Forex Trading Mein Stop-Loss Ka Istemal -

Forex trading mein stop-loss ka istemal karna ek bahut zaroori risk management technique hai. Stop-loss order trader ko protect karta hai aur usay predefined loss se bachane mein madad karta hai. Yahan, mein aapko stop-loss ka tafsili taur par istemal karne ke fayde aur tajaweezat ke baare mein bataunga:

Stop-Loss Kya Hai? Stop-loss ek predefined level hai jahan par aap apni trade ko automatically band kar dete hain taki aapki nuksan ko control mein rakha ja sake. Is level ko aap apne risk tolerance aur trading strategy ke mutabiq tay karte hain.

Stop-Loss Ka Istemal Kyun Zaroori Hai:

Stop-Loss Set Karne Ka Tareeqa:

Stop-Loss Ka Istemal Karne Ke Fawaid:

Remember, har trade mein stop-loss ka istemal karna zaroori hai, lekin ye bhi dhyan rakhein ke stop-loss level ko itna tight na rakhein ke normal market fluctuations ke bawajood aapki trade band ho jaye. Har trade ke liye ek proper analysis aur risk management plan banaayein.

Forex trading mein stop-loss ka istemal karna ek bahut zaroori risk management technique hai. Stop-loss order trader ko protect karta hai aur usay predefined loss se bachane mein madad karta hai. Yahan, mein aapko stop-loss ka tafsili taur par istemal karne ke fayde aur tajaweezat ke baare mein bataunga:

Stop-Loss Kya Hai? Stop-loss ek predefined level hai jahan par aap apni trade ko automatically band kar dete hain taki aapki nuksan ko control mein rakha ja sake. Is level ko aap apne risk tolerance aur trading strategy ke mutabiq tay karte hain.

Stop-Loss Ka Istemal Kyun Zaroori Hai:

- Risk Management:

- Stop-loss order aapko define kiye gaye loss se bachane mein madad karta hai. Aap apne trading capital ka ek percentage ya fixed amount tay karke stop-loss set kar sakte hain.

- Emotional Control:

- Stop-loss ka istemal emotional trading se bachane mein bhi madad karta hai. Agar market against ja raha hai aur aapka trade loss mein hai, to stop-loss order aapko discipline banaye rakhne mein madad karta hai.

- Market Volatility:

- Forex market bahut hi volatile hota hai, aur prices mein sudden changes ho sakte hain. Stop-loss order aapko market ki volatility ke khilaaf bachane mein madad karta hai.

- Overnight Risks:

- Forex market 24/5 open hota hai, aur overnight events ya news ke baare mein pata nahi hota. Stop-loss order overnight risks se bachane mein madad karta hai.

- Strategy Execution:

- Stop-loss ek trading strategy ka integral hissa hai. Aap apne trading plan ke mutabiq stop-loss set karke apne trades ko systematically manage kar sakte hain.

Stop-Loss Set Karne Ka Tareeqa:

- Risk Tolerance Determine Karein:

- Pehle toh aapko apne overall trading capital ke hisaab se risk tolerance tay karna hoga. Aksar traders 1% se 3% tak apne total capital ka risk lete hain ek trade par.

- Volatility Ko Consider Karein:

- Market volatility ko samajh kar stop-loss level tay karein. Agar market zyada volatile hai, toh aapko stop-loss ko wide rakhna hoga.

- Support/Resistance Levels Par Dhyan De:

- Technical analysis ke zariye, support aur resistance levels par dhyan dekar stop-loss tay karein. Yeh aapko market ke key levels par protection dega.

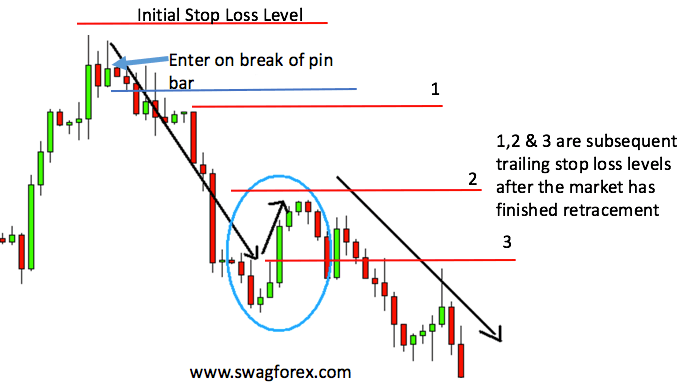

- Trailing Stop-Loss Ka Istemal:

- Profitability ke saath saath, aap trailing stop-loss ka bhi istemal kar sakte hain. Ismein aap stop-loss ko trade ke favorable direction mein adjust karte hain.

- News Events Se Bachein:

- Important economic events se bachne ke liye, aap apne stop-loss levels ko news events ke aas-paas adjust kar sakte hain.

Stop-Loss Ka Istemal Karne Ke Fawaid:

- Losses Control Mein Rahti Hain:

- Aap predefined stop-loss levels se losses ko control mein rakh sakte hain.

- Emotional Trading Se Bachaye:

- Stop-loss order aapko emotional trading ke asarat se bachata hai, kyun ki aap advance mein decide karke trading plan follow karte hain.

- Risk-Reward Ratio Improve Hota Hai:

- Stop-loss ka sahi istemal karke aap apne trades ka risk-reward ratio improve kar sakte hain.

- Discipline Banaye Rahti Hai:

- Stop-loss aapko trading discipline banaye rakhne mein madad karta hai.

Remember, har trade mein stop-loss ka istemal karna zaroori hai, lekin ye bhi dhyan rakhein ke stop-loss level ko itna tight na rakhein ke normal market fluctuations ke bawajood aapki trade band ho jaye. Har trade ke liye ek proper analysis aur risk management plan banaayein.

تبصرہ

Расширенный режим Обычный режим