#####Forex Trading Mein Rising Wedge Pattern#####

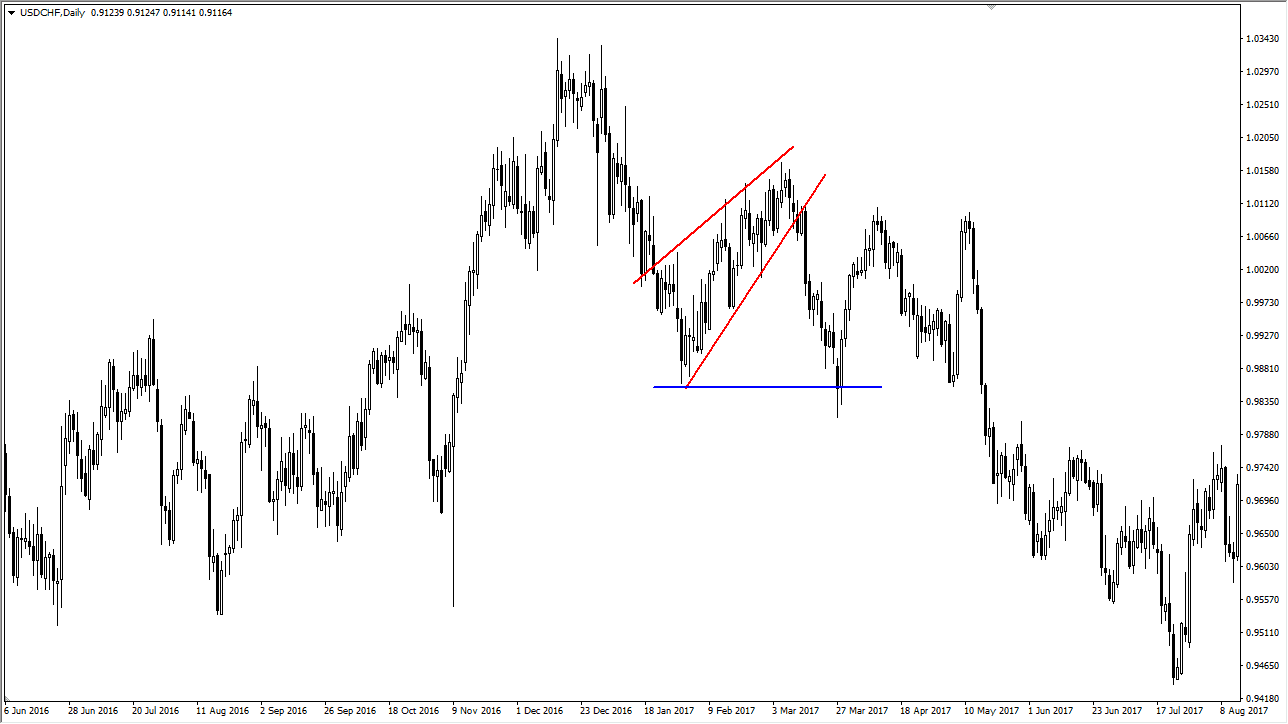

Forex trading mein, "Rising Wedge" ek chart pattern hai jo technical analysis mein istemal hota hai. Ye pattern bearish reversal pattern kehlaya jata hai aur uptrend ke doran ban sakta hai.

Rising Wedge pattern ek triangular shape ka hota hai jisme price ka movement ascending highs aur ascending lows ke beech mein hota hai. Yani highs continuously higher highs banate hain lekin lows bhi higher lows banate hain, jisse ek wedge shape banta hai.

Is pattern ko identify karne ke liye, traders ko chart par price ke highs aur lows ko connect karna hota hai, jisse wedge ka shape ban jata hai. Jab price wedge ke andar se bahar nikalta hai aur support line ko break karta hai, tab ye bearish signal provide karta hai aur traders ko sell karne ka indication milta hai.

#####Forex Trading Mein Rising Wedge Pattern Ke Ehem Nukaat#####

Rising Wedge pattern ko samajhne ke liye, kuch important points aur characteristics hain jo traders ko dhyan mein rakhna chahiye:

Forex trading mein, "Rising Wedge" ek chart pattern hai jo technical analysis mein istemal hota hai. Ye pattern bearish reversal pattern kehlaya jata hai aur uptrend ke doran ban sakta hai.

Rising Wedge pattern ek triangular shape ka hota hai jisme price ka movement ascending highs aur ascending lows ke beech mein hota hai. Yani highs continuously higher highs banate hain lekin lows bhi higher lows banate hain, jisse ek wedge shape banta hai.

Is pattern ko identify karne ke liye, traders ko chart par price ke highs aur lows ko connect karna hota hai, jisse wedge ka shape ban jata hai. Jab price wedge ke andar se bahar nikalta hai aur support line ko break karta hai, tab ye bearish signal provide karta hai aur traders ko sell karne ka indication milta hai.

#####Forex Trading Mein Rising Wedge Pattern Ke Ehem Nukaat#####

Rising Wedge pattern ko samajhne ke liye, kuch important points aur characteristics hain jo traders ko dhyan mein rakhna chahiye:

- Highs aur Lows ka pattern: Rising Wedge pattern mein highs (uchai) continuously higher highs banate hain aur lows (neeche) bhi higher lows banate hain. Iska matlab hai ki market mein bullish momentum hai lekin ye momentum dheere dheere kamzor hota jaata hai.

- Volume: Pattern ko confirm karne ke liye volume ka bhi dhyan diya jata hai. Generally, jab price wedge ke andar se bahar nikalta hai aur support line ko break karta hai, tab volume increase hota hai, jo ki bearish reversal ke liye ek positive sign ho sakta hai.

- Breakout Confirmation: Jab price rising wedge pattern ko break karta hai, traders ko confirmation ke liye wait karna chahiye. Breakout ke baad, agar price downside mein continue karta hai aur support line ko retest nahi karta, to ye bearish trend ka indication ho sakta hai.

- Price Targets: Rising Wedge pattern ko trade karte waqt, traders price targets ko calculate kar sakte hain. Target ko calculate karne ke liye, wedge ke starting point se breakout point tak ka distance lete hain aur usse neeche subtract kar dete hain. Isse potential price target mil jata hai.

- Stop Loss: Har trade mein stop loss lagana zaruri hai. Agar aap Rising Wedge pattern ko trade kar rahe hain aur price breakout ke baad retest karta hai, toh stop loss ko support line ke thode above rakhe sakte hain.

تبصرہ

Расширенный режим Обычный режим