Bollinger Bands in Forex Trading

Bollinger Bands, jinhe aam tor par "BB" ke naam se bhi jaana jaata hai, ek ahem forex indicator hain jo market volatility ko measure karne mein aur potential price reversals ko identify karne mein madad karta hai.

Introduction:

Bollinger Bands Dr. John Bollinger ke dwara develop kiye gaye hain. Ye indicator market volatility aur price levels ka pata lagane mein istemal hota hai. Bollinger Bands ka ek khaas feature hai ki ye price ke aas-paas ek dynamic range create karte hain, jo ki market conditions ke hisaab se badal sakta hai.

Components:

1. Upper Band:

Uper band, typically standard deviation ke kuch multiple ke hisaab se calculate ki jaati hai aur ye price ke volatility ko darust karti hai.

2. Lower Band:

Neche ki band bhi standard deviation par mabni hoti hai aur ye bhi price movement ko reflect karti hai.

3. Middle Band (SMA):

Middle band Simple Moving Average (SMA) hoti hai aur ye trend ko represent karti hai.

Interpretation:

Volatility Indicator:

Jab bands expand hote hain, ye indicate karta hai ki market mein volatility badh gayi hai. Jab bands contract hote hain, ye low volatility ko darust karta hai.

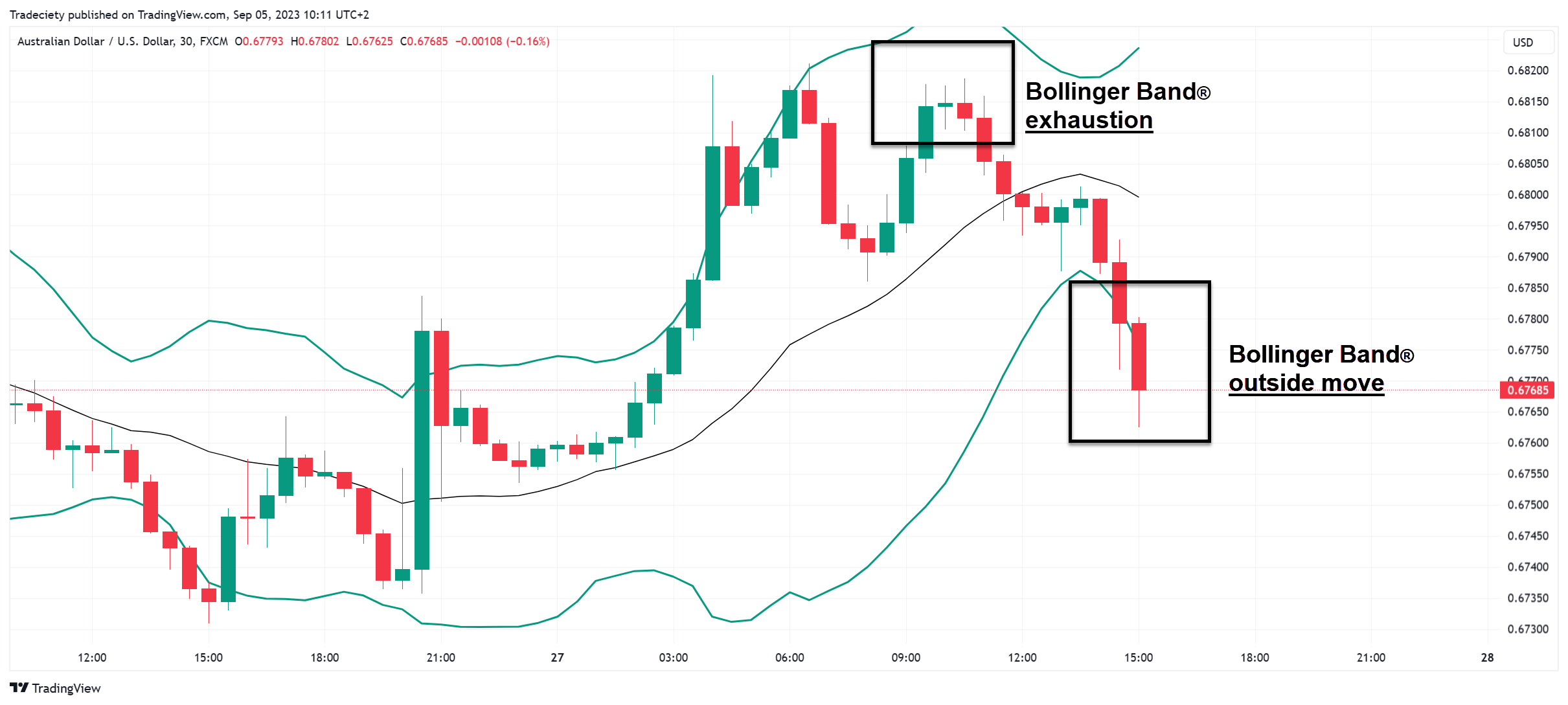

Overbought and Oversold Conditions:

Agar price upper band ke paas aata hai, to ye overbought condition ko suggest karta hai. Neche ki band ke paas aane par oversold condition indicate hoti hai.

Trading Strategies:

Bollinger Squeeze:

Jab bands narrow ho jaate hain, ye squeeze kehlata hai. Traders isko interpret karke anticipate karte hain ki koi significant price movement hone wala hai.

Reversal Signals:

Agar price upper band ko touch karta hai aur fir neeche aata hai, to ye potential reversal signal ho sakta hai aur vice versa.

Conclusion:

Bollinger Bands ek versatile indicator hain jo traders ko market conditions samajhne mein aur trading decisions lene mein madad karte hain. Hamesha yaad rahe ke indicator ko sahi dhang se interpret karna aur dusre factors ke saath combine karna zaroori hai trading success ke liye.

Bollinger Bands, jinhe aam tor par "BB" ke naam se bhi jaana jaata hai, ek ahem forex indicator hain jo market volatility ko measure karne mein aur potential price reversals ko identify karne mein madad karta hai.

Introduction:

Bollinger Bands Dr. John Bollinger ke dwara develop kiye gaye hain. Ye indicator market volatility aur price levels ka pata lagane mein istemal hota hai. Bollinger Bands ka ek khaas feature hai ki ye price ke aas-paas ek dynamic range create karte hain, jo ki market conditions ke hisaab se badal sakta hai.

Components:

1. Upper Band:

Uper band, typically standard deviation ke kuch multiple ke hisaab se calculate ki jaati hai aur ye price ke volatility ko darust karti hai.

2. Lower Band:

Neche ki band bhi standard deviation par mabni hoti hai aur ye bhi price movement ko reflect karti hai.

3. Middle Band (SMA):

Middle band Simple Moving Average (SMA) hoti hai aur ye trend ko represent karti hai.

Interpretation:

Volatility Indicator:

Jab bands expand hote hain, ye indicate karta hai ki market mein volatility badh gayi hai. Jab bands contract hote hain, ye low volatility ko darust karta hai.

Overbought and Oversold Conditions:

Agar price upper band ke paas aata hai, to ye overbought condition ko suggest karta hai. Neche ki band ke paas aane par oversold condition indicate hoti hai.

Trading Strategies:

Bollinger Squeeze:

Jab bands narrow ho jaate hain, ye squeeze kehlata hai. Traders isko interpret karke anticipate karte hain ki koi significant price movement hone wala hai.

Reversal Signals:

Agar price upper band ko touch karta hai aur fir neeche aata hai, to ye potential reversal signal ho sakta hai aur vice versa.

Conclusion:

Bollinger Bands ek versatile indicator hain jo traders ko market conditions samajhne mein aur trading decisions lene mein madad karte hain. Hamesha yaad rahe ke indicator ko sahi dhang se interpret karna aur dusre factors ke saath combine karna zaroori hai trading success ke liye.

تبصرہ

Расширенный режим Обычный режим