BULLISH COUNTER ATTACK PATTERN:

Market indication aur predictions ky leye pattern ko samajhna aur unn per amal kerna traders ky leye bhout zaroori hy. Ess ky baghair koi bi trader positive trading perform nahi ker sakta. Esi leye aaj hum aik aur pattern jis ko market mein counter attack pattern kaha jata hy, oss ky realated complete discussion kery gy. Counterattack candlestick pattern jab create hoti hay, tou aesy main market ka reversal trend confirm hota hy. Jab market continuously aik trend ko follow kerty huey movement kerti hay aur aik big candle create hony kay baad market main next candle gap ky sath open ho ker reverse direction main movement kerty huey previous candle ki closing position ky sath hi close ho jati hay, tou aesy mein jo pattern create hota hay osy counterattack candlestick pattern kaha jata hay. Agar market kisi aik direction mein big movement complete ker chuki hay, tou phir oss ky according reverse direction main bhi movement continue ker leti hay. Yeh trend reversal ki clear confirmation aur indication hoti hay.

SIGNIFICANCE OF BULLISH COUNTER ATTACK PATTERN:

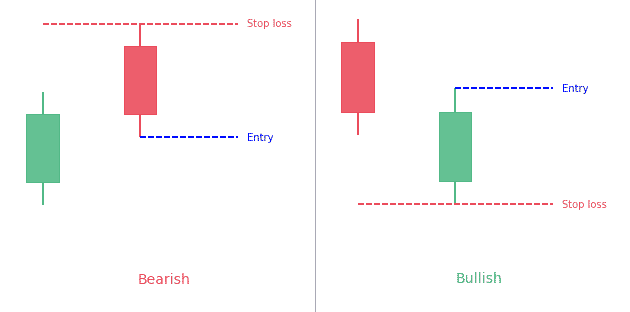

Dear forex friends market mein yeh pattern just like “bullish belt hold candlestick pattern” ya “bearish thrusting line pattern” jaisa nazar ata hay. But second bearish candle ki shape different honne ki waja se yeh pattern different ban jata hay. Yeh pattern 2 candles par consisted hota hay. Jiss mein 1st candle bearish aur 2nd candle bullish candle hoti hay. Ess ki first candle aik long real body wali bearish candle hoti hy jo kay bearish trend ya low prices ko indicate karti hay. Yeh candle black ya red color mein hoti hay. Ess ki second candle aik real body wali bullish candle hoti hay, jo kay pehli candle kay bottom par open ho kar ussi k same closing point k in line close hoti hay. First aur second candles ka closing price lazmi same point par meet karna chaheye. Enn patterns ki identity ka knowledge trading mein apply kiya jaye tu market ko samjhny mein koi mushkil nahi hoti, aur traders easily ess pattern ko identify ker kay trade laga lety hein.

TECHNICAL ANALYSIS:

Friends professional traders jab yeh prediction ker lety hain, ky market buy ki side ja rahe hay, ya market sell ki traf ja rhe hay, tou aesy time mein unn ky leye market entry bhout easy ho jati hy. Ess leye hamein chahye keh aagar ham isko correctly understand ker gy tou ess sey ham apni trade ko secure kar saken gy. Ess tarah kay indicators mein market trend reverse show ho sakta hy, aur forward bi show ho sakta hy. Jab bi market me up trend start hota hy aur eik line close ho jati hy tou second line eik gap ke sath open hoti hy . Yeh gap kuch ess tarah se form hota hy ky jaisy bearish candle aur bullish candle eik dosry ke sath eik point py aa ker join ho jaty hain . Jaisy hee yeh eik point py a kar join hoty hain tou exactly ess time mein jo trend hamein milta hy uss mein selling traders bht ziada hoty hain, kyu kay ess time both candles same point py join hoti hein. Aur yeh bht essential hy keh market apni trend selling me lay kar ja raha hota hay. Traders kay leye market mein apna order place kerny ka ideal time hota hay.

Market indication aur predictions ky leye pattern ko samajhna aur unn per amal kerna traders ky leye bhout zaroori hy. Ess ky baghair koi bi trader positive trading perform nahi ker sakta. Esi leye aaj hum aik aur pattern jis ko market mein counter attack pattern kaha jata hy, oss ky realated complete discussion kery gy. Counterattack candlestick pattern jab create hoti hay, tou aesy main market ka reversal trend confirm hota hy. Jab market continuously aik trend ko follow kerty huey movement kerti hay aur aik big candle create hony kay baad market main next candle gap ky sath open ho ker reverse direction main movement kerty huey previous candle ki closing position ky sath hi close ho jati hay, tou aesy mein jo pattern create hota hay osy counterattack candlestick pattern kaha jata hay. Agar market kisi aik direction mein big movement complete ker chuki hay, tou phir oss ky according reverse direction main bhi movement continue ker leti hay. Yeh trend reversal ki clear confirmation aur indication hoti hay.

SIGNIFICANCE OF BULLISH COUNTER ATTACK PATTERN:

Dear forex friends market mein yeh pattern just like “bullish belt hold candlestick pattern” ya “bearish thrusting line pattern” jaisa nazar ata hay. But second bearish candle ki shape different honne ki waja se yeh pattern different ban jata hay. Yeh pattern 2 candles par consisted hota hay. Jiss mein 1st candle bearish aur 2nd candle bullish candle hoti hay. Ess ki first candle aik long real body wali bearish candle hoti hy jo kay bearish trend ya low prices ko indicate karti hay. Yeh candle black ya red color mein hoti hay. Ess ki second candle aik real body wali bullish candle hoti hay, jo kay pehli candle kay bottom par open ho kar ussi k same closing point k in line close hoti hay. First aur second candles ka closing price lazmi same point par meet karna chaheye. Enn patterns ki identity ka knowledge trading mein apply kiya jaye tu market ko samjhny mein koi mushkil nahi hoti, aur traders easily ess pattern ko identify ker kay trade laga lety hein.

TECHNICAL ANALYSIS:

Friends professional traders jab yeh prediction ker lety hain, ky market buy ki side ja rahe hay, ya market sell ki traf ja rhe hay, tou aesy time mein unn ky leye market entry bhout easy ho jati hy. Ess leye hamein chahye keh aagar ham isko correctly understand ker gy tou ess sey ham apni trade ko secure kar saken gy. Ess tarah kay indicators mein market trend reverse show ho sakta hy, aur forward bi show ho sakta hy. Jab bi market me up trend start hota hy aur eik line close ho jati hy tou second line eik gap ke sath open hoti hy . Yeh gap kuch ess tarah se form hota hy ky jaisy bearish candle aur bullish candle eik dosry ke sath eik point py aa ker join ho jaty hain . Jaisy hee yeh eik point py a kar join hoty hain tou exactly ess time mein jo trend hamein milta hy uss mein selling traders bht ziada hoty hain, kyu kay ess time both candles same point py join hoti hein. Aur yeh bht essential hy keh market apni trend selling me lay kar ja raha hota hay. Traders kay leye market mein apna order place kerny ka ideal time hota hay.

تبصرہ

Расширенный режим Обычный режим