1. Tareef (Definition):

Fundamental analysis Forex trading mein ek tajziati tajaweez hai jo mukhtalif factors ko shamil karke currencies ki qeemat ka andaza lagane mein madad karti hai.

2. Arsa-e-Tajziya (Timeframe of Analysis):

Fundamental analysis lamba arsa cover karta hai aur ismein mulk ki arthik, siyasi aur samaji surat-e-haal ke asarat shamil hote hain.

3. Asarat (Factors):

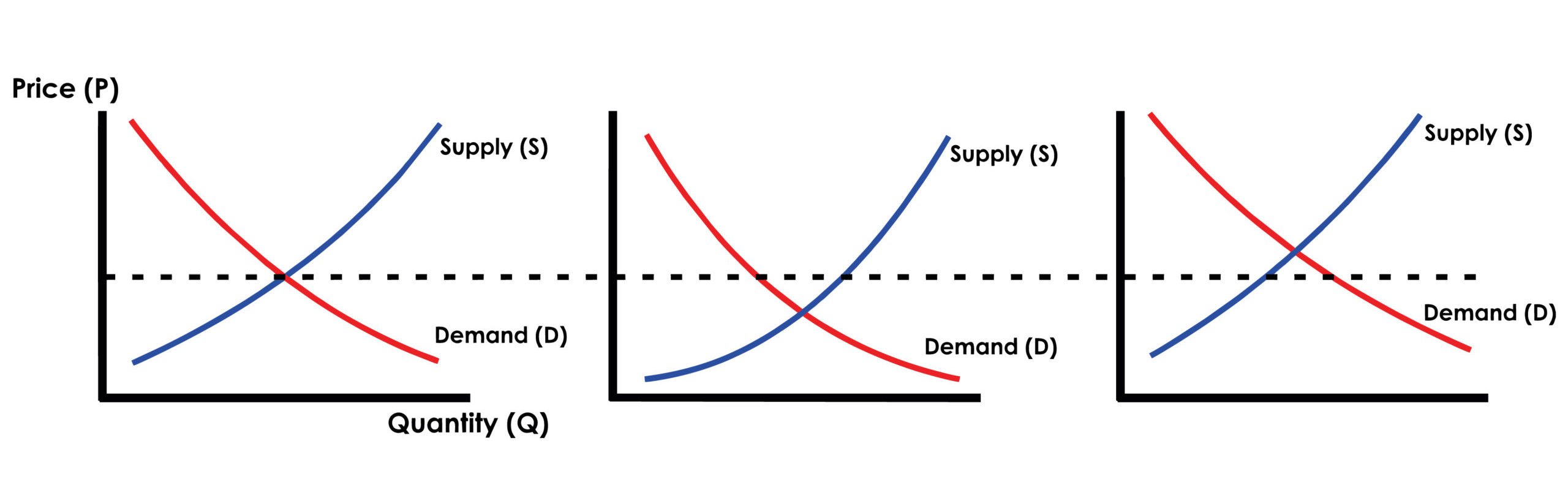

Arthik Asarat (Economic Factors):

Forex traders arthik maamlaat ka tajzia karte hain jese ke GDP, roze marra ki tijarat, aur jobs ka daromadar.

Siyasi Asarat (Political Factors):

Mulk ke andar hukumat ke faislay, policies aur election ke asarat ko bhi mad e nazar rakha jata hai.

Rasmi Idaare (Central Banks):

Central banks ki policies, unki interest rates aur monetary measures bhi currencies ki qeemat par asar daal sakti hain.

4. News aur Events ka Asar (Impact of News and Events):

Economic calendar ke zariye traders tabdiliyon aur mulk ki surat-e-haal mein anay walay tabdiliyon ki khaborat ko tajziya karte hain. Major economic indicators jese ke non-farm payrolls, inflation rates aur interest rates decisions ka asar bhi currencies par hota hai.

5. Risk Management:

Fundamental analysis traders ko market mein hone wale asarat ka behtareen andaza deti hai, jisse wo apni tajaweezat ke mutabiq risk management kar sakein.Ye analysis traders ko future expectations banane mein madad karta hai.

6. Forex Trading mein Istemal (Application in Forex Trading):

Traders fundamental analysis ka istemal karke currencies ki qeemat mein hone wale tabdiliyon ko samajhte hain aur iske mutabiq trading strategies tay karte hain.Ye analysis long-term investors aur swing traders ke liye khaas ahmiyat rakhta hai.

7. Challenges aur Mazid Tafseelat (Challenges and Further Details):

Fundamental analysis mein information ka tajzia karna mushkil ho sakta hai kyun ke har waqt naye asarat paida ho rahe hote hain.

Economic indicators ke tajziaat mein ghalat fehmi bhi nuksan dah ho sakti hai.

Fundamental analysis Forex trading mein ek mohim aur ahmiyat ka hissa hai jo traders ko market ke asarat ko samajhne mein madad karta hai.

Fundamental analysis Forex trading mein ek tajziati tajaweez hai jo mukhtalif factors ko shamil karke currencies ki qeemat ka andaza lagane mein madad karti hai.

2. Arsa-e-Tajziya (Timeframe of Analysis):

Fundamental analysis lamba arsa cover karta hai aur ismein mulk ki arthik, siyasi aur samaji surat-e-haal ke asarat shamil hote hain.

3. Asarat (Factors):

Arthik Asarat (Economic Factors):

Forex traders arthik maamlaat ka tajzia karte hain jese ke GDP, roze marra ki tijarat, aur jobs ka daromadar.

Siyasi Asarat (Political Factors):

Mulk ke andar hukumat ke faislay, policies aur election ke asarat ko bhi mad e nazar rakha jata hai.

Rasmi Idaare (Central Banks):

Central banks ki policies, unki interest rates aur monetary measures bhi currencies ki qeemat par asar daal sakti hain.

4. News aur Events ka Asar (Impact of News and Events):

Economic calendar ke zariye traders tabdiliyon aur mulk ki surat-e-haal mein anay walay tabdiliyon ki khaborat ko tajziya karte hain. Major economic indicators jese ke non-farm payrolls, inflation rates aur interest rates decisions ka asar bhi currencies par hota hai.

5. Risk Management:

Fundamental analysis traders ko market mein hone wale asarat ka behtareen andaza deti hai, jisse wo apni tajaweezat ke mutabiq risk management kar sakein.Ye analysis traders ko future expectations banane mein madad karta hai.

6. Forex Trading mein Istemal (Application in Forex Trading):

Traders fundamental analysis ka istemal karke currencies ki qeemat mein hone wale tabdiliyon ko samajhte hain aur iske mutabiq trading strategies tay karte hain.Ye analysis long-term investors aur swing traders ke liye khaas ahmiyat rakhta hai.

7. Challenges aur Mazid Tafseelat (Challenges and Further Details):

Fundamental analysis mein information ka tajzia karna mushkil ho sakta hai kyun ke har waqt naye asarat paida ho rahe hote hain.

Economic indicators ke tajziaat mein ghalat fehmi bhi nuksan dah ho sakti hai.

Fundamental analysis Forex trading mein ek mohim aur ahmiyat ka hissa hai jo traders ko market ke asarat ko samajhne mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим