Donchian ChannelsKya Hay?

Donchian Channels aik trend following technical indicator hay jo bullish aur bearish market extremes ki pahchan karne mein madad karta hay. Ye aik trading range indicator bhi hay jo market ki volatility ki map karta hay.

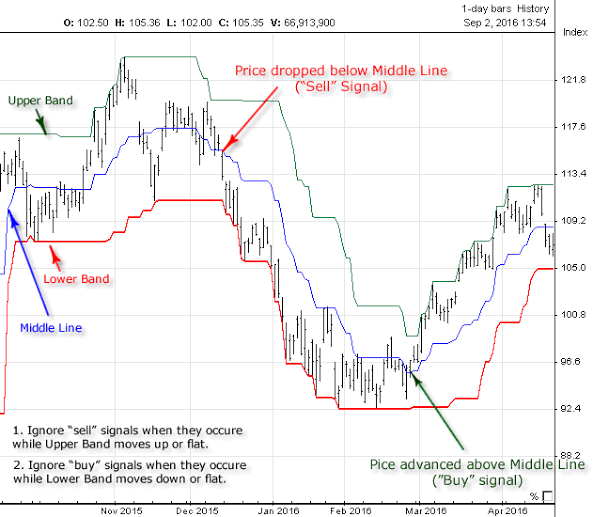

Donchian Channels teen lines per mashtamil hote hain:

Upper band: Ye pichhle n period ka highest high hota hay.

Middle band: Ye pichhle n period ka average price hota hay.

Lower band: Ye pichhle n period ka lowest low hota hay.

Donchian Channels ko istemal karne ke kuch tareeke yeh hain:

Trend identification: Jab price upper band se uper jata hay to ye bullish trend ki alamat hoti hay. Jab price lower band se niche jata hay to ye bearish trend ki alamat hoti hay.

Breakouts: Jab price upper band se uper breakout karta hay to ye long trade karne ka signal ho sakta hay. Jab price lower band se niche breakout karta hay to ye short trade karne ka signal ho sakta hay.

Volatility: Donchian Channels ki width market ki volatility ki map karti hay. Jab channels wide hote hain to ye high volatility ki alamat hoti hay. Jab channels narrow hote hain to ye low volatility ki alamat hoti hay.

Donchian Channels aik versatile indicator hay jo forex trading ke liye mukhtalif tareeqon se istemal kiya ja sakta hay. Ye trend identification, breakouts ki pahchan, aur volatility ki map karne ke liye istemal kiya ja sakta hay.

Donchian Channels ko istemal karne ke kuch tips yeh hain:

Donchian Channels ko dusre indicators ke sath combine karne se behtar results mil sakte hain. For example, aap Donchian Channels ko moving averages ya oscillators ke sath istemal kar sakte hain.

Donchian Channels ki settings ko apne trading style ke mutabiq adjust karna zaruri hay. Agar aap short-term trader hain to aap kam period size istemal kar sakte hain. Agar aap long-term trader hain to aap zyada period size istemal kar sakte hain.

Donchian Channels aik perfect indicator nahin hay. Ye false signals bhi generate kar sakta hay. Is liye ye zaruri hay ke aap apne trades ko manage karne ke liye stop losses aur risk management techniques ka istemal karen.

Note

Hamasha muktalif technics ka use kya jana chahye only aik he strategy perfect nahe hote is liye ahtiyat karen

Donchian Channels aik trend following technical indicator hay jo bullish aur bearish market extremes ki pahchan karne mein madad karta hay. Ye aik trading range indicator bhi hay jo market ki volatility ki map karta hay.

Donchian Channels teen lines per mashtamil hote hain:

Upper band: Ye pichhle n period ka highest high hota hay.

Middle band: Ye pichhle n period ka average price hota hay.

Lower band: Ye pichhle n period ka lowest low hota hay.

Donchian Channels ko istemal karne ke kuch tareeke yeh hain:

Trend identification: Jab price upper band se uper jata hay to ye bullish trend ki alamat hoti hay. Jab price lower band se niche jata hay to ye bearish trend ki alamat hoti hay.

Breakouts: Jab price upper band se uper breakout karta hay to ye long trade karne ka signal ho sakta hay. Jab price lower band se niche breakout karta hay to ye short trade karne ka signal ho sakta hay.

Volatility: Donchian Channels ki width market ki volatility ki map karti hay. Jab channels wide hote hain to ye high volatility ki alamat hoti hay. Jab channels narrow hote hain to ye low volatility ki alamat hoti hay.

Donchian Channels aik versatile indicator hay jo forex trading ke liye mukhtalif tareeqon se istemal kiya ja sakta hay. Ye trend identification, breakouts ki pahchan, aur volatility ki map karne ke liye istemal kiya ja sakta hay.

Donchian Channels ko istemal karne ke kuch tips yeh hain:

Donchian Channels ko dusre indicators ke sath combine karne se behtar results mil sakte hain. For example, aap Donchian Channels ko moving averages ya oscillators ke sath istemal kar sakte hain.

Donchian Channels ki settings ko apne trading style ke mutabiq adjust karna zaruri hay. Agar aap short-term trader hain to aap kam period size istemal kar sakte hain. Agar aap long-term trader hain to aap zyada period size istemal kar sakte hain.

Donchian Channels aik perfect indicator nahin hay. Ye false signals bhi generate kar sakta hay. Is liye ye zaruri hay ke aap apne trades ko manage karne ke liye stop losses aur risk management techniques ka istemal karen.

Note

Hamasha muktalif technics ka use kya jana chahye only aik he strategy perfect nahe hote is liye ahtiyat karen

تبصرہ

Расширенный режим Обычный режим