek right shoulder banata hai jo left shoulder se lower hota hai. Jab price right shoulder ke breakout ke baad higher level ko cross karta hai, tab bullish trend continue hoti hai.

- Bullish Falling Wedge: Falling wedge pattern ek bullish continuation pattern hai jo downtrend ke baad dekha jata hai. Is pattern mein price lower highs aur lower lows banata hai, lekin ek falling wedge shape mein. Jab price wedge ke upper boundary ko cross karta hai, tab uptrend start hoti hai.

Example ke taur par, agar aap ek stock ka chart analyze kar rahe hain aur dekhte hain ki price ek uptrend mein hai lekin ab temporary consolidation phase mein hai, aur chart par Flag ya Pennant pattern form ho raha hai, toh aapko bullish continuation ka signal mil sakta hai. Is situation mein traders price ke breakout ka wait karte hain aur phir uptrend ke continuation ke liye entry points find karte hain.

Har pattern ki validity aur accuracy ko confirm karne ke liye, traders ko aur technical indicators ka bhi use karna chahiye jaise ki moving averages, RSI, MACD, aur price action analysis. Har ek trade ke liye proper risk management aur stop-loss levels ka bhi dhyan rakhna important hai.

تبصرہ

Расширенный режим Обычный режим