Complete Detail.

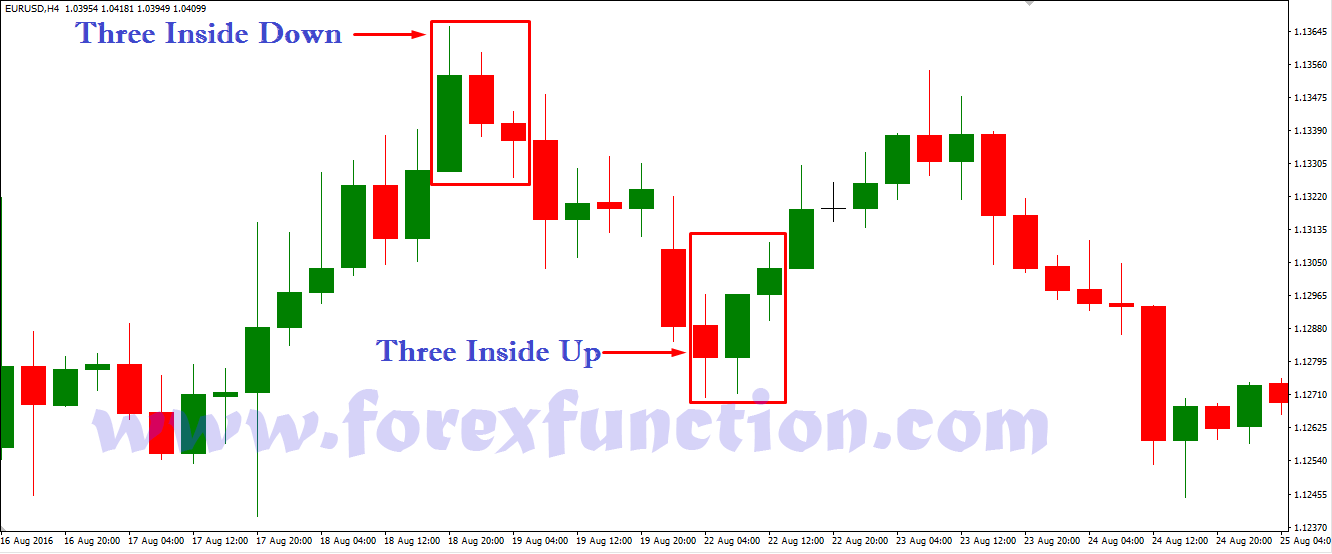

Forex trading mein Three Inside Up Candlestick Pattern ka matlab hota hai ke market mein bullish trend ki shuruat ho gayi hai aur traders ko buy ki taraf move karna chahiye. Is pattern ko samajhne ke liye, hum isko teen alag-alag headings ke tahat samajhenge:

Candlestick pattern ek technical analysis tool hai jo traders use karte hain market ki movement ke liye. Candlestick chart mein, har candlestick ek din ki trading activity ko represent karta hai. Har candlestick ko ek body aur do wicks (ya shadows) se define kiya jata hai. Body mein, open aur close price dikhaya jata hai aur wicks mein, high aur low price.

Three Inside Up Candlestick Pattern Methods.

Three Inside Up Candlestick Pattern mein, three consecutive bearish candlesticks followed by a bullish candlestick hote hain. Is pattern mein, bullish candlestick jo bearish candlesticks ke baad aata hai, unki range ke andar hi rehta hai.

Is ka matlab hai ke market mein selling pressure kam ho gayi hai aur buyers ki taraf se demand increase ho rahi hai. Ye pattern bullish reversal ka ek strong indication hota hai.

Three Inside Up Candlestick Pattern Trading Strategy.

Three Inside Up Candlestick Pattern ko samajhne ke baad, traders iska use karke trading strategy banate hain. Agar ye pattern confirm ho jata hai, to traders ko buy ki taraf move karna chahiye. Stop loss order ko low of the last bearish candlestick se set kiya jata hai. Take profit order ko, ek resistance level ke paas set kiya jata hai. Ye pattern ko confirm karne ke liye, traders ko dusre technical indicators ki bhi madad leni chahiye.

More Important.

Three Inside Up Candlestick Pattern ek bullish reversal pattern hai jiska use traders bullish trend ke shuruat ke liye karte hain.

Is pattern ko confirm karne ke liye, traders ko dusre technical indicators ki bhi madad leni chahiye. Is pattern ko samajhne ke liye, traders ko candlestick chart ke basic concepts ko samajhna zaruri hai.

Forex trading mein Three Inside Up Candlestick Pattern ka matlab hota hai ke market mein bullish trend ki shuruat ho gayi hai aur traders ko buy ki taraf move karna chahiye. Is pattern ko samajhne ke liye, hum isko teen alag-alag headings ke tahat samajhenge:

Candlestick pattern ek technical analysis tool hai jo traders use karte hain market ki movement ke liye. Candlestick chart mein, har candlestick ek din ki trading activity ko represent karta hai. Har candlestick ko ek body aur do wicks (ya shadows) se define kiya jata hai. Body mein, open aur close price dikhaya jata hai aur wicks mein, high aur low price.

Three Inside Up Candlestick Pattern Methods.

Three Inside Up Candlestick Pattern mein, three consecutive bearish candlesticks followed by a bullish candlestick hote hain. Is pattern mein, bullish candlestick jo bearish candlesticks ke baad aata hai, unki range ke andar hi rehta hai.

Is ka matlab hai ke market mein selling pressure kam ho gayi hai aur buyers ki taraf se demand increase ho rahi hai. Ye pattern bullish reversal ka ek strong indication hota hai.

Three Inside Up Candlestick Pattern Trading Strategy.

Three Inside Up Candlestick Pattern ko samajhne ke baad, traders iska use karke trading strategy banate hain. Agar ye pattern confirm ho jata hai, to traders ko buy ki taraf move karna chahiye. Stop loss order ko low of the last bearish candlestick se set kiya jata hai. Take profit order ko, ek resistance level ke paas set kiya jata hai. Ye pattern ko confirm karne ke liye, traders ko dusre technical indicators ki bhi madad leni chahiye.

More Important.

Three Inside Up Candlestick Pattern ek bullish reversal pattern hai jiska use traders bullish trend ke shuruat ke liye karte hain.

Is pattern ko confirm karne ke liye, traders ko dusre technical indicators ki bhi madad leni chahiye. Is pattern ko samajhne ke liye, traders ko candlestick chart ke basic concepts ko samajhna zaruri hai.

تبصرہ

Расширенный режим Обычный режим