Doji candlestick

Doji candlestick pattern ek technical analysis tool hai jo financial markets mein istemal hota hai, especially stock market aur forex trading mein. Ye pattern traders ko market ke future movements ke bare mein insights dene mein madad karta hai.

Doji candlestick ek particular trading period ko represent karta hai, jismein opening price aur closing price barabar hoti hain ya kafi kareeb hoti hain. Iski pehchan ek patli line se hoti hai jo price range ko indicate karta hai. Jab ye line hoti hai, traders ko samajh aata hai ke during that specific time frame, buyers aur sellers mein koi clear dominance nahi tha.

Doji candlestick ke kuch mukhtalif types hote hain, jese ke "neutral doji," "long-legged doji," aur "gravestone doji." Har type ki shape aur characteristics thodi alag hoti hain, lekin unka basic concept yahi hota hai ke market mein indecision ya balance ka ek indication hai.

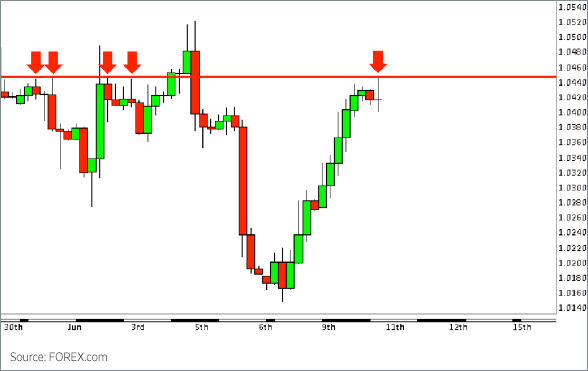

Jab market mein doji pattern appear hota hai, ye traders ke liye ek signal ban sakta hai ke ab market mein kisi specific direction ki possibility kam ho gayi hai. Agar doji ek uptrend ya downtrend ke baad aata hai, toh ye indicate kar sakta hai ke trend weak ho sakta hai aur possible trend reversal hone ke chances hote hain.

Ek important factor doji candlestick pattern ka volume hai. Agar doji ke sath high volume hota hai, toh ye indicate karta hai ke market mein strong indecision hai aur future movement unpredictable ho sakta hai. Low volume ke sath doji, on the other hand, market mein normal fluctuation ko darust karti hai.

Traders doji candlestick pattern ka istemal karke apne trading decisions ko refine karte hain. Agar doji ek support ya resistance level ke paas aata hai, toh ye ek aur confirmation factor ban sakta hai. Traders is pattern ko trend reversal ke signals ke liye bhi use karte hain.

Lekin, doji candlestick pattern ka istemal akela hi sufficient nahi hota. Isko dusre technical indicators ke sath combine karna important hai takay traders ko accurate insights mil sake. Market dynamics hamesha changing rehti hain, is liye doji candlestick pattern ko samajhna aur us par rely karna ek skillful approach ki zarurat hai.

Doji candlestick pattern ek technical analysis tool hai jo financial markets mein istemal hota hai, especially stock market aur forex trading mein. Ye pattern traders ko market ke future movements ke bare mein insights dene mein madad karta hai.

Doji candlestick ek particular trading period ko represent karta hai, jismein opening price aur closing price barabar hoti hain ya kafi kareeb hoti hain. Iski pehchan ek patli line se hoti hai jo price range ko indicate karta hai. Jab ye line hoti hai, traders ko samajh aata hai ke during that specific time frame, buyers aur sellers mein koi clear dominance nahi tha.

Doji candlestick ke kuch mukhtalif types hote hain, jese ke "neutral doji," "long-legged doji," aur "gravestone doji." Har type ki shape aur characteristics thodi alag hoti hain, lekin unka basic concept yahi hota hai ke market mein indecision ya balance ka ek indication hai.

Jab market mein doji pattern appear hota hai, ye traders ke liye ek signal ban sakta hai ke ab market mein kisi specific direction ki possibility kam ho gayi hai. Agar doji ek uptrend ya downtrend ke baad aata hai, toh ye indicate kar sakta hai ke trend weak ho sakta hai aur possible trend reversal hone ke chances hote hain.

Ek important factor doji candlestick pattern ka volume hai. Agar doji ke sath high volume hota hai, toh ye indicate karta hai ke market mein strong indecision hai aur future movement unpredictable ho sakta hai. Low volume ke sath doji, on the other hand, market mein normal fluctuation ko darust karti hai.

Traders doji candlestick pattern ka istemal karke apne trading decisions ko refine karte hain. Agar doji ek support ya resistance level ke paas aata hai, toh ye ek aur confirmation factor ban sakta hai. Traders is pattern ko trend reversal ke signals ke liye bhi use karte hain.

Lekin, doji candlestick pattern ka istemal akela hi sufficient nahi hota. Isko dusre technical indicators ke sath combine karna important hai takay traders ko accurate insights mil sake. Market dynamics hamesha changing rehti hain, is liye doji candlestick pattern ko samajhna aur us par rely karna ek skillful approach ki zarurat hai.

تبصرہ

Расширенный режим Обычный режим