Introduction

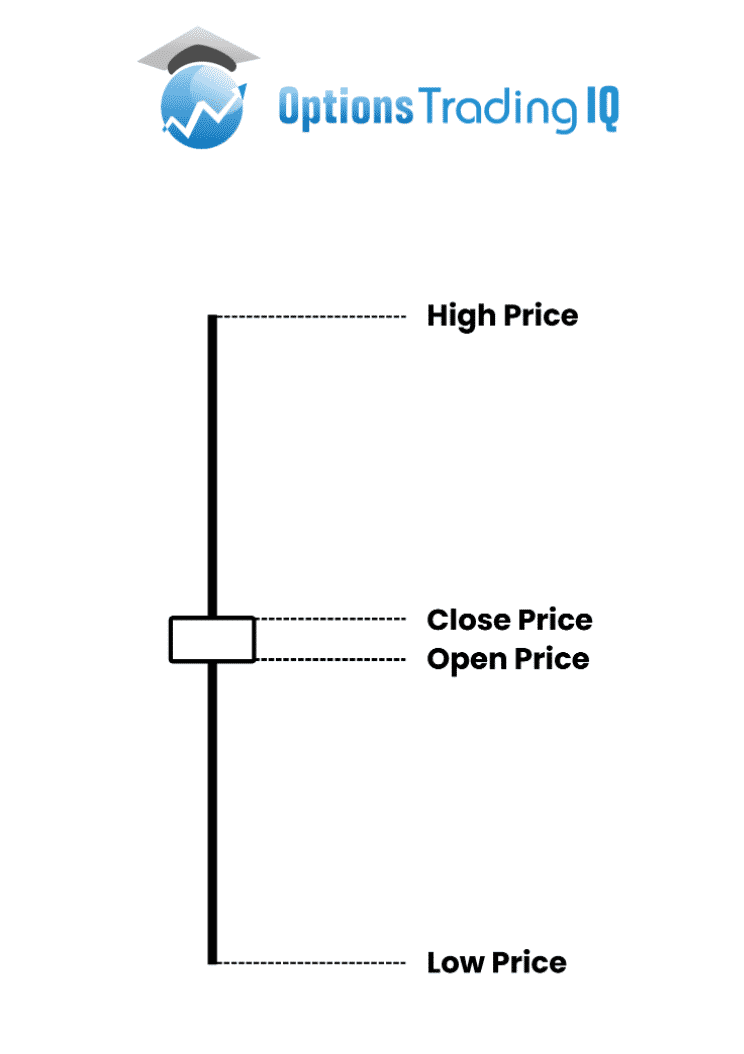

Dear traders forex market mein high wave candlestick pattern trading strategy traders ke liye aik important tool hai, jo market indecision ki understanding provide karta hai. Ess strategy ko samajhne aur es sey istemal karne sey traders apne faislay ko behtar banane mein madad le sakte hain. High wave candlestick pattern ka pehla portion ek doji ya long legged doji hota hai, jis ka matlab hai ke opening price aur closing price equal hein ya almost equal hoti hain. Es pattern ke mutabiq jab market mein high wave candlestick dikhai deta hai, tou yeh darust hota hai ke market mein tajawuzi ya phir different trend ke chances hain.

price.

Identification and Formation

High Wave Pattern ko samajhne ke liye, traders ko candlestick charts ki madad leni parti hai. Is pattern mein, ek lambi candlestick dikhai deti hai jis ke dono ends par chhoti wicks hoti hain. Candle ki body high aur low levels ke darmiyan bohot bara hota hai, jis se traders ko samajhne mein mushkil hoti hai ke market ka trend kis taraf ja raha hai.Is pattern ko dekhte waqt, traders ko volume bhi dekhna zaroori hai jo market ki activity ko darust karta hai. Agar High Wave Pattern mein high volume present hai, toh yeh indicate karta hai ke market mein zyada activity aur volatility hai aur traders ke darmiyan indecision hai.High Wave Pattern ko samajh kar traders sahi trading decisions le sakte hain aur market ke fluctuations ko samajh sakte hain. Is pattern ke sath trading karte waqt, traders ko confirmatory indicators aur doosre technical tools ka bhi istemal karna chahiye taake sahi trading decisions liye ja sakein.

High Wave Pattern Ki Trading Strategies

High Wave Pattern ke sath trading karte waqt, traders ko kuch strategies ka istemal bhut zida kya hy.High Wave Pattern ko confirm karne ke liye, traders ko doosre technical indicators aur patterns ka istemal karna chahiye. Agar doosre indicators bhi High Wave Pattern ko indicate kar rahe hain, toh traders ko samajh aata hai ke market mein volatility aur indecision hai.High Wave Pattern ke sath trading karte waqt, risk management ka khayal rakhna zaroori hai. Traders ko apne trades ko manage karne ke liye stop-loss aur take-profit orders ka istemal karna chahiye taake nuksan se bacha ja sake.

Entry Aur Exit Points: High Wave Pattern ke sath trading karte waqt, traders ko sahi entry aur exit points determine karna zaroori hai. Is pattern ko samajh kar traders ko pata chal jata hai ke market mein kis taraf ka trend hai aur unhein sahi waqt par entry aur exit points determine karne chahiye.

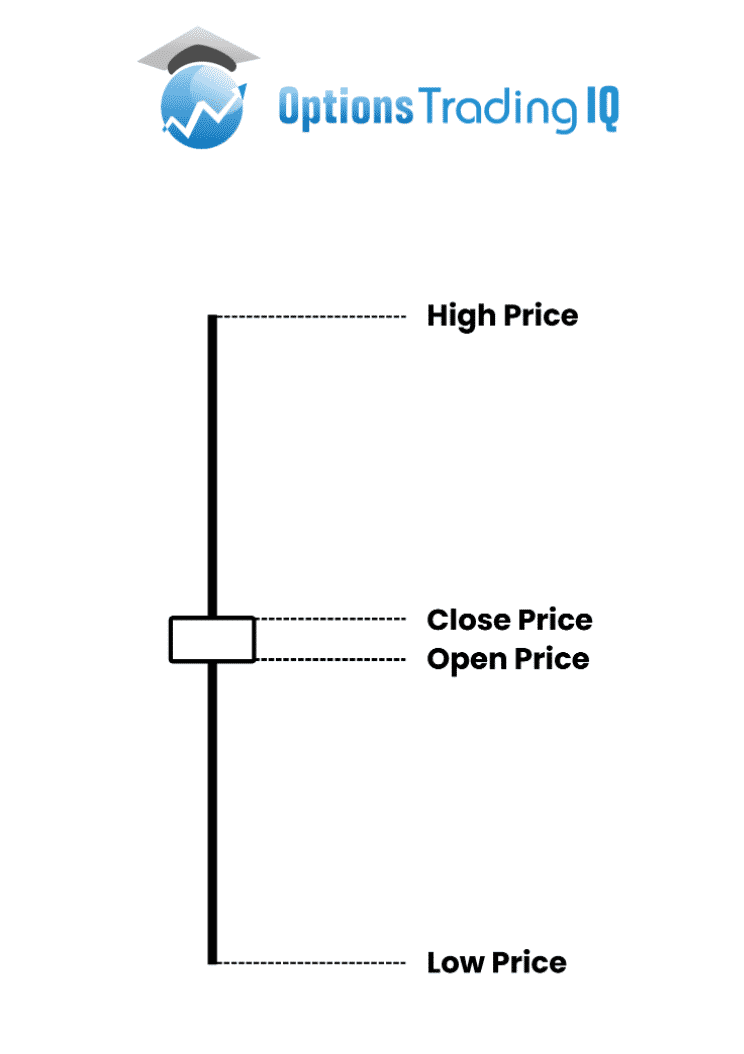

Dear traders forex market mein high wave candlestick pattern trading strategy traders ke liye aik important tool hai, jo market indecision ki understanding provide karta hai. Ess strategy ko samajhne aur es sey istemal karne sey traders apne faislay ko behtar banane mein madad le sakte hain. High wave candlestick pattern ka pehla portion ek doji ya long legged doji hota hai, jis ka matlab hai ke opening price aur closing price equal hein ya almost equal hoti hain. Es pattern ke mutabiq jab market mein high wave candlestick dikhai deta hai, tou yeh darust hota hai ke market mein tajawuzi ya phir different trend ke chances hain.

price.

Identification and Formation

High Wave Pattern ko samajhne ke liye, traders ko candlestick charts ki madad leni parti hai. Is pattern mein, ek lambi candlestick dikhai deti hai jis ke dono ends par chhoti wicks hoti hain. Candle ki body high aur low levels ke darmiyan bohot bara hota hai, jis se traders ko samajhne mein mushkil hoti hai ke market ka trend kis taraf ja raha hai.Is pattern ko dekhte waqt, traders ko volume bhi dekhna zaroori hai jo market ki activity ko darust karta hai. Agar High Wave Pattern mein high volume present hai, toh yeh indicate karta hai ke market mein zyada activity aur volatility hai aur traders ke darmiyan indecision hai.High Wave Pattern ko samajh kar traders sahi trading decisions le sakte hain aur market ke fluctuations ko samajh sakte hain. Is pattern ke sath trading karte waqt, traders ko confirmatory indicators aur doosre technical tools ka bhi istemal karna chahiye taake sahi trading decisions liye ja sakein.

High Wave Pattern Ki Trading Strategies

High Wave Pattern ke sath trading karte waqt, traders ko kuch strategies ka istemal bhut zida kya hy.High Wave Pattern ko confirm karne ke liye, traders ko doosre technical indicators aur patterns ka istemal karna chahiye. Agar doosre indicators bhi High Wave Pattern ko indicate kar rahe hain, toh traders ko samajh aata hai ke market mein volatility aur indecision hai.High Wave Pattern ke sath trading karte waqt, risk management ka khayal rakhna zaroori hai. Traders ko apne trades ko manage karne ke liye stop-loss aur take-profit orders ka istemal karna chahiye taake nuksan se bacha ja sake.

Entry Aur Exit Points: High Wave Pattern ke sath trading karte waqt, traders ko sahi entry aur exit points determine karna zaroori hai. Is pattern ko samajh kar traders ko pata chal jata hai ke market mein kis taraf ka trend hai aur unhein sahi waqt par entry aur exit points determine karne chahiye.

تبصرہ

Расширенный режим Обычный режим