Block order analysis forex trading mein ek important aspect hai jo large institutional traders, hedge funds, aur banks dwara use kiya jata hai. Yeh analysis un large orders ko samajhne aur unka impact market par evaluate karne mein madad karta hai. Yahan kuch key points hain block order analysis ke bare mein:

Conclusion

Overall, block order analysis forex trading mein institutional traders aur large market players ke liye crucial hai. Ye analysis unko market impact ko minimize karne aur efficient execution achieve karne mein madad karta hai.

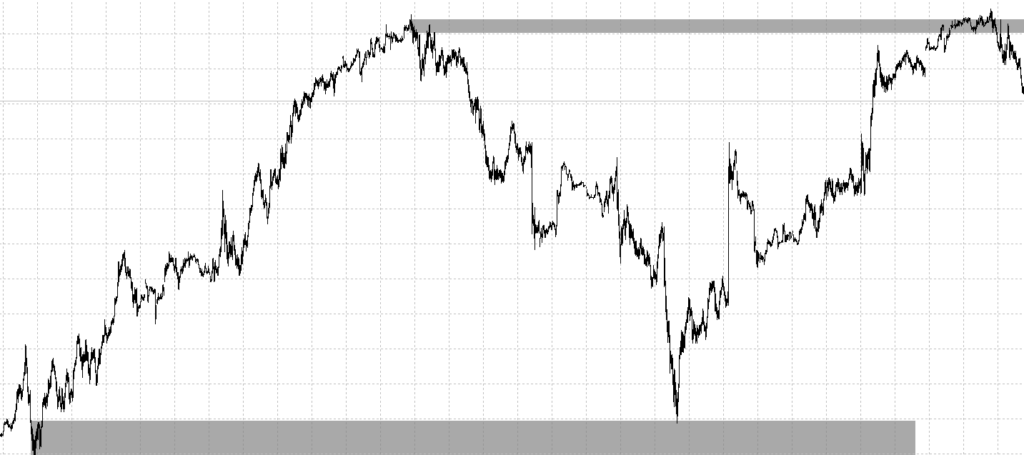

- Order Size and Impact: Block orders typically bahut bade sizes ke hote hain, jinka execution market par significant impact dalta hai. Block order analysis mein, traders ko order size ko analyze karna hota hai aur ye dekhna hota hai ki order ka execution kis extent par market par impact dal sakta hai.

- Liquidity Analysis: Block order analysis mein liquidity ka bhi dhyan diya jata hai. Agar market mein sufficient liquidity nahi hai, to large orders ke execution mein problem ho sakti hai aur price slippage ka risk bhi hota hai. Isliye, traders ko market liquidity ko evaluate karna zaroori hota hai block order analysis ke dauran.

- Price Impact: Block orders ke execution se market par price impact hota hai. Block order analysis mein, traders ko ye dekhna hota hai ki order ka execution kis tarah se price par asar dal raha hai aur kya ye market dynamics ko disturb kar raha hai.

- Market Depth: Block order analysis mein market depth ko bhi consider kiya jata hai. Market depth, ya order book, market mein kitni buy aur sell orders available hain, ye dikhata hai. Agar market depth kam hai, to large orders ke execution mein problem ho sakti hai aur price volatility badh sakti hai.

- Risk Management: Block order analysis ka ek important aspect risk management hai. Large orders ke execution se market volatility badh sakti hai aur price slippage ka risk hota hai. Isliye, traders ko risk management strategies implement karna zaroori hota hai block order execution ke time par.

Conclusion

Overall, block order analysis forex trading mein institutional traders aur large market players ke liye crucial hai. Ye analysis unko market impact ko minimize karne aur efficient execution achieve karne mein madad karta hai.

تبصرہ

Расширенный режим Обычный режим