INTRODUCTION OF ENVELOPE INDICATOR.

Dear friends,Forex market mein jab traders apne technical analysis complete kar rahe hote hain tou ess mein different important technical analysis bahut helpful hoty hain, aur trading mein profitable or effective trading karni main aap ko different important indications provide karty hote hain. envelop channel aap kay liye bahut hi profitable platform ho sakta hay..trading mein traders ko two different points ko apne mind mein rakh kar trading karna hoti hai, agar market highest point per hoti hay tou ess situation main aap ko sell ki trade place karni chahie, aur jab market ki movement lowest level per hoti hay tu ess situation main aapko buy trade place karna hoti hay.

SIGNIFICANCE DEVELOPMENT

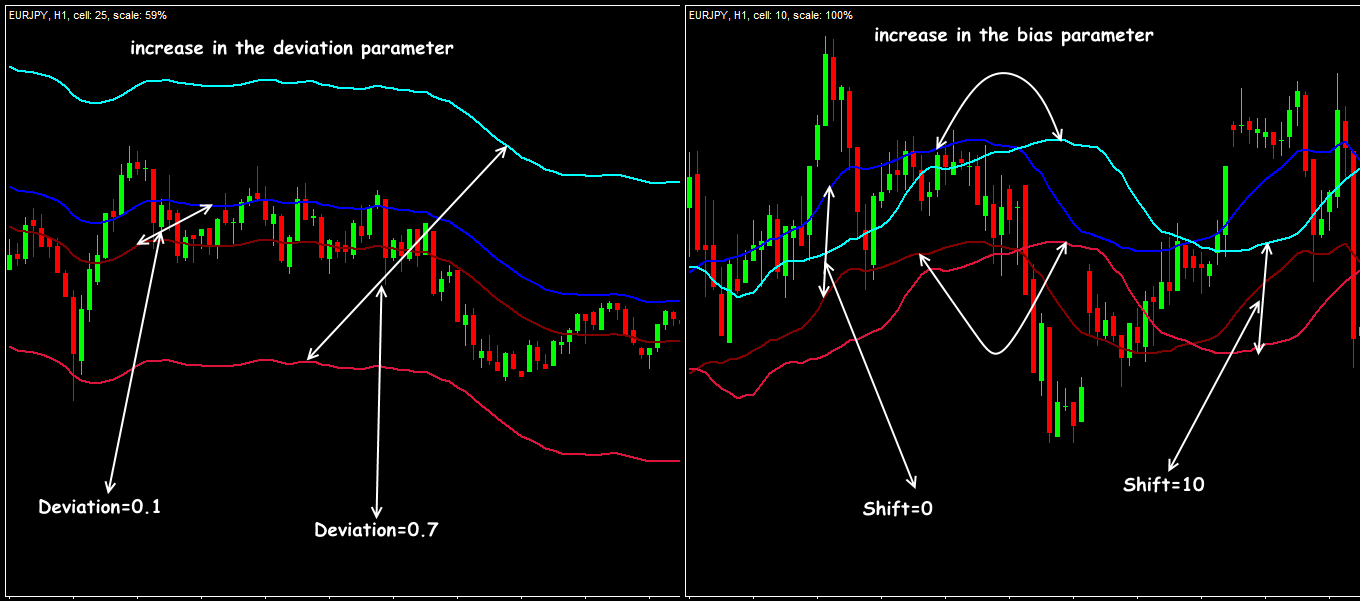

Market trading mein envelope indicators simple moving average sey form hotay hain, aur moving average kay above aur below aik pre-determined distance sey show hotay hain. Envelope indicators traders aur investors ko extreme overbought aur over sold conditions kay sath trading ranges ko identify karnay mein help kartay hain. Yeh basically technical indicators hotay hain jo price chart bars kay around upper and lower bands par place hotay hain, enn ko envelope channels kehtay hain. Jis trader k pass acha experience hota hai woh small capital sey be acha profit hasil ker leta hay. Jis trader k pass experience ki kami hoti hay woh huge capital sey bee profit hasil ni kar paty. Yeh indicator upper and lower band moving average ki help sey lower or upper moving average ko calculate karty hain. Ager ham in upper and lower bands ki movement and cross ko achi tarah say understand kar lain tou ham envelop cannels sey profit earning ker sakty hain. Traders kay leye yeh important hota hay kay woh trading ko hamesha small lot size sey start kery, aur slowly lot size ko increase keray, ta kay kisi bi false indication kay result mein capital secure rahy.

TECHNICAL ANALYSIS

Forex business mein jab traders ess channel mein apni trading kar rahe ho the tou aisi situation main hamesha eik acchi account balance ke sath apni trading karni chahie. Agar minimum account balance ke sath apni trading karte hain tou aisi situation main traders kay leye sometime bahut problem ho sakti hay. Yah aisa channel hota hay jis ka breakout per bhi acchi interest mil sakti hay. Trader ko chahiye keh ager woh envelop channels kay use per trading kar raha hay tou trend kay according kisi aik direction main trading kary, aur ess tarah ess ko proper entry and exit point mil jaty hain. Envelop channel mein traders short term trading kar sakte hain agar aap ko market mein scalping karna hoti hay tou ess kay liye bhi yeh channel traders kay liye bahut hi important role play kar sakta hay, aur profit ko increase kar sakta hain. Ess mein aap ka experience aap ko market mein acha trader ban jany mein help out kerta hy. Jab prices qareeb aa rahi hain ya nichale darjay ko touch ker rahi ho tou yeh ess factor ki indication karta hay kay market mostly buyers ko support ker rahi hay. Jis kay baad sellers ki strength ka wait ker kay trade open ki ja sakti hay.

Dear friends,Forex market mein jab traders apne technical analysis complete kar rahe hote hain tou ess mein different important technical analysis bahut helpful hoty hain, aur trading mein profitable or effective trading karni main aap ko different important indications provide karty hote hain. envelop channel aap kay liye bahut hi profitable platform ho sakta hay..trading mein traders ko two different points ko apne mind mein rakh kar trading karna hoti hai, agar market highest point per hoti hay tou ess situation main aap ko sell ki trade place karni chahie, aur jab market ki movement lowest level per hoti hay tu ess situation main aapko buy trade place karna hoti hay.

SIGNIFICANCE DEVELOPMENT

Market trading mein envelope indicators simple moving average sey form hotay hain, aur moving average kay above aur below aik pre-determined distance sey show hotay hain. Envelope indicators traders aur investors ko extreme overbought aur over sold conditions kay sath trading ranges ko identify karnay mein help kartay hain. Yeh basically technical indicators hotay hain jo price chart bars kay around upper and lower bands par place hotay hain, enn ko envelope channels kehtay hain. Jis trader k pass acha experience hota hai woh small capital sey be acha profit hasil ker leta hay. Jis trader k pass experience ki kami hoti hay woh huge capital sey bee profit hasil ni kar paty. Yeh indicator upper and lower band moving average ki help sey lower or upper moving average ko calculate karty hain. Ager ham in upper and lower bands ki movement and cross ko achi tarah say understand kar lain tou ham envelop cannels sey profit earning ker sakty hain. Traders kay leye yeh important hota hay kay woh trading ko hamesha small lot size sey start kery, aur slowly lot size ko increase keray, ta kay kisi bi false indication kay result mein capital secure rahy.

TECHNICAL ANALYSIS

Forex business mein jab traders ess channel mein apni trading kar rahe ho the tou aisi situation main hamesha eik acchi account balance ke sath apni trading karni chahie. Agar minimum account balance ke sath apni trading karte hain tou aisi situation main traders kay leye sometime bahut problem ho sakti hay. Yah aisa channel hota hay jis ka breakout per bhi acchi interest mil sakti hay. Trader ko chahiye keh ager woh envelop channels kay use per trading kar raha hay tou trend kay according kisi aik direction main trading kary, aur ess tarah ess ko proper entry and exit point mil jaty hain. Envelop channel mein traders short term trading kar sakte hain agar aap ko market mein scalping karna hoti hay tou ess kay liye bhi yeh channel traders kay liye bahut hi important role play kar sakta hay, aur profit ko increase kar sakta hain. Ess mein aap ka experience aap ko market mein acha trader ban jany mein help out kerta hy. Jab prices qareeb aa rahi hain ya nichale darjay ko touch ker rahi ho tou yeh ess factor ki indication karta hay kay market mostly buyers ko support ker rahi hay. Jis kay baad sellers ki strength ka wait ker kay trade open ki ja sakti hay.

تبصرہ

Расширенный режим Обычный режим