### Separating Line Pattern in Forex Trading

Separating Line Pattern forex trading mein ek bearish ya bullish trend reversal pattern hai, jo candlestick charts par dekhne ko milta hai. Is pattern mein do consecutive candles hote hain jinme se ek bullish aur doosra bearish hota hai. Yeh pattern uptrend ya downtrend ke reversal ko indicate karta hai, depending on its formation.

### Identifying the Separating Line Pattern

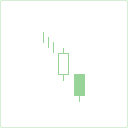

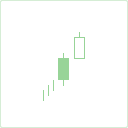

1. **Bullish Separating Line**: Is pattern mein pehla candle bearish hota hai, jiska range ya body relatively long hota hai. Doosre candle ka range pehle candle ke upper half mein hota hai aur ye candle bullish hota hai. Yeh bullish candle uptrend ke weak hone ya reversal ke indication ke taur par consider kiya ja sakta hai.

2. **Bearish Separating Line**: Is pattern mein pehla candle bullish hota hai, jiska range ya body relatively long hota hai. Doosre candle ka range pehle candle ke lower half mein hota hai aur ye candle bearish hota hai. Yeh bearish candle downtrend ke weak hone ya reversal ke indication ke taur par consider kiya ja sakta hai.

### Trading with the Separating Line Pattern

1. **Confirmation with Other Indicators**: Separating Line Pattern ko confirm karne ke liye traders doosre technical indicators jaise ki volume analysis, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence) ka istemal karte hain. Agar doosre indicators bhi reversal ki direction mein point karte hain, toh yeh pattern kaafi reliable ho sakta hai.

2. **Entry aur Exit Points**: Jab Separating Line Pattern confirm ho jaye, traders entry aur exit points set karte hain. Agar bullish Separating Line Pattern confirm hota hai, toh traders long positions enter kar sakte hain aur bearish pattern ke case mein short positions lena consider kar sakte hain.

3. **Risk Management**: Har trade mein risk management ka istemal karna zaroori hai. Stop-loss levels aur profit targets set karke traders apne risk ko control kar sakte hain. Separating Line Pattern ke signals ke sath proper risk management strategies ka istemal karke trading performance ko improve kiya ja sakta hai.

### Conclusion

Separating Line Pattern forex trading mein ek important candlestick pattern hai jo trend reversals ko indicate karta hai. Is pattern ko sahi taur par identify karke aur doosre technical tools ke sath confirm karke traders accurate trading decisions le sakte hain. Hamesha thorough analysis aur discipline ke sath trading karna zaroori hai taki traders market movements ko sahi taur par interpret kar sakein aur profitable trades execute kar sakein.

Separating Line Pattern forex trading mein ek bearish ya bullish trend reversal pattern hai, jo candlestick charts par dekhne ko milta hai. Is pattern mein do consecutive candles hote hain jinme se ek bullish aur doosra bearish hota hai. Yeh pattern uptrend ya downtrend ke reversal ko indicate karta hai, depending on its formation.

### Identifying the Separating Line Pattern

1. **Bullish Separating Line**: Is pattern mein pehla candle bearish hota hai, jiska range ya body relatively long hota hai. Doosre candle ka range pehle candle ke upper half mein hota hai aur ye candle bullish hota hai. Yeh bullish candle uptrend ke weak hone ya reversal ke indication ke taur par consider kiya ja sakta hai.

2. **Bearish Separating Line**: Is pattern mein pehla candle bullish hota hai, jiska range ya body relatively long hota hai. Doosre candle ka range pehle candle ke lower half mein hota hai aur ye candle bearish hota hai. Yeh bearish candle downtrend ke weak hone ya reversal ke indication ke taur par consider kiya ja sakta hai.

### Trading with the Separating Line Pattern

1. **Confirmation with Other Indicators**: Separating Line Pattern ko confirm karne ke liye traders doosre technical indicators jaise ki volume analysis, RSI (Relative Strength Index), ya MACD (Moving Average Convergence Divergence) ka istemal karte hain. Agar doosre indicators bhi reversal ki direction mein point karte hain, toh yeh pattern kaafi reliable ho sakta hai.

2. **Entry aur Exit Points**: Jab Separating Line Pattern confirm ho jaye, traders entry aur exit points set karte hain. Agar bullish Separating Line Pattern confirm hota hai, toh traders long positions enter kar sakte hain aur bearish pattern ke case mein short positions lena consider kar sakte hain.

3. **Risk Management**: Har trade mein risk management ka istemal karna zaroori hai. Stop-loss levels aur profit targets set karke traders apne risk ko control kar sakte hain. Separating Line Pattern ke signals ke sath proper risk management strategies ka istemal karke trading performance ko improve kiya ja sakta hai.

### Conclusion

Separating Line Pattern forex trading mein ek important candlestick pattern hai jo trend reversals ko indicate karta hai. Is pattern ko sahi taur par identify karke aur doosre technical tools ke sath confirm karke traders accurate trading decisions le sakte hain. Hamesha thorough analysis aur discipline ke sath trading karna zaroori hai taki traders market movements ko sahi taur par interpret kar sakein aur profitable trades execute kar sakein.

تبصرہ

Расширенный режим Обычный режим