Buy Limit and Sell Limit in Forex Trading

Introduction

Dear Fellows,

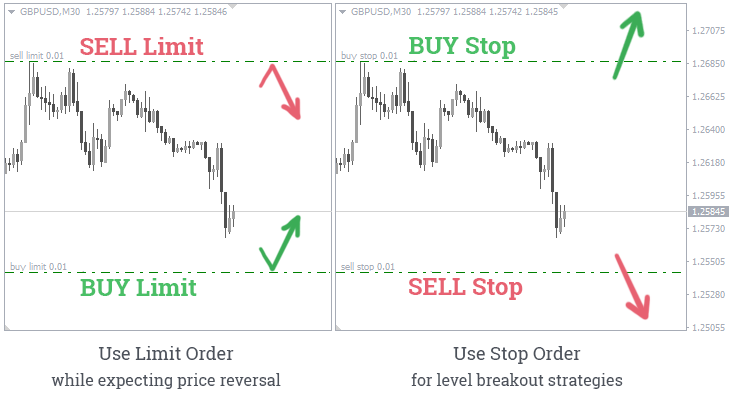

Sab say pehly ye k Market Mein trading karne ke liye different types ki technique maujud Hoti Hai. Awar in techniques may pending orders abhi Ek bahut hi best technique hai aur is pending orders ko trade apni trade ko open karte waqt use karte hain Jab vah market Mein bi ka order place karte hain. ye pencil ka order place karte hain to use Waqt vah real mein pending orders ko placed kar rahe hote hain isliye Tamam Hai vah pending orders ko properly tarike se study karna chahie aur Unka Achcha experience Hasil karne ke bad hi market Mein order placed karne chahiay. Awar Market Mein trading ke liye bee limit aur sell limit pending orders ki type se main se bahut hi special types hoti hai jinko traders apni trading ke liye select Karte Hain. Lekin Jab returns market Main bi limit ka order placed karte hain to use Waqt vah market Mein specific price ki movement ko check karte hain Agar vah price unhen buy ke signals provide karti hai to use Waqt wo market main use price Ki movement ko follow karte hue buy ka order placed kar dete Hain. Mazeed ye k Agar vah market Mein Hi Sell Ka order placed karte hain to use Waqt unhen market Mein sal ke liye specific price ko confirm karna hota hai aur jab market ki specific price ko confirm kar lete hain to use Waqt hi vah market mein market ki current situaion ko he madhe nazar rakhty howe order type kiya jata hai jis main har trha ki currennt sort e hal ko dehan main rkha jaata hai pending order main hum wo order lgaty hain jis ki hum ye hope rakhty hain k market es point par aghr ati hai tu hmara order khud he lag jay awar yah wo types hoty hain or pending orders main hum buy limit stop limit sell limit or buy limit k order lagaty haintrading karna hoti hay or is main trading karny kay liye is main order ko place karna hota hay or order ko place karny ki two types hoti hay jis main humain order ko place karna hota hay jis main first type hoti hay instant order ye order hota hain k jis main humain aik hi lamhay main order ko place karny ki saholat hoti hay is main humain usi time order ko place karna hota ha or usi time main achi eraning hasil ho sakti hain. Awar humain agr market kay bary main maloom nai ho or ya hum market say door hon or order ko matloba price kay any par place karna ho to hum is main pending order ka use kar sakty hain jis ki help say market main matloba price kay any tk humare trade place ho sakti hay magr humain acha nafa hoskta hian.

Importance

Fellows,

Eski imortance bhoot hain k Thread open kiya hai or Forex marke t main kam akrty hoay aap ko Inn Orders ke Bhoat zada Zrort hoty hain. Q k enn k use say hum ko apni Trading main Kafe zada Help hoti hai or aap Achy ay market man trade karty hain or wait kar kay kam karty hain in order kay lgany kay liya ap ko Market main movement ka Khas khyal rakna Hota hai iss liya aap ko Chaye ka aap inn orders Ko use karty hoay Zara Ehtiyat kiya Karein. Awar pir Enn orders ko use kar kay aap Ko amrket main Long Time kay liya Wait nahi karna Parta hai or aap ko In orders Ko use kar kay Acha Profit hasil kiya ja Sakta hain lekin iss Kay liya aap ko market main Apna Analyssi Zada strong karny ke Zrort hpti hai ku kay Week analysis per aap In ka use kar kay kafi Loss kar sakty hain. Awar buy Limit Hum market main tab use karty hain jab market Down Tredn main ho or Hum Apnay Analysis per trust ho kay Market nay kaha say Reversal Lyna Hai awar tab aap ko ess Orfders ko use karna Chaye iss say aap ko kafe Profit Ho sakta hai iss liyaa p ko Apny analysis Strong karny ke Zrort hai tab iss Ko use kiya karein.ess k ilawa Sell Limit Be Iss Order ke tarah hain lakin iss main Faraq Serf Itna Hai kay iss main aap ko market main Bullish trend main use kar sakty hain jiss ke Waja say ap ko iss Orders Bullish Reversal kay trend main use karna Hota hain.

Conclusion

Fellows,

Last mi ye k ye aik pending order hain k jis ka hamen kabhe kabhe use karna hota hae is main hota yeh hae ke hamne kabhe kabhe isko istemal karna hota hae tab ja kar he to hum is main kuch hasil kar lete hain is main hota yun hae ke hamne is main aik price set karne hote hain. But markt jese he us price tak jate hae to hamara order automatiically open ho jata hae or is tarah se active ho ke chalta rehta hae bas is waja se hamen bhe cahiye ke hum is main sahe tarah se kam kiya karen or ache tarah se market ka analysis kar ke is ko use kara karen tab he to hum is main kuch gain karne main hum kamyab ho he jate hain agar hum sahe se is main kam ko karte he hain to bas is ke liye hamen is main mehnat karne ho ge sahe tarah say use ho saky. How to use sell limit Enn dono pending orders ko use karn ka tareeqa bilkul bhe aik he jesa hae is main bas hamen cahiye ke hum is main same use tarah se is main price set kar ,en or isko samajhte howe hamen is main kam ko time dena hota hae tab he to hum is main success hasil karne main kamyab ho jaya karte hain or is tarah se hamne is main bahut faida milta hae to hamen is main se faida hasil kar lena cahiay hamen is main baut kuch hasil ho jaya karta hae agar hum is main se ese he pending orders ka taulq hota hain.

Thanks

Introduction

Dear Fellows,

Sab say pehly ye k Market Mein trading karne ke liye different types ki technique maujud Hoti Hai. Awar in techniques may pending orders abhi Ek bahut hi best technique hai aur is pending orders ko trade apni trade ko open karte waqt use karte hain Jab vah market Mein bi ka order place karte hain. ye pencil ka order place karte hain to use Waqt vah real mein pending orders ko placed kar rahe hote hain isliye Tamam Hai vah pending orders ko properly tarike se study karna chahie aur Unka Achcha experience Hasil karne ke bad hi market Mein order placed karne chahiay. Awar Market Mein trading ke liye bee limit aur sell limit pending orders ki type se main se bahut hi special types hoti hai jinko traders apni trading ke liye select Karte Hain. Lekin Jab returns market Main bi limit ka order placed karte hain to use Waqt vah market Mein specific price ki movement ko check karte hain Agar vah price unhen buy ke signals provide karti hai to use Waqt wo market main use price Ki movement ko follow karte hue buy ka order placed kar dete Hain. Mazeed ye k Agar vah market Mein Hi Sell Ka order placed karte hain to use Waqt unhen market Mein sal ke liye specific price ko confirm karna hota hai aur jab market ki specific price ko confirm kar lete hain to use Waqt hi vah market mein market ki current situaion ko he madhe nazar rakhty howe order type kiya jata hai jis main har trha ki currennt sort e hal ko dehan main rkha jaata hai pending order main hum wo order lgaty hain jis ki hum ye hope rakhty hain k market es point par aghr ati hai tu hmara order khud he lag jay awar yah wo types hoty hain or pending orders main hum buy limit stop limit sell limit or buy limit k order lagaty haintrading karna hoti hay or is main trading karny kay liye is main order ko place karna hota hay or order ko place karny ki two types hoti hay jis main humain order ko place karna hota hay jis main first type hoti hay instant order ye order hota hain k jis main humain aik hi lamhay main order ko place karny ki saholat hoti hay is main humain usi time order ko place karna hota ha or usi time main achi eraning hasil ho sakti hain. Awar humain agr market kay bary main maloom nai ho or ya hum market say door hon or order ko matloba price kay any par place karna ho to hum is main pending order ka use kar sakty hain jis ki help say market main matloba price kay any tk humare trade place ho sakti hay magr humain acha nafa hoskta hian.

Importance

Fellows,

Eski imortance bhoot hain k Thread open kiya hai or Forex marke t main kam akrty hoay aap ko Inn Orders ke Bhoat zada Zrort hoty hain. Q k enn k use say hum ko apni Trading main Kafe zada Help hoti hai or aap Achy ay market man trade karty hain or wait kar kay kam karty hain in order kay lgany kay liya ap ko Market main movement ka Khas khyal rakna Hota hai iss liya aap ko Chaye ka aap inn orders Ko use karty hoay Zara Ehtiyat kiya Karein. Awar pir Enn orders ko use kar kay aap Ko amrket main Long Time kay liya Wait nahi karna Parta hai or aap ko In orders Ko use kar kay Acha Profit hasil kiya ja Sakta hain lekin iss Kay liya aap ko market main Apna Analyssi Zada strong karny ke Zrort hpti hai ku kay Week analysis per aap In ka use kar kay kafi Loss kar sakty hain. Awar buy Limit Hum market main tab use karty hain jab market Down Tredn main ho or Hum Apnay Analysis per trust ho kay Market nay kaha say Reversal Lyna Hai awar tab aap ko ess Orfders ko use karna Chaye iss say aap ko kafe Profit Ho sakta hai iss liyaa p ko Apny analysis Strong karny ke Zrort hai tab iss Ko use kiya karein.ess k ilawa Sell Limit Be Iss Order ke tarah hain lakin iss main Faraq Serf Itna Hai kay iss main aap ko market main Bullish trend main use kar sakty hain jiss ke Waja say ap ko iss Orders Bullish Reversal kay trend main use karna Hota hain.

Conclusion

Fellows,

Last mi ye k ye aik pending order hain k jis ka hamen kabhe kabhe use karna hota hae is main hota yeh hae ke hamne kabhe kabhe isko istemal karna hota hae tab ja kar he to hum is main kuch hasil kar lete hain is main hota yun hae ke hamne is main aik price set karne hote hain. But markt jese he us price tak jate hae to hamara order automatiically open ho jata hae or is tarah se active ho ke chalta rehta hae bas is waja se hamen bhe cahiye ke hum is main sahe tarah se kam kiya karen or ache tarah se market ka analysis kar ke is ko use kara karen tab he to hum is main kuch gain karne main hum kamyab ho he jate hain agar hum sahe se is main kam ko karte he hain to bas is ke liye hamen is main mehnat karne ho ge sahe tarah say use ho saky. How to use sell limit Enn dono pending orders ko use karn ka tareeqa bilkul bhe aik he jesa hae is main bas hamen cahiye ke hum is main same use tarah se is main price set kar ,en or isko samajhte howe hamen is main kam ko time dena hota hae tab he to hum is main success hasil karne main kamyab ho jaya karte hain or is tarah se hamne is main bahut faida milta hae to hamen is main se faida hasil kar lena cahiay hamen is main baut kuch hasil ho jaya karta hae agar hum is main se ese he pending orders ka taulq hota hain.

Thanks

تبصرہ

Расширенный режим Обычный режим