++++Trading Mein Bearish Breakaway Pattern++++

Bearish breakaway pattern ek stock chart pattern hai jo market mein bearish reversal signal deta hai. Yeh pattern typically uptrend ke dauraan develop hota hai aur bearish reversal indicate karta hai. Is pattern mein, initially ek long bullish candle hoti hai, jo ki uptrend ko demonstrate karta hai. Uske baad, ek series of smaller bullish candles follow hoti hai, indicating continued bullish momentum.

indicating strong selling pressure.

++++Trading Mein Bearish Breakaway Pattern Ki Tashreeh++++

Bearish breakaway pattern ka detailed description:

Bearish breakaway pattern ek stock chart pattern hai jo market mein bearish reversal signal deta hai. Yeh pattern typically uptrend ke dauraan develop hota hai aur bearish reversal indicate karta hai. Is pattern mein, initially ek long bullish candle hoti hai, jo ki uptrend ko demonstrate karta hai. Uske baad, ek series of smaller bullish candles follow hoti hai, indicating continued bullish momentum.

indicating strong selling pressure.

++++Trading Mein Bearish Breakaway Pattern Ki Tashreeh++++

Bearish breakaway pattern ka detailed description:

- Initial Bullish Phase:

- Yeh pattern typically ek uptrend ke dauraan develop hota hai. Pehla step hota hai ek long bullish candle ka formation, indicating strong buying pressure and continuation of the uptrend. Is candle ke size aur volume ko closely monitor kiya jata hai, as larger candles with high volume indicate stronger bullish momentum.

- Consolidation Phase:

- Iske baad, ek series of smaller bullish candles follow hoti hai, indicating consolidation or a brief pause in the uptrend. Yeh candles typically short in size hote hain aur unka range pehle bullish candle ke andar hi hota hai.

- Bearish Breakaway Candle:

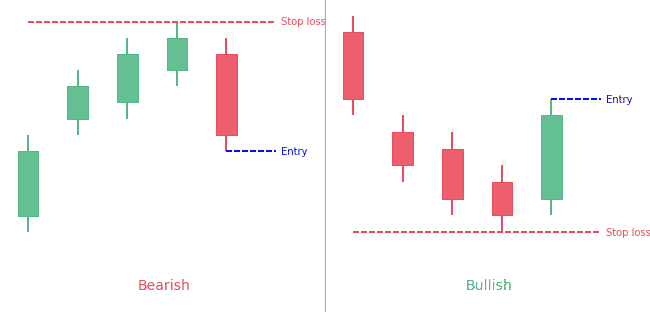

- Breakaway phase mein, ek large bearish candle develop hoti hai, jo ki previous bullish trend ko break karta hai. Is bearish candle ka size bada hota hai aur volume usually high hota hai, indicating strong selling pressure. Yeh candle bullish phase ke high levels se neeche close hoti hai, indicating a potential shift in market sentiment.

- Confirmation Phase:

- Is bearish candle ke baad, typically ek series of smaller bearish candles follow hoti hai, indicating confirmation of the bearish trend. Yeh candles usually small to medium size ke hote hain aur downward movement ko confirm karte hain.

- Volume Analysis:

- Volume plays a crucial role in confirming the validity of the bearish breakaway pattern. High volume on the bearish breakaway candle and subsequent bearish candles strengthens the signal, suggesting strong selling interest.

- Price Targets and Stop Loss:

- Traders is pattern ko analyze karke apne trading strategies develop karte hain. Price targets aur stop loss levels ko carefully define kiya jata hai, taking into consideration the pattern's implications and risk management principles.

تبصرہ

Расширенный режим Обычный режим