Introduction of Dark Cloud Cover Pattern

Dark Cloud Cover Pattern ek bearish reversal pattern hai jo candlestick chart analysis mein istemal hota hai. Ye pattern usually uptrend ke doran nazar ata hai aur indicate karta hai ke market ka trend change hone wala hai.

Dark Cloud Cover Pattern Kya Hai:

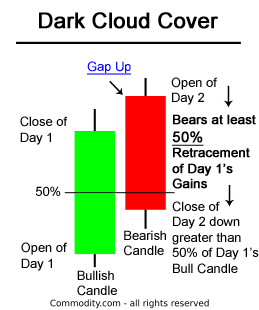

Dark Cloud Cover Pattern ek do-candlestick pattern hai. Pehla candle bullish hota hai aur doosra candle ise follow karta hai jo bearish hota hai. Doosre candle ka open price pehle candle ke upper range ke andar hota hai, lekin doosre candle ki closing price pehle candle ke half ya usse zyada neeche hoti hai.

Dark Cloud Cover Pattern Ki Tashkeel:

Dark Cloud Cover Pattern ki tashkeel mein pehla candle bullish hota hai, jo usually strong uptrend ke doran nazar ata hai. Doosra candle, jo bearish hota hai, pehle candle ke upper range mein shuru hota hai lekin phir neeche close hota hai, indicating a potential reversal.

Dark Cloud Cover Pattern Ka Tafsili Bayan:

Dark Cloud Cover Pattern ka tafsili bayan yeh hai ke pehle din buyers control mein hotay hain aur market upar ja rahi hoti hai. Lekin doosre din sellers control mein aate hain aur market ko neeche le jate hain, jo ke bearish reversal ka signal hai.

Dark Cloud Cover Pattern Ka Istemal:

Dark Cloud Cover Pattern ka istemal market trends ko predict karne ke liye kiya jata hai. Agar yeh pattern strong uptrend ke doran dikhai de, toh yeh indicate karta hai ke market ka trend bearish hone wala hai aur traders ko selling positions mein sochna chahiye.

Dark Cloud Cover Pattern Ka Istemal Kaam Karna:

Dark Cloud Cover Pattern ka istemal karna, dusre technical indicators aur price action ke saath mila kar kiya jata hai. Is pattern ko confirm karne ke liye, traders dusre bearish signals aur support levels ka bhi dhyan rakhte hain.

Dark Cloud Cover Pattern, agar sahi tarah se samjha jaye aur sahi context mein istemal kiya jaye, toh traders ko market ke potential reversals ka advance indication deta hai. Lekin, yeh ek matra indicator nahi hai aur dusre confirmatory signals ke saath istemal karna zaroori hai.

Dark Cloud Cover Pattern ek bearish reversal pattern hai jo candlestick chart analysis mein istemal hota hai. Ye pattern usually uptrend ke doran nazar ata hai aur indicate karta hai ke market ka trend change hone wala hai.

Dark Cloud Cover Pattern Kya Hai:

Dark Cloud Cover Pattern ek do-candlestick pattern hai. Pehla candle bullish hota hai aur doosra candle ise follow karta hai jo bearish hota hai. Doosre candle ka open price pehle candle ke upper range ke andar hota hai, lekin doosre candle ki closing price pehle candle ke half ya usse zyada neeche hoti hai.

Dark Cloud Cover Pattern Ki Tashkeel:

Dark Cloud Cover Pattern ki tashkeel mein pehla candle bullish hota hai, jo usually strong uptrend ke doran nazar ata hai. Doosra candle, jo bearish hota hai, pehle candle ke upper range mein shuru hota hai lekin phir neeche close hota hai, indicating a potential reversal.

Dark Cloud Cover Pattern Ka Tafsili Bayan:

Dark Cloud Cover Pattern ka tafsili bayan yeh hai ke pehle din buyers control mein hotay hain aur market upar ja rahi hoti hai. Lekin doosre din sellers control mein aate hain aur market ko neeche le jate hain, jo ke bearish reversal ka signal hai.

Dark Cloud Cover Pattern Ka Istemal:

Dark Cloud Cover Pattern ka istemal market trends ko predict karne ke liye kiya jata hai. Agar yeh pattern strong uptrend ke doran dikhai de, toh yeh indicate karta hai ke market ka trend bearish hone wala hai aur traders ko selling positions mein sochna chahiye.

Dark Cloud Cover Pattern Ka Istemal Kaam Karna:

Dark Cloud Cover Pattern ka istemal karna, dusre technical indicators aur price action ke saath mila kar kiya jata hai. Is pattern ko confirm karne ke liye, traders dusre bearish signals aur support levels ka bhi dhyan rakhte hain.

Dark Cloud Cover Pattern, agar sahi tarah se samjha jaye aur sahi context mein istemal kiya jaye, toh traders ko market ke potential reversals ka advance indication deta hai. Lekin, yeh ek matra indicator nahi hai aur dusre confirmatory signals ke saath istemal karna zaroori hai.

تبصرہ

Расширенный режим Обычный режим