Morning Star Pattern

"Morning Star Pattern" ek technical analysis ka concept hai jo stock market mein istemal hota hai. Yeh pattern traders ko market trends aur price movements ka idea deta hai, jisse wo apni trading strategies banate hain. Yeh article mein, ham Morning Star Pattern ke tafseelat ko urdu roman English mein bayan karenge.

Morning Star Pattern ek bullish reversal pattern hai, jo bearish trend ke baad aata hai aur bull trend ki shuruaat ko darust karta hai. Yeh pattern teen candlesticks se milta hai aur trading charts par dekha ja sakta hai.

Morning Star Pattern ka matlab hota hai ke bearish trend khatam ho chuka hai aur bullish trend shuru hone wala hai. Jab traders Morning Star Pattern ko dekhte hain, toh woh long positions lena shuru karte hain ya existing short positions ko cover kar lete hain.

Morning Star Pattern ki tafseelat ko samajhne ke liye, traders ko candlestick patterns aur market trends par dhyan dena chahiye. Is pattern ko sirf ek signal ke taur par nahi dekha jana chahiye, balki iske saath dusre technical indicators aur market ki muddaton ka bhi tajziya karna chahiye.

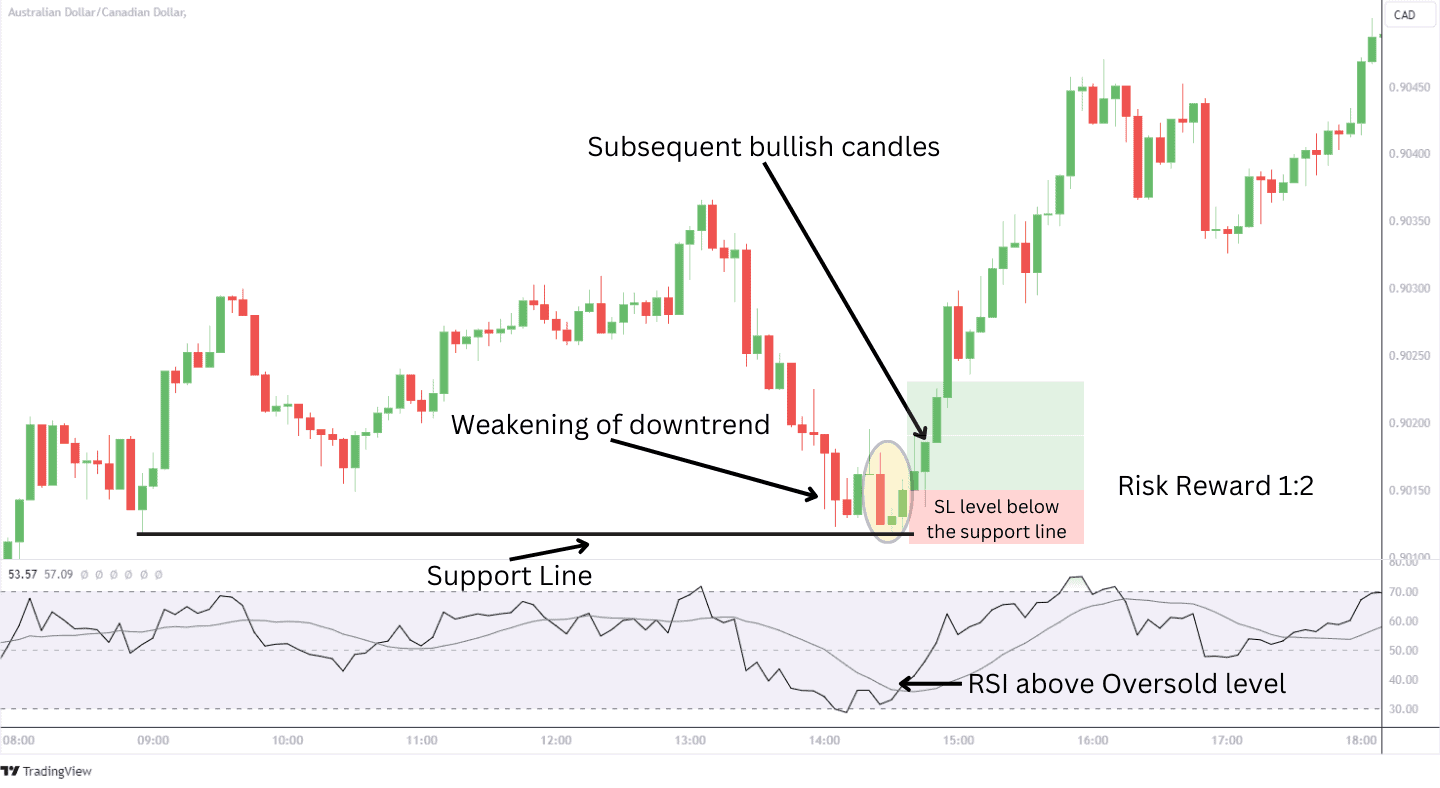

Is pattern ki validity ko confirm karne ke liye, traders ko doosre technical indicators jaise ke moving averages, RSI (Relative Strength Index), aur volume analysis ka istemal karna chahiye. Yeh sabhi tools ek saath istemal karke traders ko sahi trading decisions lene mein madad karte hain.

Morning Star Pattern ka istemal karne se pehle, traders ko yeh yaad rakhna chahiye ke kisi bhi pattern ya indicator ko akela dekh kar trading decision na len, balki market ki overall condition aur dusre factors ko bhi mad e nazar rakhte hue hi trade karna chahiye.

Umeed hai ke yeh article traders ke liye faydemand sabit hoga aur unhe Morning Star Pattern ko samajhne mein madad milegi. Trading mein safalta hasil karne ke liye, traders ko hamesha market ki analysis aur risk management par dhyan dena chahiye.

"Morning Star Pattern" ek technical analysis ka concept hai jo stock market mein istemal hota hai. Yeh pattern traders ko market trends aur price movements ka idea deta hai, jisse wo apni trading strategies banate hain. Yeh article mein, ham Morning Star Pattern ke tafseelat ko urdu roman English mein bayan karenge.

Morning Star Pattern ek bullish reversal pattern hai, jo bearish trend ke baad aata hai aur bull trend ki shuruaat ko darust karta hai. Yeh pattern teen candlesticks se milta hai aur trading charts par dekha ja sakta hai.

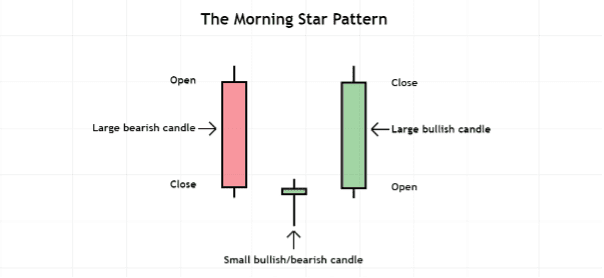

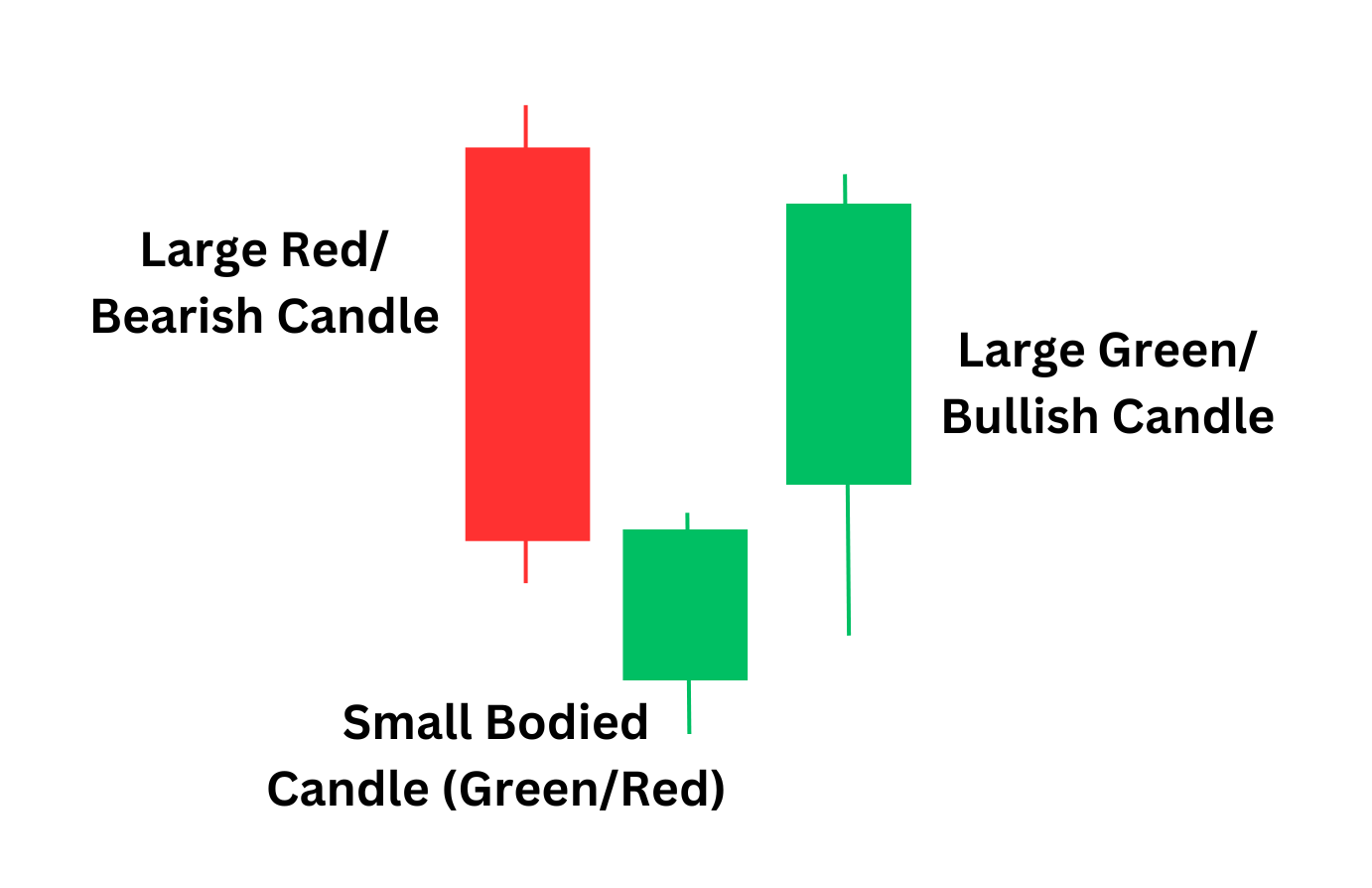

- Pehla Candlestick (Bearish): Morning Star Pattern ka pehla candlestick bearish hota hai, jo downward trend ko represent karta hai. Is candlestick ka size bada hota hai aur volume bhi zyada hota hai. Yeh candlestick market mein selling pressure ko show karta hai.

- Doosra Candlestick (Indecision): Doosra candlestick chhota hota hai aur pehle wale candlestick ke neeche ya upar close hota hai. Is candlestick ko "Doji" bhi kaha jata hai, jo market mein uncertainty ya indecision ko darust karta hai. Is stage par traders confused hote hain ke market ka trend kis disha mein ja raha hai.

- Teesra Candlestick (Bullish): Teesra candlestick bullish hota hai aur pehle dono candlesticks ko cover kar deta hai. Is candlestick ka size bada hota hai aur volume bhi zyada hota hai. Yeh candlestick market mein buying pressure ko darust karta hai aur bullish trend ki shuruaat ko indicate karta hai.

Morning Star Pattern ka matlab hota hai ke bearish trend khatam ho chuka hai aur bullish trend shuru hone wala hai. Jab traders Morning Star Pattern ko dekhte hain, toh woh long positions lena shuru karte hain ya existing short positions ko cover kar lete hain.

Morning Star Pattern ki tafseelat ko samajhne ke liye, traders ko candlestick patterns aur market trends par dhyan dena chahiye. Is pattern ko sirf ek signal ke taur par nahi dekha jana chahiye, balki iske saath dusre technical indicators aur market ki muddaton ka bhi tajziya karna chahiye.

Is pattern ki validity ko confirm karne ke liye, traders ko doosre technical indicators jaise ke moving averages, RSI (Relative Strength Index), aur volume analysis ka istemal karna chahiye. Yeh sabhi tools ek saath istemal karke traders ko sahi trading decisions lene mein madad karte hain.

Morning Star Pattern ka istemal karne se pehle, traders ko yeh yaad rakhna chahiye ke kisi bhi pattern ya indicator ko akela dekh kar trading decision na len, balki market ki overall condition aur dusre factors ko bhi mad e nazar rakhte hue hi trade karna chahiye.

Umeed hai ke yeh article traders ke liye faydemand sabit hoga aur unhe Morning Star Pattern ko samajhne mein madad milegi. Trading mein safalta hasil karne ke liye, traders ko hamesha market ki analysis aur risk management par dhyan dena chahiye.

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Morning_Star_Definition_Jun_2020-01-a6d5241bc649403aa86f394d5a2430a7.jpg)

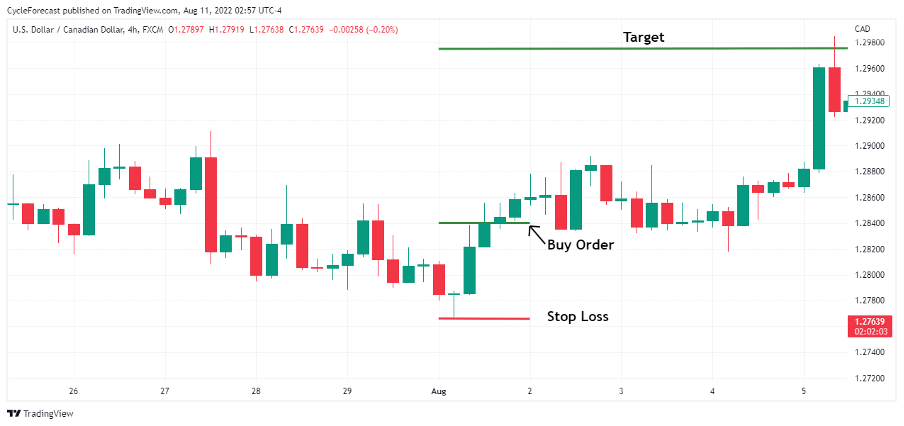

jab ap forex market mein morning star pattern ko daikhtay hein jaisa keh oper wala chart hota hey yeh bullish reversal janay ko sakhte kay sath identify kar sakta hey woh basic tor par jab ezafe confirmation karta hey es ka forex market kay technical trader kay sath he tawon keya ja sakta hey

jab ap forex market mein morning star pattern ko daikhtay hein jaisa keh oper wala chart hota hey yeh bullish reversal janay ko sakhte kay sath identify kar sakta hey woh basic tor par jab ezafe confirmation karta hey es ka forex market kay technical trader kay sath he tawon keya ja sakta hey

bhali kay bad

bhali kay bad

تبصرہ

Расширенный режим Обычный режим