What is Double Top Pattern:

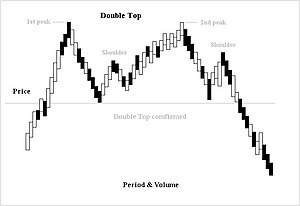

Double Top patteren aik takneeki tshkhisi chart ka namona hai jo kisi asasa ki sharah ke rujhan mein salahiyat ke ulat jane ka ishara karta hai. yeh is waqt waza kya jata hai jab kisi asasa ki sharah oonchai tak pahonch jati hai, peechay ki taraf khainchti hai, isi terhan ki chouti par wapas barhti hai, aur phir is mein kami aati hai, jis se do chotyon par muzahmat ki satah peda hoti hai. is namoonay ko aksar mandi ke tor par liya jata hai kyunkay is se zahir hota hai ke asasa muzahmat ki satah se oopar jane ke liye bhi jung kar sakta hai, jo mumkina tor par sharah mein neechay ki taraf rujhan ka baais ban sakta hai. tajir aur khredar dohray chouti ke namoonay ka istemaal market ke andar pozishnon mein daakhil honay ya bahar niklny ke baray mein qabil intikhab karne ke liye karte hain jo is ki paish kardah salahiyat ke ulat nishaan ki bunyaad par hota hai.

Formation of Double Top Pattern:

Double Top namoonay ki tashkeel aam tor par is waqt shuru hoti hai jab koi asasa up trained mein hota hai aur kaghazi karwai urooj par hoti hai, jo muzahmat ki aik mazboot satah ki numaindagi karti hai jis mein farokht ka dabao barh jaye ga. ibtidayi chouti ke baad, fees aik falls bananay ke liye peechay hatt jati hai, jisay gardan kaha jata hai. jaisa ke fees dobarah really karne ki koshish karti hai, yeh pichlle chouti marhalay par muzahmat ka saamna karti hai, jis se doosri chouti peda hoti hai. tashkeel mukammal hoti hai jab ke haar gardan ke neechay toot jati hai, jo patteren ki tasdeeq karti hai.

0c60a0_4331337808394d8c8a7b9bc86aa1decb_mv2-optimized.webp

Significance of Double Top Pattern Confirmation:

Double Top namoonay ki tasdeeq is waqt hoti hai jab qeemat gardan ke neechay toot jati hai, jo mumkina rujhan ke taizi se mandi ki taraf bherne ki nishandahi karti hai. yeh tasdeeq sarmaya karon ke liye zaroori hai ke woh mukhtasir pozishnon mein anay ya mojooda taweel pozishnon ko band karne ke baray mein bakhabar faislay karen. gardan ke neechay jitna ziyada nuqsaan hota hai, is ke ulat jane ka ishara itna hi mazboot hota hai, jis ki wajah se mukhtasir farogh dainay ya mandi ki hikmat amlyon ko nafiz karne se aamdani ke mumkina mawaqay peda hotay hain.

Trading Strategies Based on Double Top Pattern:

Tajir aksar forex market mein fori position mein jane ke liye isharay ke tor par Double Top namoonay ka istemaal karte hain. kharidari aur farokht ki aik aam hikmat e amli yeh hai ke gardan ke neechay qeemat mein khlal parney ka andaza lagaya jaye jis ke baad dosray Top ke oopar stop las ke sath aik promo order diya jaye. mazeed bar-aan, sarmaya car mandi ke taasub ki tasdeeq ke liye had ki tashkhees ya momentum oscillators samait deegar takneeki isharay bhi talaash kar satke hain. nuqsaan ko roknay ke munasib order day kar aur nazam o zabt walay tijarti mansoobay par amal karte hue khatray ko kamyabi ke sath jorna bohat zaroori hai.

Limitations and Considerations of Double Top Pattern:

Agarchay Double Top ka namona aik qabil aetmaad bearish reversal signal hai, lekin yeh hamesha jhutay break out ya jaali out ke khilaaf muzahim nahi hota hai. taajiron ko intibah ki mashq karni chahiye aur namoonay ki toseeq ke liye mukhtalif takneeki tshkhisi alaat ke sath milna chahiye. mazeed bar-aan, namoonay ki taseer bazaar ke halaat ke lehaaz se bhi mukhtalif ho sakti hai, jaisay ke kam utaar charhao ya na hamwar fees ki naqal o harkat. market ke majmoi sayaq o Sabaq ko yaad rakhna zaroori hai aur ab kharidari aur farokht ke intikhab ke liye Double Top namoonay par mukammal tor par inhisaar nahi karna chahiye. is tarz ki bunyaad par khareed o farokht ke douran khatray ka munasib intizam aur sharah ki naqal o harkat par musalsal nazar rakhna zaroori hai.

Double Top patteren aik takneeki tshkhisi chart ka namona hai jo kisi asasa ki sharah ke rujhan mein salahiyat ke ulat jane ka ishara karta hai. yeh is waqt waza kya jata hai jab kisi asasa ki sharah oonchai tak pahonch jati hai, peechay ki taraf khainchti hai, isi terhan ki chouti par wapas barhti hai, aur phir is mein kami aati hai, jis se do chotyon par muzahmat ki satah peda hoti hai. is namoonay ko aksar mandi ke tor par liya jata hai kyunkay is se zahir hota hai ke asasa muzahmat ki satah se oopar jane ke liye bhi jung kar sakta hai, jo mumkina tor par sharah mein neechay ki taraf rujhan ka baais ban sakta hai. tajir aur khredar dohray chouti ke namoonay ka istemaal market ke andar pozishnon mein daakhil honay ya bahar niklny ke baray mein qabil intikhab karne ke liye karte hain jo is ki paish kardah salahiyat ke ulat nishaan ki bunyaad par hota hai.

Formation of Double Top Pattern:

Double Top namoonay ki tashkeel aam tor par is waqt shuru hoti hai jab koi asasa up trained mein hota hai aur kaghazi karwai urooj par hoti hai, jo muzahmat ki aik mazboot satah ki numaindagi karti hai jis mein farokht ka dabao barh jaye ga. ibtidayi chouti ke baad, fees aik falls bananay ke liye peechay hatt jati hai, jisay gardan kaha jata hai. jaisa ke fees dobarah really karne ki koshish karti hai, yeh pichlle chouti marhalay par muzahmat ka saamna karti hai, jis se doosri chouti peda hoti hai. tashkeel mukammal hoti hai jab ke haar gardan ke neechay toot jati hai, jo patteren ki tasdeeq karti hai.

0c60a0_4331337808394d8c8a7b9bc86aa1decb_mv2-optimized.webp

Significance of Double Top Pattern Confirmation:

Double Top namoonay ki tasdeeq is waqt hoti hai jab qeemat gardan ke neechay toot jati hai, jo mumkina rujhan ke taizi se mandi ki taraf bherne ki nishandahi karti hai. yeh tasdeeq sarmaya karon ke liye zaroori hai ke woh mukhtasir pozishnon mein anay ya mojooda taweel pozishnon ko band karne ke baray mein bakhabar faislay karen. gardan ke neechay jitna ziyada nuqsaan hota hai, is ke ulat jane ka ishara itna hi mazboot hota hai, jis ki wajah se mukhtasir farogh dainay ya mandi ki hikmat amlyon ko nafiz karne se aamdani ke mumkina mawaqay peda hotay hain.

Trading Strategies Based on Double Top Pattern:

Tajir aksar forex market mein fori position mein jane ke liye isharay ke tor par Double Top namoonay ka istemaal karte hain. kharidari aur farokht ki aik aam hikmat e amli yeh hai ke gardan ke neechay qeemat mein khlal parney ka andaza lagaya jaye jis ke baad dosray Top ke oopar stop las ke sath aik promo order diya jaye. mazeed bar-aan, sarmaya car mandi ke taasub ki tasdeeq ke liye had ki tashkhees ya momentum oscillators samait deegar takneeki isharay bhi talaash kar satke hain. nuqsaan ko roknay ke munasib order day kar aur nazam o zabt walay tijarti mansoobay par amal karte hue khatray ko kamyabi ke sath jorna bohat zaroori hai.

Limitations and Considerations of Double Top Pattern:

Agarchay Double Top ka namona aik qabil aetmaad bearish reversal signal hai, lekin yeh hamesha jhutay break out ya jaali out ke khilaaf muzahim nahi hota hai. taajiron ko intibah ki mashq karni chahiye aur namoonay ki toseeq ke liye mukhtalif takneeki tshkhisi alaat ke sath milna chahiye. mazeed bar-aan, namoonay ki taseer bazaar ke halaat ke lehaaz se bhi mukhtalif ho sakti hai, jaisay ke kam utaar charhao ya na hamwar fees ki naqal o harkat. market ke majmoi sayaq o Sabaq ko yaad rakhna zaroori hai aur ab kharidari aur farokht ke intikhab ke liye Double Top namoonay par mukammal tor par inhisaar nahi karna chahiye. is tarz ki bunyaad par khareed o farokht ke douran khatray ka munasib intizam aur sharah ki naqal o harkat par musalsal nazar rakhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим