Tweezer Bottom Ki Tafseelat:

Tweezer Bottom, candlestick charts mein aik ahem pattern hai jo market mein trend reversal ko darust karti hai. Yeh pattern usually downtrend ke baad aata hai aur bullish reversal ko represent karta hai.

1. Shuruwat:

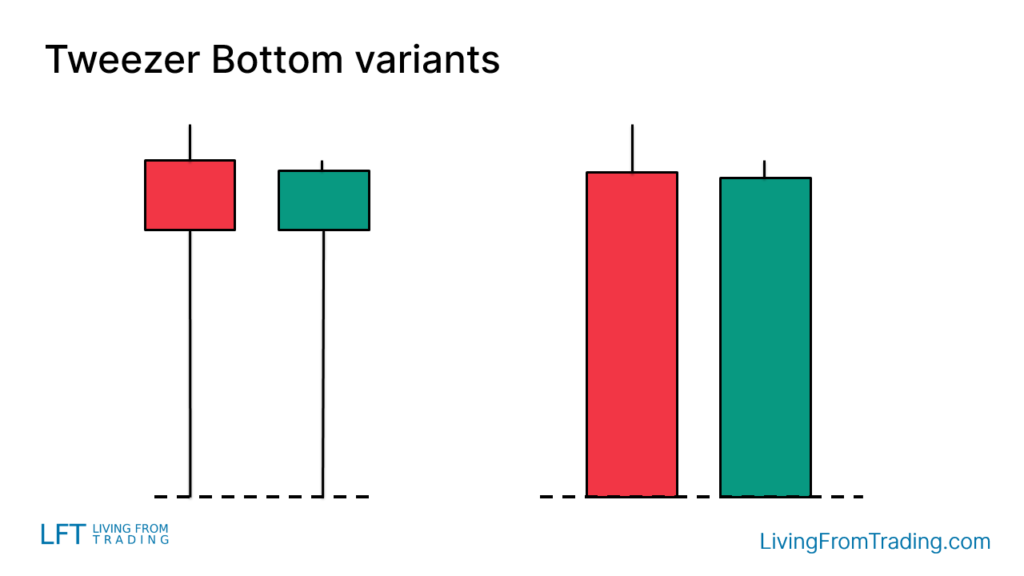

Tweezer Bottom ek do candlesticks se milta hai. Pehli candlestick downtrend ke doran aati hai aur yeh bearish hoti hai.

Phela Candlestick

Pehla candlestick zyadatar lambi hoti hai aur sellers ka dominance darust karta hai. Isme price neeche ja rahi hoti hai, jisse downtrend ki continuation hoti hai.

3. Dusra Candlestick:

Dusra candlestick, jo ke direct pehle candlestick ke baad aata hai, ek sudden change ko darust karta hai. Yeh candlestick bullish hoti hai aur iski closing price pehle candlestick ki opening price ke barabar ya usse oopar hoti hai.

4. Shadows ki Importancy:

Tweezer Bottom ki pehchan karne ke liye, candlesticks ke shadows ka bhi khass dhyan diya jata hai. Agar dono candlesticks ki lower shadows aapas mein mil rahi hain, toh yeh ek aur confirmation hai ke trend reversal hone wala hai.

5. Confirmation:

Is pattern ki confirmation ke liye, traders ko doosre technical indicators aur price patterns ka bhi istemal karna chahiye. Volume analysis bhi madadgar hoti hai is pattern ki tasdeeq mein.

6. Trading Strategies:

Agar Tweezer Bottom confirm hota hai, toh traders bullish positions le sakte hain. Stop-loss orders ka istemal zaroori hai taki unexpected market movements se bacha ja sake.

7. Hidings:

Trend Reversal Indicator:

Tweezer Bottom, market mein trend reversal ko darust karta hai.

Shadows ki Tafseelat:

Candlesticks ki lower shadows ka dhyan rakhna ahem hai.

Confirmation ke Liye Istemal:

Doosre technical indicators aur patterns ka istemal confirmation ke liye kiya jata hai.

Trading Strategies:

Confirm Tweezer Bottom ke baad, traders ko cautious trading strategies istemal karni chahiye.

Yeh pattern market analysis mein ek ahem tool hai, lekin hamesha yaad rakhein ke har ek indicator ki tarah, yeh bhi 100% perfect nahi hota aur risk management ko hamesha priority dein.

Tweezer Bottom, candlestick charts mein aik ahem pattern hai jo market mein trend reversal ko darust karti hai. Yeh pattern usually downtrend ke baad aata hai aur bullish reversal ko represent karta hai.

1. Shuruwat:

Tweezer Bottom ek do candlesticks se milta hai. Pehli candlestick downtrend ke doran aati hai aur yeh bearish hoti hai.

Phela Candlestick

Pehla candlestick zyadatar lambi hoti hai aur sellers ka dominance darust karta hai. Isme price neeche ja rahi hoti hai, jisse downtrend ki continuation hoti hai.

3. Dusra Candlestick:

Dusra candlestick, jo ke direct pehle candlestick ke baad aata hai, ek sudden change ko darust karta hai. Yeh candlestick bullish hoti hai aur iski closing price pehle candlestick ki opening price ke barabar ya usse oopar hoti hai.

4. Shadows ki Importancy:

Tweezer Bottom ki pehchan karne ke liye, candlesticks ke shadows ka bhi khass dhyan diya jata hai. Agar dono candlesticks ki lower shadows aapas mein mil rahi hain, toh yeh ek aur confirmation hai ke trend reversal hone wala hai.

5. Confirmation:

Is pattern ki confirmation ke liye, traders ko doosre technical indicators aur price patterns ka bhi istemal karna chahiye. Volume analysis bhi madadgar hoti hai is pattern ki tasdeeq mein.

6. Trading Strategies:

Agar Tweezer Bottom confirm hota hai, toh traders bullish positions le sakte hain. Stop-loss orders ka istemal zaroori hai taki unexpected market movements se bacha ja sake.

7. Hidings:

Trend Reversal Indicator:

Tweezer Bottom, market mein trend reversal ko darust karta hai.

Shadows ki Tafseelat:

Candlesticks ki lower shadows ka dhyan rakhna ahem hai.

Confirmation ke Liye Istemal:

Doosre technical indicators aur patterns ka istemal confirmation ke liye kiya jata hai.

Trading Strategies:

Confirm Tweezer Bottom ke baad, traders ko cautious trading strategies istemal karni chahiye.

Yeh pattern market analysis mein ek ahem tool hai, lekin hamesha yaad rakhein ke har ek indicator ki tarah, yeh bhi 100% perfect nahi hota aur risk management ko hamesha priority dein.

تبصرہ

Расширенный режим Обычный режим