DEFINITION.

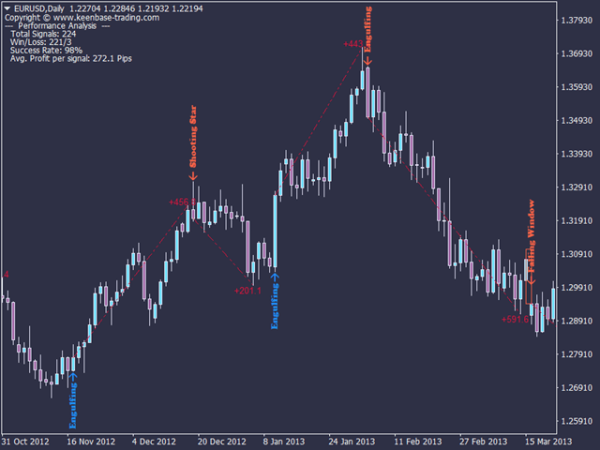

Dear traders market mein Ess pattern ko dekhte hue aisa feel hota hy kay market mein eik downward movement ho raha hy, aur price action downward move kar rahi hy. Ess pattern ka origin aur concept technical analysis ki domain sey hy, jahan traders price action ko analyze kar kay future ke movements ko predict karte hain. Kuch traders pattern confirm hone ke saath hi short position enter karte hyn, taki who significant downward move capture kar sake. Kuch traders pullback ya pattern ki retest ka wait karte hain, phir trade enter karte hain. Enn elements aur factors ki understanding kay baad trader ess qail ho jaty hein kay who accurate time per market mein entry kar kay positive earning ker sakaein. Descending Hawk pattern ko aik mustaqil signal samjha jata hy jab ye ek lambi uptrend ke baad hota hy. Yeh dikhata hy ke bullish ko control khona shuru ho hukka hy, aur bears control ko barha rahe hain, jis se potential trend reversal hota hy.

DESCRIPTIVE FORMATION.

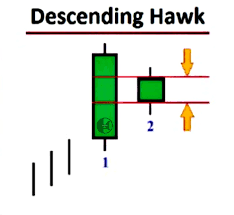

Forex market ka Ye khaas pattern aik green color ki candle se start hota hy, jo kaafi normal aur clear body rakhta hy, aur phir second candle aati hy, who bhi green hoti hay jis kay body small hoti hy. Ess pattern mein jab price action support zone se neeche drop hota hy, aur downtrend ko continue karta hy, traders sell positions enter karte hain, aur breakout kay baad further downward movement ko expect karte hain. Agar price action support zone se neeche drop hoti hy aur phir reversal ke signs show karta hy,, tou traders long term positions enter kar sakte hain, aur reversal and upward movement market mein expect kerty hein. Traders doosre technical indicators aur price action analysis ka istemal karte hain taake ess pattern k confirmation mein koi mistake na ho. Bescause jab accurately pattern ki identity hi jati hay tou traders kay leye apna order place kerny mein koi confusion nahi hoti.

HOW TO USE IN TRADING.

My fellows Price chart par jab prices buyers k bohut ziada pressure ki waja se bullish jati hy, to wahan par aksar iss ko reversal honne kay chances hote hen, jiss main aksar kuch aise pattern hote hen, jo do candles par mushtamil hote hen.. Descending hawk pattern ko aik permanent and mature signal samjha jata hy, jab yeh eik long uptrend kay baad hota hy. Yeh dikhata hy ke bullish ko control loss shuru ho chuka hy, aur bears control ko increase ker rahe hain, jis sey potential trend reversal hota hy. Pattern kay top par sellers ziada active ho jate hen. Trend reversal pattern par trading trend continuation patterns ki nisbat ziada riski hoti hy. ess waja se pattern par trading sey pehle market main aik bearish ya black candle ka hona zarori hy. Jiss ki real body honi chaheye, jiss mein open aur close same point par na ho. Agar pattern kay baad bullish candle form hoti hy, tou yeh pattern invalid ho jaye ga, jiss par entry nahi karni chaheye. Kyu kay ess time per traders wrong prediction ker kay apni trade ko risk mein involve ho sakty hein.

Dear traders market mein Ess pattern ko dekhte hue aisa feel hota hy kay market mein eik downward movement ho raha hy, aur price action downward move kar rahi hy. Ess pattern ka origin aur concept technical analysis ki domain sey hy, jahan traders price action ko analyze kar kay future ke movements ko predict karte hain. Kuch traders pattern confirm hone ke saath hi short position enter karte hyn, taki who significant downward move capture kar sake. Kuch traders pullback ya pattern ki retest ka wait karte hain, phir trade enter karte hain. Enn elements aur factors ki understanding kay baad trader ess qail ho jaty hein kay who accurate time per market mein entry kar kay positive earning ker sakaein. Descending Hawk pattern ko aik mustaqil signal samjha jata hy jab ye ek lambi uptrend ke baad hota hy. Yeh dikhata hy ke bullish ko control khona shuru ho hukka hy, aur bears control ko barha rahe hain, jis se potential trend reversal hota hy.

DESCRIPTIVE FORMATION.

Forex market ka Ye khaas pattern aik green color ki candle se start hota hy, jo kaafi normal aur clear body rakhta hy, aur phir second candle aati hy, who bhi green hoti hay jis kay body small hoti hy. Ess pattern mein jab price action support zone se neeche drop hota hy, aur downtrend ko continue karta hy, traders sell positions enter karte hain, aur breakout kay baad further downward movement ko expect karte hain. Agar price action support zone se neeche drop hoti hy aur phir reversal ke signs show karta hy,, tou traders long term positions enter kar sakte hain, aur reversal and upward movement market mein expect kerty hein. Traders doosre technical indicators aur price action analysis ka istemal karte hain taake ess pattern k confirmation mein koi mistake na ho. Bescause jab accurately pattern ki identity hi jati hay tou traders kay leye apna order place kerny mein koi confusion nahi hoti.

HOW TO USE IN TRADING.

My fellows Price chart par jab prices buyers k bohut ziada pressure ki waja se bullish jati hy, to wahan par aksar iss ko reversal honne kay chances hote hen, jiss main aksar kuch aise pattern hote hen, jo do candles par mushtamil hote hen.. Descending hawk pattern ko aik permanent and mature signal samjha jata hy, jab yeh eik long uptrend kay baad hota hy. Yeh dikhata hy ke bullish ko control loss shuru ho chuka hy, aur bears control ko increase ker rahe hain, jis sey potential trend reversal hota hy. Pattern kay top par sellers ziada active ho jate hen. Trend reversal pattern par trading trend continuation patterns ki nisbat ziada riski hoti hy. ess waja se pattern par trading sey pehle market main aik bearish ya black candle ka hona zarori hy. Jiss ki real body honi chaheye, jiss mein open aur close same point par na ho. Agar pattern kay baad bullish candle form hoti hy, tou yeh pattern invalid ho jaye ga, jiss par entry nahi karni chaheye. Kyu kay ess time per traders wrong prediction ker kay apni trade ko risk mein involve ho sakty hein.

تبصرہ

Расширенный режим Обычный режим