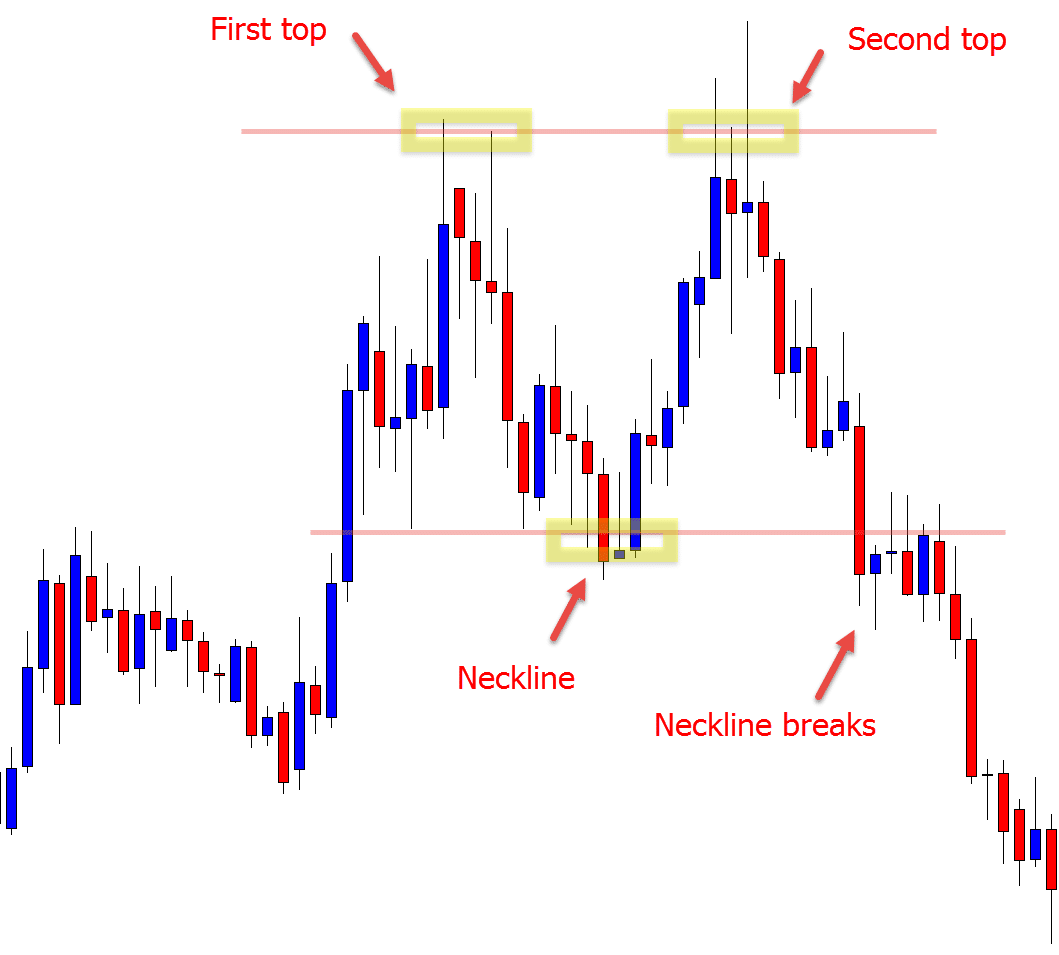

Double Top Candlestick pattern ek important technical analysis tool hai jo traders aur investors ke liye ahmiyat rakhta hai. Ye pattern generally price reversal ko darust karta hai, jis se aap market ki movement ka andaza laga sakte hain. Yeh pattern do high points ko indicate karta hai jo ek dusre ke barabar hote hain, aur inke darmiyan ek short-term decline hota hai.

Reversal Signal:

Double top candlestick pattern ek reversal signal provide karta hai, yani ke market trend ka palatna darust hone ki indication deta hai.

Confirmation ke Liye Use:

Jab double top pattern dekha jata hai, traders aur investors confirmatory signals jaise ke price decline ya other technical indicators ka istemal karte hain takay unhe confirm ho sake ke price indeed reverse hone wala hai.

Sell Signal:

Double top pattern ko dekhte hue traders sell signal samajhte hain. Iska matlab hai ke agar price ek double top pattern ke baad down trend mein hai, to traders selling positions mein ja sakte hain expecting further decline.

Risk Management:

Double top pattern traders ko risk management mein madad karta hai. Isko pehchan karke woh apni positions ko adjust kar sakte hain taake potential losses kam kiye ja sakein.

Market Psychology:

Ye pattern market psychology ko represent karta hai. Double top pattern se traders ka confidence level decrease hota hai aur selling pressure create hota hai.

Short-Term Outlook:

Double top pattern generally short-term outlook ke liye istemal kiya jata hai. Iska matalab hai ke agar aap short-term trading kar rahe hain, to ye pattern aapke liye useful ho sakta hai.

Historical Performance:

Double top pattern ka historical performance bhi dekha jata hai takay traders ko idea mil sake ke kis tarah ye pattern past mein behave kiya hai aur kya expectations hain.

Volume Analysis:

Double top pattern ke samay volume analysis bhi important hota hai. Volume decline karte hue double top pattern ke saath indicate karta hai ke reversal ki strength kam ho sakti hai. Double top candlestick pattern ke istemal se traders aur investors market trends aur price movements ko analyze karte hain, jisse unka decision making process improve hota hai. Magar hamesha yaad rahe ke kisi bhi single indicator ya pattern par pura bharosa na karein, aur dusre technical analysis tools aur fundamental analysis ko bhi samjhein market movements ko samajhne ke liye.

تبصرہ

Расширенный режим Обычный режим