Morning Star pattern

Morning Star candlestick pattern ek technical analysis tool hai jo market trends ko predict karne mein istemal hota hai. Yeh pattern market mein trend reversal ko indicate karta hai aur traders ko future price movements ke liye signals deta hai.

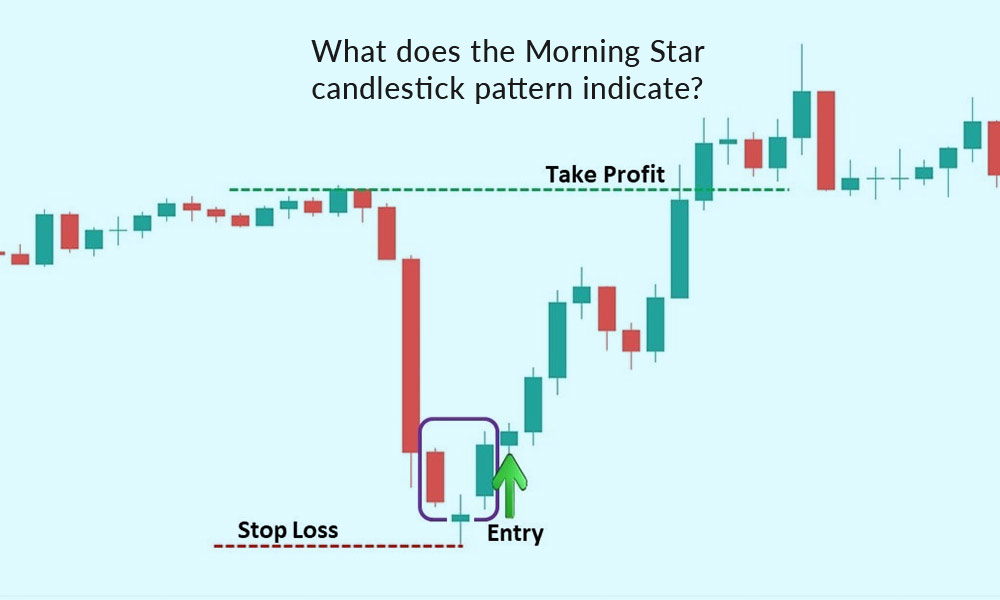

Morning Star pattern teen consecutive candles se banta hai. Pehli candle bearish hoti hai, jo existing downtrend ko represent karti hai. Dusri candle small body ki hoti hai, indicating market uncertainty. Teesri candle bullish hoti hai, suggesting a potential trend reversal. Yeh pattern market mein buyer dominance ko signal karta hai.

Jab pehli candle down trend ko show karta hai, ye dikhata hai ke sellers control mein hain. Dusri candle ki chhoti body uncertainty ko represent karti hai, jise market indecision ke roop mein interpret kiya ja sakta hai. Teesri candle ka bullish nature indicate karta hai ke buyers ne control le liya hai aur market mein reversal hone ke chances hain.

Morning Star pattern ka sahi se confirmation ke liye, traders ko volume ka bhi dhyan rakhna chahiye. Agar teesri candle ke saath badha volume hai, toh ye confirmation ko aur bhi strong banata hai.

Yeh pattern alag-alag timeframes par effective ho sakta hai, lekin har trading decision se pehle risk management ka bhi dhyan rakhna important hai. Morning Star pattern ke istemal se traders ko market mein hone wale potential changes ka pata lagta hai, lekin yeh kisi bhi guarantee ke saath nahi aata aur market risks ko samajhkar hi iska istemal karna chahiye.

Morning Star candlestick pattern ek technical analysis tool hai jo market trends ko predict karne mein istemal hota hai. Yeh pattern market mein trend reversal ko indicate karta hai aur traders ko future price movements ke liye signals deta hai.

Morning Star pattern teen consecutive candles se banta hai. Pehli candle bearish hoti hai, jo existing downtrend ko represent karti hai. Dusri candle small body ki hoti hai, indicating market uncertainty. Teesri candle bullish hoti hai, suggesting a potential trend reversal. Yeh pattern market mein buyer dominance ko signal karta hai.

Jab pehli candle down trend ko show karta hai, ye dikhata hai ke sellers control mein hain. Dusri candle ki chhoti body uncertainty ko represent karti hai, jise market indecision ke roop mein interpret kiya ja sakta hai. Teesri candle ka bullish nature indicate karta hai ke buyers ne control le liya hai aur market mein reversal hone ke chances hain.

Morning Star pattern ka sahi se confirmation ke liye, traders ko volume ka bhi dhyan rakhna chahiye. Agar teesri candle ke saath badha volume hai, toh ye confirmation ko aur bhi strong banata hai.

Yeh pattern alag-alag timeframes par effective ho sakta hai, lekin har trading decision se pehle risk management ka bhi dhyan rakhna important hai. Morning Star pattern ke istemal se traders ko market mein hone wale potential changes ka pata lagta hai, lekin yeh kisi bhi guarantee ke saath nahi aata aur market risks ko samajhkar hi iska istemal karna chahiye.

تبصرہ

Расширенный режим Обычный режим