Explanation.

Klinger Volume Oscillator ek technical analysis tool hai jo market trends aur market momentum ko assess karne ke liye use kiya jata hai. Is tool ka use stock market, forex, aur cryptocurrency trading mein kiya jata hay oscillator trading k liye best tool sabit hotay hain is liye in ka proper use continue krna chahiye or is ko igonre nahi krna hota

Klinger Volume Oscillator working.

Klinger Volume Oscillator ka kaam market volume aur price action ke beech ke correlation ko dekhna hai. Is tool mein positive aur negative divergence ke signals hote hai jo market ke trend aur momentum ko indicate karte hai.

Klinger Volume Oscillator formula.

Klinger Volume Oscillator ka formula market volume ke barabar hai. Yeh oscillator market volume aur price action ke correlation ke based par kaam karta hai.

Klinger Volume Oscillator benefits.

Klinger Volume Oscillator ke bahut se benefits hai jaise ki:

1. Market trends aur momentum ko assess karne mein help karta hai.

2. Market volatility aur trend reversals ko identify karne mein help karta hai.

3. Trading decisions ko improve karne mein help karta hai.

4. Market ka overall health aur strength ko assess karne mein help karta hai.

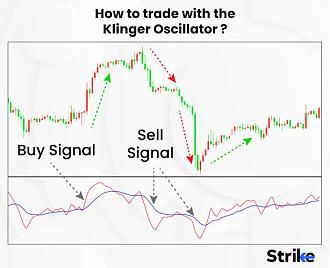

Klinger Volume Oscillator kaise use kiya jata hai?

Klinger Volume Oscillator ka use market trends aur momentum ko assess karne ke liye kiya jata hai. Is tool ka use trading strategies ko improve karne ke liye bhi kiya jata hai.

More Points.

Klinger Volume Oscillator ek powerful technical analysis tool hai jo market trends aur momentum ko assess karne ke liye use kiya jata hai. Is tool ka use trading decisions ko improve karne ke liye kiya jata hai.

Klinger Volume Oscillator ek technical analysis tool hai jo market trends aur market momentum ko assess karne ke liye use kiya jata hai. Is tool ka use stock market, forex, aur cryptocurrency trading mein kiya jata hay oscillator trading k liye best tool sabit hotay hain is liye in ka proper use continue krna chahiye or is ko igonre nahi krna hota

Klinger Volume Oscillator working.

Klinger Volume Oscillator ka kaam market volume aur price action ke beech ke correlation ko dekhna hai. Is tool mein positive aur negative divergence ke signals hote hai jo market ke trend aur momentum ko indicate karte hai.

Klinger Volume Oscillator formula.

Klinger Volume Oscillator ka formula market volume ke barabar hai. Yeh oscillator market volume aur price action ke correlation ke based par kaam karta hai.

Klinger Volume Oscillator benefits.

Klinger Volume Oscillator ke bahut se benefits hai jaise ki:

1. Market trends aur momentum ko assess karne mein help karta hai.

2. Market volatility aur trend reversals ko identify karne mein help karta hai.

3. Trading decisions ko improve karne mein help karta hai.

4. Market ka overall health aur strength ko assess karne mein help karta hai.

Klinger Volume Oscillator kaise use kiya jata hai?

Klinger Volume Oscillator ka use market trends aur momentum ko assess karne ke liye kiya jata hai. Is tool ka use trading strategies ko improve karne ke liye bhi kiya jata hai.

More Points.

Klinger Volume Oscillator ek powerful technical analysis tool hai jo market trends aur momentum ko assess karne ke liye use kiya jata hai. Is tool ka use trading decisions ko improve karne ke liye kiya jata hai.

تبصرہ

Расширенный режим Обычный режим