Forex trading mein currency exchange rates ki tanqeed par mabni hoti hai. Traders mukhtalif technical analysis tools aur candlestick patterns ka istemal karte hain taake woh currency pairs ko khareedne ya bechne ke baray mein maloomat hasil kar sakein. Aik aisa candlestick pattern jo forex trading mein ahmiyat rakhta hai woh hai Dark Cloud Cover. Dark Cloud Cover pattern aik bearish reversal pattern hai jo ek uptrend ke akhir mein banta hai, aur ek downtrend ke liye mumkinah revers ka ishara deta hai.

Dark Cloud Cover Ka Formation

Dark Cloud Cover pattern do candlesticks se banta hai: pehla candlestick bullish hota hai, jo continued buying pressure ko signal karta hai, jabke doosra candlestick pehle candlestick ke high se ooncha khulta hai lekin pehle candlestick ke body ka midpoint se neeche band hota hai. Ye doosra candlestick essentially peechle bullish candlestick ko "cover" karta hai, is wajah se iska naam "Dark Cloud Cover" hai. Ye pattern bullish se bearish momentum mein tabdil hone ka ishara karta hai, jab bechnay ki dabav kharid ki dabav ko khatam karne lagta hai.

Dark Cloud Cover Ki Tabeer

Dark Cloud Cover pattern ki tabeer ko samajhna hai, iske muzo mein mojood market trend ke context mein. Jab ye pattern ek uptrend ke akhir mein banta hai, to ye dikhata hai ke kharidne wale control khona shuru kar rahe hain, aur bechnay walon ko momentum hasil karne mein kami mehsoos ho rahi hai. Traders isay ek signal ke taur par samajhte hain ke long positions se bahar nikalne ya phir short positions kholne ka waqt aa gaya hai taa ke expected downtrend reversal ka faida uthaya ja sake.

Magar, ehmiyat hai ke Dark Cloud Cover pattern par trading ke faislay par sirf aitmad na rakha jaye. Forex trading mein context ka bohat bara asar hota hai, aur doosre technical indicators ya candlestick patterns se Dark Cloud Cover pattern ki signal ko mazboot karne ka aham haisiyat hota hai.

Dark Cloud Cover Ke Ahem Hissay

Dark Cloud Cover pattern ko effectively identify aur interpret karne ke liye, traders ko iske ahem hisso par ghor karna chahiye:

Dark Cloud Cover pattern ko trading strategies mein shamil karne ke liye, traders ko iske nuances aur potential pitfalls ko samajhna zaroori hai. Yahan kuch strategies hain jo traders Dark Cloud Cover pattern ko forex trading mein istemal karte waqt ghor kar sakte hain:

Dark Cloud Cover Ka Formation

Dark Cloud Cover pattern do candlesticks se banta hai: pehla candlestick bullish hota hai, jo continued buying pressure ko signal karta hai, jabke doosra candlestick pehle candlestick ke high se ooncha khulta hai lekin pehle candlestick ke body ka midpoint se neeche band hota hai. Ye doosra candlestick essentially peechle bullish candlestick ko "cover" karta hai, is wajah se iska naam "Dark Cloud Cover" hai. Ye pattern bullish se bearish momentum mein tabdil hone ka ishara karta hai, jab bechnay ki dabav kharid ki dabav ko khatam karne lagta hai.

Dark Cloud Cover Ki Tabeer

Dark Cloud Cover pattern ki tabeer ko samajhna hai, iske muzo mein mojood market trend ke context mein. Jab ye pattern ek uptrend ke akhir mein banta hai, to ye dikhata hai ke kharidne wale control khona shuru kar rahe hain, aur bechnay walon ko momentum hasil karne mein kami mehsoos ho rahi hai. Traders isay ek signal ke taur par samajhte hain ke long positions se bahar nikalne ya phir short positions kholne ka waqt aa gaya hai taa ke expected downtrend reversal ka faida uthaya ja sake.

Magar, ehmiyat hai ke Dark Cloud Cover pattern par trading ke faislay par sirf aitmad na rakha jaye. Forex trading mein context ka bohat bara asar hota hai, aur doosre technical indicators ya candlestick patterns se Dark Cloud Cover pattern ki signal ko mazboot karne ka aham haisiyat hota hai.

Dark Cloud Cover Ke Ahem Hissay

Dark Cloud Cover pattern ko effectively identify aur interpret karne ke liye, traders ko iske ahem hisso par ghor karna chahiye:

- Pehla Candlestick (Bullish): Dark Cloud Cover pattern ke pehle candlestick normally bullish hota hai, jo upar ki taraf price momentum ko dikhata hai. Ye candlestick pattern ko establish karke market mein bullish sentiment banata hai.

- Doosra Candlestick: Dark Cloud Cover pattern ke doosre candlestick pehle candlestick ke high se ooncha khulta hai, jo initial bullish sentiment ko reflect karta hai. Magar, ye upar ki taraf ka momentum barqarar nahi rakhta aur pehle candlestick ke body ka midpoint se neeche band hota hai, trend mein reversal ka potential ishara karta hai.

- Volume: Volume Dark Cloud Cover pattern ki strength ke liye ahem hai. Behtar hai ke doosre candlestick ke saath zyada trading volume ho, jo reversal ke peeche conviction ko dikhata hai. Magar, pattern ke formation ke doran kam volume ye dikhata hai ke reversal signal ki weak confirmation hai.

- Price Confirmation: Traders often look for confirmation of the Dark Cloud Cover pattern through subsequent price action. A follow-through with lower prices in the sessions following the pattern formation strengthens the validity of the bearish reversal signal.

Dark Cloud Cover pattern ko trading strategies mein shamil karne ke liye, traders ko iske nuances aur potential pitfalls ko samajhna zaroori hai. Yahan kuch strategies hain jo traders Dark Cloud Cover pattern ko forex trading mein istemal karte waqt ghor kar sakte hain:

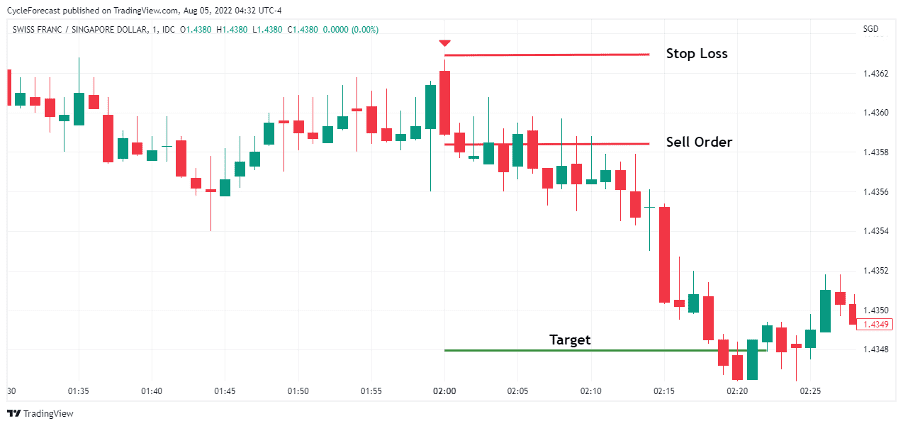

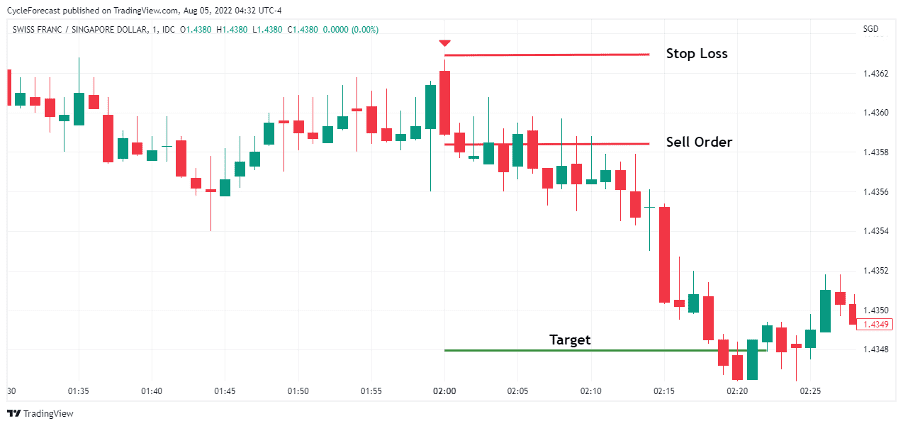

- Confirmation with Other Indicators: Dark Cloud Cover pattern ki reliability ko barhane ke liye, traders ko doosre technical indicators jaise ke Relative Strength Index (RSI), Moving Averages, ya support aur resistance levels se confirmation dhoondhna chahiye. Multiple indicators ke signals ka milaap successful trades ki probability ko zyada karta hai.

- Risk Management: Jaise ke har trading strategy mein, risk management Dark Cloud Cover pattern par trading karte waqt zaroori hai. Potential losses ko limit karne ke liye stop-loss orders implement karna aur sahi position sizing techniques ko adhere karna risk ko mitigate karne mein madad karta hai jo bearish reversal patterns ke saath judi hui hain.

- Wait for Confirmation: Dark Cloud Cover pattern ke formation ke baad trades mein enter karne ke bajaye, traders subsequent price action ke through confirmation ka intezar kar sakte hain. Ye approach false signals ko filter karta hai aur premature trades mein shamil hone ki sambhavna ko kam karta hai.

- Combine with Trend Analysis: Jab Dark Cloud Cover pattern aik potential reversal in trend ko indicate karta hai, to ahmiyat hai ke bade market context ko dhyan mein rakha jaye. Trades ko prevailing trend ke saath align karna successful outcomes ki probability ko zyada karta hai. Traders ko Dark Cloud Cover patterns ko dhundne ke liye dekhna chahiye jo key resistance levels ke paas ya overbought conditions mein hote hain taake reversal signals mazboot hon.

- Backtesting and Practice: Dark Cloud Cover pattern ko live trading mein istemal karne se pehle, aik mukammal backtesting historical price data par zaroori hai takay iski efficacy ko alag alag market conditions mein assess kiya ja sake. Additionally, demo accounts par practice karna traders ko confidence hasil karne aur apni execution skills ko refine karne mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим