Mat Hold Candlestick Pattern

Mat Hold Pattern

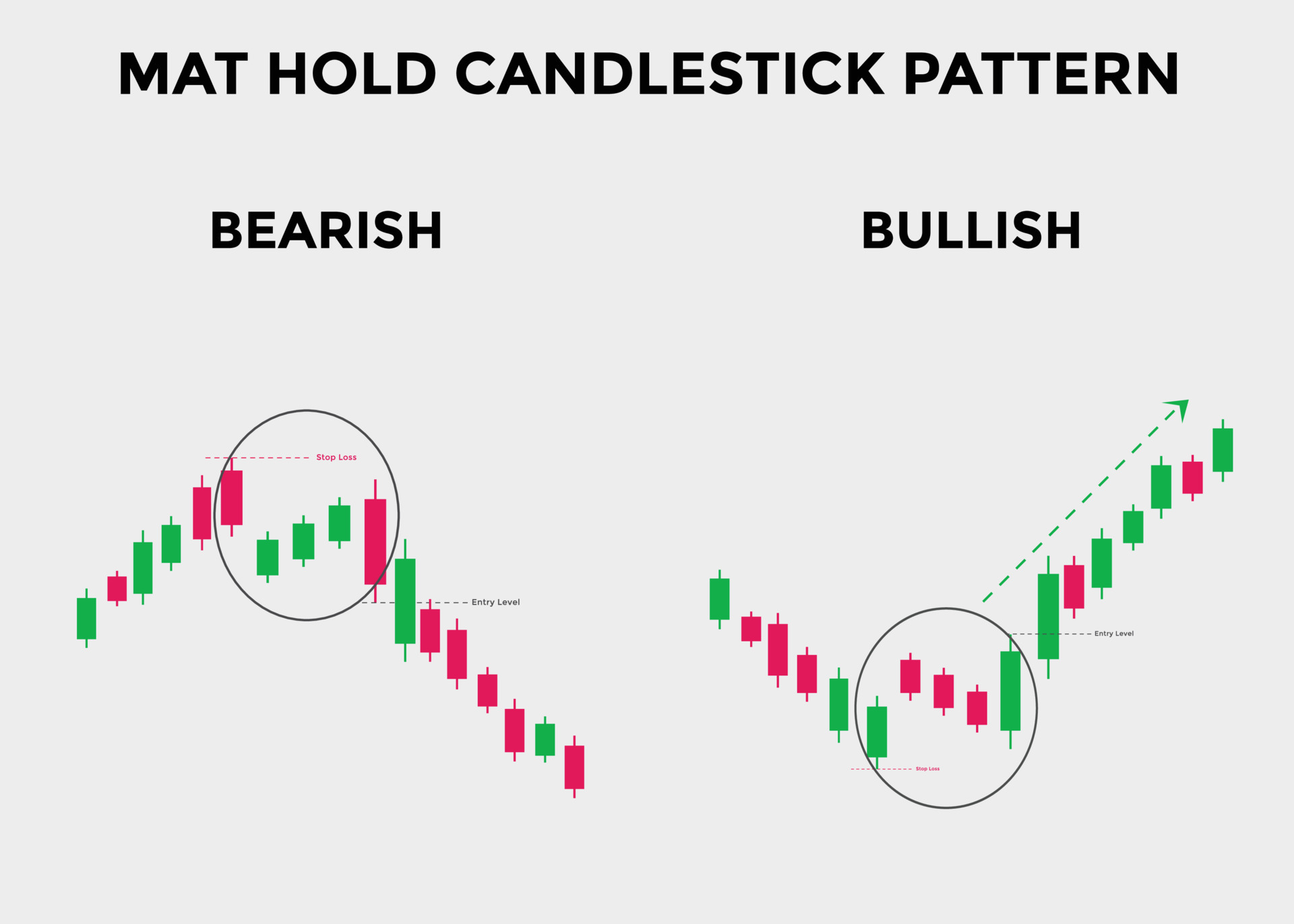

Assalam o Alaikum Dear Friends and fellows Mat Hold Pattern, forex trading me aik ahem chart pattern hy jo traders ko market trends aur potential reversals ki taraf ishara karta hy. Yeh pattern market analysis me istemal hota hy aur traders ko future price movements ke bare me malumat farahem karta hy.Mat Hold Pattern, aik bullish continuation pattern hy jo trading charts par bannywala hota hy. Yeh pattern market me taraqqi ya bullish trend ke doran ata hy jab ke aik maqbul trend ke bad hota hy. Is pattern ki pehchan ko samajhny ke liye traders ko chart analysis aur price action ka istemal karna parta hy.Mat Hold Pattern ka nam is wajah se hy kyunki iske chart par dikhy deny wali chand ki jhalak, yani candlesticks, aik mat (rectangle) ke andar ghira hua hota hy. Is pattern me pehle aik strong bullish trend hota hy, phir aik small bearish candle ata hy jise "mat" kehte hein, aur phir market phir se bullish trend me chala jata hy.

Bullish Mat Hold Candlestick Pattern

Dear Friends Bullish mat hold candle kasey banti hy.as k banay me kin kin batoo ka khyal krna hota hy. to friend as me jo 1st candle bany wo lambi bullish honi chahiye ya phr tezi ki red green candle honi chahiye. as k bad bannay wali 2nd candle gap up price se open ho ya jahn pr 1st cnalde ki price end hoti hy to 2nd candle osi jaga se open ho jaye. jbkah 3rd candle gap up or gap down ho skti hy.but 3rd candle ki price 2nd candle ki lower low pr close ho . aor asi 4th candle bi gap down se start ho aor ya canlde bi 3rd candle k low se lower price pr close ho.as me 2nd ,3rd aor 4th canlde samall bearish honi chahiye. as k bad 5th candle achi tazi ki canlde ho ya phr labi bullish ki candle hone chahiyee.aor 5th candle 2nd canlde k close price se oper close honi chye. aor 5th candle 1st cnalde ka low bi na tory aor 5 candle ka high sab se high price ho

Bearish Mat Hold Candlestick Pattern

Dear Friends and Fellows Bearish mat hold pattern aik bearish reversal candlestick pattern hota hy jo keh forex market me 5 kesam ke candlestick par moshtamel hota hy es chart patter ka nam Japani lafaz mat hold kay nam say he rakha ja sakta hy yeh chart pattern os timme banta hy jab forex market me trend hote hy jes kay bad teen kesam ke chote bullish candlestick ban sakte hein or forex market ke tamam kesam ke candlestick nechay close ho jate hein yeh candlestick pattern forex market kay trend kay mumka reversal janay ke taraf strong eshara fraham karta hy yeh es bat ke taraf eshara karta hy bulls pehlay say he apna chargee sanbhal rahay hotay hein seller ko teen bullih candlestick bata sakte hein keh forex market me bulls dobara apna control sanbhal rahay hein or woh nakam ho jatay hein jaisa keh end me bearish candlestick es bat ko identify kar sakti hy keh selle forex market me faisla karnay wallay hotay hein

تبصرہ

Расширенный режим Обычный режим