Bull Call Spread vs Long Call Butterfly Spread: Samajiyat aur Fawaid

Mukhtalif Trading Strategies:

Stock market mein sharikeen ke liye mukhtalif trading strategies mojood hain, jo unhein mukhtalif scenarios mein faida pohanchane mein madad karti hain. Yeh strategies mukhtalif maqsadat aur risk tolerances ke mutabiq istemal ki jati hain. Is maqale mein, hum bull call spread aur long call butterfly spread ke darmiyan mukhtaliftao aur fawaid par ghaur karenge.

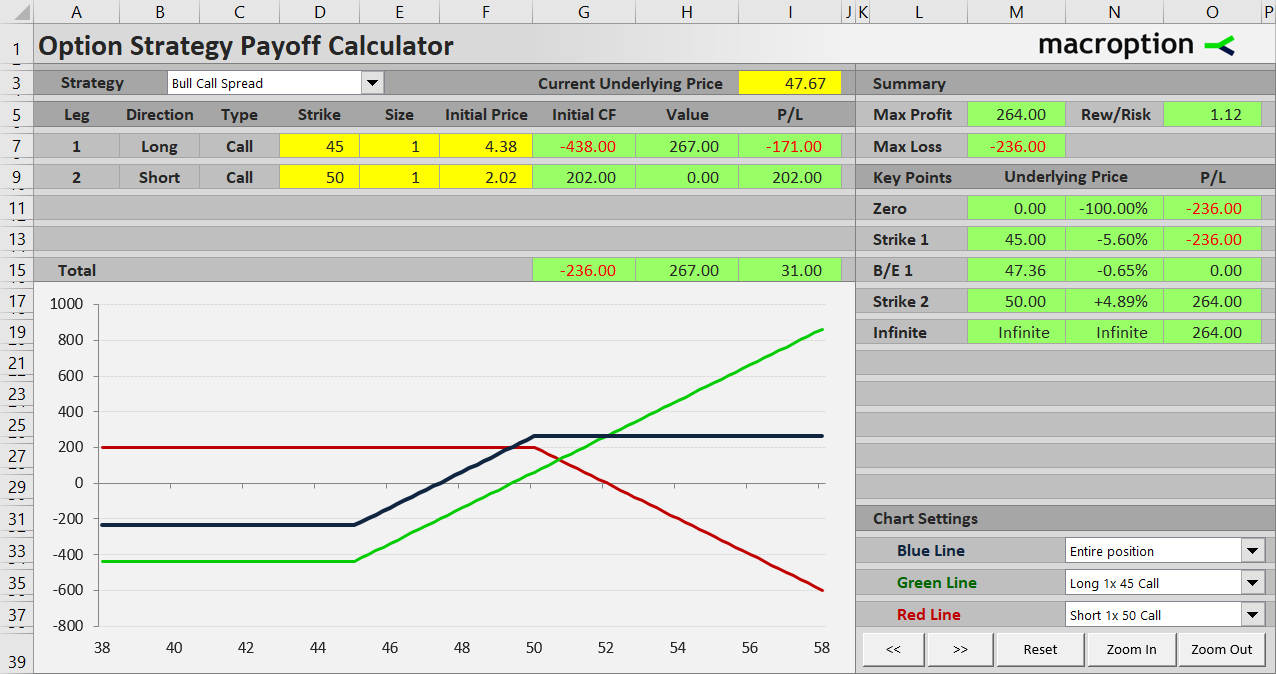

Bull Call Spread:

Bull call spread ek bullish trading strategy hai jismein ek shakhs ek call option buy karta hai aur ek call option sell karta hai, lekin different strike prices par. Yeh strategy tab istemal hoti hai jab sharikeen ko ummeed hai ke underlying asset ki keemat barhegi, lekin sirf limited risk lena chahte hain.

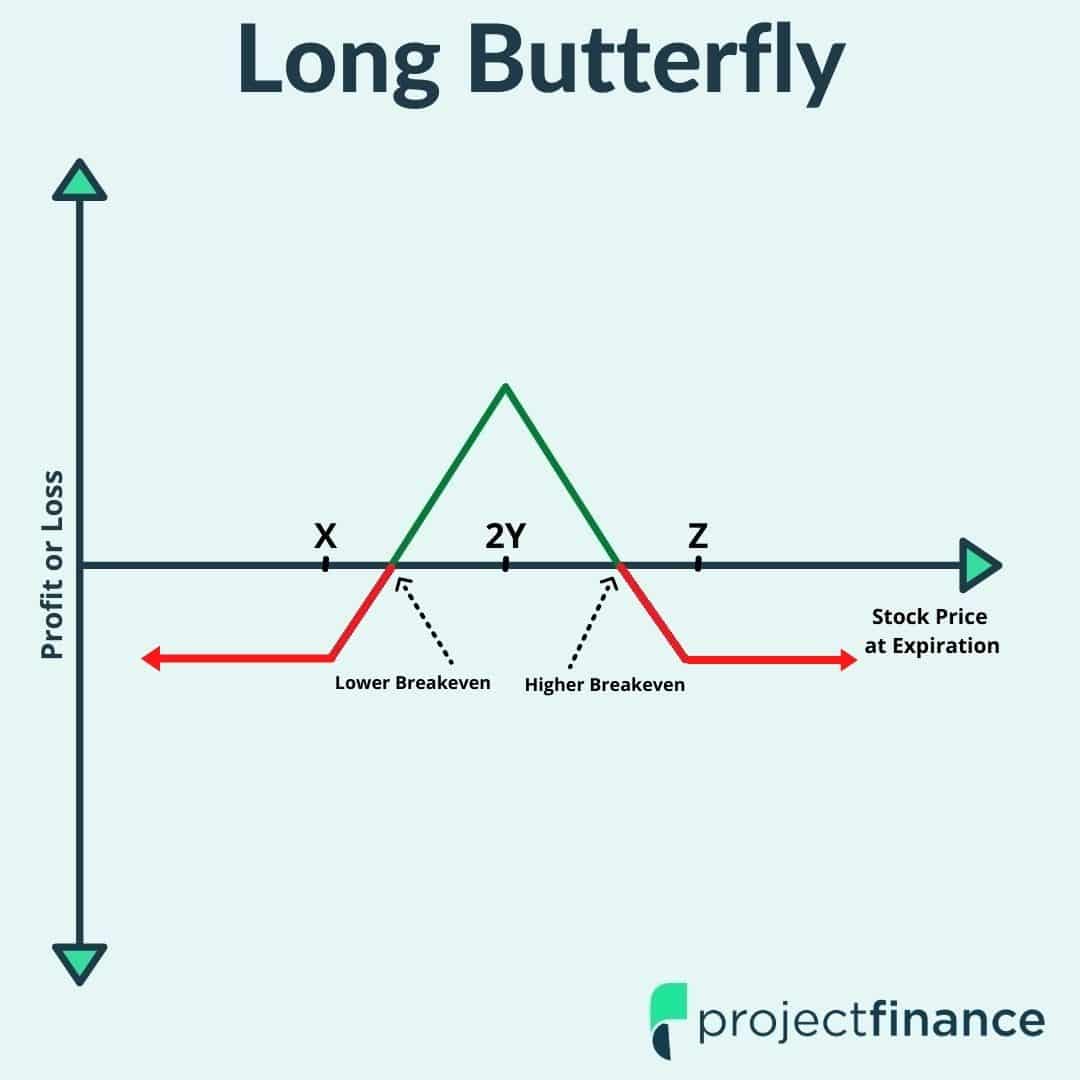

Long Call Butterfly Spread:

Long call butterfly spread ek complex trading strategy hai jismein teen call options buy aur sell kiye jate hain, jin ke strike prices ek dosre se mukhtalif hote hain. Yeh strategy istemal hoti hai jab sharikeen ko underlying asset ki price mein moderate increase ki umeed hoti hai aur woh limited risk lena chahte hain.

Mukhtaliftao mein Izafa:

Bull call spread aur long call butterfly spread dono hi mukhtalif maqasid aur muddaton ke liye istemal kiye jate hain. Bull call spread mein zyada profit potential hota hai agar underlying asset ki keemat ziada barh jati hai, jabke long call butterfly spread mein profit zyada hota hai agar keemat moderate level par rehti hai.

Risk aur Reward:

Bull call spread mein limited risk hota hai, kyunki call option buy aur sell dono ki cost ko adjust kiya jata hai. Magar ismein potential reward bhi limited hota hai. Long call butterfly spread mein bhi limited risk hota hai, lekin yahan bhi reward limited hota hai.

Conclusion:

Dono hi strategies apne apne faiday aur risks ke sath aate hain. Sharikeen ko apne maqsad aur risk tolerance ke mutabiq in strategies ko chunna chahiye. Bull call spread zyada aggressive traders ke liye mufeed ho sakta hai jo zyada profit potential chahte hain, jabke long call butterfly spread moderate risk lena pasand karne walon ke liye mufeed ho sakta hai. Isliye, har trading strategy ko samajh kar, uske faiday aur nuksan ko dhoran karte hue istemal karna chahiye.

Mukhtalif Trading Strategies:

Stock market mein sharikeen ke liye mukhtalif trading strategies mojood hain, jo unhein mukhtalif scenarios mein faida pohanchane mein madad karti hain. Yeh strategies mukhtalif maqsadat aur risk tolerances ke mutabiq istemal ki jati hain. Is maqale mein, hum bull call spread aur long call butterfly spread ke darmiyan mukhtaliftao aur fawaid par ghaur karenge.

Bull Call Spread:

Bull call spread ek bullish trading strategy hai jismein ek shakhs ek call option buy karta hai aur ek call option sell karta hai, lekin different strike prices par. Yeh strategy tab istemal hoti hai jab sharikeen ko ummeed hai ke underlying asset ki keemat barhegi, lekin sirf limited risk lena chahte hain.

Long Call Butterfly Spread:

Long call butterfly spread ek complex trading strategy hai jismein teen call options buy aur sell kiye jate hain, jin ke strike prices ek dosre se mukhtalif hote hain. Yeh strategy istemal hoti hai jab sharikeen ko underlying asset ki price mein moderate increase ki umeed hoti hai aur woh limited risk lena chahte hain.

Mukhtaliftao mein Izafa:

Bull call spread aur long call butterfly spread dono hi mukhtalif maqasid aur muddaton ke liye istemal kiye jate hain. Bull call spread mein zyada profit potential hota hai agar underlying asset ki keemat ziada barh jati hai, jabke long call butterfly spread mein profit zyada hota hai agar keemat moderate level par rehti hai.

Risk aur Reward:

Bull call spread mein limited risk hota hai, kyunki call option buy aur sell dono ki cost ko adjust kiya jata hai. Magar ismein potential reward bhi limited hota hai. Long call butterfly spread mein bhi limited risk hota hai, lekin yahan bhi reward limited hota hai.

Conclusion:

Dono hi strategies apne apne faiday aur risks ke sath aate hain. Sharikeen ko apne maqsad aur risk tolerance ke mutabiq in strategies ko chunna chahiye. Bull call spread zyada aggressive traders ke liye mufeed ho sakta hai jo zyada profit potential chahte hain, jabke long call butterfly spread moderate risk lena pasand karne walon ke liye mufeed ho sakta hai. Isliye, har trading strategy ko samajh kar, uske faiday aur nuksan ko dhoran karte hue istemal karna chahiye.

تبصرہ

Расширенный режим Обычный режим