Dow theory in Forex Trading

Dow Theory (Definition and Purpose)

Assalam o Alaikum Dear friends and Fellows Dow Theory ek aesi financial theory hy jo stock market analysis me istemal hoti hy. Is theory ka naam Charles Dow ke naam par rakha gaya hy, jinhon ne 19th century me ek influential financial newspaper "The Wall Street Journal" shuru ki thi. Dow Theory market trends aur stock prices ko samajhny ke liye ek achi theory hy.

Dow Theory Ka Purpose:

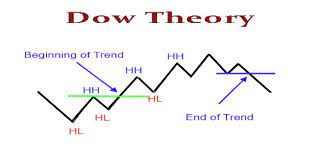

Dear Friends Dow Theory ka maqsad market trends aur stock prices ko samajhna hy. Is theory ke zariye se traders aur investors market ke future direction ko predict karny ki koshish karty hyn. Is theory ki achhi bat ye hy ke market me 2 tarah ke trends hoty hyn: primary trend aur secondary trend. Primary trend lamby arsey tak chalti hy, jabke secondary trend choti muddat ke liye hoti hy.

Dow Theory Forex Characristics.

Dear Fellows Dow Theory ek technical analysis method hy jo stock market me use hota hy. Yeh theory Charles Dow ke naam pr develop ki gayi hy. Charles Dow ne late 19th aur early 20th century me stock market movements ko study kiya aur unki observations par Dow Theory ko establish kiya. Dow Theory ka concept Forex market me bhi apply kiya ja sakta hy. Forex market currency pairs ke buying aur selling activities par focus karta hy. Dow Theory ke principles ko Forex market ke trends aur price movements ke analysis me bhi istemal kiya ja sakta hy.

Importence of DOW Theory.

Forex market me bhi traders different timeframes par analysis karty hyn. Short term traders like scalpers short-term trends par focus karty hyn jabki long-term position traders long-term trends par dhyan dete hyn. Different timeframes par analysis karny se traders ko market ki complete picture milti hy.

Dow Theory (Definition and Purpose)

Assalam o Alaikum Dear friends and Fellows Dow Theory ek aesi financial theory hy jo stock market analysis me istemal hoti hy. Is theory ka naam Charles Dow ke naam par rakha gaya hy, jinhon ne 19th century me ek influential financial newspaper "The Wall Street Journal" shuru ki thi. Dow Theory market trends aur stock prices ko samajhny ke liye ek achi theory hy.

Dow Theory Ka Purpose:

Dear Friends Dow Theory ka maqsad market trends aur stock prices ko samajhna hy. Is theory ke zariye se traders aur investors market ke future direction ko predict karny ki koshish karty hyn. Is theory ki achhi bat ye hy ke market me 2 tarah ke trends hoty hyn: primary trend aur secondary trend. Primary trend lamby arsey tak chalti hy, jabke secondary trend choti muddat ke liye hoti hy.

Dow Theory Forex Characristics.

Dear Fellows Dow Theory ek technical analysis method hy jo stock market me use hota hy. Yeh theory Charles Dow ke naam pr develop ki gayi hy. Charles Dow ne late 19th aur early 20th century me stock market movements ko study kiya aur unki observations par Dow Theory ko establish kiya. Dow Theory ka concept Forex market me bhi apply kiya ja sakta hy. Forex market currency pairs ke buying aur selling activities par focus karta hy. Dow Theory ke principles ko Forex market ke trends aur price movements ke analysis me bhi istemal kiya ja sakta hy.

Importence of DOW Theory.

Forex market me bhi traders different timeframes par analysis karty hyn. Short term traders like scalpers short-term trends par focus karty hyn jabki long-term position traders long-term trends par dhyan dete hyn. Different timeframes par analysis karny se traders ko market ki complete picture milti hy.

تبصرہ

Расширенный режим Обычный режим