Introduction

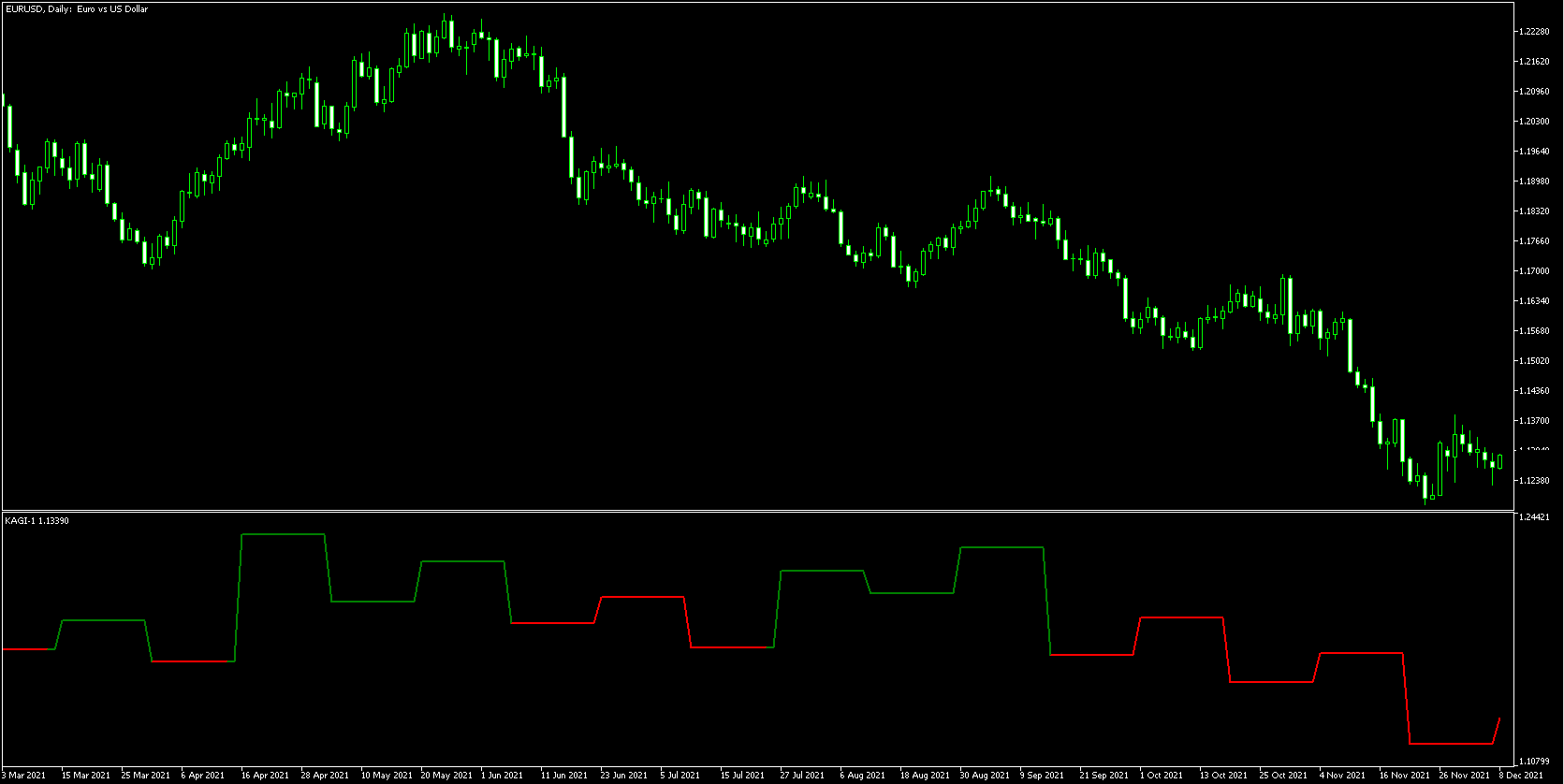

Kagi chart ek mukhtalif tareeqa hai jo khaas tor par Japani traders ke darmiyan mashhoor hai. Ye ek trend-based chart hai jo keemat ke tabdil hone par hi lines banata hai, na ke waqt ke mutabiq. Is tareeqay ki khaasiyat ye hai ke ye trading signals ko aasaani se samajhne aur trading decisions ke liye istemal karne mein madad karta hai.

How to Kagi Charts

Kagi charts khaas tor par price action aur trends par mabni hotay hain. Ye charting technique line charts se mukhtalif hoti hai, jahan line ka rukh waqt ke mutabiq hota hai, jabke Kagi chart ki lines ke rukh keemat ke tabdil hone par hota hai. Isi wajah se ye trend ko zyada behtar taur par darust karne mein madad karta hai.

Kagi Chart Type Components

- Kagi Lines: Kagi chart mein lines ko "Kagi Lines" kehte hain. Ye lines price movements ko darust karte hain. Jab price trend badalta hai, Kagi line bhi badalti hai.

- Reversal Lines: Ye lines indicate karte hain jab trend direction badalta hai. Ye typically Kagi line ke opposite side par draw ki jati hain.

Kagi Chart Trading Strategy

- Trend Identification: Sab se pehle, traders ko trend ko identify karna hota hai. Ye strategy trend-based hai, is liye trend ki direction ko samajhna zaroori hai.

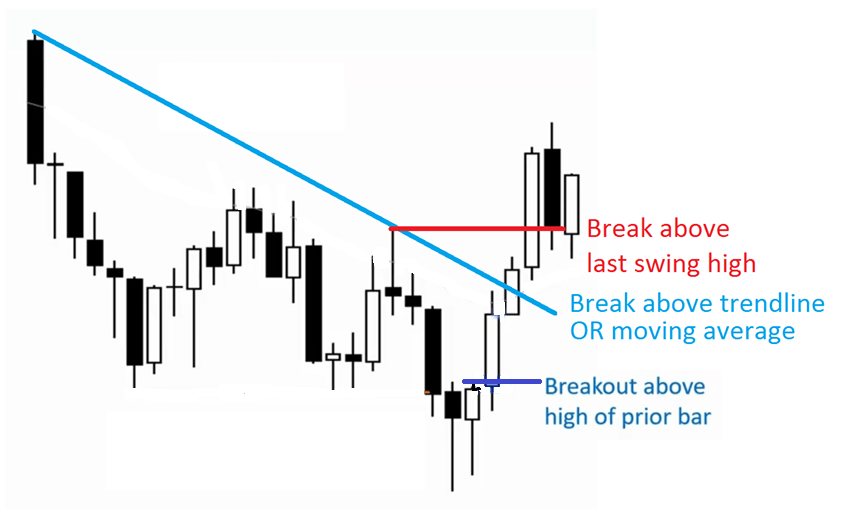

- Entry Points: Kagi chart ke zariye entry points ko identify karna asaan hota hai. Jab Kagi line ne direction change kiya hai aur nayi trend shuru hoti hai, wahan entry point ho sakta hai.

- Stop Loss and Take Profit Levels: Trading strategy mein stop loss aur take profit levels ka tayyun karna zaroori hota hai. Ye levels Kagi chart ki lines ke based par tay kiye jaate hain, jis se traders apne losses ko minimize aur profits ko maximize kar sakte hain.

- Use of Reversal Lines: Reversal lines ko istemal karke trend direction ke changes ko identify karna zaroori hai. Jab Kagi line reversal line ko cross karta hai, ye ek potential reversal signal hai.

- Confirmation: Trading signals ko confirm karne ke liye, traders ko doosri technical indicators ka istemal bhi kar sakte hain jaise ke moving averages ya RSI.

Kagi Chart Trading Strategy Benefit

- Clear Trend Signals: Kagi chart ki clear lines aur reversal points traders ko trend ko samajhne mein madad karte hain.

- Simplicity: Ye strategy simple hai aur traders ko complex technical indicators ki zarurat nahi hoti.

- Flexible: Kagi charts ke istemal se traders ko mukhtalif timeframe aur securities par trading karne ki flexibility milti hai.

- Trend Confirmation: Kagi chart ki lines ko doosri technical analysis tools ke saath istemal karke trend ko confirm karna asaan hota hai.

Kagi Chart Trading Strategy Challenges

- False Signals: Kabhi kabhi Kagi chart false signals bhi generate kar sakta hai, is liye confirmation ke liye doosri tools ki zarurat hoti hai.

- Whipsaws: Agar market choppy ho ya sideways move kare, to Kagi chart whipsaws (false signals) generate kar sakta hai.

- Not Suitable for All Markets: Ye strategy sabhi markets ke liye suitable nahi hoti, khaas karke volatile ya choppy markets mein.

تبصرہ

Расширенный режим Обычный режим