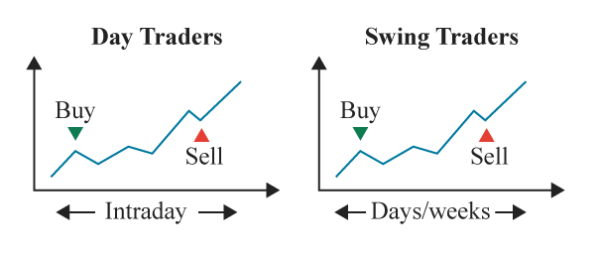

Introduction

forex market mein day trading swing trading ke he aik kesam hote hey kunkeh yeh forex market ke price kay otar charhao ko he identify karnay mein madad kar sakte hey yeh forex market mein day trading kay opposite he hote hey jes mein market ke security ke price ko he identifykeya ja sakta hey jes mein forex market ein aik he day men buy ya sell ke ja sakte hey forex market ke swing trading mei wekly he position ko shamel keya ja sakta hey trader ko forex market kay natural bahao ka he faida deya ja sakta hey or forex markett k big tabdele jo keh market kay natural bahao sayhe ho sakte hey

The benefit of swing trading with day trade

forex market mein day trader kay ley swing trading kay bohut he faiday hotay hein important yeh hey yeh forex trader kay ley bohut he important faiday dayta hey kunkeh en ko den bhar mein api osition ko jare rakhna hota hey or overall trading performance ko behtarbana sakte hey swng trading bohut he faiday ka hamel hota hey trader chote position mein enter honay kay ley faiday mein dakhal hota hey invstor ko zyada say zyada profit hasell karnay min madad karte hey khas tor par chotay size kay trader kay ley

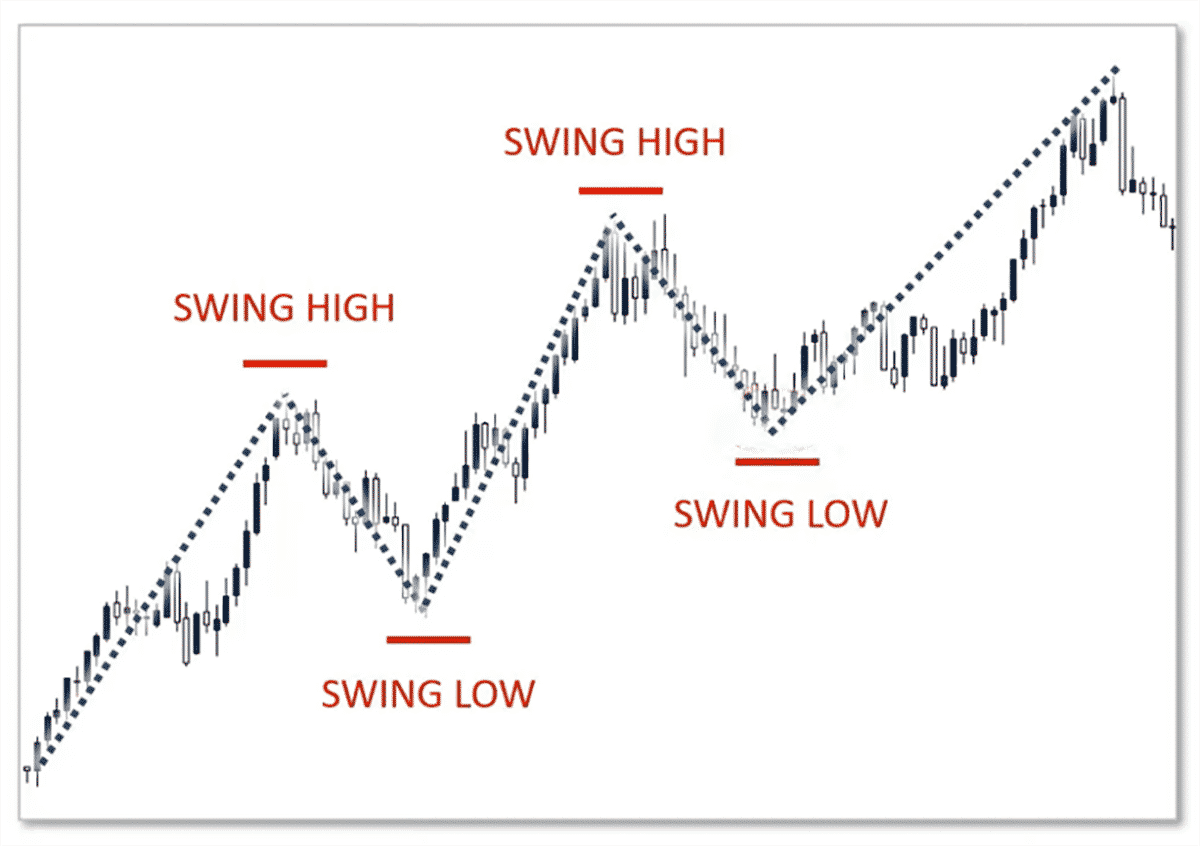

Identify swing trading with day trader

forex arket mei swing trading aik important kesam ke trading strategy hote hy jo keh aik technical kesam ke trading strategy hote hey es mein forex market kay chart or dosray important kesam kay technical analysis ka estamal keya ja sakta hey takeh forex market kay en pattern or trend ko identify keya ja sakay takeh dosree kesam kay technical trader ka pata lagya ja sakay es kesam kay chart pattern mein RSI bhe shamel hota hey

forex market mein stop loss or take profit level ka estamal

forex market ke kamyab trading strategy stop loss or take profit level ka he estamal karte hey or forex market mein stop loss aik pehlay say tay shodah trading strategy hote hey jes mein aik trader trading say out ho jata hey jabkeh price en kay opposite chale jate jabkeh profit ka target bhe fix hota hey forex trade apnay risk ko manage kar saktay hein or apni mumkana entry ko bhe identify kar saktay hein takeh profit ko zyada say zyada leya ja sakta hey

Risk management swing trading

forex market mein risk management ka bohut he important pehlo hota hey kunkeh fore trader bohut he long period say ohdon par he faiz rehtay hein or forex market ay wabesta bohut he trading say agah hotay hein stop loss or profit kay target say tayon kar saktay hein or forex market mein overall risk ko kam kar kay portfolio ko motayan banya ja sakta hey

forex market mein day trading swing trading ke he aik kesam hote hey kunkeh yeh forex market ke price kay otar charhao ko he identify karnay mein madad kar sakte hey yeh forex market mein day trading kay opposite he hote hey jes mein market ke security ke price ko he identifykeya ja sakta hey jes mein forex market ein aik he day men buy ya sell ke ja sakte hey forex market ke swing trading mei wekly he position ko shamel keya ja sakta hey trader ko forex market kay natural bahao ka he faida deya ja sakta hey or forex markett k big tabdele jo keh market kay natural bahao sayhe ho sakte hey

The benefit of swing trading with day trade

forex market mein day trader kay ley swing trading kay bohut he faiday hotay hein important yeh hey yeh forex trader kay ley bohut he important faiday dayta hey kunkeh en ko den bhar mein api osition ko jare rakhna hota hey or overall trading performance ko behtarbana sakte hey swng trading bohut he faiday ka hamel hota hey trader chote position mein enter honay kay ley faiday mein dakhal hota hey invstor ko zyada say zyada profit hasell karnay min madad karte hey khas tor par chotay size kay trader kay ley

Identify swing trading with day trader

forex arket mei swing trading aik important kesam ke trading strategy hote hy jo keh aik technical kesam ke trading strategy hote hey es mein forex market kay chart or dosray important kesam kay technical analysis ka estamal keya ja sakta hey takeh forex market kay en pattern or trend ko identify keya ja sakay takeh dosree kesam kay technical trader ka pata lagya ja sakay es kesam kay chart pattern mein RSI bhe shamel hota hey

forex market mein stop loss or take profit level ka estamal

forex market ke kamyab trading strategy stop loss or take profit level ka he estamal karte hey or forex market mein stop loss aik pehlay say tay shodah trading strategy hote hey jes mein aik trader trading say out ho jata hey jabkeh price en kay opposite chale jate jabkeh profit ka target bhe fix hota hey forex trade apnay risk ko manage kar saktay hein or apni mumkana entry ko bhe identify kar saktay hein takeh profit ko zyada say zyada leya ja sakta hey

Risk management swing trading

forex market mein risk management ka bohut he important pehlo hota hey kunkeh fore trader bohut he long period say ohdon par he faiz rehtay hein or forex market ay wabesta bohut he trading say agah hotay hein stop loss or profit kay target say tayon kar saktay hein or forex market mein overall risk ko kam kar kay portfolio ko motayan banya ja sakta hey

تبصرہ

Расширенный режим Обычный режим