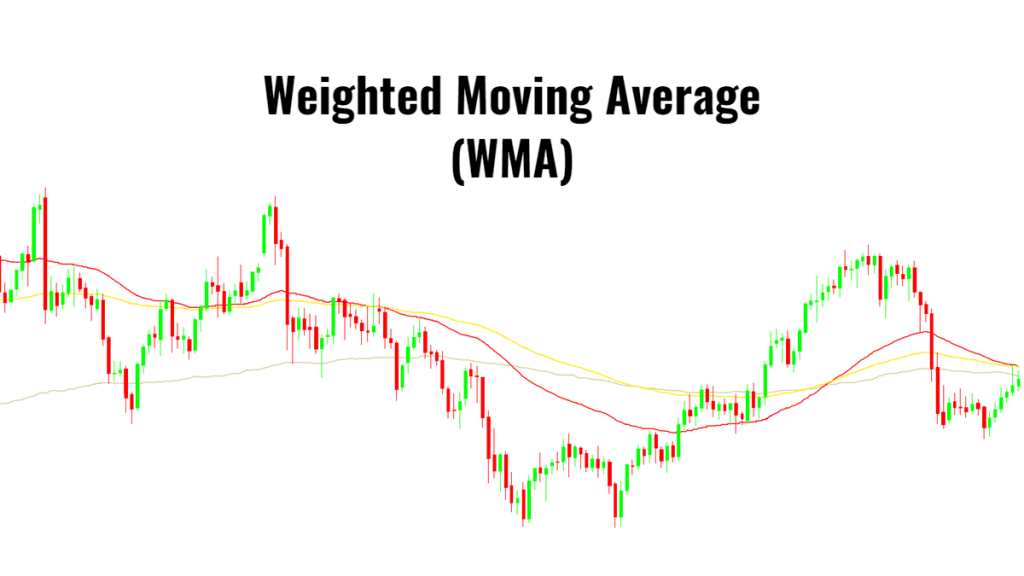

Weighted Moving Average (WMA)

Weighted Moving Average (WMA) ek statistics aur finance mein istemal hone wala aik method hai jo data ko analyze karne aur forecasts banane ke liye istemal kiya jata hai. WMA, average (average) ki tarah hota hai, lekin isme har value ko ek weight diya jata hai jis se recent values ko zyada importance di jati hai aur purani values ko kam importance di jati hai.

WMA ka Formula: ���=(�1×�1)+(�2×�2)+…+(��×��)�1+�2+…+��WMA=w1+w2 +…+wn(w1×y1)+(w2×y2)+…+(wn×yn)

Yahan, �1,�2,…,��w1,w2,…,wn weights hain jo har observation ko diye gaye hain aur �1,�2,…,��y1,y2,…,yn observations hain.

Weighted Moving Average (WMA) ka Istemal: WMA ko aksar time series data analysis mein istemal kiya jata hai. Iska istemal sales forecasts, stock price analysis, aur economic indicators ke forecasts ke liye kiya jata hai. Isme recent data ko zyada weight diya jata hai taake current trends ko accurately reflect kiya ja sake.

WMA ki Advantages:

- Recent Data Importance: WMA mein recent data ko zyada weight diya jata hai, jis se current trends ko accurately capture kiya ja sakta hai.

- Flexibility: WMA mein weights ko adjust kiya ja sakta hai, jis se analysts apne preference ke mutabiq data ko analyze kar sakte hain.

- Simple Calculation: WMA ka calculation simple hota hai aur easily implement kiya ja sakta hai.

WMA ki Limitations:

- Subjectivity: WMA mein weights ko assign karna subjective hota hai aur yeh depend karta hai ke analyst ko kis observation ko zyada importance dena hai.

- Lagging Indicators: WMA, lagging indicators ko capture karne mein kaam aata hai, isliye yeh future trends ko predict karne mein kisi had tak limitation mein hota hai.

- Sensitive to Outliers: Agar kisi outlier value ko zyada weight diya gaya hai, to WMA us outlier ke impact ko zyada capture karega, jis se forecasts inaccurate ho sakte hain.

WMA ka Istemal Kaise Kiya Jata Hai:

- Data Collection: Sabse pehle, relevant data collect kiya jata hai jaise sales figures, stock prices, ya kisi bhi time-series data.

- Weights Assign karna: Phir, har observation ke liye appropriate weights assign kiye jate hain. Jaise ke recent observations ko zyada weight aur purani observations ko kam weight diya jata hai.

- WMA Calculation: Weighted Moving Average ka calculation kiya jata hai formula ke zariye.

- Analysis aur Forecasting: Phir, hasil kiya gaya WMA data ko analyze kiya jata hai aur future trends ko predict kiya jata hai.

WMA aur Simple Moving Average (SMA) mein Farq: WMA aur SMA dono hi moving average techniques hain, lekin unme kuch farq hai. WMA mein har observation ko ek specific weight diya jata hai, jabke SMA mein sabhi observations ka equal weight hota hai. Is tarah, WMA recent data ko zyada importance deta hai jabke SMA har observation ko equal importance deta hai.

Umeed hai ke yeh tafseeli maqala aapko Weighted Moving Average (WMA) ke concept ko samajhne mein madad karega. Yeh technique finance aur statistics mein aham hai aur accurate analysis aur forecasting ke liye istemal kiya jata hai.

تبصرہ

Расширенный режим Обычный режим