Breakouts aur Retests Ko Samajhna

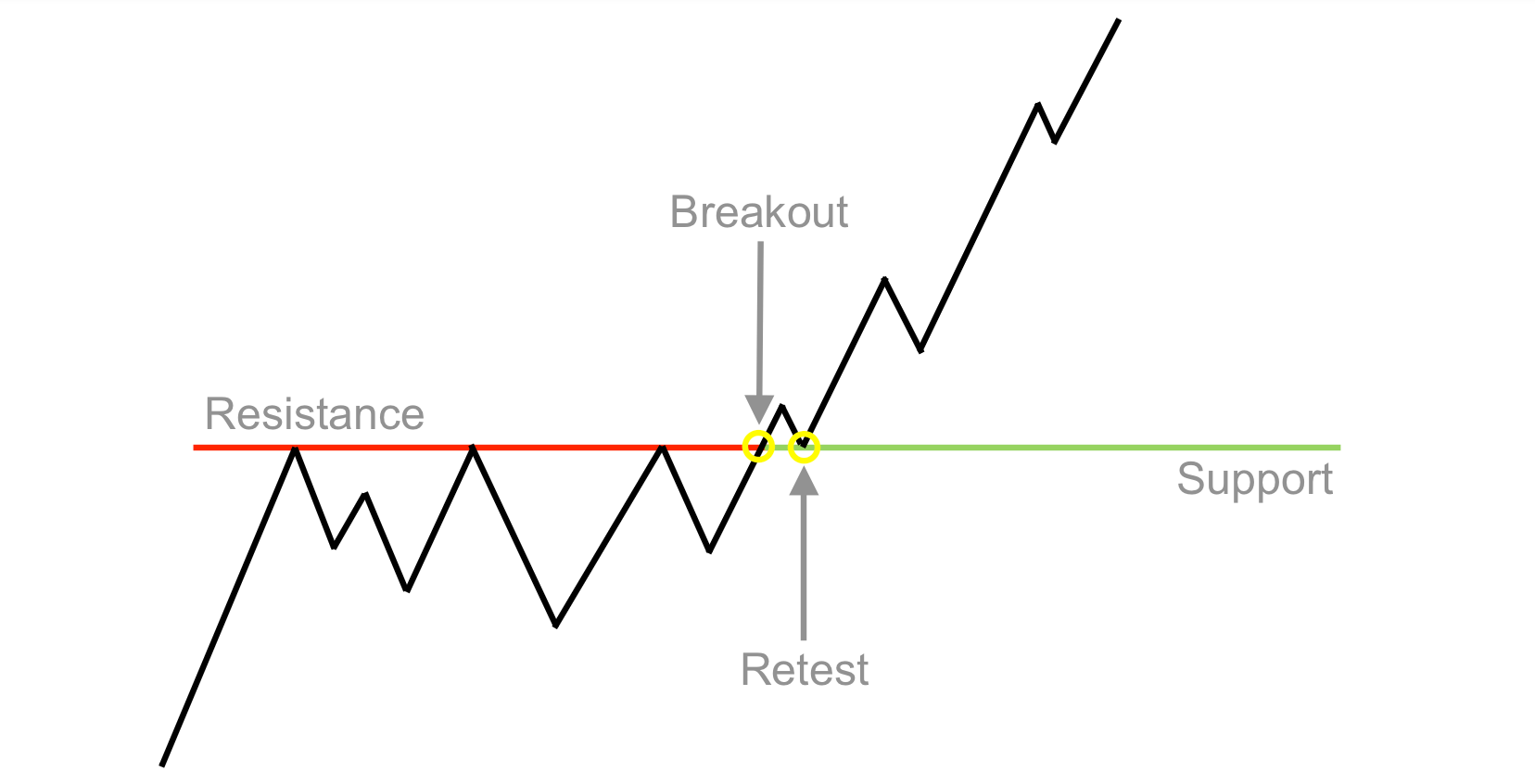

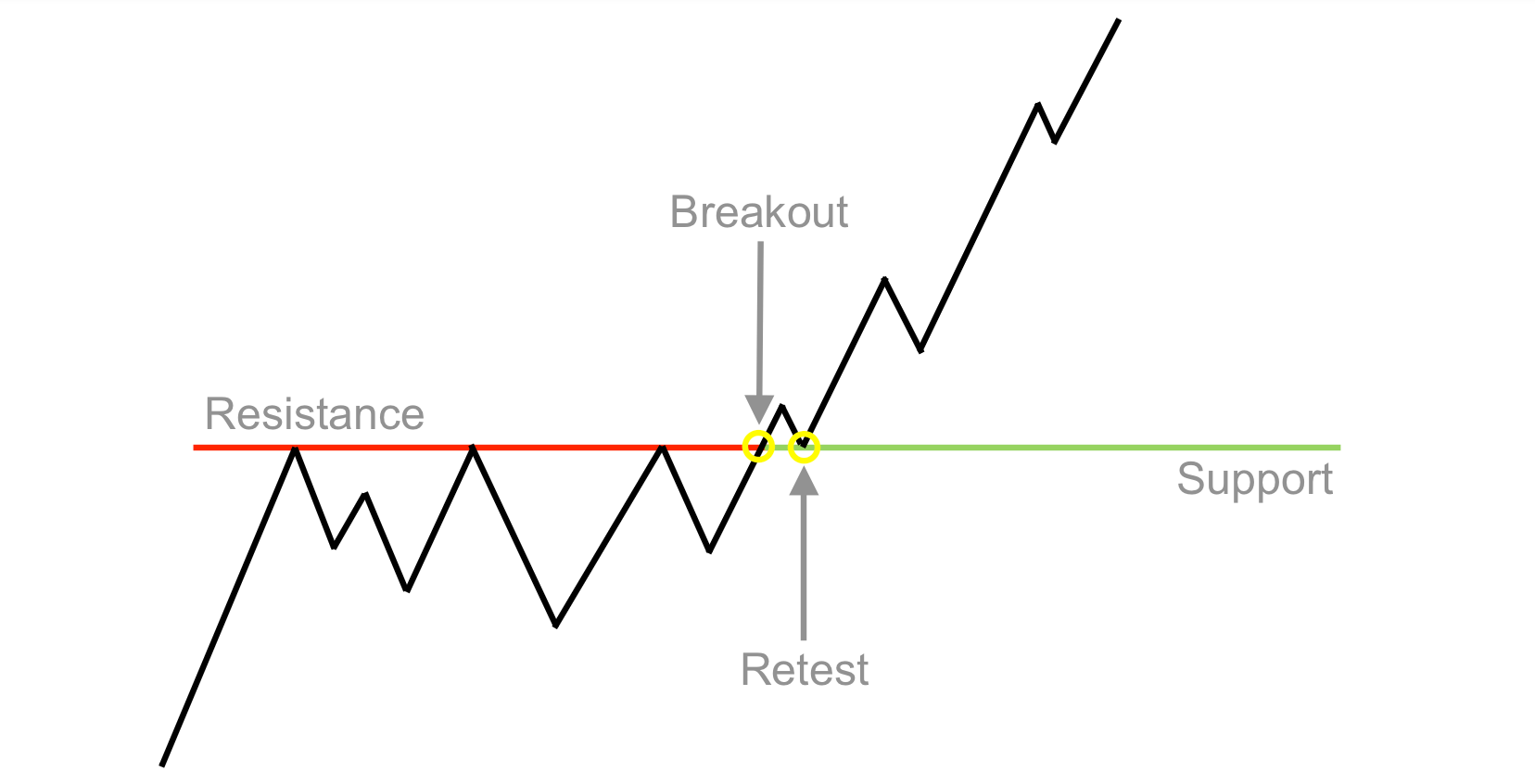

Retest strategy ke makhsoos hone se pehle, breakouts aur retests ke concepts ko samajhna ahem hai. Ek breakout tab hota hai jab kisi maqsoodah support ya resistance level se price ek mukarrar had tak chali jati hai, jo ek mumkinah market sentiment ya momentum ke tabdeeli ka ishara hai. Breakouts aksar barhaye hue trading volume ke sath hotay hain, jo naye direction mein market ki hissa dari aur itminan ki nishaandahi karta hai.

Breakout ke baad, aam tor par price ko pehle breach kiye gaye level par dobara talaash kiya jata hai, jo ek retest kehlaya jata hai. Retest muddaiqan yeh sabaq deta hai ke pehle ka breakout kya farzi nishan ya waqti market ghalti tha. Ek kamiyab retest pehle ka breakout tasdeeq karta hai aur traders ko naye trend ki taraf yaqeen dilata hai.

Retest Strategy Ke Aham Usool

Retest strategy mukhtalif aham usool par mabni hai jo iski kargar hone aur itminan dene ki hamil hain:

Retest strategy ko amal mein anay ke liye ek tarteeb yafta raahe tareeqat shamil hoti hai jo potential trading opportunities ko talaash karne aur prevailing market conditions ke mutabiq trades ka anjam dena shamil hai. Niche diye gaye marahil ek aam tareeqa hai retest strategy ko amal mein lanay ka:

Retest strategy forex traders ko kai faide deti hai, jo ise naye aur tajwez shudah market shirakton mein mashhoor banati hai:

Retest strategy forex traders ke liye ek taqatwar aala hai, jo unko buland imkani trading opportunities ko pehchanne aur risk ko behtar taur par manage karne ki salahiyat deta hai. Breakout ki tasdeeq ke intezar mein retests ki tahqiq, traders ko farzi signals ko filter out karne aur wazeh risk-reward profiles wali trades par tawajju dene mein madad karta hai. Magar, jaise kisi bhi trading strategy mein, retest strategy ke saath kamiyabi ke liye discipline, sabra, aur sound risk management principles ki paalan zaroori hai. Retest strategy ke usool aur amal mein maharat hasil karke, traders apni trading performance ko behtar bana sakte hain aur forex markets mein lambi muddat tak kamiyabi haasil kar sakte hain.

Retest strategy ke makhsoos hone se pehle, breakouts aur retests ke concepts ko samajhna ahem hai. Ek breakout tab hota hai jab kisi maqsoodah support ya resistance level se price ek mukarrar had tak chali jati hai, jo ek mumkinah market sentiment ya momentum ke tabdeeli ka ishara hai. Breakouts aksar barhaye hue trading volume ke sath hotay hain, jo naye direction mein market ki hissa dari aur itminan ki nishaandahi karta hai.

Breakout ke baad, aam tor par price ko pehle breach kiye gaye level par dobara talaash kiya jata hai, jo ek retest kehlaya jata hai. Retest muddaiqan yeh sabaq deta hai ke pehle ka breakout kya farzi nishan ya waqti market ghalti tha. Ek kamiyab retest pehle ka breakout tasdeeq karta hai aur traders ko naye trend ki taraf yaqeen dilata hai.

Retest Strategy Ke Aham Usool

Retest strategy mukhtalif aham usool par mabni hai jo iski kargar hone aur itminan dene ki hamil hain:

- Breakout Ki Tasdeeq: Retest ka asal maqsad pehle breakout ki tasdeeq hai. Ek successful retest pehle ka breakout tasdeeq karta hai aur traders ko naye trend ki satah par yaqeen dilata hai.

- Support aur Resistance Levels Ka Pehchan Karna: Retest strategy ka markazi hissa ahem support aur resistance levels ka pehchan karna hai. Ye levels aksar taqreeban purani price data, chart patterns, ya technical indicators ke mabain par tay kiye jate hain. Traders un jagahon ko talaash karte hain jahan price ne bar bar se guzarna mushkil samjha ho (resistance) ya samarthan hasil kiya ho (support), umeed karte hain ke breakout in levels se honay se kisi aham price movement ke chance hain.

- Risk Management: Jaise kisi bhi trading strategy mein, risk management retest strategy ko istemal karte waqt ahem hai. Traders ko apni risk bardasht ki satah tay karni chahiye aur mohtaj marzi se stop-loss levels tay karna chahiye taakey ek nakami hone par nuqsan ko kam kiya ja sake. Iske ilawa, position sizing aur sahi capital ka allocation zaroori hai taakey individual trades asar na dalein aur overall portfolio performance par bojh na daalein.

- Sabra aur Discipline: Retest strategy ko kamyab istemal karne ke liye sabra aur discipline ki zaroorat hoti hai. Traders ko breakout aur mukhtalif levels ke baad retest ka intezaar karna hota hai, taa ke wo trading plan se na bhatak jaayein. Discipline banaye rakhna strategy ke qawaid ka paalan karna lamha bhar mein kamiyabi ke liye ahem hai.

Retest strategy ko amal mein anay ke liye ek tarteeb yafta raahe tareeqat shamil hoti hai jo potential trading opportunities ko talaash karne aur prevailing market conditions ke mutabiq trades ka anjam dena shamil hai. Niche diye gaye marahil ek aam tareeqa hai retest strategy ko amal mein lanay ka:

- Breakout Candidates Ka Pehchan Karna: Traders pehle breakout candidates ko market mein dhoondhte hain jo potential breakouts ke nishan dikhate hain. Ismein price charts ka tajziya, news events ka mutala, ya technical indicators ka istemal shamil ho sakta hai.

- Breakout Ki Tasdeeq: Jab ek potential breakout candidate paaya jaata hai, traders breakout ki tasdeeq ka intezar karte hain, fazool trading volume ke sath decisive price action aur increased trading volume ke zariye. Breakout tab tasdeeq hota hai jab price kisi ahem support ya resistance level ko convincingly breach karta hai, jo market dynamics mein tabdeeli ka ishara karta hai.

- Retest Ka Intezaar Karna: Breakout ke baad, traders be sabar taur par price ko wapas aane ka aur pehle breached level ko dobara test karne ka intezar karte hain. Retest opportunity deti hai ke breakout ki taqat aur potential trades mein entry point ko dekhne ka mouqa milta hai.

- Dakhil aur Baahar Nikalne Ke Sharait: Ek retest trade mein dakhil hone ki amli shara'it, jaise ke bullish ya bearish candlestick pattern ke pehchan ke upar mabni hoti hai, ya retest ke baad price mein rebound hone par hoti hai. Stop-loss orders retested level ke neeche (long trades ke liye) ya uske upar (short trades ke liye) rakhe jate hain takay potential nuqsan mein kami ho. Profit targets trader ke risk-reward preferences aur prevailing market conditions ke mutabiq tay kiye jate hain.

- Risk Management aur Position Sizing: Traders ko strict risk management principles ka paalan karna zaroori hai, jaise ke sahi position sizing aur stop-loss orders ko un levels par rakhe jate hain jo unki risk bardasht ki satah ke mutabiq hoti hain. Isse ensure hota hai ke individual trades overall portfolio performance par bojh na daalein aur market volatility ke dauran capital ko mehfooz rakhte hain.

- Trade Progress Ka Nigraani Karna: Jab ek trade shuru hoti hai, traders use closely monitor karte hain, stop-loss aur take-profit levels ko evolve hone wali market conditions ke mutabiq adjust karte hain. Eham hai ke price dynamics ke tabdeel hone par mutasir hone ka dhyan rakha jaye taakey munafa ki hadd tak ko pohcha sakein aur nuqsan ko kam kiya ja sake.

Retest strategy forex traders ko kai faide deti hai, jo ise naye aur tajwez shudah market shirakton mein mashhoor banati hai:

- Buland Imkani Setups: Retests aksar buland imkani setups dete hain, kyunke wo breakout ki taqat tasdeeq karte hain aur prevailing trend ki satah ka tasdeeq karte hain. Confirm ke intezar mein reh kar, traders farzi breakout signals ko talaash kar sakte hain aur pehle trading mein dakhil hone ki sambhavna ko kam kar sakte hain.

- Wazeh Risk-Reward Profile: Retest strategy traders ke liye wazeh risk-reward profiles qayam karna asan karta hai, jahan wazeh dakhil, stop-loss, aur take-profit levels hote hain. Ye mohtaj marzi se risk management ko asaan karta hai aur traders ko unke maqsad ke hisaab se inform ki maqbooliyat par faisla karne mein madad karta hai.

- Tarmeem Karne Ki Salahiyat Aur Mushtaqil Pan: Retest strategy ko mukhtalif timeframes aur market shirakton par istemal kiya ja sakta hai, jo traders ko unki trading approach mein flexibility deta hai. Chahe intraday, swing, ya long-term trends par trading kar rahe hon, retest strategy ke usool lagoo rehne ke qabil hote hain, jo traders ko tabdeel hone wali market dynamics ke mutabiq adapt hone ki salahiyat deta hai.

- Ghalati Signals Ki Kam Se Kamat: Breakout ki tasdeeq ke intezar ke baad, retest strategy farzi signals ke asar ko kam karne mein madad karta hai, jo nuqsan ya miss ki gayi opportunities ka natija hota hai. Traders ghair mo'atabar signals ko filter out kar sakte hain aur high conviction aur zyada munafa ki sambhavna wali trades par tawajju den sakte hain.

- Nafsiyati Itminan: Retest strategy traders ko unki trading decisions mein nafsiyati itminan aur yaqeen deta hai. Breakout aur retest ki tasdeeq ke intezar mein, traders impulsive trading behavior se bach sakte hain aur maqool faislo par rational faislo ka intekhab kar sakte hain.

Retest strategy forex traders ke liye ek taqatwar aala hai, jo unko buland imkani trading opportunities ko pehchanne aur risk ko behtar taur par manage karne ki salahiyat deta hai. Breakout ki tasdeeq ke intezar mein retests ki tahqiq, traders ko farzi signals ko filter out karne aur wazeh risk-reward profiles wali trades par tawajju dene mein madad karta hai. Magar, jaise kisi bhi trading strategy mein, retest strategy ke saath kamiyabi ke liye discipline, sabra, aur sound risk management principles ki paalan zaroori hai. Retest strategy ke usool aur amal mein maharat hasil karke, traders apni trading performance ko behtar bana sakte hain aur forex markets mein lambi muddat tak kamiyabi haasil kar sakte hain.

تبصرہ

Расширенный режим Обычный режим