+====Forex Market Mein Sideways Trend (Range-bound)====+

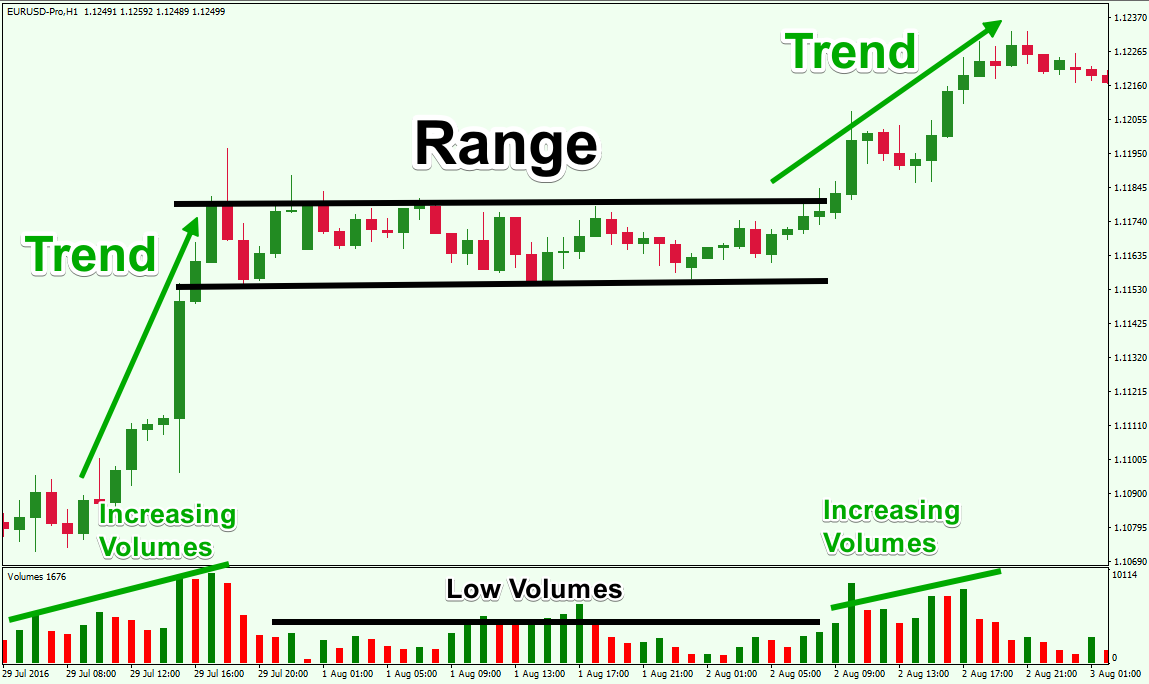

Forex market mein "sideways trend" ya "range-bound market" ka matlab hota hai jab currency pair ka price ek specific range mein move karta hai aur kisi bhi clear direction mein nahi jaata. Is tarah ka trend market mein stability aur consolidation ko represent karta hai, jab traders ko clear trend ki samajh nahi aati.

Range-bound market mein, price ek upper resistance level aur ek lower support level ke beech mein oscillate karta hai. Traders is trend mein typically support aur resistance levels ko identify karte hain taki wo entry aur exit points determine kar sakein.

Range-bound market mein trading karna challenging ho sakta hai kyunki price ka movement unpredictable ho sakta hai aur clear trend ki absence mein traders ko false signals mil sakte hain. Isliye, traders ko market conditions ko acchi tarah se analyze karna aur risk management strategies ka istemal karna zaroori hota hai.

+====Forex Market Mein Sideways Trend (Range-bound) Ki Ehem Tips====+

Range-bound market ya sideways trend mein trading karne ke liye kuch tips hain:

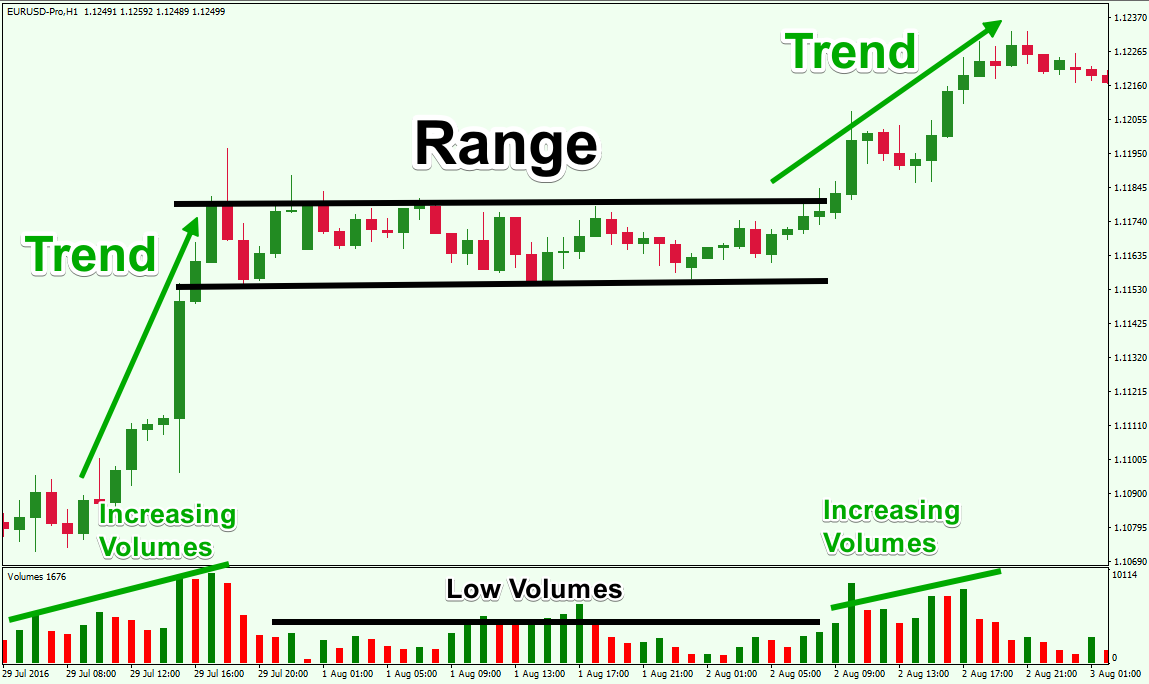

Forex market mein "sideways trend" ya "range-bound market" ka matlab hota hai jab currency pair ka price ek specific range mein move karta hai aur kisi bhi clear direction mein nahi jaata. Is tarah ka trend market mein stability aur consolidation ko represent karta hai, jab traders ko clear trend ki samajh nahi aati.

Range-bound market mein, price ek upper resistance level aur ek lower support level ke beech mein oscillate karta hai. Traders is trend mein typically support aur resistance levels ko identify karte hain taki wo entry aur exit points determine kar sakein.

Range-bound market mein trading karna challenging ho sakta hai kyunki price ka movement unpredictable ho sakta hai aur clear trend ki absence mein traders ko false signals mil sakte hain. Isliye, traders ko market conditions ko acchi tarah se analyze karna aur risk management strategies ka istemal karna zaroori hota hai.

+====Forex Market Mein Sideways Trend (Range-bound) Ki Ehem Tips====+

Range-bound market ya sideways trend mein trading karne ke liye kuch tips hain:

- Support aur Resistance Levels ka istemal: Range-bound market mein, support aur resistance levels ka istemal karna behad zaroori hai. Support level par buying aur resistance level par selling karke traders profit earn kar sakte hain.

- Volatility ka dhyan rakhein: Volatility range-bound market mein kam hoti hai, isliye traders ko market mein hone wali kisi bhi unexpected volatility ka dhyan rakhna zaroori hai. News announcements ya economic events ke samay, market volatility badh sakti hai, isliye aise samay mein extra cautious rehna chahiye.

- Range Trading Strategies ka istemal karein: Range trading strategies range-bound market mein kaam karte hain. Ismein traders support aur resistance levels ke beech mein hi buy aur sell orders place karte hain. Yeh strategy price ke oscillations ka fayda uthata hai.

- Indicators ka istemal: Oscillators jaise ki Relative Strength Index (RSI), Stochastic Oscillator, aur Bollinger Bands range-bound market mein kaafi upyogi ho sakte hain. In indicators ka istemal karke traders market ke overbought aur oversold conditions ko identify kar sakte hain.

- Trend ki Shuruaat ka Intezaar na karein: Range-bound market mein, trend ka pata lagana mushkil ho sakta hai. Isliye, traders ko trend ki shuruaat ka intezaar karke apna trading plan banane ki jagah, existing range ke andar hi trading karna chahiye.

- Risk Management: Har trading situation mein risk management bahut ahem hota hai. Range-bound market mein bhi risk management strategies ko dhyan mein rakhte hue positions open karna chahiye. Stop-loss orders ka istemal karna aur position sizes ko control karna zaroori hai.

- Psychological Discipline: Range-bound market mein patience aur discipline maintain karna zaroori hai. Kabhi-kabhi market mein movement slow hoti hai, isliye traders ko apne emotions ko control karke apne trading plan ko follow karna chahiye.

تبصرہ

Расширенный режим Обычный режим