Accumulated Swing Index (ASI) ek technical analysis indicator hai jo traders ko market ke trends aur momentum ko samajhne mein madad karta hai. Yeh article ASI indicator ke benefits par roshni daalega aur traders ko iska istemal karne ke tareeqon ko samjhayega.

1. ASI Indicator Ki Tareef

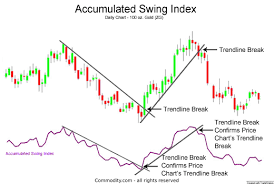

ASI ek momentum oscillator hai jo market ke direction aur strength ko measure karta hai. Yeh price swings ko analyze karta hai aur unki intensity ko quantify karta hai, jo traders ko trend reversals aur continuations ke liye signals provide karta hai.

ASI ki calculation price swings aur price bar's open, high, low, aur close prices par based hoti hai. Isse ek accumulation/distribution index generate hota hai jo market volatility aur momentum ko represent karta hai.

2. Trend Identification Mein Madadgar

ASI indicator trend identification mein madadgar hota hai. Isse traders ko pata chalta hai ke market ka trend kaunsa hai aur kis direction mein price ja rahi hai. Agar ASI uptrend mein hai to yeh bullish trend ko confirm karta hai, jabke agar ASI downtrend mein hai to yeh bearish trend ko indicate karta hai.

Traders ASI ke sath price action aur other indicators ka istemal kar ke trend direction ko confirm karte hain aur apni trading strategies ko us ke mutabiq adjust karte hain.

3. Price Swings Ki Quantification

ASI price swings ko quantify karta hai, jo ke market volatility ka ek measure hai. Isse traders ko pata chalta hai ke market kitna volatile hai aur kis direction mein price swings ho rahe hain.

Market volatility ko samajh kar traders apne risk management strategies ko adjust karte hain. Zayada volatility wale markets mein traders apni position sizes ko kam karte hain taake zyada losses se bach sakein. Isi tarah, kam volatility wale markets mein traders apne position sizes ko bada kar zyada profits earn kar sakte hain.

4. Divergence Ki Pehchan

ASI indicator ki madad se traders divergence detect kar sakte hain. Divergence jab hoti hai jab price aur indicator ke signals mein farq hota hai. Bullish divergence jab ASI ki lows down-trend mein lower lows banata hai jabke price ki lows down-trend mein higher lows banati hai. Yeh ek potential trend reversal signal hai aur traders ko future price movements ke bare mein advance warning deta hai.

Isi tarah, bearish divergence jab hoti hai jab ASI ki highs up-trend mein higher highs banata hai jabke price ki highs up-trend mein lower highs banati hai.

Traders divergence ke signals par amal kar ke apni trading decisions ko improve kar sakte hain aur zyada accurate entries aur exits kar sakte hain.

5. Overbought Aur Oversold Levels

ASI indicator overbought aur oversold levels ko bhi identify karta hai. Overbought level ko typically +100 ke upar aur oversold level ko -100 ke neeche consider kiya jata hai, lekin kuch traders apne specific trading styles ke mutabiq ismein variations bhi kar sakte hain.

Overbought aur oversold levels ka determination ASI ke specific numerical values ke through hota hai. Yeh values market volatility aur price swings ke basis par calculate kiye jate hain.

Overbought aur oversold levels ke recognition traders ke liye ek opportunity provide karte hain ki jab market extreme levels par hoti hai, tab woh potential reversals ka hint pakar sakein. Overbought conditions mein, jab ASI +100 ke upar hai, yeh indicate karta hai ke market mein bahut zyada buying activity ho rahi hai aur prices artificially high ho gaye hain. Is situation mein, traders cautious rehna chahiye aur trend reversal ka potential dekh kar apne positions ko adjust karna chahiye.

Ek similar approach oversold conditions mein bhi apply hota hai. Jab ASI -100 ke neeche hai, yeh suggest karta hai ke market mein bahut zyada selling activity ho rahi hai aur prices artificially low ho gaye hain. Traders ko is situation mein bhi alert rehna chahiye aur potential trend reversal ka wait karna chahiye.

Overbought aur oversold levels ke sath sath, traders ko dusre technical indicators aur price action ko bhi consider karna chahiye. Yeh levels ek context provide karte hain lekin yeh akela sufficient nahi hota hai trading decisions ke liye. Dusre indicators jaise ke RSI (Relative Strength Index) aur Stochastic Oscillator ke sath mila kar traders ek comprehensive view develop kar sakte hain.

Ek important point hai ke overbought aur oversold levels ek chalta rehta hai market ke sentiment aur conditions ke sath. Kabhi kabhi market ek extended period tak overbought ya oversold reh sakti hai, aur ismein short-term fluctuations bhi ho sakte hain. Isliye, traders ko ek holistic approach maintain karna chahiye aur overbought ya oversold levels ko sirf ek piece of information ke roop mein consider karna chahiye trading decisions ke liye.

6. Trading Signals

ASI indicator trading signals provide karta hai. Jab ASI line upward direction mein move karta hai aur ek certain level ko cross karta hai, to yeh ek buy signal generate karta hai. Jab ASI line downward direction mein move karta hai aur ek certain level ko cross karta hai, to yeh ek sell signal generate karta hai.

Traders in signals ka istemal kar ke apne trades ko time par enter aur exit karte hain, jisse unka profit potential increase hota hai aur losses minimize hote hain.

7. Risk Management

ASI indicator risk management mein bhi madadgar hai. Traders iska istemal kar ke apni positions ko manage kar sakte hain aur stop-loss levels ko set kar sakte hain.

Stop-loss levels ko set kar ke traders apne losses ko control kar sakte hain aur apni capital ko protect kar sakte hain. Isi tarah, profit targets ko set kar ke traders apne profits ko maximize kar sakte hain aur disciplined trading approach maintain kar sakte hain.

8. Multiple Time Frame Analysis

ASI indicator ko multiple time frames par apply kar ke traders ko ek comprehensive view milta hai. Isse traders long-term trends ko identify kar sakte hain aur short-term fluctuations ko bhi samajh sakte hain.

Traders different time frames ko analyze kar ke market ke different aspects ko samajhte hain aur apni trading decisions ko us ke mutabiq adjust karte hain. Isi tarah, traders ek holistic approach adopt karte hain aur market ke different dynamics ko samajhne mein kamyaab ho jate hain.

9. Entry Aur Exit Points

ASI indicator entry aur exit points identify karne mein madad deta hai. Traders iska istemal kar ke sahi waqt par positions enter aur exit kar sakte hain, jisse unka profit potential increase hota hai aur losses minimize hote hain.

Entry aur exit points ko identify kar ke traders apne trades ko time par execute karte hain aur zyada profitable trades karte hain. Isi tarah, traders apni trading performance ko improve karte hain aur consistent profits earn karte hain.

10. Confidence Boost

ASI indicator traders ko confidence boost karta hai. Jab traders reliable indicators ka istemal karte hain jo unhe sahi direction mein guide karte hain, to unka confidence trading mein increase hota hai.

Isi tarah, jab traders apne analysis aur indicators par trust karte hain, to unhe apne trading decisions par zyada confidence hota hai aur woh apni trading strategies ko disciplined tareeqe se follow karte hain.

1. ASI Indicator Ki Tareef

ASI ek momentum oscillator hai jo market ke direction aur strength ko measure karta hai. Yeh price swings ko analyze karta hai aur unki intensity ko quantify karta hai, jo traders ko trend reversals aur continuations ke liye signals provide karta hai.

ASI ki calculation price swings aur price bar's open, high, low, aur close prices par based hoti hai. Isse ek accumulation/distribution index generate hota hai jo market volatility aur momentum ko represent karta hai.

2. Trend Identification Mein Madadgar

ASI indicator trend identification mein madadgar hota hai. Isse traders ko pata chalta hai ke market ka trend kaunsa hai aur kis direction mein price ja rahi hai. Agar ASI uptrend mein hai to yeh bullish trend ko confirm karta hai, jabke agar ASI downtrend mein hai to yeh bearish trend ko indicate karta hai.

Traders ASI ke sath price action aur other indicators ka istemal kar ke trend direction ko confirm karte hain aur apni trading strategies ko us ke mutabiq adjust karte hain.

3. Price Swings Ki Quantification

ASI price swings ko quantify karta hai, jo ke market volatility ka ek measure hai. Isse traders ko pata chalta hai ke market kitna volatile hai aur kis direction mein price swings ho rahe hain.

Market volatility ko samajh kar traders apne risk management strategies ko adjust karte hain. Zayada volatility wale markets mein traders apni position sizes ko kam karte hain taake zyada losses se bach sakein. Isi tarah, kam volatility wale markets mein traders apne position sizes ko bada kar zyada profits earn kar sakte hain.

4. Divergence Ki Pehchan

ASI indicator ki madad se traders divergence detect kar sakte hain. Divergence jab hoti hai jab price aur indicator ke signals mein farq hota hai. Bullish divergence jab ASI ki lows down-trend mein lower lows banata hai jabke price ki lows down-trend mein higher lows banati hai. Yeh ek potential trend reversal signal hai aur traders ko future price movements ke bare mein advance warning deta hai.

Isi tarah, bearish divergence jab hoti hai jab ASI ki highs up-trend mein higher highs banata hai jabke price ki highs up-trend mein lower highs banati hai.

Traders divergence ke signals par amal kar ke apni trading decisions ko improve kar sakte hain aur zyada accurate entries aur exits kar sakte hain.

5. Overbought Aur Oversold Levels

ASI indicator overbought aur oversold levels ko bhi identify karta hai. Overbought level ko typically +100 ke upar aur oversold level ko -100 ke neeche consider kiya jata hai, lekin kuch traders apne specific trading styles ke mutabiq ismein variations bhi kar sakte hain.

Overbought aur oversold levels ka determination ASI ke specific numerical values ke through hota hai. Yeh values market volatility aur price swings ke basis par calculate kiye jate hain.

Overbought aur oversold levels ke recognition traders ke liye ek opportunity provide karte hain ki jab market extreme levels par hoti hai, tab woh potential reversals ka hint pakar sakein. Overbought conditions mein, jab ASI +100 ke upar hai, yeh indicate karta hai ke market mein bahut zyada buying activity ho rahi hai aur prices artificially high ho gaye hain. Is situation mein, traders cautious rehna chahiye aur trend reversal ka potential dekh kar apne positions ko adjust karna chahiye.

Ek similar approach oversold conditions mein bhi apply hota hai. Jab ASI -100 ke neeche hai, yeh suggest karta hai ke market mein bahut zyada selling activity ho rahi hai aur prices artificially low ho gaye hain. Traders ko is situation mein bhi alert rehna chahiye aur potential trend reversal ka wait karna chahiye.

Overbought aur oversold levels ke sath sath, traders ko dusre technical indicators aur price action ko bhi consider karna chahiye. Yeh levels ek context provide karte hain lekin yeh akela sufficient nahi hota hai trading decisions ke liye. Dusre indicators jaise ke RSI (Relative Strength Index) aur Stochastic Oscillator ke sath mila kar traders ek comprehensive view develop kar sakte hain.

Ek important point hai ke overbought aur oversold levels ek chalta rehta hai market ke sentiment aur conditions ke sath. Kabhi kabhi market ek extended period tak overbought ya oversold reh sakti hai, aur ismein short-term fluctuations bhi ho sakte hain. Isliye, traders ko ek holistic approach maintain karna chahiye aur overbought ya oversold levels ko sirf ek piece of information ke roop mein consider karna chahiye trading decisions ke liye.

6. Trading Signals

ASI indicator trading signals provide karta hai. Jab ASI line upward direction mein move karta hai aur ek certain level ko cross karta hai, to yeh ek buy signal generate karta hai. Jab ASI line downward direction mein move karta hai aur ek certain level ko cross karta hai, to yeh ek sell signal generate karta hai.

Traders in signals ka istemal kar ke apne trades ko time par enter aur exit karte hain, jisse unka profit potential increase hota hai aur losses minimize hote hain.

7. Risk Management

ASI indicator risk management mein bhi madadgar hai. Traders iska istemal kar ke apni positions ko manage kar sakte hain aur stop-loss levels ko set kar sakte hain.

Stop-loss levels ko set kar ke traders apne losses ko control kar sakte hain aur apni capital ko protect kar sakte hain. Isi tarah, profit targets ko set kar ke traders apne profits ko maximize kar sakte hain aur disciplined trading approach maintain kar sakte hain.

8. Multiple Time Frame Analysis

ASI indicator ko multiple time frames par apply kar ke traders ko ek comprehensive view milta hai. Isse traders long-term trends ko identify kar sakte hain aur short-term fluctuations ko bhi samajh sakte hain.

Traders different time frames ko analyze kar ke market ke different aspects ko samajhte hain aur apni trading decisions ko us ke mutabiq adjust karte hain. Isi tarah, traders ek holistic approach adopt karte hain aur market ke different dynamics ko samajhne mein kamyaab ho jate hain.

9. Entry Aur Exit Points

ASI indicator entry aur exit points identify karne mein madad deta hai. Traders iska istemal kar ke sahi waqt par positions enter aur exit kar sakte hain, jisse unka profit potential increase hota hai aur losses minimize hote hain.

Entry aur exit points ko identify kar ke traders apne trades ko time par execute karte hain aur zyada profitable trades karte hain. Isi tarah, traders apni trading performance ko improve karte hain aur consistent profits earn karte hain.

10. Confidence Boost

ASI indicator traders ko confidence boost karta hai. Jab traders reliable indicators ka istemal karte hain jo unhe sahi direction mein guide karte hain, to unka confidence trading mein increase hota hai.

Isi tarah, jab traders apne analysis aur indicators par trust karte hain, to unhe apne trading decisions par zyada confidence hota hai aur woh apni trading strategies ko disciplined tareeqe se follow karte hain.

تبصرہ

Расширенный режим Обычный режим