No announcement yet.

X

new posts

-

#1 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Top Strong forex Chart PatternsThank you for your attention -

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#2 Collapse

Top strong forex chart patterns

Forex Chart Patterns: Mufeed Aur Taqatwar Tareeqay

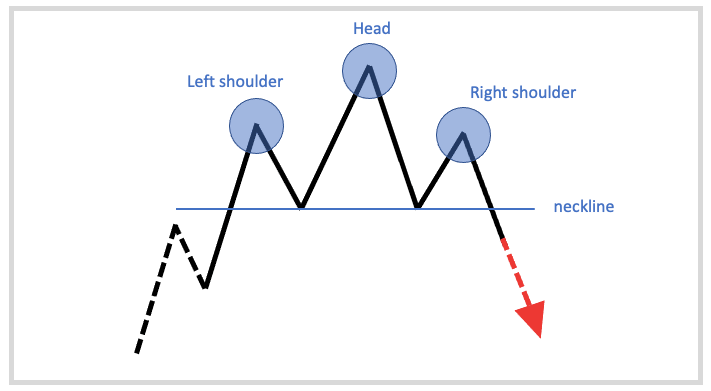

Forex trading ek shoba hai jahan traders currencies ke beech mein trading karte hain aur ismein chart patterns ek ahem hissa hain jo unhe trading decisions mein madad dete hain. Chart patterns market ki trend aur movement ko samajhne mein madadgar hote hain aur traders ko munafa kamane mein madad dete hain. Is article mein, hum kuch top strong forex chart patterns ke baare mein baat karenge.- Head and Shoulders (Sar aur Kandhay): Head and Shoulders pattern ek reversal pattern hai jo market ke trend ko change hone ki nishaani hoti hai. Is pattern mein ek "head" aur do "shoulders" hote hain jo price action mein dikhte hain. Agar price ek "head" ke baad doosre "shoulder" tak gir jata hai to yeh bearish signal hota hai aur agar ek "head" ke baad doosre "shoulder" tak price barh jata hai to yeh bullish signal hota hai.

- Double Top aur Double Bottom: Double Top pattern ek bearish reversal pattern hai jo uptrend ke baad aata hai. Ismein price do martaba ek specific level tak barhti hai phir gir jati hai, is se ek "M" shape banta hai. Double Bottom pattern bhi ek reversal pattern hai jo downtrend ke baad aata hai. Ismein price do martaba ek specific level tak gir jati hai phir barhti hai, is se ek "W" shape banta hai. Yeh patterns trend change ki nishani hoti hain.

- Symmetrical Triangle (Hamwari Trikona): Symmetrical Triangle pattern ek continuation pattern hai jo price consolidation ke doran banta hai. Ismein price higher lows aur lower highs banata hai, jis se triangle shape ban jati hai. Jab price triangle ke andar se bahar nikalta hai, toh yeh trend ka continuation signal hota hai.

- Ascending aur Descending Triangle: Ascending Triangle pattern ek bullish continuation pattern hai jo uptrend ke doran banta hai. Ismein price ek horizontal resistance line aur ek ascending support line ke darmiyan move karta hai. Descending Triangle pattern ek bearish continuation pattern hai jo downtrend ke doran banta hai. Ismein price ek horizontal support line aur ek descending resistance line ke darmiyan move karta hai. In patterns mein jab price triangle ke andar se bahar nikalta hai, toh trend ka continuation signal hota hai.

- Flag aur Pennant: Flag aur Pennant patterns short-term continuation patterns hain jo market mein short-term consolidation ke doran ban sakte hain. Flag pattern ek rectangle shape ka hota hai jabki Pennant pattern ek small symmetrical triangle hota hai. In patterns mein jab price breakout karta hai, toh trend ka continuation signal hota hai.

In top strong forex chart patterns ko samajhna aur pehchanna har trader ke liye zaroori hai. In patterns ko samajh kar, traders market ki movement ko predict kar sakte hain aur munafa kamane ka behtar faisla kar sakte hain. Lekin, yaad rahe ke sirf chart patterns par aitmaad karke trading na karein, balke market ki overall analysis aur risk management ko bhi ahmiyat dein.

- CL

- Mentions 0

-

سا0 like

-

#3 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Forex market mein trading karte waqt, chart patterns ko samajhna aur unka istemal karna bohot ahem hai. Chart patterns traders ko market ki movements ko samajhne mein madad karte hain aur unhe trading decisions banane mein guide karte hain. Yahan hum top strong forex chart patterns par baat karenge jo traders ke liye ahem hota hai:- Head and Shoulders (Sar, Kandhon aur Sar Kay Barabar): Yeh ek reversal pattern hai jo trend change indicate karta hai. Is pattern mein price ek peak form karta hai jo "head" kehlata hai, jo ke do smaller peaks, ya "shoulders", ke darmiyan hota hai. Jab price is pattern ko break karta hai, usually neck line ke neeche, toh yeh bullish se bearish ya bearish se bullish trend ki indication hoti hai.

- Double Top aur Double Bottom (Dobara Top aur Dobara Neechay): Double top ek bearish reversal pattern hai, jabki double bottom ek bullish reversal pattern hai. Double top mein price do baar ek certain level pe aake ruk jaata hai aur fir neeche jaata hai, jabki double bottom mein price do baar ek certain level pe aake ruk jaata hai aur fir upar jaata hai. Yeh patterns trend reversal ke liye indication dete hain.

- Ascending Triangle (Upar Charni): Yeh ek continuation pattern hai jo uptrend ke dauraan banta hai. Is pattern mein price higher lows banata hai aur ek horizontal resistance level ko touch karta hai. Jab price is resistance level ko break karta hai, toh yeh uptrend continue hone ki indication deta hai.

- Descending Triangle (Neeche Charni): Descending triangle ek continuation pattern hai jo downtrend ke dauraan banta hai. Is pattern mein price lower highs banata hai aur ek horizontal support level ko touch karta hai. Jab price is support level ko break karta hai, toh yeh downtrend continue hone ki indication deta hai.

- Symmetrical Triangle (Symmetrical Charni): Yeh pattern jab market indecision mein hota hai, ya phir consolidation phase mein hota hai. Is pattern mein price ek symmetrical triangle shape banata hai, jismein highs aur lows ek dusre ke qareeb hotay hain. Jab price is pattern ko break karta hai, toh trend direction clear hoti hai.

In chart patterns ko samajh kar aur unhe sahi tareeqay se istemal kar ke, traders apni trading strategies ko improve kar sakte hain aur better trading decisions le sakte hain. Lekin, yaad rahe ke chart patterns sirf ek tool hain aur dusre indicators aur analysis ke saath mila kar istemal karna chahiye. -

#4 Collapse

Yahan kuch top aur strong forex chart patterns roman Urdu mein diye gaye hain:

Bullish Engulfing Pattern

Bullish Engulfing pattern ek strong uptrend ki shuruaat ko darshata hai. Yeh pattern tab hota hai jab ek chhoti si red candle ek lambi green candle ko poori tarah se engulf kar leti hai. Yeh bullish reversal signal hai.

Bearish Engulfing Pattern

Bearish Engulfing pattern ek strong downtrend ki shuruaat ko darshata hai. Yeh pattern tab hota hai jab ek chhoti si green candle ek lambi red candle ko poori tarah se engulf kar leti hai. Yeh bearish reversal signal hai.

Double Top Pattern

Double Top pattern ek bearish reversal pattern hai. Yeh pattern tab hota hai jab price ek specific level par do baar top banata hai aur phir neeche gir jaata hai. Yeh selling pressure ka indication hai.

Double Bottom Pattern

Double Bottom pattern ek bullish reversal pattern hai. Yeh pattern tab hota hai jab price ek specific level par do baar bottom banata hai aur phir upar chadh jaata hai. Yeh buying pressure ka indication hai.

Head and Shoulders Pattern

Head and Shoulders pattern ek bearish reversal pattern hai. Yeh pattern tab hota hai jab price ek peak (head) ke around do smaller peaks (shoulders) banata hai. Yeh pattern downtrend ki shuruaat ko darshata hai.

Inverse Head and Shoulders Pattern

Inverse Head and Shoulders pattern ek bullish reversal pattern hai. Yeh pattern tab hota hai jab price ek dip (head) ke around do smaller dips (shoulders) banata hai. Yeh pattern uptrend ki shuruaat ko darshata hai.In chart patterns ko samajhna aur unka istemal karna forex trading mein ahem hai. Ye patterns market sentiment ko samajhne aur trading decisions ko lenay mein madad karte hain. Lekin, hamesha yaad rahe ke kisi bhi single pattern par bharosa na karein aur hamesha dusre technical indicators aur market conditions ko bhi consider karein.

-

#5 Collapse

Forex market mein trading karte waqt, chart patterns ki understanding ka buhat ahem role hota hai. Ye patterns traders ko market trends aur price movements ka achi tarah se analysis karne mein madad karte hain. Yahan hum kuch top strong forex chart patterns ke bare mein baat karenge jo traders ke liye useful hotay hain:- Head and Shoulders Pattern (Sar aur Kandhon ka Pattern): Ye pattern trend reversal ko indicate karta hai. Ismein ek "head" aur do "shoulders" hote hain jo price chart par visible hote hain. Jab price ek trend ke against move karta hai aur phir wapis original trend ki taraf jaata hai, to yeh pattern form hota hai.

- Double Top and Double Bottom Pattern (Dobara Top aur Dobara Bottom ka Pattern): Ye patterns bhi trend reversal ko indicate karte hain. Double top mein price do dafa ek level par pohanchti hai aur phir neeche jaati hai, jabke double bottom mein price do dafa ek level par gir kar phir se ooper jaati hai.

- Ascending Triangle Pattern (Upar Chalne Wala Triangle Pattern): Ye pattern uptrend mein hota hai aur price ek diagonal line se upar jaati hai, lekin ek horizontal resistance level ke neeche nahi girati. Traders is pattern ko breakout ke liye dekhte hain, jab price resistance level ko break karke upar jaati hai.

- Descending Triangle Pattern (Neeche Chalne Wala Triangle Pattern): Ye pattern downtrend mein hota hai aur price ek diagonal line se neeche jaati hai, lekin ek horizontal support level ke ooper nahi jaati. Is pattern ko bhi breakout ke liye dekha jata hai, jab price support level ko break karke neeche jaati hai.

- Flag and Pennant Patterns (Jhanda aur Nishan Pattern): Ye patterns trend continuation ko indicate karte hain. Flag pattern mein price ek straight line ke baad ek chhoti si range mein trade karti hai, jabke pennant pattern mein price ek small triangle mein consolidate hoti hai.

In chart patterns ko samajh kar aur unka sahi tarah se istemal karke traders market mein hone wale movements ko predict kar sakte hain. Lekin hamesha yaad rahe ke kisi bhi ek indicator ya pattern par pura bharosa na karein aur hamesha risk management ka dhyan rakhein.

-

#6 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Top Best Forex Chart Patterns.

1. Head and Shoulders Pattern:

Yeh pattern bearish trend ke baad dekha jata hai aur ismein price pehle se high hota hai jisse ek sar (head) banta hai aur phir uske dono taraf shoulders ban jate hain.

2. Double Top Pattern:

Yeh pattern bullish trend ke baad dekha jata hai aur ismein price pehle se high hota hai phir dubara high par jata hai jisse ek double top pattern ban jata hai.

3. Double Bottom Pattern:

Yeh pattern bearish trend ke baad dekha jata hai aur ismein price pehle se low hota hai phir dubara low par jata hai jisse ek double bottom pattern ban jata hai.

4. Ascending Triangle Pattern:

Yeh pattern bullish trend ke baad dekha jata hai aur ismein price higher lows par move karta hai aur ek resistance line ko touch karta hai jisse ascending triangle pattern ban jata hai.

5. Descending Triangle Pattern:

Yeh pattern bearish trend ke baad dekha jata hai aur ismein price lower highs par move karta hai aur ek support line ko touch karta hai jisse descending triangle pattern ban jata hai.

6. Bullish Flag Pattern:

Yeh pattern bullish trend ke baad dekha jata hai aur ismein price ek horizontal trend line ke upar move karta hai aur phir ek small downward trend line ke baad dubara upward move karta hai jisse bullish flag pattern ban jata hai.

7. Bearish Flag Pattern:

Yeh pattern bearish trend ke baad dekha jata hai aur ismein price ek horizontal trend line ke niche move karta hai aur phir ek small upward trend line ke baad dubara downward move karta hai jisse bearish flag pattern ban jata hai.

8. Pennant Pattern:

Yeh pattern bullish ya bearish trend ke baad dekha jata hai aur ismein price ek triangle shape banata hai jisse pennant pattern ban jata hai.

In sabhi patterns ko samajhna aur identify karna forex trading mein bahut important hai kyunki ye traders ko future price movement ke baare mein idea dete hain.

-

#7 Collapse

Forex trading ek challenging aur fascinating duniya hai jahan traders duniya bhar ke currencies ke daamo mein trade karte hain. Ek achay trader ke liye, sahi chart patterns ko samajhna aur unhe istemal karna bohot zaroori hai. Yeh article aapko un mukhtalif aur mazboot forex chart patterns ke bare mein batayega jo aksar traders ke liye mufeed hotay hain.- Head and Shoulders (Sar aur Kandha): Head and Shoulders pattern ek reversal pattern hai jo uptrend ya downtrend ke baad aata hai. Is pattern mein, price ek high point (head) ke around banata hai, phir do chhote high points (shoulders) follow karte hain. Jab price ne neckline ko break kar diya, yeh indicate karta hai ke trend change hone wala hai.

- Double Top/Bottom (Doopla Chhat/Neecay): Double Top ya Double Bottom pattern ek reversal indicator hai jo market ke direction change hone ka signal deta hai. Double Top mein price do baar ek specific level par touch karta hai aur phir neeche gir jata hai. Double Bottom mein price do baar ek specific level par touch karta hai aur phir upar chad jata hai. Yeh pattern traders ke liye mukhtalif entry aur exit points provide karta hai.

- Triangles (Tikona): Triangles chart patterns mein include hote hain symmetrical triangles, ascending triangles, aur descending triangles. Yeh patterns price ke consolidation aur phir breakout ko darust karte hain. Symmetrical triangle mein, high aur low points ek line se connect karte hain, jabki ascending triangle mein highs ek line par hote hain aur lows neeche ki taraf move karte hain. Descending triangle mein highs neeche ki taraf move karte hain aur lows ek line par hote hain.

- Flag and Pennant (Jhandi aur Penaant): Flag aur Pennant patterns continuation patterns hote hain jo short-term price consolidation ke baad aate hain. Flag pattern mein price ek straight line ke saath move karta hai, jaise ek flag pole, phir ek small rectangle ya pennant form hota hai. Yeh pattern typically ek strong trend ke doran dekha jata hai aur continuation ko darust karta hai.

- Cup and Handle (Cup aur Handle): Cup and Handle pattern ek bullish continuation pattern hai jo ek strong uptrend ke doran aata hai. Is pattern mein, price ek "cup" shape form karta hai, phir ek chhota "handle" form hota hai. Jab handle break hota hai, yeh ek aur uptrend ke indication ke taur par consider hota hai.

In mukhtalif chart patterns ko samajhna aur unhe identify karna forex traders ke liye bohot zaroori hai. In patterns ki madad se traders entry aur exit points ka faisla kar sakte hain aur market ke movements ko samajh sakte hain. Lekin yaad rahe ke kisi bhi ek pattern par pura bharosa na rakhe aur hamesha dusri technical analysis tools ke saath in patterns ko confirm karein. -

#8 Collapse

Forex Chart Patterns: Fawaid Aur Nuksanat

Tasreeh

Forex market mein chart patterns ka istemal trading strategies ke tor par ahem hai. In patterns ko samajhna aur unka istemal karna traders ko price action ko samajhne mein madad karta hai aur unhe market trends ko samajhne mein madad deta hai. Jab traders chart patterns ko sahi taur par pehchante hain aur samajhte hain, to unhe trading ke faislay lene mein asani hoti hai aur unka risk kam hota hai. Is article mein, ham top strong forex chart patterns ke baray mein tafseel sa bayan karenge, unke fawaid aur nuksanat ke saath.

Introduction to Forex Chart Patterns

Forex chart patterns trading mein ahem role ada karte hain, kyunke ye market trends aur price action ko samajhne ka aik tareeqa hain. In patterns ko pehchan kar, traders market mein hone wale mukhtalif scenarios ko samajh sakte hain aur unke trading strategies ko behtar bana sakte hain. Chart patterns ka istemal technical analysis ka aik hissa hai aur ye traders ko price movements ka andaza lagane mein madad karta hai.

Top Strong Forex Chart Patterns- Head and Shoulders Pattern

Head and Shoulders pattern aik reversal pattern hai jo trend ki change ko darust karta hai. Ye pattern jab market trend ke end par hota hai aur bearish trend ko indicate karta hai. Is pattern mein teen peaks hote hain: ek head aur do shoulders. Head peak market ke high point ko represent karta hai, jabke shoulders peaks head ke dono taraf hote hain aur kam zyada highs ko darust karte hain. Head and Shoulders pattern jab market ke trend ke end par hota hai, to ye bullish trend ko indicate karta hai.

Fawaid:- Head and Shoulders pattern ko pehchanna asan hota hai aur iska istemal trading strategies mein madadgar hota hai.

- Is pattern ki wajah se traders ko market ke trend ki reversal ke baare mein pata chalta hai, jo unhe trading opportunities faraham karta hai.

Nuksanat:- Kabhi-kabhi false signals bhi ho sakte hain, jiski wajah se traders ko galat trading decisions lena pad sakta hai.

- Head and Shoulders pattern ke confirmation ke liye thori si mushkil hoti hai, isliye traders ko aur technical analysis ka istemal karna hota hai.

- Double Top aur Double Bottom Patterns

Double Top aur Double Bottom patterns bhi reversal patterns hote hain jo market ke trend ki change ko darust karte hain. Double Top pattern jab market ke uptrend ke end par hota hai aur Double Bottom pattern jab market ke downtrend ke end par hota hai. Double Top pattern mein do peaks hote hain jo ek doosre ke barabar hote hain, jabke Double Bottom pattern mein do bottoms hote hain jo ek doosre ke barabar hote hain. Ye patterns market ke reversal ko indicate karte hain aur traders ko opposite direction mein trading karne ka signal dete hain.

Fawaid:- Double Top aur Double Bottom patterns ko pehchanna asan hota hai aur inka istemal trading strategies mein asani se kiya ja sakta hai.

- In patterns ke istemal se traders ko market ke trend ki reversal ke baare mein early indications milte hain, jo unhe profitable trading opportunities faraham karta hai.

Nuksanat:- False signals ki possibility hoti hai, jo traders ko galat trading decisions lena pad sakta hai.

- Is pattern ke confirmation ke liye additional technical analysis ki zaroorat hoti hai, jaise ke volume analysis ya price action analysis.

- Ascending aur Descending Triangles

Ascending aur Descending Triangles bhi chart patterns hote hain jo market ke trend ki continuation ya reversal ko darust karte hain. Ascending Triangle pattern bullish trend ko indicate karta hai, jabke Descending Triangle pattern bearish trend ko indicate karta hai. Ascending Triangle pattern mein ek horizontal resistance line aur ek ascending trend line hoti hai, jabke Descending Triangle pattern mein ek horizontal support line aur ek descending trend line hoti hai. Ye patterns market ke price consolidation ke doran bante hain aur traders ko potential breakout points ke baare mein pata chal jata hai.

Fawaid:- Ascending aur Descending Triangles ko pehchanna asan hota hai aur inka istemal trading strategies mein asani se kiya ja sakta hai.

- In patterns se traders ko market ke trend ke continuation ya reversal ke baare mein pata chalta hai, jo unhe trading opportunities faraham karta hai.

Nuksanat:- False breakouts ki possibility hoti hai, jo traders ko galat trading decisions lena pad sakta hai.

- Is patterns ke confirmation ke liye additional technical analysis ki zaroorat hoti hai, jaise ke volume analysis ya price action analysis.

- Pennant aur Flags

Pennant aur Flags patterns bhi continuation patterns hote hain jo market ke trend ki continuation ko darust karte hain. Ye patterns market ke price consolidation ke doran bante hain aur ek short-term pause ko indicate karte hain. Pennant pattern ek small symmetrical triangle hota hai, jabke Flag pattern ek small rectangle hota hai. Ye patterns market ke price mein temporary halt ko indicate karte hain, lekin phir se trend ke direction mein move hotay hain.

Fawaid:- Pennant aur Flags patterns ko pehchanna asan hota hai aur inka istemal trading strategies mein asani se kiya ja sakta hai.

- In patterns se traders ko market ke trend ke continuation ke baare mein pata chalta hai, jo unhe trading opportunities faraham karta hai.

Nuksanat:- False signals ki possibility hoti hai, jo traders ko galat trading decisions lena pad sakta hai.

- Is patterns ke confirmation ke liye additional technical analysis ki zaroorat hoti hai, jaise ke volume analysis ya price action analysis.

Conclusion

Forex chart patterns trading mein ahem role ada karte hain aur traders ko market ke trends aur price action ko samajhne mein madad karte hain. In patterns ko sahi taur par pehchanna aur samajhna traders ke liye ahem hai, kyunke ye unhe trading ke faislay lene mein asani deta hai aur unka risk kam hota hai. Top strong forex chart patterns jaise ke Head and Shoulders, Double Top aur Double Bottom, Ascending aur Descending

- Head and Shoulders Pattern

-

#9 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Strong Forex Chart Patterns: Mazboot Forex Chart Patterns

Forex trading mein mukhtalif chart patterns hote hain jo traders ke liye ahem hote hain kyunki ye market ke movements ko samajhne aur trading decisions lene mein madad karte hain. Neeche kuch mazboot Forex chart patterns diye gaye hain:

1. Double Bottom (Dohra Neecha): Double Bottom pattern bearish trend ke baad dekha jata hai aur bullish reversal ka indication deta hai. Is pattern mein do successive lows hote hain jo ek dusre ke kareeb hote hain.

2. Double Top (Dohra Chhat): Double Top pattern bullish trend ke baad dekha jata hai aur bearish reversal ka indication deta hai. Is pattern mein do successive highs hote hain jo ek dusre ke kareeb hote hain.

3. Head and Shoulders (Sar aur Kandho): Head and Shoulders pattern typically uptrend ke baad dekha jata hai aur bearish reversal ka indication deta hai. Is pattern mein ek central peak (head) aur do smaller peaks (shoulders) hote hain.

4. Inverse Head and Shoulders (Ulat Sar aur Kandho): Inverse Head and Shoulders pattern typically downtrend ke baad dekha jata hai aur bullish reversal ka indication deta hai. Is pattern mein ek central trough (head) aur do smaller troughs (shoulders) hote hain.

5. Bullish Engulfing Candlestick Pattern (Bullish Engulfing Mombatti Pattern): Bullish Engulfing pattern downtrend ke baad dekha jata hai aur bullish reversal ka indication deta hai. Is pattern mein ek small bearish candlestick ko ek large bullish candlestick engulf karta hai.

6. Bearish Engulfing Candlestick Pattern (Bearish Engulfing Mombatti Pattern): Bearish Engulfing pattern uptrend ke baad dekha jata hai aur bearish reversal ka indication deta hai. Is pattern mein ek small bullish candlestick ko ek large bearish candlestick engulf karta hai.

In mazboot Forex chart patterns ka istemal karke traders market ke movements ko samajh sakte hain aur sahi waqt par trading decisions lene mein madad le sakte hain.

Top Strong forex Chart Patterns -

#10 Collapse

Forex trading, jo ke duniya bhar mein bohot mashhoor hai, woh ek aise field hai jahan traders chart patterns ka istemal karte hain taake market ki movements ko samajh sakein aur trading decisions le sakein. Chart patterns trading mein ek ahem hissa hain, aur in mein se kuch strong aur popular patterns hain jo traders ke liye khaas ahmiyat rakhte hain.- Head and Shoulders Pattern (Sar aur Kandhon ka Pattern): Yeh ek reversal pattern hai jo market ke trend ko indicate karta hai. Is pattern mein price pehle upar jaati hai, phir ek "head" banata hai, phir niche aakar "shoulders" ban jaate hain. Jab price shoulders ko break karti hai, toh yeh ek reversal signal hota hai.

- Double Top aur Double Bottom Patterns: Double top pattern jab hota hai jab price do baar ek particular level tak jaata hai aur wahan se girne lagta hai, jo ke ek bearish reversal signal hai. Double bottom pattern mein price do baar ek level tak girta hai aur phir se upar jaane lagta hai, jo ek bullish reversal signal hai.

- Flags aur Pennants: Yeh patterns typically strong trending markets mein dekhe jaate hain. Flags ek rectangle shape ke pattern hote hain, jabki pennants ek triangle shape ke hote hain. Dono patterns mein price ek choti si consolidation phase ke baad phir se trend ke direction mein move karta hai.

- Ascending aur Descending Triangles: Ascending triangle pattern mein higher lows aur ek horizontal resistance line hoti hai, jabki descending triangle pattern mein lower highs aur ek horizontal support line hoti hai. In dono patterns mein breakout ke baad strong moves dekhe jaate hain.

- Symmetrical Triangles: Symmetrical triangles ek consolidation phase ko indicate karte hain, jab price ek symmetric shape mein move karta hai. Breakout ke baad, price typically strong move karta hai.

In chart patterns ko samajhna aur unhe sahi tareeke se trade karna forex trading ke liye bohot zaroori hai. Lekin, yeh patterns keval ek tool hain aur khud mein perfect nahi hote, isliye risk management aur proper analysis bhi zaroori hai. Trading mein safalta paane ke liye, traders ko apne trading plan ko barqarar rakhna chahiye aur hamesha market ko samajhne ki koshish karni chahiye.

-

#11 Collapse

Introduction of the post.

I hope my Frind Forex trading ek shoba hai jahan traders currencies ke beech mein trading karte hain aur ismein chart patterns ek ahem hissa hain jo unhe trading decisions mein madad dete hain. Chart patterns market ki trend aur movement ko samajhne mein madadgar hote hain aur traders ko munafa kamane mein madad dete hain. Is article mein, hum kuch top strong forex chart patterns ke baare mein baat karenge.- Head and Shoulders (Sar aur Kandhay): Head and Shoulders pattern ek reversal pattern hai jo market ke trend ko change hone ki nishaani hoti hai. Is pattern mein ek "head" aur do "shoulders" hote hain jo price action mein dikhte hain. Agar price ek "head" ke baad doosre "shoulder" tak gir jata hai to yeh bearish signal hota hai aur agar ek "head" ke baad doosre "shoulder" tak price barh jata hai to yeh bullish signal hota hay.

- Double Top aur Double Bottom: Double Top pattern ek bearish reversal pattern hai jo uptrend ke baad aata hai. Ismein price do martaba ek specific level tak barhti hai phir gir jati hai, is se ek "M" shape banta hai. Double Bottom pattern bhi ek reversal pattern hai jo downtrend ke baad aata hai. Ismein price do martaba ek specific level tak gir jati hai phir barhti hai, is se ek "W" shape banta hai. Yeh patterns trend change ki nishani hoti hay.

- Symmetrical Triangle (Hamwari Trikona): Symmetrical Triangle pattern ek continuation pattern hai jo price consolidation ke doran banta hai. Ismein price higher lows aur lower highs banata hai, jis se triangle shape ban jati hai. Jab price triangle ke andar se bahar nikalta hai, toh yeh trend ka continuation signal hota hay.

- Ascending aur Descending Triangle: Ascending Triangle pattern ek bullish continuation pattern hai jo uptrend ke doran banta hai. Ismein price ek horizontal resistance line aur ek ascending support line ke darmiyan move karta hai. Descending Triangle pattern ek bearish continuation pattern hai jo downtrend ke doran banta hai. Ismein price ek horizontal support line aur ek descending resistance line ke darmiyan move karta hai. In patterns mein jab price triangle ke andar se bahar nikalta hai, toh trend ka continuation signal hota hay.

- Flag aur Pennant: Flag aur Pennant patterns short-term continuation patterns hain jo market mein short-term consolidation ke doran ban sakte hain. Flag pattern ek rectangle shape ka hota hai jabki Pennant pattern ek small symmetrical triangle hota hai. In patterns mein jab price breakout karta hai, toh trend ka continuation signal hota hay.

In top strong forex chart patterns ko samajhna aur pehchanna har trader ke liye zaroori hai. In patterns ko samajh kar, traders market ki movement ko predict kar sakte hain aur munafa kamane ka behtar faisla kar sakte hain. Lekin, yaad rahe ke sirf chart patterns par aitmaad karke trading na karein, balke market ki overall analysis aur risk management ko bhi ahmiyat dein gay. -

#12 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Top Strong Forex Chart Patterns

Forex trading mein, chart patterns market ke future movement ko samajhne aur forecast karne ke liye use hote hain. Ye patterns traders ko help karte hain entry aur exit points identify karne mein. Yahaan kuch top strong forex chart patterns hain jo aapko trading decisions mein madadgar sabit ho sakte hain:

1. Head and Shoulders

Definition

Head and Shoulders pattern ek reversal pattern hai jo market ke direction ke change ko indicate karta hai. Is pattern ke do types hain: Head and Shoulders Top (bearish reversal) aur Head and Shoulders Bottom (bullish reversal).

Formation

Head and Shoulders Top: Ismein teen peaks hoti hain, jismein middle peak sabse high hota hai (head), aur dono side ki peaks (shoulders) usse kam high hoti hain.

Head and Shoulders Bottom: Ismein do troughs aur ek lower trough hoti hai jo middle mein hoti hai (head), aur dono side ke troughs (shoulders) usse uchi hoti hain.

Trading Strategy

Top: Jab pattern complete hota hai aur price neckline ko break karti hai, toh sell signal generate hota hai.

Bottom: Jab price neckline ko break karti hai, toh buy signal generate hota hai.

2. Double Top and Double Bottom

Definition

Double Top aur Double Bottom patterns bhi reversal patterns hain jo price ke direction mein change ko signal dete hain.

Formation

Double Top: Do high points hote hain jo ek hi level pe hoti hain, aur unke beech mein ek trough hota hai.

Double Bottom: Do low points hote hain jo ek hi level pe hoti hain, aur unke beech mein ek peak hota hai.

Trading Strategy

Double Top: Jab price second top ke baad neckline ko break karti hai, toh sell signal generate hota hai.

Double Bottom: Jab price second bottom ke baad neckline ko break karti hai, toh buy signal generate hota hai.

3. Flags and Pennants

Definition

Flags aur Pennants short-term continuation patterns hain jo market ki existing trend ko continue karte hain.

Formation

Flag: Flag pattern ek strong trend ke baad hota hai, jo ek rectangular shape mein hota hai. Iske do types hain: Bullish Flag aur Bearish Flag.

Pennant: Pennant pattern bhi ek strong trend ke baad hota hai, jo triangular shape mein hota hai. Iske bhi do types hain: Bullish Pennant aur Bearish Pennant.

Trading Strategy

Flags: Buy/sell signal tab generate hota hai jab price flag ke upper/lower boundary ko break karti hai.

Pennants: Buy/sell signal tab generate hota hai jab price pennant ke boundary ko break karti hai.

4. Cup and Handle

Definition

Cup and Handle pattern ek bullish continuation pattern hai jo long-term uptrend ko signal karta hai.

Formation

Is pattern mein ek cup shape banata hai jo rounded bottom aur phir ek handle banata hai jo thoda sa downward sloping hota hai.

Trading Strategy

Buy signal tab generate hota hai jab price handle ke high ko break karti hai.

5. Triangle Patterns

Definition

Triangles continuation patterns hain jo market ke consolidation aur breakout phase ko show karte hain.

Formation

Ascending Triangle: Ismein upper boundary horizontal hoti hai aur lower boundary upward sloping hoti hai.

Descending Triangle: Ismein lower boundary horizontal hoti hai aur upper boundary downward sloping hoti hai.

Symmetrical Triangle: Ismein dono boundaries converging hoti hain aur pattern ke andar price consolidate hoti hai.

Trading Strategy

Ascending Triangle: Buy signal tab generate hota hai jab price upper boundary ko break karti hai.

Descending Triangle: Sell signal tab generate hota hai jab price lower boundary ko break karti hai.

Symmetrical Triangle: Buy/sell signal tab generate hota hai jab price triangle ke boundary ko break karti hai.

6. Rectangles

Definition

Rectangle pattern ek consolidation pattern hai jo market ke sideways movement ko indicate karta hai.

Formation

Ismein price ek horizontal range ke andar move karti hai jismein upper aur lower boundaries hoti hain.

Trading Strategy

Buy signal tab generate hota hai jab price upper boundary ko break karti hai aur sell signal tab generate hota hai jab price lower boundary ko break karti hai.

7. Wedges

Definition

Wedge patterns continuation ya reversal patterns hote hain jo trend ke continuation ya reversal ko signal dete hain.

Formation

Rising Wedge: Ismein price upper aur lower boundaries ke saath upward sloping hoti hai.

Falling Wedge: Ismein price upper aur lower boundaries ke saath downward sloping hoti hai.

Trading Strategy

Rising Wedge: Sell signal tab generate hota hai jab price lower boundary ko break karti hai.

Falling Wedge: Buy signal tab generate hota hai jab price upper boundary ko break karti hai.

8. Engulfing Patterns

Definition

Engulfing patterns reversal patterns hote hain jo market ke direction ke change ko indicate karte hain.

Formation

Bullish Engulfing: Ek small bearish candle ke baad ek larger bullish candle hoti hai jo purani candle ko engulf karti hai.

Bearish Engulfing: Ek small bullish candle ke baad ek larger bearish candle hoti hai jo purani candle ko engulf karti hai.

Trading Strategy

Bullish Engulfing: Buy signal tab generate hota hai jab bullish engulfing pattern complete hota hai.

Bearish Engulfing: Sell signal tab generate hota hai jab bearish engulfing pattern complete hota hai.

Conclusion

Ye chart patterns forex trading mein market ke future movements ko predict karne mein madad karte hain. Har pattern ki formation aur trading strategy alag hoti hai, aur inhe samajhna aur effectively use karna important hai. Patterns ka proper use karne se aap apni trading decisions ko improve kar sakte hain aur market ke changes ke sath align ho sakte hain.

-

#13 Collapse

Top Strong Forex Chart Patterns

1. Head and Shoulders

Head and Shoulders Pattern

Head and Shoulders ek popular reversal pattern hai jo price trend ke reversal ko signal deta hai. Yeh pattern teen peaks ko form karta hai: ek central peak (head) aur do smaller peaks (shoulders) dono sides pe.

Bullish Head and Shoulders

Agar yeh pattern downtrend ke baad develop hota hai, to isse bullish trend reversal signal milta hai. Pattern ke complete hone ke baad, price usually ek significant uptrend start karti hai.

Bearish Head and Shoulders

Agar yeh pattern uptrend ke baad develop hota hai, to isse bearish reversal ka signal milta hai. Pattern complete hone ke baad, price ek downtrend ko follow karti hai.

2. Double Top and Double Bottom

Double Top Pattern

Double Top pattern ek bearish reversal pattern hai jo do high points ko indicate karta hai, jo ek resistance level ko touch karte hain. Do high points ke beech mein ek valley hota hai. Is pattern ke baad, price typically ek strong downtrend ko follow karti hai.

Double Bottom Pattern

Double Bottom pattern bullish reversal pattern hai jo do low points ko show karta hai, jo ek support level ko touch karte hain. Do low points ke beech mein ek peak hota hai. Is pattern ke complete hone ke baad, price usually ek strong uptrend ko follow karti hai.

3. Flags and Pennants

Flag Pattern

Flag pattern ek continuation pattern hai jo ek strong trend ke baad develop hota hai. Is pattern mein price ek parallel channel ke andar consolidate karti hai. Flag ke complete hone ke baad, price trend ko continue karti hai.

Pennant Pattern

Pennant pattern bhi ek continuation pattern hai jo ek strong trend ke baad develop hota hai. Is pattern mein price consolidation ke doran ek small symmetrical triangle banaati hai. Pennant ke complete hone ke baad, price trend ko continue karti hai.

4. Cup and Handle

Cup and Handle Pattern

Cup and Handle pattern ek bullish continuation pattern hai. Is pattern mein price pehle ek cup shape (U-shaped) banaati hai aur uske baad ek handle (consolidation phase) form hota hai. Handle ke complete hone ke baad, price ek strong uptrend ki taraf move karti hai.

5. Rising and Falling Wedges

Rising Wedge Pattern

Rising Wedge pattern ek bearish reversal pattern hai jo ek uptrend ke dauran develop hota hai. Is pattern mein price ek upward sloping channel ke andar consolidate karti hai. Rising Wedge ke complete hone ke baad, price typically ek downtrend ko follow karti hai.

Falling Wedge Pattern

Falling Wedge pattern ek bullish reversal pattern hai jo ek downtrend ke dauran develop hota hai. Is pattern mein price ek downward sloping channel ke andar consolidate karti hai. Falling Wedge ke complete hone ke baad, price usually ek uptrend ko follow karti hai.

6. Triangles

Ascending Triangle Pattern

Ascending Triangle pattern ek bullish continuation pattern hai jo ek uptrend ke dauran develop hota hai. Is pattern mein ek horizontal resistance level aur ek upward sloping support line hoti hai. Pattern ke complete hone ke baad, price ek strong uptrend ko follow karti hai.

Descending Triangle Pattern

Descending Triangle pattern ek bearish continuation pattern hai jo ek downtrend ke dauran develop hota hai. Is pattern mein ek horizontal support level aur ek downward sloping resistance line hoti hai. Pattern ke complete hone ke baad, price ek strong downtrend ko follow karti hai.

Symmetrical Triangle Pattern

Symmetrical Triangle pattern ek neutral pattern hai jo consolidation ke doran develop hota hai. Is pattern mein price do converging trendlines ke andar move karti hai. Pattern ke complete hone ke baad, price ya to bullish trend ko follow karti hai ya bearish trend ko, depending on breakout direction.

7. Engulfing Patterns

Bullish Engulfing Pattern

Bullish Engulfing pattern ek bullish reversal pattern hai jo do candlesticks ke combination se bana hota hai. Pehli candlestick choti red body hoti hai aur doosri candlestick larger green body hoti hai jo pehli candlestick ko completely engulf karti hai. Is pattern ke baad, price typically ek uptrend ko follow karti hai.

Bearish Engulfing Pattern

Bearish Engulfing pattern ek bearish reversal pattern hai jo do candlesticks ke combination se bana hota hai. Pehli candlestick choti green body hoti hai aur doosri candlestick larger red body hoti hai jo pehli candlestick ko completely engulf karti hai. Is pattern ke baad, price usually ek downtrend ko follow karti hai.

8. Doji

Doji Pattern

Doji pattern ek indecision pattern hai jo price ke opening aur closing levels ek hi point par hone ko show karta hai. Is pattern ke baad market indecisive hota hai aur price ka direction future price action ke basis pe decide hota hai. Doji pattern ka analysis context ke basis pe kiya jata hai, jaise ki preceding trend aur surrounding patterns.

9. Hammer and Hanging Man

Hammer Pattern

Hammer pattern ek bullish reversal pattern hai jo ek downtrend ke baad develop hota hai. Is pattern mein ek small body hoti hai jo upper side pe close hoti hai aur ek long lower shadow hoti hai. Hammer ke baad, price typically ek uptrend ko follow karti hai.

Hanging Man Pattern

Hanging Man pattern ek bearish reversal pattern hai jo ek uptrend ke baad develop hota hai. Is pattern mein ek small body hoti hai jo lower side pe close hoti hai aur ek long lower shadow hoti hai. Hanging Man ke baad, price usually ek downtrend ko follow karti hai.

10. Morning Star and Evening Star

Morning Star Pattern

Morning Star pattern ek bullish reversal pattern hai jo ek downtrend ke baad develop hota hai. Is pattern mein teen candlesticks hoti hain: pehli red candlestick, doosri small-bodied candlestick (star) aur teesri green candlestick. Morning Star ke baad, price typically ek strong uptrend ko follow karti hai.

Evening Star Pattern

Evening Star pattern ek bearish reversal pattern hai jo ek uptrend ke baad develop hota hai. Is pattern mein teen candlesticks hoti hain: pehli green candlestick, doosri small-bodied candlestick (star) aur teesri red candlestick. Evening Star ke baad, price usually ek downtrend ko follow karti hai.

Conclusion

Forex trading mein chart patterns ki pehchan aur unka sahi analysis bahut zaroori hai. In patterns ke through aap market trends aur reversals ko identify kar sakte hain aur informed trading decisions le sakte hain. Har pattern ka context aur confirmation signals ko samajhna zaroori hai taake aap trading strategies ko accurately implement kar saken.

- CL

- Mentions 0

-

سا0 like

-

#14 Collapse

Forex mein Top Strong Chart Patterns ki Tashreeh

Forex mein chart patterns ki ahmiyat bohat zyada hai. Ye patterns traders ko market ki movement aur trend ka andaza lagane mein madad deta hai. Yahan hum Top Strong forex chart patterns ki tashreeh karn ge.

1. Double Top Pattern

Double top pattern market mein trend reversal ki indication hai. Is pattern mein market do baar apni high price tak pohanchti hi aur phir neechay aati hai. Is pattern ko confirm karne ke liye traders volume ar price ki movement ko dekhte hain.

2. Double Bottom Pattern

Double bottom pattern market mein trend reversal ki indication hai. Is pattern mein market do baar apni low price tak pohanchti hai aur phir upar aati hai. Is pattern ko confirm karne ke liye traders volume ar price ki movement ko dekhte hain.

3. Head and Shoulders Pattern

Head and shoulders pattern market mein trend reversal ki indication hai. Is pattern mein market apni high price tak pohanchti hai, phir neechay aati hai aur phir dobara high price tak pohanchti hai. Is pattern ko confirm karne ke liye traders volume ar price ki movement ko dekhte hain.

4. Inverse Head and Shoulders Pattern

Inverse head and shoulders pattern market mein trend reversal ki indication hai. Is pattern mein market apni low price tak pohanchti hai, phir upar aati hai aur phir dobara low price tak pohanchti hai. Is pattern ko confirm karne ke liye traders volume ar price ki movement ko dekhte hain.

5. Ascending Triangle Pattern

Ascending triangle pattern bullish trend ki indication hai. Is pattern mein market apni high price tak pohanchti hai aur phir kuch arse ke baad neechay aati hai. Is pattern ko confirm karne ke liye traders volume aur price ki movement ko dekhte hain.

6. Descending Triangle Pattern

Descending triangle pattern bearish trend ki indication hai. Is pattern mein market apni low price tak pohanchti h aur phir kuch arse ke baad upar aati hai. Is pattern ko confirm karne ke liye traders volume aur price ki movement ko dekhte hain.

Conclusion

In chart patterns ko samajhna aur confirm karna forex trading mein bohat ahmiyat rakhta hai. Ye patterns traders ko market ki movement aur trend ka andaza lagane mein madad deta hai.

-

<a href="https://www.instaforex.org/ru/?x=ruforum">InstaForex</a> -

#15 CollapseInstaSpot: کسی بھی EPS اور بینک سے منافع واپس لیں، اور EPS اور cryptocurrencies کے تبادلے پر 7% تک کمائیں۔

Top Strong Forex Chart Patterns

Forex trading mein chart patterns market ke movements aur trends ko samajhne ke liye bohot zaroori hain. Yeh patterns traders ko potential entry aur exit points identify karne mein madad karte hain. Yahan hum kuch top strong forex chart patterns discuss karenge jo traders ke liye bohot valuable hote hain.

1. Head and Shoulders Pattern

Head and Shoulders ek bearish reversal pattern hai jo uptrend ke baad banta hai. Is pattern mein teen peaks hote hain: middle peak (head) sabse lamba hota hai aur do side peaks (shoulders) usse chhote hote hain. Jab neckline break hoti hai, to yeh strong sell signal hota hai.

2. Double Top and Double Bottom

Double Top ek bearish reversal pattern hai jo uptrend ke baad banta hai aur do baar same high touch karke neeche aata hai. Double Bottom ek bullish reversal pattern hai jo downtrend ke baad banta hai aur do baar same low touch karke upar jaata hai. In patterns ko trade karte waqt neckline ka break confirmatory signal hota hai.

3. Triangle Patterns

Triangle patterns market ke consolidation phases ko show karte hain aur teen types mein aate hain: Ascending, Descending, aur Symmetrical. Ascending Triangle bullish breakout ka signal hota hai, Descending Triangle bearish breakout ka, aur Symmetrical Triangle kisi bhi direction mein breakout indicate kar sakta hai.

4. Flag and Pennant

Flag aur Pennant patterns continuation patterns hain jo strong price movements ke baad bante hain. Flag pattern ek parallel channel banata hai jabke Pennant ek small symmetrical triangle ki tarah hota hai. In patterns ke breakout ke baad price movement ka continuation expected hota hai.

5. Wedge Patterns

Wedge patterns bhi reversal aur continuation patterns ho sakte hain. Rising Wedge ek bearish pattern hai aur Falling Wedge ek bullish pattern hai. Yeh patterns price ke narrowing range ko show karte hain aur breakout strong price movement ko indicate karta hai.

Conclusion

Yeh top strong forex chart patterns traders ke liye valuable tools hain jo market trends aur potential trading opportunities ko identify karne mein madad karte hain. In patterns ko samajhkar aur effectively use karke, traders apne trading strategies ko optimize kar sakte hain aur successful outcomes achieve kar sakte hain.

اب آن لائن

ہم مواصلات کے پلیٹ فارم کے طور پر فاریکس فورم فاریکس پاکستان کے آپ کے انتخاب کی تعریف کرتے ہیں۔

موجودہ وقت 08:03 PM (GMT+5)۔

Working...

X

تبصرہ

Расширенный режим Обычный режим