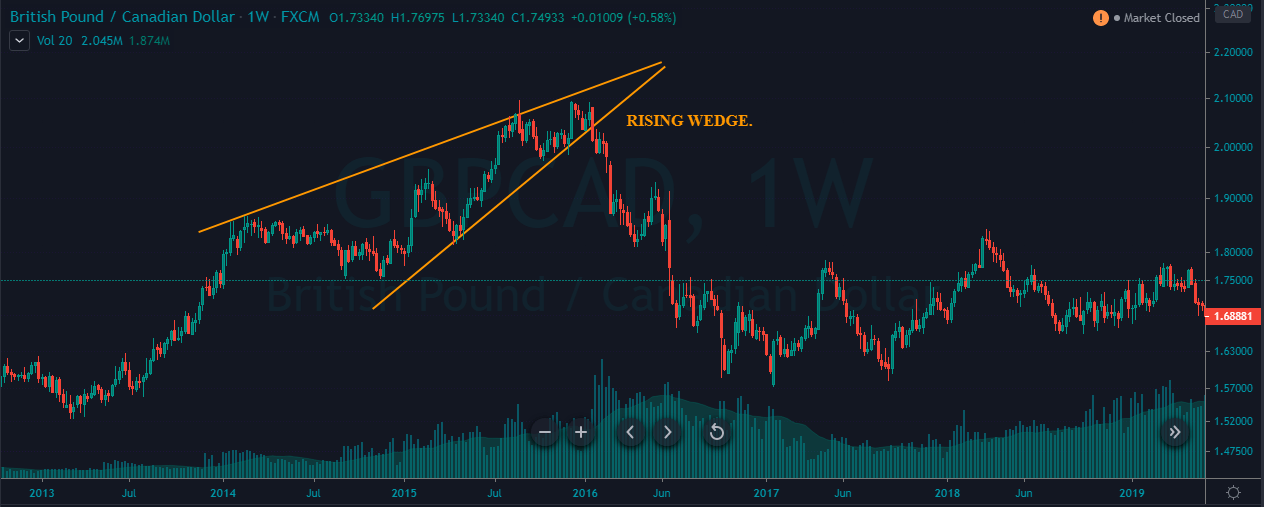

What is Rising Wedge Pattern:

Rising Wedge patteren aik takneeki tshkhisi Pattern hai jo is waqt banaya gaya hai jab madad aur muzahmat dono oopar ki taraf dhalwan ka suraagh lagatay hain. Pattern ki khasusiyat onche oonchaiyon aur behtar oonchaiyon ki madad se hoti hai jo bil akhir Wedge numa dhanchay ki tashkeel ke liye yakja hotay hain. is Pattern ko down trained mein mandi ka ulta Pattern ya up trained mein mumkina tasalsul ka Pattern samjha jata hai. yeh istehkaam ki muddat ki nishandahi karta hai jis mein market behtar onche aur onche kmyan bana rahi hai, taham Pattern ke pukhta honay ki wajah se fees ki hudood ko kam karne ke sath. Rising Wedge ke patteren ki tashkeel mein kisi marhalay par miqdaar par tawajah dena zaroori hai, kyunkay hajam mein kami ka matlab raftaar ko kamzor karna hai, jis se kharabi ka imkaan barh jata hai.

Characteristics of Rising Wedge Pattern:

Rising Wedge ke Pattern ki aik ahem khasusiyat Rising madad aur muzahmat ke nishanaat ke darmiyan charge ke irtiaash ka rujhan hai. yeh nishanaat kam az kam soyng lovs aur do soyng highs ko jor kar kheinchain jatay hain, jis se aik charhata sun-hwa channel tayyar hota hai. jaisay jaisay Pattern agay barhta hai, yeh rujhan ke tanao har aik mukhtalif ki taraf yakja hotay hain, jis se aik tang Wedge ki shakal banti hai. tajir patteren ki takmeel aur mumkina mandi ke ulat palat ki tasdeeq ke liye Rising help line ke neechay break out ko baqaidagi se dekhte hain. yeh baat bhi qabil ghhor hai ke Rising Wedge ki shakal aksar jaali break out dekh sakti hai, jahan charge neechay ki taraf palatnay se pehlay muzahmat ki lakeer ke oopar mukhtasir tor par kaam karta hai.

Trading with Rising Wedge Pattern:

Rising Wedge patteren kharedtay aur farokht karte waqt, sarmaya car aam tor par farokht ke imkanaat talaash karte hain kyunkay charge Rising guide line se neechay toot jata hai. yeh kharabi mandi ke ulat patteren ki tasdeeq ke tor par nazar aati hai, singling ki salahiyat fees ko pehlay se kam kar deti hai. aik aam hikmat e amli yeh hai ke aik baar break out honay ke baad guide line ke neechay aik mukhtasir promo order diya jaye, jis mein stop las taaza tareen soyng high se oopar ho. tajir –apne tijarti intikhab ko taqwiyat dainay ke liye izafi tasdeeq ke isharay bhi talaash kar satke hain, jin mein mandi ki mom batii ke andaaz ya raftaar ke isharay mein farq shaamil hain. kisi bhi Pattern ko kharedtay aur farokht karte waqt khatray ko muaser tareeqay se sanbhaalna aur munasib rule size ka istemaal karna zaroori hai.

Potential Price Targets and Stop Losses in Rising Wedge Pattern:

Rising Wedge ke Pattern ki bunyaad par tabdeeli ke liye salahiyat ki qeemat ke maqasid ka faisla karne ke liye, tajir baqaidagi se Wedge ki chouti ko is ke wasee tareen maqam par degree dete hain aur woh kaam jo break out point se neechay ki taraf hota hai. yeh mutawaqqa hadaf aamdani ke maqasid ko rakhnay ya munafe ko roknay ke liye nuqsaan se bachao ki satah ko adjust karne ke liye aik dasti ke tor par kaam karna chahta hai. mazeed bar-aan, tajir Fibonacci Retracement degree ya is se pehlay ke support / rizstns zone ko shaamil karna bhi nahi bhool satke hain kyunkay Pattern ke mandi ke taasub ke sath saf bandi karne ke liye salahiyat ki qeemat ke ahdaaf hain. jahan tak nuqsaan se bachney ki jagah ka talluq hai, khredar aam tor par –apne stop ko taaza tareen soyng high se oopar ya break out Ansar se oopar rakhtay hain taakay salahiyat ke nuqsaan ko mehdood kya ja sakay agar tabdeeli un ke khilaaf harkat karti hai.

rising-wedge-bearish-reversal.webp

Common Pitfalls and Considerations in Rising Wedge Pattern:

Agarchay Rising Wedge ka Pattern qeemti tijarti isharay paish kar sakta hai, lekin is ki rukawaton aur salahiyat ke nuqsanaat se bakhabar rehna zaroori hai. kharidaron ki aik ghair mamooli ghalti yeh hai ke woh break out ki tasdeeq se bohat pehlay mutabadil daakhil karen, jis ki wajah qabal az waqt position aur barhatay hue khatraat hain. fori tabadlay par ghhor karne se pehlay bardasht ka istemaal karna aur Rising support line ke neechay faisla kin qareeb ki taraf dekhna zaroori hai. mazeed bar-aan, forex market mein jaali break out aur korray maarny ki harkatein peda ho sakti hain, jo khatray par qaboo panay aur tabdeeli par sahih amal daraamad ki ahmiyat par zor deti hain. taajiron ko market ke wasee tar sayaq o Sabaq par bhi ghhor karna chahiye, jis mein ahem maliyati waqeat aur market ke jazbaat shaamil hain, jabkay apni bunyadi takmeel ki sharah ko badhaane ke liye barhatay hue Wedge Pattern ki tijarat karte hain.

Rising Wedge patteren aik takneeki tshkhisi Pattern hai jo is waqt banaya gaya hai jab madad aur muzahmat dono oopar ki taraf dhalwan ka suraagh lagatay hain. Pattern ki khasusiyat onche oonchaiyon aur behtar oonchaiyon ki madad se hoti hai jo bil akhir Wedge numa dhanchay ki tashkeel ke liye yakja hotay hain. is Pattern ko down trained mein mandi ka ulta Pattern ya up trained mein mumkina tasalsul ka Pattern samjha jata hai. yeh istehkaam ki muddat ki nishandahi karta hai jis mein market behtar onche aur onche kmyan bana rahi hai, taham Pattern ke pukhta honay ki wajah se fees ki hudood ko kam karne ke sath. Rising Wedge ke patteren ki tashkeel mein kisi marhalay par miqdaar par tawajah dena zaroori hai, kyunkay hajam mein kami ka matlab raftaar ko kamzor karna hai, jis se kharabi ka imkaan barh jata hai.

Characteristics of Rising Wedge Pattern:

Rising Wedge ke Pattern ki aik ahem khasusiyat Rising madad aur muzahmat ke nishanaat ke darmiyan charge ke irtiaash ka rujhan hai. yeh nishanaat kam az kam soyng lovs aur do soyng highs ko jor kar kheinchain jatay hain, jis se aik charhata sun-hwa channel tayyar hota hai. jaisay jaisay Pattern agay barhta hai, yeh rujhan ke tanao har aik mukhtalif ki taraf yakja hotay hain, jis se aik tang Wedge ki shakal banti hai. tajir patteren ki takmeel aur mumkina mandi ke ulat palat ki tasdeeq ke liye Rising help line ke neechay break out ko baqaidagi se dekhte hain. yeh baat bhi qabil ghhor hai ke Rising Wedge ki shakal aksar jaali break out dekh sakti hai, jahan charge neechay ki taraf palatnay se pehlay muzahmat ki lakeer ke oopar mukhtasir tor par kaam karta hai.

Trading with Rising Wedge Pattern:

Rising Wedge patteren kharedtay aur farokht karte waqt, sarmaya car aam tor par farokht ke imkanaat talaash karte hain kyunkay charge Rising guide line se neechay toot jata hai. yeh kharabi mandi ke ulat patteren ki tasdeeq ke tor par nazar aati hai, singling ki salahiyat fees ko pehlay se kam kar deti hai. aik aam hikmat e amli yeh hai ke aik baar break out honay ke baad guide line ke neechay aik mukhtasir promo order diya jaye, jis mein stop las taaza tareen soyng high se oopar ho. tajir –apne tijarti intikhab ko taqwiyat dainay ke liye izafi tasdeeq ke isharay bhi talaash kar satke hain, jin mein mandi ki mom batii ke andaaz ya raftaar ke isharay mein farq shaamil hain. kisi bhi Pattern ko kharedtay aur farokht karte waqt khatray ko muaser tareeqay se sanbhaalna aur munasib rule size ka istemaal karna zaroori hai.

Potential Price Targets and Stop Losses in Rising Wedge Pattern:

Rising Wedge ke Pattern ki bunyaad par tabdeeli ke liye salahiyat ki qeemat ke maqasid ka faisla karne ke liye, tajir baqaidagi se Wedge ki chouti ko is ke wasee tareen maqam par degree dete hain aur woh kaam jo break out point se neechay ki taraf hota hai. yeh mutawaqqa hadaf aamdani ke maqasid ko rakhnay ya munafe ko roknay ke liye nuqsaan se bachao ki satah ko adjust karne ke liye aik dasti ke tor par kaam karna chahta hai. mazeed bar-aan, tajir Fibonacci Retracement degree ya is se pehlay ke support / rizstns zone ko shaamil karna bhi nahi bhool satke hain kyunkay Pattern ke mandi ke taasub ke sath saf bandi karne ke liye salahiyat ki qeemat ke ahdaaf hain. jahan tak nuqsaan se bachney ki jagah ka talluq hai, khredar aam tor par –apne stop ko taaza tareen soyng high se oopar ya break out Ansar se oopar rakhtay hain taakay salahiyat ke nuqsaan ko mehdood kya ja sakay agar tabdeeli un ke khilaaf harkat karti hai.

rising-wedge-bearish-reversal.webp

Common Pitfalls and Considerations in Rising Wedge Pattern:

Agarchay Rising Wedge ka Pattern qeemti tijarti isharay paish kar sakta hai, lekin is ki rukawaton aur salahiyat ke nuqsanaat se bakhabar rehna zaroori hai. kharidaron ki aik ghair mamooli ghalti yeh hai ke woh break out ki tasdeeq se bohat pehlay mutabadil daakhil karen, jis ki wajah qabal az waqt position aur barhatay hue khatraat hain. fori tabadlay par ghhor karne se pehlay bardasht ka istemaal karna aur Rising support line ke neechay faisla kin qareeb ki taraf dekhna zaroori hai. mazeed bar-aan, forex market mein jaali break out aur korray maarny ki harkatein peda ho sakti hain, jo khatray par qaboo panay aur tabdeeli par sahih amal daraamad ki ahmiyat par zor deti hain. taajiron ko market ke wasee tar sayaq o Sabaq par bhi ghhor karna chahiye, jis mein ahem maliyati waqeat aur market ke jazbaat shaamil hain, jabkay apni bunyadi takmeel ki sharah ko badhaane ke liye barhatay hue Wedge Pattern ki tijarat karte hain.

تبصرہ

Расширенный режим Обычный режим