Candle Stick Patterns:

Candle stick patterns forex trading aur stock market mein aham hissa hain. In patterns ko samajh kar traders market ki movement ko samajhne ki koshish karte hain. Ye patterns traders ko signals dete hain ke market ka trend kis tarah ka ho sakta hai. Chuki ye patterns visual hotay hain, isliye inka istemal traders ke darmiyan popular hai.

Candle Stick Patterns Kya Hain?

Candle stick patterns ek tarah ka technical analysis tool hain jo traders istemal karte hain market ki movement ko samajhne ke liye. Har ek candle stick ek specific samay ke trading activity ko darust darust darshata hai.

Candle stick patterns ka asal maqsad market ke sentiment aur trend ko samajhna hai. Har ek candle stick ka ek open, high, low, aur close value hota hai jo us samay ke trading session ke dauran hota hai.

Types of Candle Stick Patterns

1. Doji

Doji ek aham candle stick pattern hai jo indicate karta hai ke buyers aur sellers ke darmiyan balance hai. Ye pattern ek cross ya plus sign ki tarah dikhta hai jahan open aur close price barabar ya qareeb barabar hoti hai.

2. Hammer

Hammer ek bullish reversal pattern hai jo price ke neeche se upar ki taraf indicate karta hai. Ye pattern jab hota hai jab price neeche girne ke baad upar se recover karta hai. Hammer ki shape ek hammer ki tarah hoti hai jahan ek choti body aur lambi lower shadow hoti hai.

3. Shooting Star

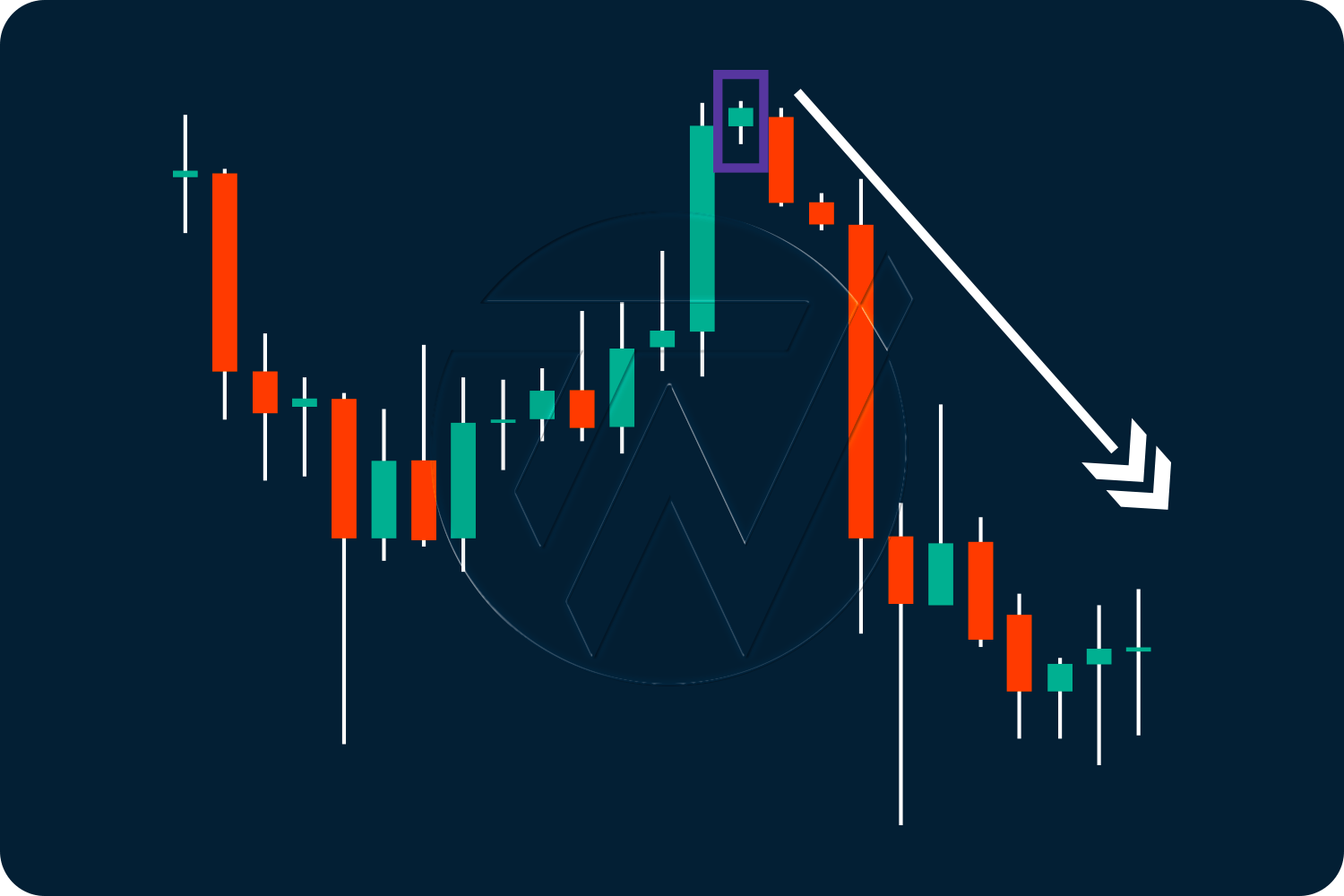

Shooting star ek bearish reversal pattern hai jo price ke upar se neeche ki taraf indicate karta hai. Ye pattern jab hota hai jab price upar jaane ke baad neeche girne lagta hai. Shooting star ki shape ek lambi upper shadow aur choti body ki tarah hoti hai.

4. Engulfing Pattern

Engulfing pattern ek reversal pattern hai jo do opposite direction ke candles se bana hota hai. Bullish engulfing ek bearish candle ko follow karta hai aur phir usse bada bullish candle hota hai. Bearish engulfing pattern opposite hota hai jahan ek bullish candle ek bearish candle ko engulf karta hai.

5. Harami

Harami ek reversal pattern hai jo do candles se bana hota hai. Ye pattern show karta hai ke market ka trend change ho sakta hai. Harami pattern mein pehli candle badi hoti hai aur doosri candle usse choti hoti hai.

6. Morning Star

Morning star ek bullish reversal pattern hai jo price ke neeche se upar ki taraf indicate karta hai. Ye pattern ek downtrend ke baad hota hai jab price neeche jaane ke baad upar recover karta hai. Morning star pattern mein pehli candle bearish hoti hai, doosri candle small body ki hoti hai aur teesri candle bullish hoti hai.

7. Evening Star

Evening star ek bearish reversal pattern hai jo price ke upar se neeche ki taraf indicate karta hai. Ye pattern ek uptrend ke baad hota hai jab price upar jaane ke baad neeche girne lagta hai. Evening star pattern mein pehli candle bullish hoti hai, doosri candle small body ki hoti hai aur teesri candle bearish hoti hai.

Conclusion

Candle stick patterns market analysis ke liye powerful tools hain jo traders ko market trends aur sentiment ko samajhne mein madad karte hain. In patterns ko samajhna aur pehchanna traders ke liye zaroori hai taake wo sahi waqt par trading decisions le sakein. Lekin, candle stick patterns ke istemal mein risk bhi hota hai aur sirf patterns par hi rely karke trading karna recommended nahi hai. Iske saath technical aur fundamental analysis bhi zaroori hai.

Candle stick patterns forex trading aur stock market mein aham hissa hain. In patterns ko samajh kar traders market ki movement ko samajhne ki koshish karte hain. Ye patterns traders ko signals dete hain ke market ka trend kis tarah ka ho sakta hai. Chuki ye patterns visual hotay hain, isliye inka istemal traders ke darmiyan popular hai.

Candle Stick Patterns Kya Hain?

Candle stick patterns ek tarah ka technical analysis tool hain jo traders istemal karte hain market ki movement ko samajhne ke liye. Har ek candle stick ek specific samay ke trading activity ko darust darust darshata hai.

Candle stick patterns ka asal maqsad market ke sentiment aur trend ko samajhna hai. Har ek candle stick ka ek open, high, low, aur close value hota hai jo us samay ke trading session ke dauran hota hai.

Types of Candle Stick Patterns

1. Doji

Doji ek aham candle stick pattern hai jo indicate karta hai ke buyers aur sellers ke darmiyan balance hai. Ye pattern ek cross ya plus sign ki tarah dikhta hai jahan open aur close price barabar ya qareeb barabar hoti hai.

2. Hammer

Hammer ek bullish reversal pattern hai jo price ke neeche se upar ki taraf indicate karta hai. Ye pattern jab hota hai jab price neeche girne ke baad upar se recover karta hai. Hammer ki shape ek hammer ki tarah hoti hai jahan ek choti body aur lambi lower shadow hoti hai.

3. Shooting Star

Shooting star ek bearish reversal pattern hai jo price ke upar se neeche ki taraf indicate karta hai. Ye pattern jab hota hai jab price upar jaane ke baad neeche girne lagta hai. Shooting star ki shape ek lambi upper shadow aur choti body ki tarah hoti hai.

4. Engulfing Pattern

Engulfing pattern ek reversal pattern hai jo do opposite direction ke candles se bana hota hai. Bullish engulfing ek bearish candle ko follow karta hai aur phir usse bada bullish candle hota hai. Bearish engulfing pattern opposite hota hai jahan ek bullish candle ek bearish candle ko engulf karta hai.

5. Harami

Harami ek reversal pattern hai jo do candles se bana hota hai. Ye pattern show karta hai ke market ka trend change ho sakta hai. Harami pattern mein pehli candle badi hoti hai aur doosri candle usse choti hoti hai.

6. Morning Star

Morning star ek bullish reversal pattern hai jo price ke neeche se upar ki taraf indicate karta hai. Ye pattern ek downtrend ke baad hota hai jab price neeche jaane ke baad upar recover karta hai. Morning star pattern mein pehli candle bearish hoti hai, doosri candle small body ki hoti hai aur teesri candle bullish hoti hai.

7. Evening Star

Evening star ek bearish reversal pattern hai jo price ke upar se neeche ki taraf indicate karta hai. Ye pattern ek uptrend ke baad hota hai jab price upar jaane ke baad neeche girne lagta hai. Evening star pattern mein pehli candle bullish hoti hai, doosri candle small body ki hoti hai aur teesri candle bearish hoti hai.

Conclusion

Candle stick patterns market analysis ke liye powerful tools hain jo traders ko market trends aur sentiment ko samajhne mein madad karte hain. In patterns ko samajhna aur pehchanna traders ke liye zaroori hai taake wo sahi waqt par trading decisions le sakein. Lekin, candle stick patterns ke istemal mein risk bhi hota hai aur sirf patterns par hi rely karke trading karna recommended nahi hai. Iske saath technical aur fundamental analysis bhi zaroori hai.

تبصرہ

Расширенный режим Обычный режим