~~~~~Forex trading Mein Elliot Theory Mein Mojood "Motive Waves"~~~~~

Forex trading mein Elliott Wave Theory ka istemal karke, "motive waves" ya "trend waves" kehlane wale waves ko pehchanna aur samajhna mahatvapurna hota hai. Elliott Wave Theory, financial markets mein price action ko analyze karne ke liye ek technical analysis tool hai. Iske anusaar, market ke moves ko patterns mein classify kiya jata hai, jo ki investor ko market direction aur potential future moves ke baare mein madad karta hai.

Motive waves, market ke primary trend ya direction ko reflect karte hain. In waves mein, price action typically moves in the direction of the underlying trend. Ye waves trading opportunities aur trends ko identify karne mein madad karte hain.

Elliot Wave Theory ke anusaar, ye motive waves long-term trends ko represent karte hain aur inka understanding karne se traders ko market ki long-term direction ka idea milta hai. Ye waves market ke complex nature ko samajhne mein madad karte hain aur trading decisions ko informed banaate hain.

~~~~~Forex trading Mein Elliot Theory Mein Mojood "Motive Waves" Ki Khasosiyaat~~~~~

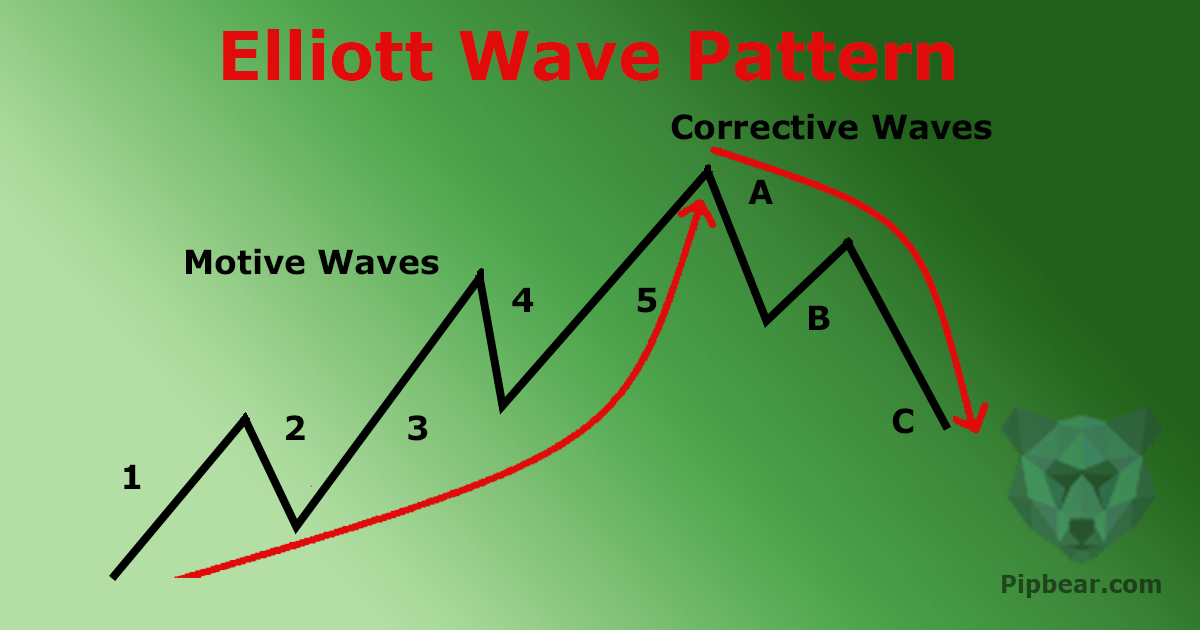

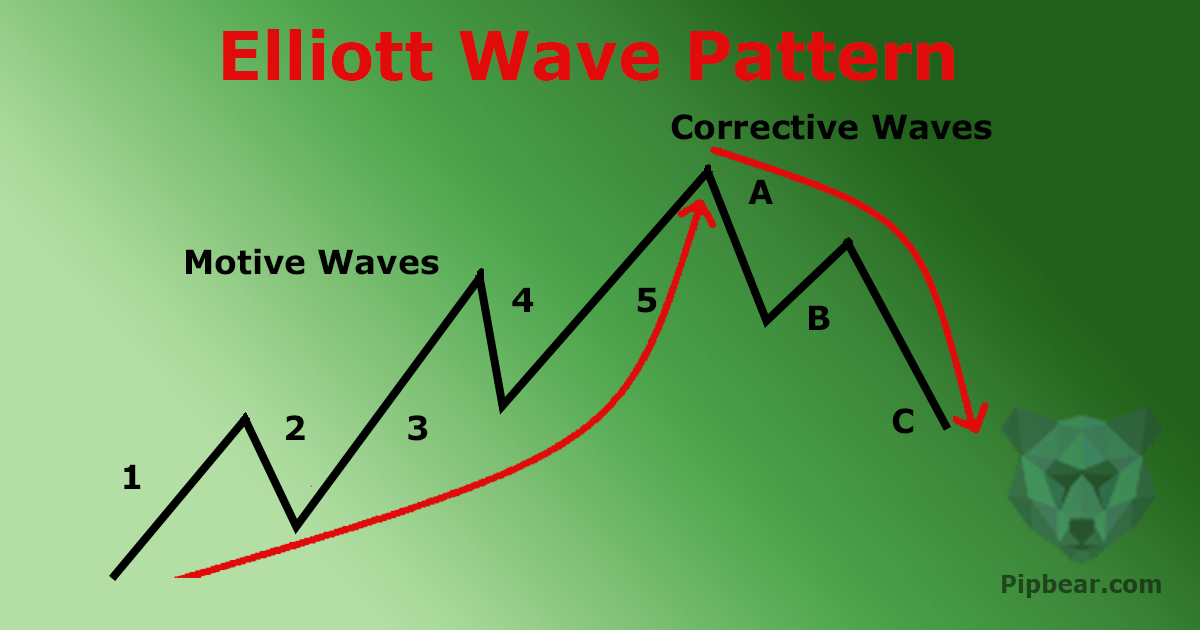

Elliot Wave Theory ke mutabiq, motive waves ko 5-wave structures mein taqseem kiya jata hai, jinmein 3 impulse waves (1, 3, aur 5) aur 2 corrective waves (2 aur 4) hote hain. In waves ke characteristics aur behavior ko samajhna trading mein kaafi ahem hota hai:

Forex trading mein Elliott Wave Theory ka istemal karke, "motive waves" ya "trend waves" kehlane wale waves ko pehchanna aur samajhna mahatvapurna hota hai. Elliott Wave Theory, financial markets mein price action ko analyze karne ke liye ek technical analysis tool hai. Iske anusaar, market ke moves ko patterns mein classify kiya jata hai, jo ki investor ko market direction aur potential future moves ke baare mein madad karta hai.

Motive waves, market ke primary trend ya direction ko reflect karte hain. In waves mein, price action typically moves in the direction of the underlying trend. Ye waves trading opportunities aur trends ko identify karne mein madad karte hain.

Elliot Wave Theory ke anusaar, ye motive waves long-term trends ko represent karte hain aur inka understanding karne se traders ko market ki long-term direction ka idea milta hai. Ye waves market ke complex nature ko samajhne mein madad karte hain aur trading decisions ko informed banaate hain.

~~~~~Forex trading Mein Elliot Theory Mein Mojood "Motive Waves" Ki Khasosiyaat~~~~~

Elliot Wave Theory ke mutabiq, motive waves ko 5-wave structures mein taqseem kiya jata hai, jinmein 3 impulse waves (1, 3, aur 5) aur 2 corrective waves (2 aur 4) hote hain. In waves ke characteristics aur behavior ko samajhna trading mein kaafi ahem hota hai:

- Impulse Waves (1, 3, aur 5):

- Ye waves trend ki taraf move karte hain aur aam tor par taqatwar momentum ke saath hota hai.

- Wave 1 mein, price action naye trend ki shuruaat ko dikhata hai.

- Wave 3 aam tor par sabse lamba hota hai aur sabse powerful hota hai, jismein trend ka zyada se zyada extension hota hai.

- Wave 5 mein, price action trend ka aakhri hissa hota hai aur aam tor par taqatwar momentum ke saath complete hota hai.

- Corrective Waves (2 aur 4):

- Ye waves trend ke ulte direction mein move karte hain, lekin overall trend ko reverse nahi karte hain.

- Wave 2 mein, price action mein chhoti muddat ke liye reversal hota hai, lekin overall trend mein ye ek retracement hota hai.

- Wave 4 mein, price action mein phir se chhoti muddat ke liye reversal hota hai, lekin ye bhi overall trend ka retracement hota hai.

تبصرہ

Расширенный режим Обычный режим