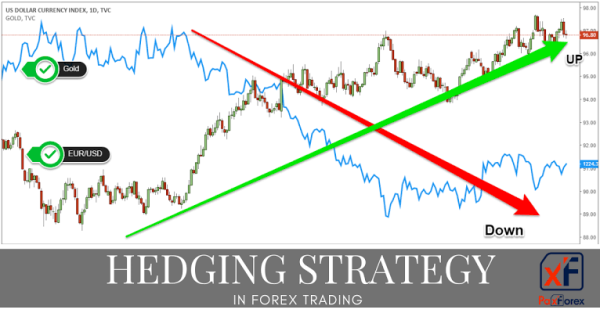

Hedging in Forex Trading

Introduction

Dear Fellows,

Jaisa k hum jaanty hain k Hedging strategy esy time me hoti hain. Awar jab market condition aisi ho k hamary sell order me hamy loss ho raha ho aur market bullish trend k sath up move kar rahi ho to aisy me ham buy order place karty hey jo key hamary sell orders se zeyda key lot size key sath ham open karty hey, hedge strategy key mutabeq ham apna sell order cancel to nahi karty magar ham apny buy order par hi depend karty hain. Awar jab market me bullish trend jesy hi end ho jaye ya market trend jesy hi change ho jaye ham es buy order main logg mukhtalif tarhaa say kaam karty hain aur kuch logon ke strategy he hedging hoti hain. Waisy kuch logg sirf aur sirf apney loss ko kam karney ya loss ko khatam karny kay liey hedging strategies par kaam karty hain. Moreover, Hedging main agar aap nay koi bhe trade lagai hai aur us trade ma aapko loss ho raha ho aur aapka khyaal ho k market ma abb shyed aapko us ma mazeed loss hoga kunkay trend change ho chuka hai to simple aap ny jiss lot say order lagaya hota hai us say bari lot say us kay mukhaalif simt ma order laga dety hain. Maslan aapne GBPUSD ko 1.3200 par buy kiya 1.0 sy aur market 1.3100 par aa gai ha aur apko lagta ha kay mazeed 100 pips neechy jaay ge to aap aes market mai kaam kar rahy hai aor hum ne ais mai trades lagai hai to hum ko agar ais mai loss hoa hai to ais mai ye hai k hum ko agar ais mai loss ho raha ho aor hum ye chaty hai k hum ais mai ye hai k hum ko mazeed loss ho raha ho to us mai ye hai k hum agar ais mai kaam karty hai to hum ko ais mai ye option hai k hum apni trades ko loss rokhny k liay hum apni trades ko hedge kar lety hai ais mai ye hai k hum ko mazeed loss ni hota ais mai ye hai k hum ko ais mai jab loss khatam ho jata hai to aus time hum hedge khtam kar lety hai ais mai yehai k hum agar ais mai hedge ko achy se use karty hai to hedge k zarye hum ko profit bhi ho sakta hai jab hum lot ziayda karty jaty hain to acha hota hain

Importance

Fellows,

Eski importance b hain awar nuksanat b hain. Q k forex trading members hedging aik aisi trading strategies ma sy hai jis ma apko faidy bhi hain aor nuqsanat bhi hain sub sy pehly ma apko faidy bata ho k sab say pehly hedging sy apko loss nhi hota keun ky ap ny aik waqat ma trade buy bhi aor sell bhi ki hoti hai agr market range ma ho bar bar aik specific support aor resistance sy retracment ly rahi ho to ap bht zeyada profit earning kr skty ho. Awar pir ess sy apko trading experience bhi hota hai aor apko market ma moves ka bhi andaza hota rehta hai. Pir ye k hedging strategy ma ap ko trend ka andaza lgana asan ho jata hai jub apki trade maximum profit wali simt chli jay loss wali ko close kr ky profit wali ko chlty rehny do apko bht acha trading result mil jata hain. Awar agr ap ny trading management ki hui ho to aik trade kat ko profit wali to dosri ky sath udr sy aik aor trade sell ki lga do apki trade jub profit ma ajay dono to close kr do doible prof2 earn kr skty ho. Awar es k ilawa hedging ky nuqsanat main trading members market main agr ap hedging krty hain lkn mmarket aik he direction ma trtrend ko follow krty huy move krti jay kch arsarsa retracment he na ly aor ap ny ghlti ma thory profit ma aik trade close kr di resistance oy keh market yayahan sy retracment ly skti hai lkn aisa na ho to apko bht loss ho skta hai aor apki trade phns bbhi jati hai aksar agr ap management na kren aor full risk py trades open kr dety hain.

Conclusion

Fellows,

Last main ye k Hedging, aik hi pair ya commodity par same time mein buy aur sell dono orders open karna ha. Hedging ka bunyadi maqsad loss ko kam se kam karna hota ha ta'k market reversal par ziyada profit hasil ho sakay. Hedging kay liye big equity ki zarurat hoti ha because aik hi pair ya commodity par buying selling dono lagany se margin call ka khatra barh jata ha, aur dono trades ko sustain rakhnay kay liye ziyada equity chahiye hoti hain. Awr Profit wali trade ka problem nahi hota, masla loss wali trade ka hota ha kay trader kitna wait kar sakta ha ta'k market wapas ho. Kai dafa market kisi na kisi (nisbatan near) point se wapas ho jati ha lekin kai dafa wapas nahi hoti aur trader ka account washout ho jata ha ya trader mayus ho kar trade close kar deta ha. Is liye hedging kay liye market condition main Trading me bht c techiques istimaal hoti hain. un me se aik hedging bhi haiin. Awar esi me ye hota ha k aik trader crruncey pair buy ki trade lagata ha. or phr at the same time us pair par sell ki trade lagata ha. or aik he waqt men dono trade open hoti hain. or tarder ka net profiy zero hota ha. to ye strategy aik acahay kahasaa profit generate krti hai. agr market k darust mushahday k badd lagaee ho. esi bht staratagies forex men istimal hoti hain.

Thanks

Introduction

Dear Fellows,

Jaisa k hum jaanty hain k Hedging strategy esy time me hoti hain. Awar jab market condition aisi ho k hamary sell order me hamy loss ho raha ho aur market bullish trend k sath up move kar rahi ho to aisy me ham buy order place karty hey jo key hamary sell orders se zeyda key lot size key sath ham open karty hey, hedge strategy key mutabeq ham apna sell order cancel to nahi karty magar ham apny buy order par hi depend karty hain. Awar jab market me bullish trend jesy hi end ho jaye ya market trend jesy hi change ho jaye ham es buy order main logg mukhtalif tarhaa say kaam karty hain aur kuch logon ke strategy he hedging hoti hain. Waisy kuch logg sirf aur sirf apney loss ko kam karney ya loss ko khatam karny kay liey hedging strategies par kaam karty hain. Moreover, Hedging main agar aap nay koi bhe trade lagai hai aur us trade ma aapko loss ho raha ho aur aapka khyaal ho k market ma abb shyed aapko us ma mazeed loss hoga kunkay trend change ho chuka hai to simple aap ny jiss lot say order lagaya hota hai us say bari lot say us kay mukhaalif simt ma order laga dety hain. Maslan aapne GBPUSD ko 1.3200 par buy kiya 1.0 sy aur market 1.3100 par aa gai ha aur apko lagta ha kay mazeed 100 pips neechy jaay ge to aap aes market mai kaam kar rahy hai aor hum ne ais mai trades lagai hai to hum ko agar ais mai loss hoa hai to ais mai ye hai k hum ko agar ais mai loss ho raha ho aor hum ye chaty hai k hum ais mai ye hai k hum ko mazeed loss ho raha ho to us mai ye hai k hum agar ais mai kaam karty hai to hum ko ais mai ye option hai k hum apni trades ko loss rokhny k liay hum apni trades ko hedge kar lety hai ais mai ye hai k hum ko mazeed loss ni hota ais mai ye hai k hum ko ais mai jab loss khatam ho jata hai to aus time hum hedge khtam kar lety hai ais mai yehai k hum agar ais mai hedge ko achy se use karty hai to hedge k zarye hum ko profit bhi ho sakta hai jab hum lot ziayda karty jaty hain to acha hota hain

Importance

Fellows,

Eski importance b hain awar nuksanat b hain. Q k forex trading members hedging aik aisi trading strategies ma sy hai jis ma apko faidy bhi hain aor nuqsanat bhi hain sub sy pehly ma apko faidy bata ho k sab say pehly hedging sy apko loss nhi hota keun ky ap ny aik waqat ma trade buy bhi aor sell bhi ki hoti hai agr market range ma ho bar bar aik specific support aor resistance sy retracment ly rahi ho to ap bht zeyada profit earning kr skty ho. Awar pir ess sy apko trading experience bhi hota hai aor apko market ma moves ka bhi andaza hota rehta hai. Pir ye k hedging strategy ma ap ko trend ka andaza lgana asan ho jata hai jub apki trade maximum profit wali simt chli jay loss wali ko close kr ky profit wali ko chlty rehny do apko bht acha trading result mil jata hain. Awar agr ap ny trading management ki hui ho to aik trade kat ko profit wali to dosri ky sath udr sy aik aor trade sell ki lga do apki trade jub profit ma ajay dono to close kr do doible prof2 earn kr skty ho. Awar es k ilawa hedging ky nuqsanat main trading members market main agr ap hedging krty hain lkn mmarket aik he direction ma trtrend ko follow krty huy move krti jay kch arsarsa retracment he na ly aor ap ny ghlti ma thory profit ma aik trade close kr di resistance oy keh market yayahan sy retracment ly skti hai lkn aisa na ho to apko bht loss ho skta hai aor apki trade phns bbhi jati hai aksar agr ap management na kren aor full risk py trades open kr dety hain.

Conclusion

Fellows,

Last main ye k Hedging, aik hi pair ya commodity par same time mein buy aur sell dono orders open karna ha. Hedging ka bunyadi maqsad loss ko kam se kam karna hota ha ta'k market reversal par ziyada profit hasil ho sakay. Hedging kay liye big equity ki zarurat hoti ha because aik hi pair ya commodity par buying selling dono lagany se margin call ka khatra barh jata ha, aur dono trades ko sustain rakhnay kay liye ziyada equity chahiye hoti hain. Awr Profit wali trade ka problem nahi hota, masla loss wali trade ka hota ha kay trader kitna wait kar sakta ha ta'k market wapas ho. Kai dafa market kisi na kisi (nisbatan near) point se wapas ho jati ha lekin kai dafa wapas nahi hoti aur trader ka account washout ho jata ha ya trader mayus ho kar trade close kar deta ha. Is liye hedging kay liye market condition main Trading me bht c techiques istimaal hoti hain. un me se aik hedging bhi haiin. Awar esi me ye hota ha k aik trader crruncey pair buy ki trade lagata ha. or phr at the same time us pair par sell ki trade lagata ha. or aik he waqt men dono trade open hoti hain. or tarder ka net profiy zero hota ha. to ye strategy aik acahay kahasaa profit generate krti hai. agr market k darust mushahday k badd lagaee ho. esi bht staratagies forex men istimal hoti hain.

Thanks

تبصرہ

Расширенный режим Обычный режим