Introduction.

Hammer Candlestick Pattern Forex Mein Kya Hai?

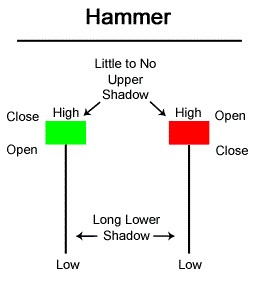

Hammer candlestick pattern forex mein ek bahut hi popular chart pattern hai. Is pattern ko kai traders apni trading strategy mein use karte hain. Is pattern ko identify karne ke liye, aapko ek candlestick ki shape aur color par dhyan dena hota hai. Hammer candlestick pattern bullish reversal pattern hai, jo ki downtrend ke baad aata hai.

Hammer candlestick pattern ek single candlestick pattern hota hai, jo ki ek chhoti body aur ek lambi lower shadow ke saath aata hai. Is pattern ko identify karne ke liye, aapko chhoti body aur lambi lower shadow par dhyan dena hota hai. Agar is pattern ko sahi tarike se identify kiya jaye, to iska matlab hai ki market ka trend ab upar ki taraf change hone wala hai.

Use of Hammer Candlestick Pattern.

aapko market ke trend ko identify karna hoga. Agar market downtrend mein hai aur ek hammer candlestick pattern form ho raha hai, to iska matlab hai ki market ka trend ab upar ki taraf change hone wala hai. Aap is point par long position le sakte hain, aur stop loss ko low of the hammer candlestick ke neeche rakh sakte hain. Agar market trend upar ki taraf change ho jata hai, to aapko achha profit mil sakta hai.

Hammer Candlestick Pattern more facts.

Hammer candlestick pattern forex mein ek bahut hi useful chart pattern hai. Is pattern ko identify karne ke liye, aapko chhoti body aur lambi lower shadow par dhyan dena hota hai. Is pattern ko sahi tarike se use karne se, aap apni trading strategy ko improve kar sakte hain aur achha profit kama sakte hain.

Hammer Candlestick Pattern Forex Mein Kya Hai?

Hammer candlestick pattern forex mein ek bahut hi popular chart pattern hai. Is pattern ko kai traders apni trading strategy mein use karte hain. Is pattern ko identify karne ke liye, aapko ek candlestick ki shape aur color par dhyan dena hota hai. Hammer candlestick pattern bullish reversal pattern hai, jo ki downtrend ke baad aata hai.

Hammer candlestick pattern ek single candlestick pattern hota hai, jo ki ek chhoti body aur ek lambi lower shadow ke saath aata hai. Is pattern ko identify karne ke liye, aapko chhoti body aur lambi lower shadow par dhyan dena hota hai. Agar is pattern ko sahi tarike se identify kiya jaye, to iska matlab hai ki market ka trend ab upar ki taraf change hone wala hai.

Use of Hammer Candlestick Pattern.

aapko market ke trend ko identify karna hoga. Agar market downtrend mein hai aur ek hammer candlestick pattern form ho raha hai, to iska matlab hai ki market ka trend ab upar ki taraf change hone wala hai. Aap is point par long position le sakte hain, aur stop loss ko low of the hammer candlestick ke neeche rakh sakte hain. Agar market trend upar ki taraf change ho jata hai, to aapko achha profit mil sakta hai.

Hammer Candlestick Pattern more facts.

Hammer candlestick pattern forex mein ek bahut hi useful chart pattern hai. Is pattern ko identify karne ke liye, aapko chhoti body aur lambi lower shadow par dhyan dena hota hai. Is pattern ko sahi tarike se use karne se, aap apni trading strategy ko improve kar sakte hain aur achha profit kama sakte hain.

تبصرہ

Расширенный режим Обычный режим