Range breakout strategy forex market mein aik mashhoor trading technique hai. Is ka maqsad aik qabil-e-qadar price movement ka faida uthana hai jab kisi asset trading range se bahar nikal jata hai. Forex trading mein, currencies aksar kisi khaas price range ke andar trade karte hain, jo aik muqarrar band ke andar highs aur lows ke doran chalti hai. Range breakout strategy is soorat mein mabni hai ke jab price is tay shuda range se bahar nikalta hai to aise significant price movements ka faida uthaya ja sakta hai. Ye strategy is bunyadi faislay par mabni hai ke aise breakouts mazid mazboot trends ka janam dete hain, jo traders ko nafay ka moqa dete hain.

Trading Ranges ki Samajh

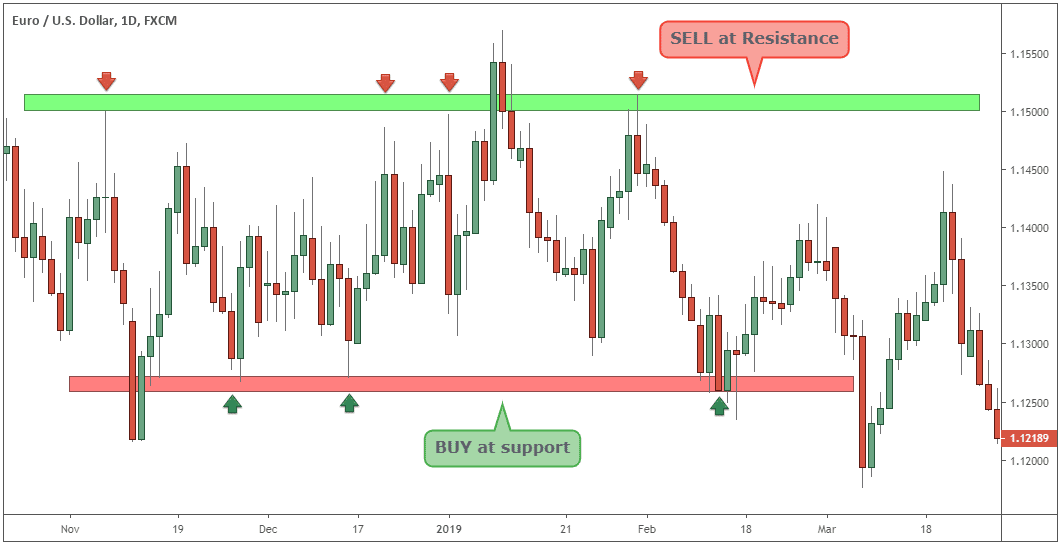

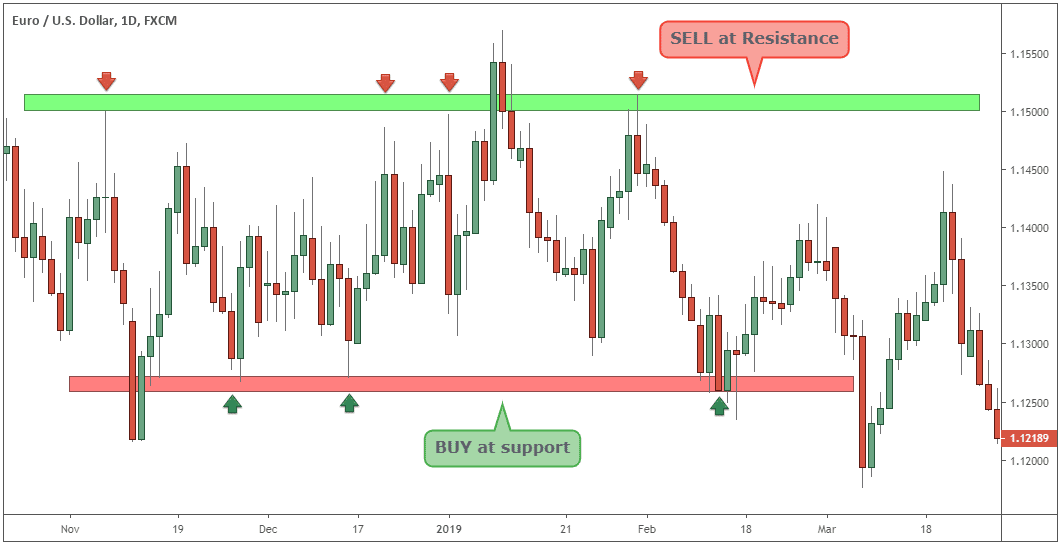

Range breakout strategy ka amal shuru karne se pehle, trading ranges ko samajhna zaroori hai. Forex trading mein, trading range aik aise doran ki taraf ishara karta hai jismein currency pair ka price aik nisbatan tang band ke andar fluctuate karta hai. Ye band un highs aur lows dwara tay kiya jata hai jo price chart par aik muqarrar doran mein pohanchti hai. Traders aksar support aur resistance levels ka istemal karke trading ranges ko pehchante hain, jo trading range ke upper aur lower boundaries ko mark karte hain.

Trading Ranges ki Pechan

Range breakout strategy ko implement karne ka pehla qadam trading ranges ko pehchanna hai. Traders ko in ranges ko durust pehchane ke liye mukhtalif technical analysis tools ka istemal kar sakte hain. Aik mamooli approach support aur resistance levels ka istemal hai. Support levels wo areas hain jahan price ko buying interest milta hai aur wo apni downward movement ko reverse karta hai. Jabke resistance levels wo areas hain jahan selling interest nazar aata hai, jo price ko apni upward movement ko reverse karne ka sabab banta hai.

Traders price chart par horizontal lines draw kar sakte hain taake significant swing lows aur highs ko connect karke trading range ke boundaries ko pehchanein. Jab range tay hojaye, traders price ko support ya resistance level ke nazdeek pohanchne ka intezar karte hain, ek potential breakout ka intezar karte hue.

Range Breakout Strategy ke Key Components

Range breakout strategy kai ahem components par mabni hai:

Range breakouts mukhtalif tareeqon se ho sakte hain, jo mukhtalif trading opportunities faraham karte hain:

Risk management range breakout trading mein ahem hai. Jabke breakouts ko khas tor par jari rehne ki sambhavna hoti hai, inke saath ghair-mumkin risks bhi hote hain, jaise ke false breakouts aur whipsaws. Traders in risks ko kam karne ke liye mukhtalif risk management techniques ka istemal karte hain:

Range breakout strategy ko live trading mein implement karne se pehle, historical price data ka istemal karke strategy ko backtest karna zaroori hai. Backtesting wo process hai jismein strategy ko peechle market conditions par apply karke uski performance aur profitability ko assess kiya jata hai. Traders specialized software ya trading platforms ka istemal karke backtests aur apne range breakout strategy ko optimize karte hain.

Optimization ke doran, traders strategy ke mukhtalif parameters ko adjust karte hain, jaise ke entry aur exit rules, stop-loss aur take-profit levels, aur position sizing criteria, taake profitability ko zyada kiya ja sake aur risk ko kam kiya ja sake. Halaanke, yad rakhna zaroori hai ke strategy ko peechle data ke liye optimize karna aur uski mazbooti ko barqarar rakhna ke darmiyan aik balance qayam karna zaroori hai.

Psychological Considerations

Trading psychology range breakout trading ki kamiyabi mein ahem kirdar ada karta hai. Khof, lalach, aur be-sabri jaise emotions faislay par asar dal sakte hain aur bay-tadreeji kaari ko janam de sakte hain. Traders ko apne trading plan aur risk management rules ka paas rakhne ke liye discipline, sabar, aur emotional control qaim rakhna zaroori hai.

Forex market ki be-peshi aur ghalatian ka samna karna ek mazboot mindset aur nuqsanain trading process ka hissa qubool karne ki salahiyat ko talab karta hai. Ek musbat trading psychology ka vikas aur lambay doran mein aik mufeed perspective ko qubool karna traders ko apne maqasid par mabni rehne aur range breakout trading ke challenges ko behtar taur par samajhne mein madadgar sabit ho sakta hai.

Range breakout strategy forex traders ko market mein significant price movements ko pehchane aur unse faida uthane ka nizami tareeqa faraham karta hai. Trading ranges ko samajhna, breakouts ko tasdiq karna, risk ko mukhtasar karna, aur discipline ko qaim rakhna ke zariye traders long aur short term mein kamiyabi ko barhane ki salahiyat ko barqarar rakh sakte hain. Halaanke, yad rakhna zaroori hai ke range breakout trading mein koi guarantee nahi hoti. Market conditions jald badal sakti hain aur anjaane events ke asar mein price movements mein tabadlaat aa sakte hain. Traders ko apne strategies ko adjust karne aur mukhtalif market conditions ke sath mukhtalif tareeqon ko explore karne ke liye tayyar rehna chahiye.

Trading Ranges ki Samajh

Range breakout strategy ka amal shuru karne se pehle, trading ranges ko samajhna zaroori hai. Forex trading mein, trading range aik aise doran ki taraf ishara karta hai jismein currency pair ka price aik nisbatan tang band ke andar fluctuate karta hai. Ye band un highs aur lows dwara tay kiya jata hai jo price chart par aik muqarrar doran mein pohanchti hai. Traders aksar support aur resistance levels ka istemal karke trading ranges ko pehchante hain, jo trading range ke upper aur lower boundaries ko mark karte hain.

Trading Ranges ki Pechan

Range breakout strategy ko implement karne ka pehla qadam trading ranges ko pehchanna hai. Traders ko in ranges ko durust pehchane ke liye mukhtalif technical analysis tools ka istemal kar sakte hain. Aik mamooli approach support aur resistance levels ka istemal hai. Support levels wo areas hain jahan price ko buying interest milta hai aur wo apni downward movement ko reverse karta hai. Jabke resistance levels wo areas hain jahan selling interest nazar aata hai, jo price ko apni upward movement ko reverse karne ka sabab banta hai.

Traders price chart par horizontal lines draw kar sakte hain taake significant swing lows aur highs ko connect karke trading range ke boundaries ko pehchanein. Jab range tay hojaye, traders price ko support ya resistance level ke nazdeek pohanchne ka intezar karte hain, ek potential breakout ka intezar karte hue.

Range Breakout Strategy ke Key Components

Range breakout strategy kai ahem components par mabni hai:

- Range ki Pechan: Jaisa ke pehle zikar kiya gaya, pehla qadam aik trading range ko pehchanna hai jo price chart par support aur resistance levels ka istemal karke kiya jata hai.

- Confirmation Signals: Traders confirmation signals ko verify karne ke liye dekhte hain takay potential breakout ko tasdiq kiya ja sake. Ye signals barhaye hue trading volume, significant price movements, ya phir key technical levels ke breach ho sakte hain.

- Entry Points: Jab breakout tasdiq hojaye, traders breakout ke direction mein positions enter karte hain. Wo mukhtalif entry techniques ka istemal kar sakte hain, jaise ke breakout level ko dobara test karne ka intezaar karna ya breakout ke turant baad enter karna.

- Stop Loss aur Take Profit Levels: Risk management range breakout trading mein ahem hai. Traders aam tor par stop-loss orders set karte hain takay agar breakout momentum ko sustain nahi kar pata toh potential nuqsanain had mein reh jayein. Take profit levels ko profit hasil karne ke liye set kiya jata hai jab price breakout ke direction mein jari rahe.

- Monitoring aur Adjusting: Traders apne positions ko nazarandaz karte hain aur market evolve hone par apni strategies ko adjust karte hain. Wo apne stop-loss orders ko profits lock karne ke liye move karte hain ya phir market conditions ke tabadlaat ke mutabiq take-profit levels ko adjust karte hain.

Range breakouts mukhtalif tareeqon se ho sakte hain, jo mukhtalif trading opportunities faraham karte hain:

- Continuation Breakouts: Ye wo waqt hota hai jab price trading range se bahar nikal jata hai aur pichle trend ke direction mein jari rahta hai. Continuation breakouts mukhtalif trends ke istehqaq ko sabit karte hain aur traders ko faida uthane ke moqa faraham karte hain.

- Reversal Breakouts: Reversal breakouts wo waqt hota hai jab price trading range se bahar nikal jata hai aur apne pichle trend ko palat deta hai. Ye breakouts market sentiment mein tabdeeli ka ishara karte hain aur traders ko naye trend ke direction mein positions enter karne ke moqa faraham karte hain.

- False Breakouts: False breakouts wo waqt hota hai jab price pehle trading range se bahar nikalta hai magar baad mein momentum ko sustain nahi kar pata aur phir se range mein wapas chala jata hai. False breakouts aise traders ko phansate hain jo initial breakout signal par positions enter karte hain. Traders ko ihtiyat se kaam lena chahiye aur false breakouts ko filter karne ke liye confirmation signals ka istemal karna chahiye.

Risk management range breakout trading mein ahem hai. Jabke breakouts ko khas tor par jari rehne ki sambhavna hoti hai, inke saath ghair-mumkin risks bhi hote hain, jaise ke false breakouts aur whipsaws. Traders in risks ko kam karne ke liye mukhtalif risk management techniques ka istemal karte hain:

- Position Sizing: Traders apne positions ke saize ko apni risk tolerance, account size, aur market ki volatility ke mutabiq tay karte hain. Durust position sizing se ye ensure hota hai ke nuqsanain qubool ke gaye had tak mehdood rehte hain, halaanke koi bhi unfavourable price movements ke asar mein aayein.

- Stop Loss Orders: Stop loss orders nuqsanain had mein rehne ke liye zaroori hote hain agar breakout momentum ko sustain nahi kar pata. Traders aam tor par stop-loss orders ko trading range ke bahar ya phir apni entry points se mukhtalif dori par set karte hain.

- Take Profit Targets: Take profit targets traders ko faida hasil karne mein madadgar hote hain jab price unke favour mein chalta hai. Realistic take-profit levels ko set karna ahem hai jo support aur resistance levels, Fibonacci extensions, ya doosre technical indicators ke bunyadi par mabni hotay hain taake nafa ko zyada kiya ja sake.

- Risk-Reward Ratio: Traders trade enter karne se pehle risk-reward ratio ka jaeza lete hain taake ye yaqeeni ho sake ke potential faida risk se zyada hai. Aik munasib risk-reward ratio trades ke profitability ko lambay doran mein zyada karta hai.

- Diversification: Diversification strategies aur currency pairs par risk ko failaane aur kisi bhi aik trade ya market event ke exposure ko kam karne mein madad karta hai. Traders aksar apne portfolio risk ko kam karne ke liye mukhtalif asset classes par bhi diversified ho sakte hain.

Range breakout strategy ko live trading mein implement karne se pehle, historical price data ka istemal karke strategy ko backtest karna zaroori hai. Backtesting wo process hai jismein strategy ko peechle market conditions par apply karke uski performance aur profitability ko assess kiya jata hai. Traders specialized software ya trading platforms ka istemal karke backtests aur apne range breakout strategy ko optimize karte hain.

Optimization ke doran, traders strategy ke mukhtalif parameters ko adjust karte hain, jaise ke entry aur exit rules, stop-loss aur take-profit levels, aur position sizing criteria, taake profitability ko zyada kiya ja sake aur risk ko kam kiya ja sake. Halaanke, yad rakhna zaroori hai ke strategy ko peechle data ke liye optimize karna aur uski mazbooti ko barqarar rakhna ke darmiyan aik balance qayam karna zaroori hai.

Psychological Considerations

Trading psychology range breakout trading ki kamiyabi mein ahem kirdar ada karta hai. Khof, lalach, aur be-sabri jaise emotions faislay par asar dal sakte hain aur bay-tadreeji kaari ko janam de sakte hain. Traders ko apne trading plan aur risk management rules ka paas rakhne ke liye discipline, sabar, aur emotional control qaim rakhna zaroori hai.

Forex market ki be-peshi aur ghalatian ka samna karna ek mazboot mindset aur nuqsanain trading process ka hissa qubool karne ki salahiyat ko talab karta hai. Ek musbat trading psychology ka vikas aur lambay doran mein aik mufeed perspective ko qubool karna traders ko apne maqasid par mabni rehne aur range breakout trading ke challenges ko behtar taur par samajhne mein madadgar sabit ho sakta hai.

Range breakout strategy forex traders ko market mein significant price movements ko pehchane aur unse faida uthane ka nizami tareeqa faraham karta hai. Trading ranges ko samajhna, breakouts ko tasdiq karna, risk ko mukhtasar karna, aur discipline ko qaim rakhna ke zariye traders long aur short term mein kamiyabi ko barhane ki salahiyat ko barqarar rakh sakte hain. Halaanke, yad rakhna zaroori hai ke range breakout trading mein koi guarantee nahi hoti. Market conditions jald badal sakti hain aur anjaane events ke asar mein price movements mein tabadlaat aa sakte hain. Traders ko apne strategies ko adjust karne aur mukhtalif market conditions ke sath mukhtalif tareeqon ko explore karne ke liye tayyar rehna chahiye.

تبصرہ

Расширенный режим Обычный режим