RISK MANAGEMENT

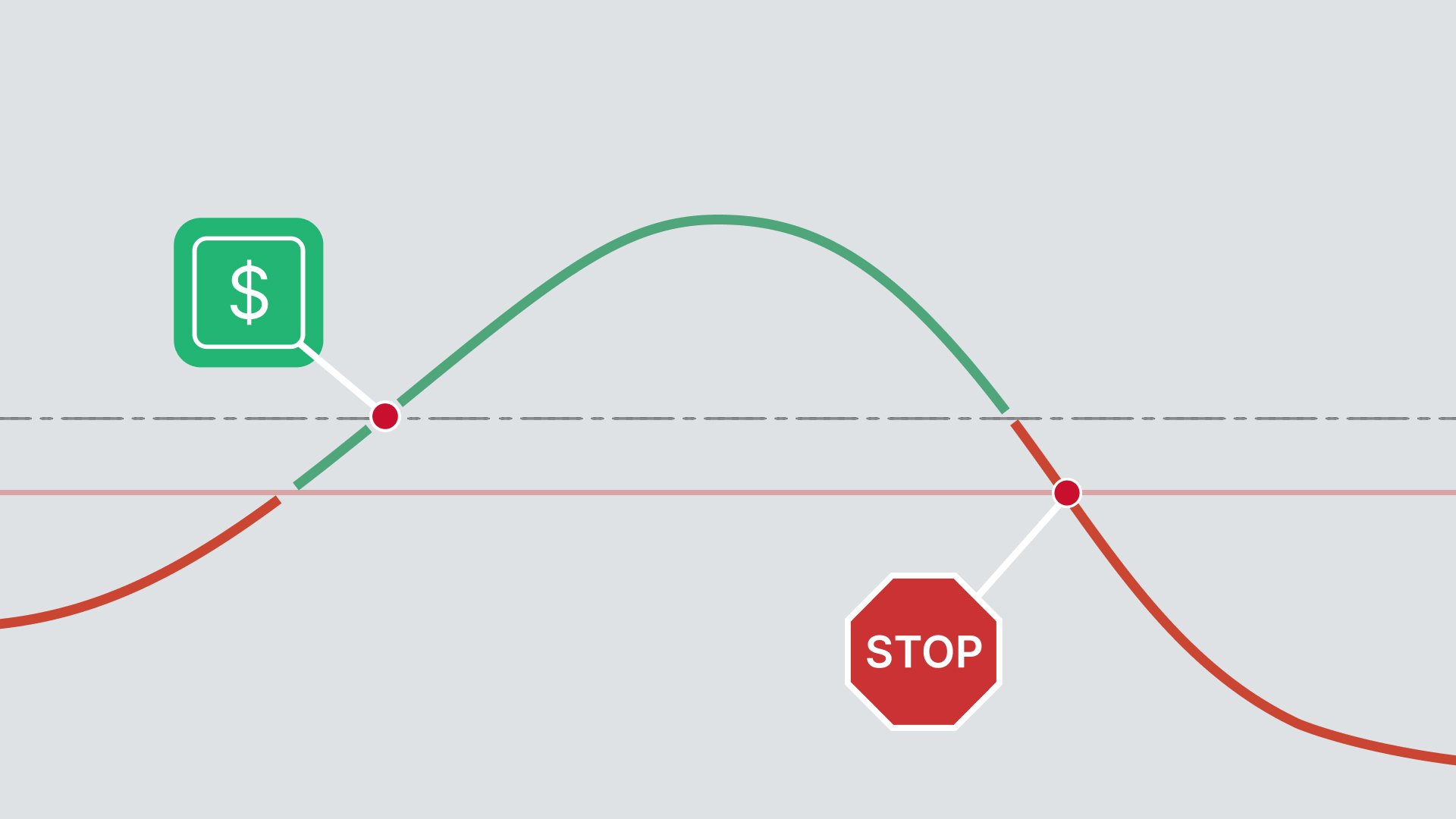

Dear traders analysis, threat management and emotional balance par recognition kar ky traders future mein loss sey secure sakte hain and behtar taur par buying and selling kar sakte hain.. Apne risk desire ko sahi taur par samajhna, ek sahi risk management strategy banane ka first step hai. Kyun kay currency pairs volatile hote hain, aur din bhar mein kai martaba keemat mein increase ya decrease hoti hai, is liye traders ko yeh pata hona chahiye kay woh kitni amount ka loss bear kar sakte hain. Agar aap kisi bhi trade mein zyada risk lete hain aur woh trade loss mein tabdeel ho jata hai, to aap ka pura paisa khatam ho sakta hai. Isliye, risk management ke zariye aap apni trading ko control mein rakh sakte hain. Volatility risk markets mein fluctuations ki degree ko bayan karta hai aur har trader ki trading strategy mein zaroor shamil hona chahiye.

HOW TO MANAGE RISKS

Risk management trading strategy ka ek zaroori factor hai jo aapko nuksan se bachata hai aur aapki trading career ko stable rakhta hai.. Aap ko apne trading account ke size ke according sahi position sizing ka selection karna chahiye, taa kay agar aap ki trade loss mein changing ho jaye, to aap ka pura account wash na ho. Position sizing ke liye, aap ko apne account size aur risk tolerance ka idea lagana ho ga. Agar traders sirf aik currency pair mein invest karte hain, aur woh pair loss mein change ho jata hai, tou aap ka complete account loss mein ja sakta hai. Lekin agar aap, different currencies mein invest karte hain, tou traders kay loss sey bachny kay chances zyada hote hain. Ess liye, zaroori hai ke traders apne emotions ko control mein rakhein, aur hamesha objective and positive trading decisions apply kerein. Regularly apni trading performance ko review karna aur apne risk management strategies ko adjust karna zaroori hai. Agar koi strategy consistently losses generate kar rahi hai, tou oss ko change karna chahiye. Jisssey change of luck bi ho sakti hy.

HISTORICAL ANALYSIS

Kisi bi pattern ko follow kerny sy pehly oss ka history check kerna lazmi hota hy ta kay oss ka historical dataaur success rate per analysis kiya ja saky. Apne trading portfolio ko diversify karna, yani ke alag-alag assets aur market instruments mein invest karna, risk ko spread karta hai. Ek hi asset ya market par depend na karein. Balky different trades open ki jayein tou oss sey some time losses ko cover bi kiya ja sakta hy. And as a result profit earning element ki waja sey target bi achieve kiya j asakta hy.

Dear traders analysis, threat management and emotional balance par recognition kar ky traders future mein loss sey secure sakte hain and behtar taur par buying and selling kar sakte hain.. Apne risk desire ko sahi taur par samajhna, ek sahi risk management strategy banane ka first step hai. Kyun kay currency pairs volatile hote hain, aur din bhar mein kai martaba keemat mein increase ya decrease hoti hai, is liye traders ko yeh pata hona chahiye kay woh kitni amount ka loss bear kar sakte hain. Agar aap kisi bhi trade mein zyada risk lete hain aur woh trade loss mein tabdeel ho jata hai, to aap ka pura paisa khatam ho sakta hai. Isliye, risk management ke zariye aap apni trading ko control mein rakh sakte hain. Volatility risk markets mein fluctuations ki degree ko bayan karta hai aur har trader ki trading strategy mein zaroor shamil hona chahiye.

HOW TO MANAGE RISKS

Risk management trading strategy ka ek zaroori factor hai jo aapko nuksan se bachata hai aur aapki trading career ko stable rakhta hai.. Aap ko apne trading account ke size ke according sahi position sizing ka selection karna chahiye, taa kay agar aap ki trade loss mein changing ho jaye, to aap ka pura account wash na ho. Position sizing ke liye, aap ko apne account size aur risk tolerance ka idea lagana ho ga. Agar traders sirf aik currency pair mein invest karte hain, aur woh pair loss mein change ho jata hai, tou aap ka complete account loss mein ja sakta hai. Lekin agar aap, different currencies mein invest karte hain, tou traders kay loss sey bachny kay chances zyada hote hain. Ess liye, zaroori hai ke traders apne emotions ko control mein rakhein, aur hamesha objective and positive trading decisions apply kerein. Regularly apni trading performance ko review karna aur apne risk management strategies ko adjust karna zaroori hai. Agar koi strategy consistently losses generate kar rahi hai, tou oss ko change karna chahiye. Jisssey change of luck bi ho sakti hy.

HISTORICAL ANALYSIS

Kisi bi pattern ko follow kerny sy pehly oss ka history check kerna lazmi hota hy ta kay oss ka historical dataaur success rate per analysis kiya ja saky. Apne trading portfolio ko diversify karna, yani ke alag-alag assets aur market instruments mein invest karna, risk ko spread karta hai. Ek hi asset ya market par depend na karein. Balky different trades open ki jayein tou oss sey some time losses ko cover bi kiya ja sakta hy. And as a result profit earning element ki waja sey target bi achieve kiya j asakta hy.

تبصرہ

Расширенный режим Обычный режим