What is Hammer Pattern:

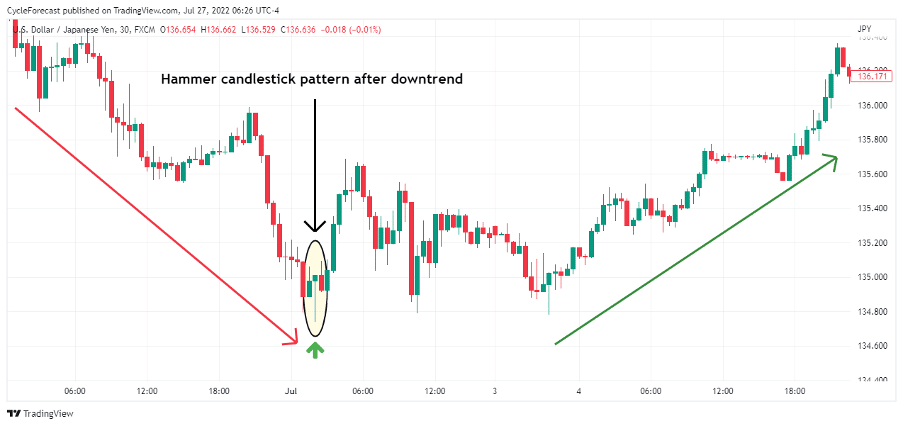

Zar e mubadla mein Hammery ka namona aik taizi se ulat jane wala mom batii ka namona hai jo aam tor par neechay ki taraf rujhan ke nichale hissay mein hota hai. is ki khasusiyat mom batii ki chhari ke chouti par aik chhota sa jism hai jis ka lamba nichala saya Hammery se milta jalta hai. yeh namona is baat ki nishandahi karta hai ke ibtidayi farokht ke dabao se qata nazar, sarfeen charge ko wapas karne mein kamyaab rahay, jis se salahiyat ke rujhan ko mandi se taizi ki taraf mornay ka ishara milta hai. tajir aksar forex market mein taweel pozishnon mein daakhil honay par ghhor karne se pehlay Hammery ke patteren ki sadaqat ko mazboot karne ke liye darj zail mom btyon ke andar behtar bandishon samait tasdeeq ke ishaaron ki talaash karte hain. bakhabar tijarti faislay karne ke liye is namoonay ko mukhtalif takneeki isharay ya tashkhees ke sath jorna zaroori hai.

Characteristics of the Hammer Pattern:

Hammer ka namona aam tor par neechay ke rujhan ke baad zahir hota hai aur yeh zahir karta hai ke sarfeen qadam barhana shuru kar rahay hain. is ki khasusiyat aik taweel nichale saaye ke sath mashwaray ke oopri hissay ke qareeb aik chhootey haqeeqi frame ki madad se ki gayi hai, jis se yeh zahir hota hai ke dilron ne session ke douran qeemat ko kam kardiya, taham khredar usay qareeb se oopar ki taraf dhakelnay mein kamyaab rahay. taweel kami ka saya kam qeematon ke mustard honay ki akkaasi karta hai aur baqaidagi se ziyada qeematon ke qareeb ulat jane ki salahiyat ki nishandahi karta hai.

Understanding the Psychology Behind the Hammer Pattern:

Hammery ka namona market ke jazbaat mein mandi se taizi ki taraf tabdeeli ki akkaasi karta hai. davn trained ke douran, farokht knndgan market par ghalba haasil karte hain, jis se laagat kam hoti hai. taham, jab Hammer namona byorokrisi hoti hai, to yeh ishara karta hai ke khredar zindah ho kar ubhray hain aur kam laagat par qadam rakhnay ki taraf mael hain. sarfeen ki madad se nichale darjay ko mustard karna aur mandarja zail really raftaar mein salahiyat ki tabdeeli ki numaindagi kar sakti hai, jis mein khredar heera pheri aur mumkina tor par driving charges ko behtar tareeqay se haasil kar satke hain.

Significance of Confirmation in Trading the Hammer Pattern:

Agarchay Hammer ka namona mumkina rujhan ke ulat jane ke baray mein qeemti baseerat paish kar sakta hai, lekin izafi isharay ya sharah ki karwai ke sath nishaan ki tasdeeq karna zaroori hai. tajir aksar tosiay hajam, Hammery ke patteren ke baad aik taiz mom batii, ya kaleedi muzahmat ki hudood se oopar ke malbay ke zariye tasdeeq ki talaash karte hain. tasdeeq ke liye intzaar karne se jhutay isharay ko kam karne aur Hammery ki tashkeel par mabni mutabadil mein daakhil honay se pehlay patteren ko badhaane mein madad mil sakti hai.

Trading Strategies Using the Hammer Pattern:

Tajir taizi se tijarat ke liye mumkina dakhli awamil ka intikhab karne ke liye apni kharidari aur farokht ki technique mein Hammery ka namona shaamil kar satke hain. aik ghair mamooli tareeqa yeh hai ke kharidari ke order ko Hammery ki candle stick ke oopar rakha jaye aur namoonay ke nichale hissay se neechay stop las muqarrar kya jaye. yeh tareeqa kharidaron ko –apne khatray se muaser tareeqay se nimatnay ke douran salahiyat ki qeemat ke ulat palat ka faida uthany ki ijazat deta hai. mazeed bar-aan, sarmaya car Hammery ke namoonay ki bunyaad par –apne khareed o farokht ke intikhab ki sadaqat ko taqwiyat dainay ke liye ost ya muawnat ke marahil ki muntaqili ke sath sath deegar takneeki alamaat ke sath sangam ki talaash bhi kar satke hain.

Zar e mubadla mein Hammery ka namona aik taizi se ulat jane wala mom batii ka namona hai jo aam tor par neechay ki taraf rujhan ke nichale hissay mein hota hai. is ki khasusiyat mom batii ki chhari ke chouti par aik chhota sa jism hai jis ka lamba nichala saya Hammery se milta jalta hai. yeh namona is baat ki nishandahi karta hai ke ibtidayi farokht ke dabao se qata nazar, sarfeen charge ko wapas karne mein kamyaab rahay, jis se salahiyat ke rujhan ko mandi se taizi ki taraf mornay ka ishara milta hai. tajir aksar forex market mein taweel pozishnon mein daakhil honay par ghhor karne se pehlay Hammery ke patteren ki sadaqat ko mazboot karne ke liye darj zail mom btyon ke andar behtar bandishon samait tasdeeq ke ishaaron ki talaash karte hain. bakhabar tijarti faislay karne ke liye is namoonay ko mukhtalif takneeki isharay ya tashkhees ke sath jorna zaroori hai.

Characteristics of the Hammer Pattern:

Hammer ka namona aam tor par neechay ke rujhan ke baad zahir hota hai aur yeh zahir karta hai ke sarfeen qadam barhana shuru kar rahay hain. is ki khasusiyat aik taweel nichale saaye ke sath mashwaray ke oopri hissay ke qareeb aik chhootey haqeeqi frame ki madad se ki gayi hai, jis se yeh zahir hota hai ke dilron ne session ke douran qeemat ko kam kardiya, taham khredar usay qareeb se oopar ki taraf dhakelnay mein kamyaab rahay. taweel kami ka saya kam qeematon ke mustard honay ki akkaasi karta hai aur baqaidagi se ziyada qeematon ke qareeb ulat jane ki salahiyat ki nishandahi karta hai.

Understanding the Psychology Behind the Hammer Pattern:

Hammery ka namona market ke jazbaat mein mandi se taizi ki taraf tabdeeli ki akkaasi karta hai. davn trained ke douran, farokht knndgan market par ghalba haasil karte hain, jis se laagat kam hoti hai. taham, jab Hammer namona byorokrisi hoti hai, to yeh ishara karta hai ke khredar zindah ho kar ubhray hain aur kam laagat par qadam rakhnay ki taraf mael hain. sarfeen ki madad se nichale darjay ko mustard karna aur mandarja zail really raftaar mein salahiyat ki tabdeeli ki numaindagi kar sakti hai, jis mein khredar heera pheri aur mumkina tor par driving charges ko behtar tareeqay se haasil kar satke hain.

Significance of Confirmation in Trading the Hammer Pattern:

Agarchay Hammer ka namona mumkina rujhan ke ulat jane ke baray mein qeemti baseerat paish kar sakta hai, lekin izafi isharay ya sharah ki karwai ke sath nishaan ki tasdeeq karna zaroori hai. tajir aksar tosiay hajam, Hammery ke patteren ke baad aik taiz mom batii, ya kaleedi muzahmat ki hudood se oopar ke malbay ke zariye tasdeeq ki talaash karte hain. tasdeeq ke liye intzaar karne se jhutay isharay ko kam karne aur Hammery ki tashkeel par mabni mutabadil mein daakhil honay se pehlay patteren ko badhaane mein madad mil sakti hai.

Trading Strategies Using the Hammer Pattern:

Tajir taizi se tijarat ke liye mumkina dakhli awamil ka intikhab karne ke liye apni kharidari aur farokht ki technique mein Hammery ka namona shaamil kar satke hain. aik ghair mamooli tareeqa yeh hai ke kharidari ke order ko Hammery ki candle stick ke oopar rakha jaye aur namoonay ke nichale hissay se neechay stop las muqarrar kya jaye. yeh tareeqa kharidaron ko –apne khatray se muaser tareeqay se nimatnay ke douran salahiyat ki qeemat ke ulat palat ka faida uthany ki ijazat deta hai. mazeed bar-aan, sarmaya car Hammery ke namoonay ki bunyaad par –apne khareed o farokht ke intikhab ki sadaqat ko taqwiyat dainay ke liye ost ya muawnat ke marahil ki muntaqili ke sath sath deegar takneeki alamaat ke sath sangam ki talaash bhi kar satke hain.

تبصرہ

Расширенный режим Обычный режим