Asslam O Alikum Dosto ?

Pivot points trading mein istemaal honay wali aik taknik hai jo mumkina support aur muzahmat ki sthon ki nishandahi karne ke liye maazi ki qeematon ka istemaal karti hai. yeh khayaal yeh hai ke agar qeemat kisi khaas satah se oopar ya neechay toot jati hai, to yeh mazeed isi simt mein chalti rahay gi .

Pivot points kaisay kaam karte hain

Pivot points calculate karne ke liye, aap ko teen ahem qeematon ki zaroorat hai :

aik baar jab aap ke paas yeh qeematein ho jayen, to aap darj zail formulay ka istemaal karte hue Pivot point calculate kar satke hain :

Pivot point = ( onche + neechi + band ) / 3

yeh aap ko aik bunyadi Pivot point day ga. is ke ilawa, aap mazeed support aur muzahmat ki sthon ki nishandahi karne ke liye darj zail formulay istemaal kar satke hain :

r1 = ( 2 Pivot point ) - neechi

s1 = ( 2 Pivot point ) - onche

r2 = Pivot point + ( r1 - s1 )

s2 = Pivot point - ( r1 - s1 )

Pivot points ka istemaal kaisay karen

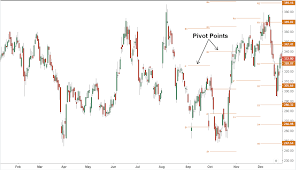

Pivot points ko mukhtalif tareeqon se istemaal kya ja sakta hai. aik aam tareeqa yeh hai ke inhen mumkina support aur muzahmat ki sthon ki nishandahi karne ke liye istemaal kya jaye. jab qeemat kisi Pivot point se takrata hai, to yeh aik ishara ho sakta hai ke qeemat apni simt badalny wali hai .

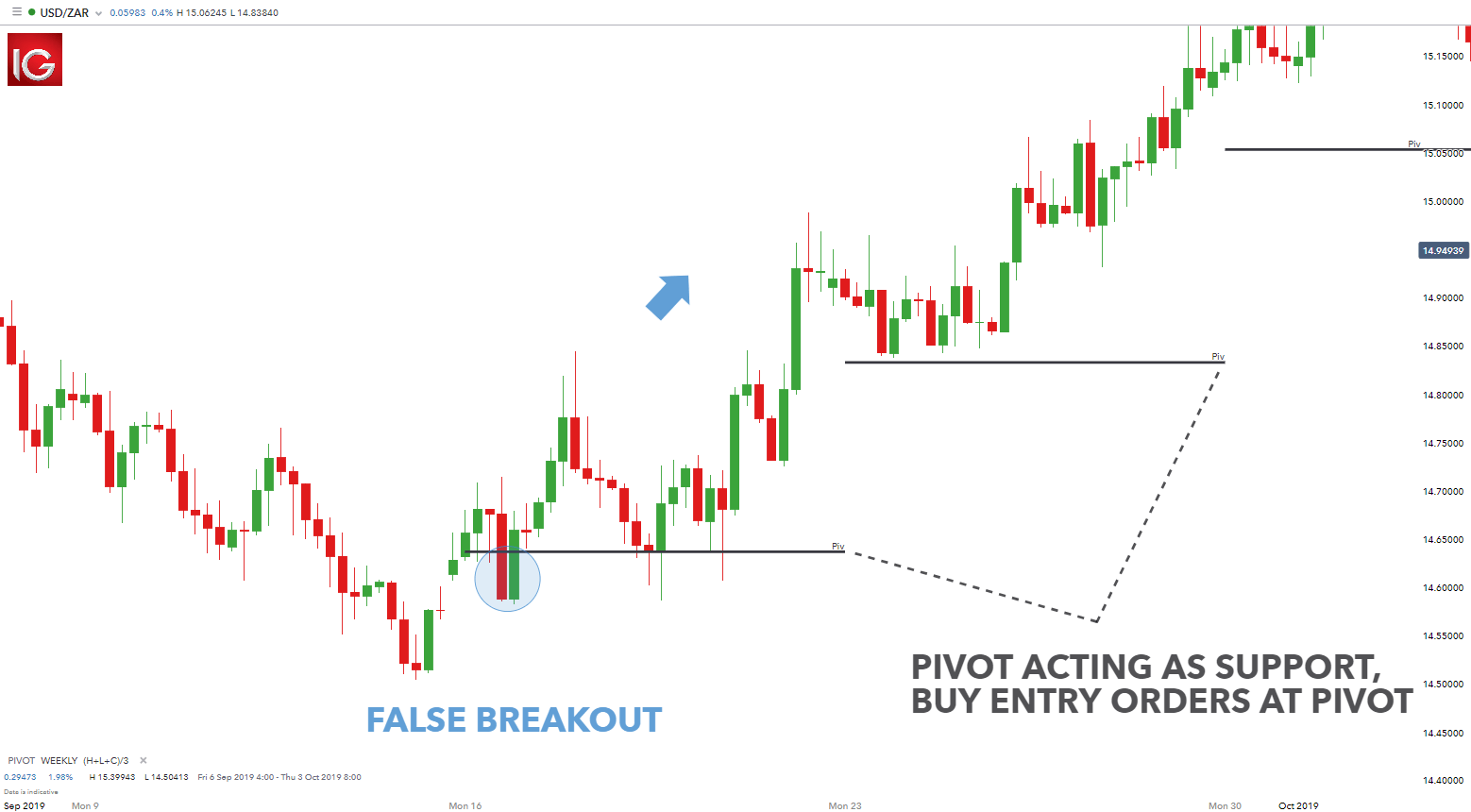

Pivot points ko trading ke mawaqay ki nishandahi karne ke liye bhi istemaal kya ja sakta hai. misaal ke tor par, agar qeemat kisi support level se neechay toot jati hai, to yeh aik short position kholnay ka ishara ho sakta hai .

Pivot points ki hudood

Pivot points aik mufeed tool ho satke hain, lekin un ki kuch hudood bhi hain. aik had yeh hai ke woh 100 % durust nahi hain. qeemat hamesha Pivot points se nahi takrata, aur jab yeh takrata hai, to yeh hamesha apni simt nahi badalti .

aik aur had yeh hai ke Pivot points sirf maazi ki qeematon par mabni hain. woh deegar awamil ko mad e nazar nahi rakhtay hain jo qeemat ko mutasir kar satke hain, jaisay ke khabron ke waqeat ya market ka jazbaat .

nateeja

Pivot points trading mein aik mufeed tool ho satke hain, lekin inhen ahthyat ke sath istemaal karna chahiye. inhen deegar takneeki isharay ke sath istemaal karna aur market ke deegar awamil par ghhor karna zaroori hai .

Pivot points trading mein istemaal honay wali aik taknik hai jo mumkina support aur muzahmat ki sthon ki nishandahi karne ke liye maazi ki qeematon ka istemaal karti hai. yeh khayaal yeh hai ke agar qeemat kisi khaas satah se oopar ya neechay toot jati hai, to yeh mazeed isi simt mein chalti rahay gi .

Pivot points kaisay kaam karte hain

Pivot points calculate karne ke liye, aap ko teen ahem qeematon ki zaroorat hai :

- pichlle din ki bandish ki qeemat

- pichlle din ki onche qeemat

- pichlle din ki neechi qeemat

aik baar jab aap ke paas yeh qeematein ho jayen, to aap darj zail formulay ka istemaal karte hue Pivot point calculate kar satke hain :

Pivot point = ( onche + neechi + band ) / 3

yeh aap ko aik bunyadi Pivot point day ga. is ke ilawa, aap mazeed support aur muzahmat ki sthon ki nishandahi karne ke liye darj zail formulay istemaal kar satke hain :

r1 = ( 2 Pivot point ) - neechi

s1 = ( 2 Pivot point ) - onche

r2 = Pivot point + ( r1 - s1 )

s2 = Pivot point - ( r1 - s1 )

Pivot points ka istemaal kaisay karen

Pivot points ko mukhtalif tareeqon se istemaal kya ja sakta hai. aik aam tareeqa yeh hai ke inhen mumkina support aur muzahmat ki sthon ki nishandahi karne ke liye istemaal kya jaye. jab qeemat kisi Pivot point se takrata hai, to yeh aik ishara ho sakta hai ke qeemat apni simt badalny wali hai .

Pivot points ko trading ke mawaqay ki nishandahi karne ke liye bhi istemaal kya ja sakta hai. misaal ke tor par, agar qeemat kisi support level se neechay toot jati hai, to yeh aik short position kholnay ka ishara ho sakta hai .

Pivot points ki hudood

Pivot points aik mufeed tool ho satke hain, lekin un ki kuch hudood bhi hain. aik had yeh hai ke woh 100 % durust nahi hain. qeemat hamesha Pivot points se nahi takrata, aur jab yeh takrata hai, to yeh hamesha apni simt nahi badalti .

aik aur had yeh hai ke Pivot points sirf maazi ki qeematon par mabni hain. woh deegar awamil ko mad e nazar nahi rakhtay hain jo qeemat ko mutasir kar satke hain, jaisay ke khabron ke waqeat ya market ka jazbaat .

nateeja

Pivot points trading mein aik mufeed tool ho satke hain, lekin inhen ahthyat ke sath istemaal karna chahiye. inhen deegar takneeki isharay ke sath istemaal karna aur market ke deegar awamil par ghhor karna zaroori hai .

:max_bytes(150000):strip_icc():format(webp)/dotdash_Final_Using_Pivot_Points_for_Predictions_Feb_2020-01-b3d14a9e8e864875aa404a7664fbb23b.jpg)

تبصرہ

Расширенный режим Обычный режим