Introduction of Day and Algo Trading

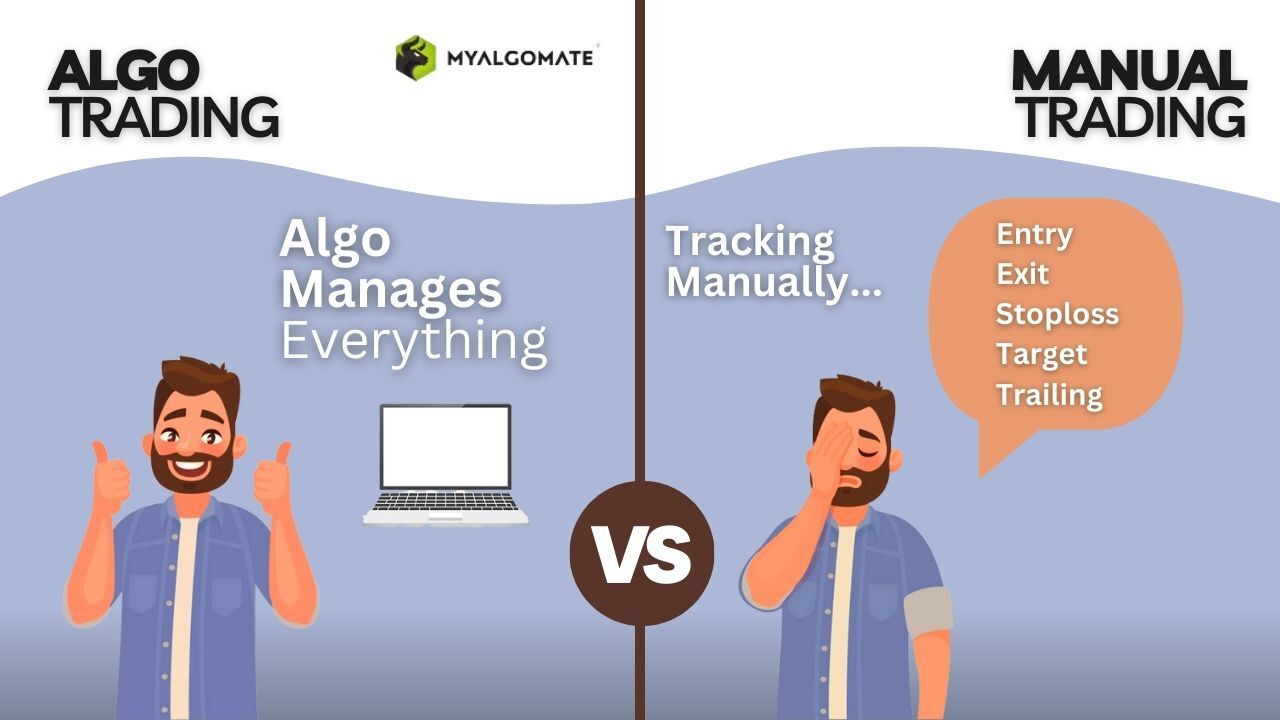

Day trading aur algo trading dono tajziyaati ma'ashiyat mein aham hissa ada karte hain. Ye dono tijarat ki alag-alag shaklon ko darust karte hain, magar unke tareeqe aur tareeqay mukhtalif hotay hain.Day trading, jise rozana ki tijarat bhi kaha jata hai, ek aam tijarat ka tareeqa hai jismein traders ek din mein mukhtalif securities ko kharidte aur farokht karte hain. Ye tijarat bohot ziada active hoti hai aur traders ko chand ghanton ya mintoo mein faisle lena hota hai.Algo trading, jise algorithmic trading bhi kaha jata hai, ek computerized tareeqa hai jismein tajziyaati algorithms istemal kiye jate hain tijarat karne ke liye. Ye algorithms market ki harkat ko monitor aur trade execute karne ke liye istemal kiye jate hain.

Features of Day Trading and Algo Trading

Drawbacks of Day Trading and Algo Trading

Day trading aur algo trading dono tajziyaati ma'ashiyat mein aham hissa ada karte hain. Ye dono tijarat ki alag-alag shaklon ko darust karte hain, magar unke tareeqe aur tareeqay mukhtalif hotay hain.Day trading, jise rozana ki tijarat bhi kaha jata hai, ek aam tijarat ka tareeqa hai jismein traders ek din mein mukhtalif securities ko kharidte aur farokht karte hain. Ye tijarat bohot ziada active hoti hai aur traders ko chand ghanton ya mintoo mein faisle lena hota hai.Algo trading, jise algorithmic trading bhi kaha jata hai, ek computerized tareeqa hai jismein tajziyaati algorithms istemal kiye jate hain tijarat karne ke liye. Ye algorithms market ki harkat ko monitor aur trade execute karne ke liye istemal kiye jate hain.

Features of Day Trading and Algo Trading

- Chust o chap tijarat: Day trading bohot tezi se hoti hai aur traders ko chand ghanton ya mintoo mein faisle lena padta hai.

- Jismani aur zehni tawanai ki zaroorat: Day trading mein traders ko jismani aur zehni tawanai ki zaroorat hoti hai, kyunke ye tijarat bohot active aur tezi se hoti hai.

- Khud kar tijarat: Algo trading mein, algorithms khud se trade ko monitor aur execute karte hain, jis se manual intervention ki zaroorat nahi hoti.

- Tehqeeq o tajziyaat: Algo trading mein algorithms ko tajziyaati data aur patterns ke buniyadi asaas par program kiya jata hai, jo ke insani traders se ziada tezi aur accuracy ke sath amal karte hain.

Drawbacks of Day Trading and Algo Trading

- Emotionally taxing: Day trading ki tezi aur active nature ki wajah se, traders ko baray faisle lene mein emotions ka asar hota hai, jo ke unke faisle ko mutasir kar sakta hai.

- Ziyada risk: Day trading mein jismani aur zehni tawanai ki zaroorat hoti hai, jis se traders zyada risk mein mubtala ho sakte hain.

- Technical glitches: Algo trading ke dauran technical glitches ya ghalatiyan aksar hoti hain, jo ke nuqsan deh ho sakti hain.

- Over-reliance on algorithms: Kuch situations mein, traders algorithms par zyada ittemad kar ke apni control ko kho dete hain, jo ke nuqsan deh ho sakta hai.

تبصرہ

Расширенный режим Обычный режим