1. Moving Average Kya Hai?

Forex trading mein moving average ek aham tool hai jo market trends ko samajhne mein madad deta hai. Ye ek statistical indicator hai jo market ki average price ko mukhtalif waqt ke doran calculate karta hai. Isay istemal kar ke traders market ki direction aur momentum ka andaza lagate hain. Moving average market ke volatilty ko smooth karke trends ko highlight karta hai aur traders ko trading decisions ke liye guidance deta hai.

Moving average ko samajhne ke liye, ek simple example diya ja sakta hai. Maan lijiye aap ek moving average ka 50-day SMA istemal kar rahe hain. Iska matlab hai ke aap har roze market ki closing prices ko 50 dinon ke liye jama karke unka average nikalenge. Is average ki madad se aap market ke direction ko samajh sakte hain, jaise ke uptrend, downtrend, ya sideways trend.

2. Simple Moving Average (SMA)

Simple moving average (SMA) market ki mukhtalif dino ya waqt ke price ki average ko darust karti hai. Isay calculate karne ke liye, aap peechlay kuch dino ya hafton ke closing prices ko jama karke unka average nikalte hain. SMA ko calculate karne ka simple tareeqa hai, lekin ismein peechlay prices ka equal weight hota hai. Yani har price ka equal importance hota hai, chahe wo peechlay din ka ho ya current din ka.

SMA ko istemal kar ke traders market ke trends ko samajhte hain. Agar current price SMA se upar hai, to yeh indicate karta hai ke market uptrend mein hai. Jabke agar current price SMA se neeche hai, to yeh downtrend ko darust karti hai. SMA ka istemal long-term trends ko samajhne ke liye hota hai.

3. Exponential Moving Average (EMA)

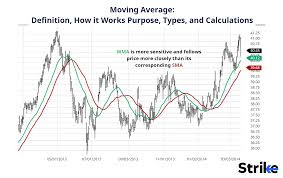

Exponential moving average (EMA) bhi market ki trend ko samajhne mein madadgar hoti hai. Ye bhi price ki average ko calculate karti hai, lekin ismein halqa-e-kar ke tor par current prices ko zyada weight diya jata hai. EMA current prices ko zyada importance dene ke wajah se, isay SMA se zyada sensitive aur responsive maana jata hai.

EMA ka istemal short-term trends ko samajhne ke liye hota hai. Isay traders often market ki recent changes aur volatility ko samajhne ke liye istemal karte hain. EMA ko calculate karne ke liye, recent prices ko zyada weight diya jata hai, isliye wo jaldi react karta hai market ke changes par.

4. Weighted Moving Average (WMA)

Weighted moving average (WMA) mein current prices ko zyada weight diya jata hai, jabke peechlay prices ko kam weight diya jata hai. Is tarah ka moving average bhi trend analysis mein istemal hota hai. WMA ka calculation bhi SMA ke tarah hota hai, lekin ismein har price ka weight alag hota hai. Recent prices ko zyada importance di jati hai, jabke peechlay prices ka weight kam hota hai.

WMA ki madad se traders market ki recent behavior ko samajhte hain. Isay istemal kar ke wo market ke short-term changes aur volatility ko analyze karte hain. WMA zyada responsive hota hai market ke changes par, lekin iski calculation complex hoti hai aur isay samajhna thora mushkil ho sakta hai.

5. Hull Moving Average (HMA)

Hull moving average (HMA) ek mukhtalif qisam ka moving average hai jo market ki trend ko smooth karne mein madad deta hai. Ye traditional moving averages se behtar results dene ka dawa karta hai. HMA ka unique feature ye hai ke ismein lagging aur leading indicators ka istemal hota hai, jo ke market ki volatility ko kam karke trends ko samajhne mein madad deta hai.

HMA ko calculate karne ke liye, price ka weighted average aur lagging indicators ka istemal hota hai. Is tarah ke calculation se HMA market ki noise ko filter karta hai aur clear trend lines dikhata hai. HMA ka istemal mainly long-term trends ko analyze karne ke liye hota hai.

6. Kaufman's Adaptive Moving Average (KAMA)

Kaufman's adaptive moving average (KAMA) ek aur advanced moving average hai jo market ki volatility ko madad deti hai. Isay market conditions ke mutabiq adjust kiya jata hai, jo ke traders ke liye faida mand hai. KAMA ka unique feature ye hai ke isay market ki volatility aur noise ko filter karne ke liye design kiya gaya hai.

KAMA ko calculate karne ke liye, ek complex formula istemal hota hai jo market ke conditions ko samajhta hai aur moving average ko accordingly adjust karta hai. Isay istemal kar ke traders market ki volatility aur trends ko accurately analyze kar sakte hain. KAMA market ke changing conditions par zyada responsive hota hai aur isay samajhna aur istemal karna thora mushkil ho sakta hai, lekin iski accuracy traders ke liye bohot faida mand hoti hai.

7. Double Exponential Moving Average (DEMA)

Double exponential moving average (DEMA) market ki trend ko samajhne ke liye ek aur aham tool hai. Isay istemal kar ke traders market ki volatility aur direction ko samajh sakte hain. DEMA ka unique feature ye hai ke ismein price ke liye do levels of smoothing ka istemal hota hai, jo ke market ke changes ko aur zyada clear aur accurate banata hai.

DEMA ko calculate karne ke liye, pehle exponential moving average (EMA) calculate kiya jata hai. Phir is EMA ka dobara EMA calculate kiya jata hai, jisse double smoothing effect hasil hota hai. Is tarah ke calculation se DEMA market ke changes ko zyada accurately capture karta hai aur traders ko clear signals provide karta hai.

8. Triple Exponential Moving Average (TEMA)

Triple exponential moving average (TEMA) ek aur advanced moving average hai jo market ki trend ko analyze karta hai. Isay istemal kar ke traders market ke complex patterns ko samajh sakte hain. TEMA ka unique feature ye hai ke ismein triple smoothing effect hota hai, jo ke market ki volatility aur noise ko aur zyada filter karta hai.

TEMA ko calculate karne ke liye, pehle ek simple moving average (SMA) calculate kiya jata hai. Phir is SMA ka dobara SMA calculate kiya jata hai, jisse double smoothing effect hasil hota hai. Phir is dobara SMA ka ek aur bar SMA calculate kiya jata hai, jisse triple smoothing effect hasil hota hai. Is tarah ke calculation se TEMA market ke complex patterns ko zyada accurately capture karta hai aur traders ko clear trend signals provide karta hai.

9. Volume Weighted Moving Average (VWMA)

Volume weighted moving average (VWMA) market ki trend ko samajhne mein madadgar hoti hai, lekin ismein volume bhi shamil hota hai. Isay istemal kar ke traders volume aur price ke sath market ke behavior ko samajh sakte hain. VWMA market ke volume aur price ke darmiyan correlation ko analyze karta hai aur traders ko clear signals provide karta hai.

VWMA ko calculate karne ke liye, har price ko uske corresponding volume ke sath multiply kiya jata hai. Phir in products ka total calculate kiya jata hai aur volume ka total divide kiya jata hai. Is tarah ke calculation se VWMA market ke price aur volume ke darmiyan relationship ko zyada accurately capture karta hai aur traders ko clear trend signals provide karta hai.

10. Moving Average Kese Kaam Karta Hai?

Moving average kaam karte waqt market ki past prices ko dekhta hai aur unka average calculate karta hai. Is average ko current price ke sath compare kiya jata hai taake trend ka pata lagaya ja sake. Agar current price moving average se upar hai, to yeh indicate karta hai ke market mein bullish trend ho sakti hai, jabke agar current price moving average se neeche hai, to yeh bearish trend ki sambhavna darust karti hai. Is tarah, moving average market ki trend ko samajhne mein madad karta hai.

Moving average ka calculation mukhtalif tareeqon se kiya jata hai, jaise ke simple moving average (SMA), exponential moving average (EMA), weighted moving average (WMA), etc. Har ek moving average apni khasiyat aur fawaid rakhta hai, lekin unka maqsad ek hi hota hai - market ki trend ko samajhna aur trading decisions ke liye guidance dena.

11. Conclusion

Forex trading mein moving averages ek aham tool hain jo traders ko market ki trend aur direction ko samajhne mein madad dete hain. Har moving average apni khasiyat aur fawaid rakhta hai, isliye zaroori hai ke traders inhein samajh kar istemal karen aur apnay trading strategies ko behtar banayen. Har trader ke liye, sahi moving average ka chunav karna zaroori hai jo unke trading style aur goals ke mutabiq ho. Moving averages ke istemal se traders market ke patterns ko samajh kar zyada faida utha sakte hain aur successful trading kar sakte hain.

Forex trading mein moving average ek aham tool hai jo market trends ko samajhne mein madad deta hai. Ye ek statistical indicator hai jo market ki average price ko mukhtalif waqt ke doran calculate karta hai. Isay istemal kar ke traders market ki direction aur momentum ka andaza lagate hain. Moving average market ke volatilty ko smooth karke trends ko highlight karta hai aur traders ko trading decisions ke liye guidance deta hai.

Moving average ko samajhne ke liye, ek simple example diya ja sakta hai. Maan lijiye aap ek moving average ka 50-day SMA istemal kar rahe hain. Iska matlab hai ke aap har roze market ki closing prices ko 50 dinon ke liye jama karke unka average nikalenge. Is average ki madad se aap market ke direction ko samajh sakte hain, jaise ke uptrend, downtrend, ya sideways trend.

2. Simple Moving Average (SMA)

Simple moving average (SMA) market ki mukhtalif dino ya waqt ke price ki average ko darust karti hai. Isay calculate karne ke liye, aap peechlay kuch dino ya hafton ke closing prices ko jama karke unka average nikalte hain. SMA ko calculate karne ka simple tareeqa hai, lekin ismein peechlay prices ka equal weight hota hai. Yani har price ka equal importance hota hai, chahe wo peechlay din ka ho ya current din ka.

SMA ko istemal kar ke traders market ke trends ko samajhte hain. Agar current price SMA se upar hai, to yeh indicate karta hai ke market uptrend mein hai. Jabke agar current price SMA se neeche hai, to yeh downtrend ko darust karti hai. SMA ka istemal long-term trends ko samajhne ke liye hota hai.

3. Exponential Moving Average (EMA)

Exponential moving average (EMA) bhi market ki trend ko samajhne mein madadgar hoti hai. Ye bhi price ki average ko calculate karti hai, lekin ismein halqa-e-kar ke tor par current prices ko zyada weight diya jata hai. EMA current prices ko zyada importance dene ke wajah se, isay SMA se zyada sensitive aur responsive maana jata hai.

EMA ka istemal short-term trends ko samajhne ke liye hota hai. Isay traders often market ki recent changes aur volatility ko samajhne ke liye istemal karte hain. EMA ko calculate karne ke liye, recent prices ko zyada weight diya jata hai, isliye wo jaldi react karta hai market ke changes par.

4. Weighted Moving Average (WMA)

Weighted moving average (WMA) mein current prices ko zyada weight diya jata hai, jabke peechlay prices ko kam weight diya jata hai. Is tarah ka moving average bhi trend analysis mein istemal hota hai. WMA ka calculation bhi SMA ke tarah hota hai, lekin ismein har price ka weight alag hota hai. Recent prices ko zyada importance di jati hai, jabke peechlay prices ka weight kam hota hai.

WMA ki madad se traders market ki recent behavior ko samajhte hain. Isay istemal kar ke wo market ke short-term changes aur volatility ko analyze karte hain. WMA zyada responsive hota hai market ke changes par, lekin iski calculation complex hoti hai aur isay samajhna thora mushkil ho sakta hai.

5. Hull Moving Average (HMA)

Hull moving average (HMA) ek mukhtalif qisam ka moving average hai jo market ki trend ko smooth karne mein madad deta hai. Ye traditional moving averages se behtar results dene ka dawa karta hai. HMA ka unique feature ye hai ke ismein lagging aur leading indicators ka istemal hota hai, jo ke market ki volatility ko kam karke trends ko samajhne mein madad deta hai.

HMA ko calculate karne ke liye, price ka weighted average aur lagging indicators ka istemal hota hai. Is tarah ke calculation se HMA market ki noise ko filter karta hai aur clear trend lines dikhata hai. HMA ka istemal mainly long-term trends ko analyze karne ke liye hota hai.

6. Kaufman's Adaptive Moving Average (KAMA)

Kaufman's adaptive moving average (KAMA) ek aur advanced moving average hai jo market ki volatility ko madad deti hai. Isay market conditions ke mutabiq adjust kiya jata hai, jo ke traders ke liye faida mand hai. KAMA ka unique feature ye hai ke isay market ki volatility aur noise ko filter karne ke liye design kiya gaya hai.

KAMA ko calculate karne ke liye, ek complex formula istemal hota hai jo market ke conditions ko samajhta hai aur moving average ko accordingly adjust karta hai. Isay istemal kar ke traders market ki volatility aur trends ko accurately analyze kar sakte hain. KAMA market ke changing conditions par zyada responsive hota hai aur isay samajhna aur istemal karna thora mushkil ho sakta hai, lekin iski accuracy traders ke liye bohot faida mand hoti hai.

7. Double Exponential Moving Average (DEMA)

Double exponential moving average (DEMA) market ki trend ko samajhne ke liye ek aur aham tool hai. Isay istemal kar ke traders market ki volatility aur direction ko samajh sakte hain. DEMA ka unique feature ye hai ke ismein price ke liye do levels of smoothing ka istemal hota hai, jo ke market ke changes ko aur zyada clear aur accurate banata hai.

DEMA ko calculate karne ke liye, pehle exponential moving average (EMA) calculate kiya jata hai. Phir is EMA ka dobara EMA calculate kiya jata hai, jisse double smoothing effect hasil hota hai. Is tarah ke calculation se DEMA market ke changes ko zyada accurately capture karta hai aur traders ko clear signals provide karta hai.

8. Triple Exponential Moving Average (TEMA)

Triple exponential moving average (TEMA) ek aur advanced moving average hai jo market ki trend ko analyze karta hai. Isay istemal kar ke traders market ke complex patterns ko samajh sakte hain. TEMA ka unique feature ye hai ke ismein triple smoothing effect hota hai, jo ke market ki volatility aur noise ko aur zyada filter karta hai.

TEMA ko calculate karne ke liye, pehle ek simple moving average (SMA) calculate kiya jata hai. Phir is SMA ka dobara SMA calculate kiya jata hai, jisse double smoothing effect hasil hota hai. Phir is dobara SMA ka ek aur bar SMA calculate kiya jata hai, jisse triple smoothing effect hasil hota hai. Is tarah ke calculation se TEMA market ke complex patterns ko zyada accurately capture karta hai aur traders ko clear trend signals provide karta hai.

9. Volume Weighted Moving Average (VWMA)

Volume weighted moving average (VWMA) market ki trend ko samajhne mein madadgar hoti hai, lekin ismein volume bhi shamil hota hai. Isay istemal kar ke traders volume aur price ke sath market ke behavior ko samajh sakte hain. VWMA market ke volume aur price ke darmiyan correlation ko analyze karta hai aur traders ko clear signals provide karta hai.

VWMA ko calculate karne ke liye, har price ko uske corresponding volume ke sath multiply kiya jata hai. Phir in products ka total calculate kiya jata hai aur volume ka total divide kiya jata hai. Is tarah ke calculation se VWMA market ke price aur volume ke darmiyan relationship ko zyada accurately capture karta hai aur traders ko clear trend signals provide karta hai.

10. Moving Average Kese Kaam Karta Hai?

Moving average kaam karte waqt market ki past prices ko dekhta hai aur unka average calculate karta hai. Is average ko current price ke sath compare kiya jata hai taake trend ka pata lagaya ja sake. Agar current price moving average se upar hai, to yeh indicate karta hai ke market mein bullish trend ho sakti hai, jabke agar current price moving average se neeche hai, to yeh bearish trend ki sambhavna darust karti hai. Is tarah, moving average market ki trend ko samajhne mein madad karta hai.

Moving average ka calculation mukhtalif tareeqon se kiya jata hai, jaise ke simple moving average (SMA), exponential moving average (EMA), weighted moving average (WMA), etc. Har ek moving average apni khasiyat aur fawaid rakhta hai, lekin unka maqsad ek hi hota hai - market ki trend ko samajhna aur trading decisions ke liye guidance dena.

11. Conclusion

Forex trading mein moving averages ek aham tool hain jo traders ko market ki trend aur direction ko samajhne mein madad dete hain. Har moving average apni khasiyat aur fawaid rakhta hai, isliye zaroori hai ke traders inhein samajh kar istemal karen aur apnay trading strategies ko behtar banayen. Har trader ke liye, sahi moving average ka chunav karna zaroori hai jo unke trading style aur goals ke mutabiq ho. Moving averages ke istemal se traders market ke patterns ko samajh kar zyada faida utha sakte hain aur successful trading kar sakte hain.

تبصرہ

Расширенный режим Обычный режим