Forex trading, jo kay Foreign Exchange trading ka short form hai, ek tarah ka trading hai jahan par currencies ko khareedna aur bechna hota hai. Yeh market global hoti hai aur duniya bhar ke banks, financial institutions, corporations, governments, aur individual traders ismein participate karte hain. Yeh trading market 24 ghanton ke liye khuli hoti hai, isliye traders duniya bhar ke wakt ke mutabiq trading kar sakte hain.

Forex Market Kya Hai?

Forex market mein currencies trade ki jati hain. Yeh market global hai aur duniya bhar ke financial centers mein operate hoti hai, jaise New York, London, Tokyo, aur Sydney.

Forex Trading Kaise Kaam Karta Hai?

Forex trading mein traders currencies ko ek dusre ke saath exchange karte hain. Jese ke agar koi trader sochta hai ke euro ka rate barh jayega, toh wo euro ko khareedega aur jab rate barh jaye ga toh usko bech dega.

Currency Pairs:

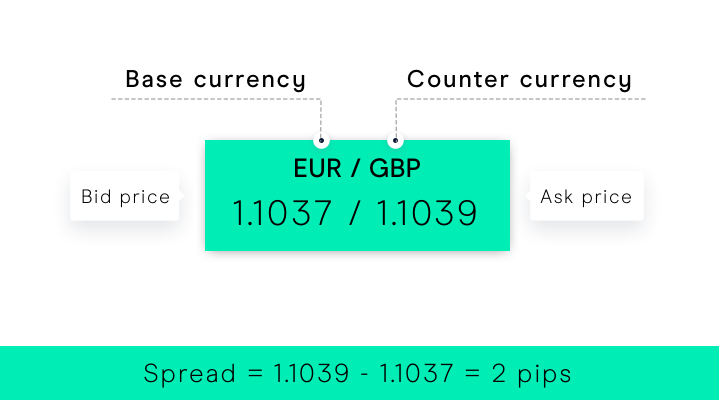

Forex trading mein currencies pairs ke form mein trade hoti hain. Jese ke EUR/USD, USD/JPY, GBP/USD, etc. Har pair mein pehla currency "base currency" hoti hai aur doosri currency "quote currency" hoti hai.

Trading Platforms:

Forex trading ke liye online trading platforms ka istemal hota hai, jinmein se kuch popular platforms hain MetaTrader 4 aur MetaTrader 5.

Leverage:

Leverage ka istemal kar ke traders apne investments ko barha sakte hain. Leverage trading mein traders apne invested amount se zyada amount trade karte hain, lekin yeh zyada risk bhi laata hai.

Risk Management:

Forex trading mein risk management ka bohot ahem kirdar hota hai. Traders ko apni investments ko monitor karna chahiye aur stop-loss orders ka istemal karna chahiye taki nuksan se bacha ja sake.

Market Analysis:

Forex trading mein market analysis ka bohot ahem maqam hai. Technical analysis aur fundamental analysis ke zariye traders market trends aur future price movements ka andaza lagate hain.

Trading Strategies:

Forex trading mein mukhtalif strategies ka istemal hota hai, jaise ke scalping, day trading, swing trading, aur position trading.

Regulation:

Forex trading kayi jurisdictions mein regulate ki jati hai. Traders ko apni country ke financial regulatory authorities ke rules aur regulations ka paalan karna chahiye.

Education and Practice:

Forex trading mein safalta hasil karne ke liye education aur practice ka bohot zaroori hai. Traders ko market ke baare mein acchi tarah se samajhna chahiye aur demo accounts ka istemal kar ke practice karna chahiye. Forex trading ek mahirana duniya hai jismein samajhdaari aur mehnat ki zaroorat hoti hai. Nuksan se bachne ke liye, traders ko hamesha apni investment ko samjhein aur risk management ka istemal karein.

تبصرہ

Расширенный режим Обычный режим