What is Swing Trading in forex:

Swing trading forex market mein trading ke nuqta nazar ki aik shakal hai jis ka maqsad ghair shadi shuda trading ke din mein aksar aur taizi se tijarat karna hai, Swing trading qeemat ki naqal o harkat se faida uthany par markooz hai jo sirf aik taweel waqt ke frame mein hoti hai. yeh tareeqa un kharidaron ko appeal karta hai jin ke paas day trading ka ehad karne ka waqt nahi hai lekin phir bhi woh ghair mulki currency ki market mein fa-aal tor par hissa lena chahtay hain. Swing sarmaya car aam tor par fees ke andaaz, khaalato aur alamaat ke majmoay ki bunyaad par mumkina rasai aur ikhraj ke awamil ko samajhney ke liye takneeki tajzia ka istemaal karte hain. chand dinon se le kar teen hafton tak position barqarar rakh kar, Swing traders ka maqsad market ke utaar charhao ka faida uthana hai jis ke nateejay mein aamdani ke mawaqay peda ho satke hain.

Trading Analysis in Swing Trading:

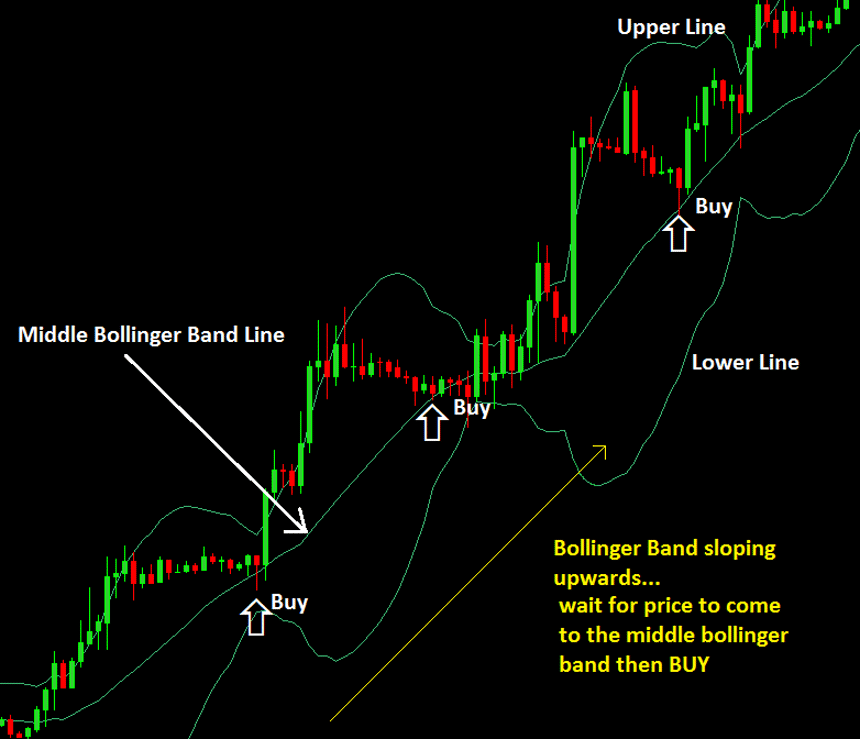

Takneeki tajzia Swing trading mein aik ahem kirdaar ada karta hai kyunkay sarmaya car bakhabar tijarti intikhab karne ke liye chart ke andaaz aur takneeki isharay par inhisaar karte hain. Swing trading mein istemaal honay walay aam takneeki tools mein Shifting Averages, rishta daar taaqat index ( are s aayi ) aur Stochastic oscillators jaisay oscillators, aur jhndon, maslason, aur sir aur kaandhon samait chart patteren shaamil hain. tajir rujhanaat, imdaad aur muzahmat ki hudood, aur mumkina ulat points se aagah honay ke liye tareekhi charge data ka tajzia karte hain. aik se ziyada alamaat aur namonon ko yakja karkay, Swing sarmaya karon ka maqsad apni kharidari aur farokht ke intabahat ki tasdeeq karna aur khatray ko muaser tareeqay se sanbhaalna hai. Swing kharidaron ke liye yeh bohat zaroori hai ke woh takneeki tshkhisi tasawurat ka thos ilm rakhen aur un ki Trading o farokht ki kamyabi ko khobsorat bananay ke liye Swing Trading o farokht ke tanazur mein un par amal kaisay karen.

Risk Management in Swing Trading:

Swing taajiron ke liye –apne sarmaye ki hifazat aur salahiyat ke nuqsanaat ko kam karne ke liye mo-asar mauqa ka intizam bohat zaroori hai. chunkay Swing trading mein kayi dinon se le kar hafton tak pozishnon ka tahaffuz shaamil hota hai, is liye sarmaya karon ko function size, nuqsaan ke orders ko roknay aur khatray ki qader ke tanasub samait awamil ko yaad rakhnay ki zaroorat hai. position size se morad aam account ke size aur khatray ki rawadari ki bunyaad par har tabdeeli ke liye mukhtas kiye jane walay sarmaye ki miqdaar ka taayun karna hai. stop las orders ka istemaal tijarat se bahar jane ke liye kya jata hai agar market dealer ke khilaaf pehlay se tay shuda satah se agay barh jati hai, jis se zaroorat se ziyada nuqsanaat ko roknay mein madad millti hai. tajir har tijarat par anay walay khatray ke muqablay mein salahiyat ke inaam ka bhi taayun karte hain, jis ka maqsad sazgaar rissk aur inaam ke tanasub ko yakeeni banana hai taakay mojooda tijarat khoye hue tijarat se kahin ziyada ho. mauqa ke intizam ki thos techniques ko nafiz karkay, Swing Trading –apne Trading o farokht ke sarmaye ka difaa kar satke hain aur aakhir mein apni majmoi munafe ko behtar bana satke hain.

Developing Trading Plane for Swing Trading:

Swing trading ke liye aik achi terhan se mutayyan trading plan ahem hai, kyunkay is mein market tak rasai aur bahar jane ke mayarat, mauqa par qaboo panay ki policia, aur bunyadi tijarti ahdaaf samait dealer ke nuqta nazar ka khaka paish kya jata hai. tijarti mansoobah taajiron ko nazam o zabt barqarar rakhnay aur apni hikmat e amli par markooz rehne ke qabil banata hai, jazbati intikhab ko rokta hai jis ke nateejay mein kharidari aur farokht ke jazbati faislay ho satke hain. Swing Trading o farokht ke liye tijarti mansoobah banatay waqt, sarmaya karon ko un anasir ko yaad rakhna chahiye jin mein market ka tajzia, set up ke mayarat mein tabdeeli, rule sayzng ki tajaweez, rissk control ke qawaid, aur majmoi karkardagi ka jaiza lainay ke liye jaizay ke amal shaamil hain. wazeh ahdaaf tay karkay aur aik mabni mansoobay par amal karkay, Swing tajir apni Trading o farokht ki taknik mein mustaqil mizaji barqarar rakh satke hain aur bazaar ke halaat ko sahih tareeqay se tabdeel karne ke mutabiq dhaal satke hain. musalsal taraqqi aur Swing trading mein taweel mudti kamyabi ke liye majmoi karkardagi aur market ki harkiyaat ki bunyaad par trading plan ka baqaidagi se jaiza lena aur usay adjust karna bohat zaroori hai.

Swing trading forex market mein trading ke nuqta nazar ki aik shakal hai jis ka maqsad ghair shadi shuda trading ke din mein aksar aur taizi se tijarat karna hai, Swing trading qeemat ki naqal o harkat se faida uthany par markooz hai jo sirf aik taweel waqt ke frame mein hoti hai. yeh tareeqa un kharidaron ko appeal karta hai jin ke paas day trading ka ehad karne ka waqt nahi hai lekin phir bhi woh ghair mulki currency ki market mein fa-aal tor par hissa lena chahtay hain. Swing sarmaya car aam tor par fees ke andaaz, khaalato aur alamaat ke majmoay ki bunyaad par mumkina rasai aur ikhraj ke awamil ko samajhney ke liye takneeki tajzia ka istemaal karte hain. chand dinon se le kar teen hafton tak position barqarar rakh kar, Swing traders ka maqsad market ke utaar charhao ka faida uthana hai jis ke nateejay mein aamdani ke mawaqay peda ho satke hain.

Trading Analysis in Swing Trading:

Takneeki tajzia Swing trading mein aik ahem kirdaar ada karta hai kyunkay sarmaya car bakhabar tijarti intikhab karne ke liye chart ke andaaz aur takneeki isharay par inhisaar karte hain. Swing trading mein istemaal honay walay aam takneeki tools mein Shifting Averages, rishta daar taaqat index ( are s aayi ) aur Stochastic oscillators jaisay oscillators, aur jhndon, maslason, aur sir aur kaandhon samait chart patteren shaamil hain. tajir rujhanaat, imdaad aur muzahmat ki hudood, aur mumkina ulat points se aagah honay ke liye tareekhi charge data ka tajzia karte hain. aik se ziyada alamaat aur namonon ko yakja karkay, Swing sarmaya karon ka maqsad apni kharidari aur farokht ke intabahat ki tasdeeq karna aur khatray ko muaser tareeqay se sanbhaalna hai. Swing kharidaron ke liye yeh bohat zaroori hai ke woh takneeki tshkhisi tasawurat ka thos ilm rakhen aur un ki Trading o farokht ki kamyabi ko khobsorat bananay ke liye Swing Trading o farokht ke tanazur mein un par amal kaisay karen.

Risk Management in Swing Trading:

Swing taajiron ke liye –apne sarmaye ki hifazat aur salahiyat ke nuqsanaat ko kam karne ke liye mo-asar mauqa ka intizam bohat zaroori hai. chunkay Swing trading mein kayi dinon se le kar hafton tak pozishnon ka tahaffuz shaamil hota hai, is liye sarmaya karon ko function size, nuqsaan ke orders ko roknay aur khatray ki qader ke tanasub samait awamil ko yaad rakhnay ki zaroorat hai. position size se morad aam account ke size aur khatray ki rawadari ki bunyaad par har tabdeeli ke liye mukhtas kiye jane walay sarmaye ki miqdaar ka taayun karna hai. stop las orders ka istemaal tijarat se bahar jane ke liye kya jata hai agar market dealer ke khilaaf pehlay se tay shuda satah se agay barh jati hai, jis se zaroorat se ziyada nuqsanaat ko roknay mein madad millti hai. tajir har tijarat par anay walay khatray ke muqablay mein salahiyat ke inaam ka bhi taayun karte hain, jis ka maqsad sazgaar rissk aur inaam ke tanasub ko yakeeni banana hai taakay mojooda tijarat khoye hue tijarat se kahin ziyada ho. mauqa ke intizam ki thos techniques ko nafiz karkay, Swing Trading –apne Trading o farokht ke sarmaye ka difaa kar satke hain aur aakhir mein apni majmoi munafe ko behtar bana satke hain.

Developing Trading Plane for Swing Trading:

Swing trading ke liye aik achi terhan se mutayyan trading plan ahem hai, kyunkay is mein market tak rasai aur bahar jane ke mayarat, mauqa par qaboo panay ki policia, aur bunyadi tijarti ahdaaf samait dealer ke nuqta nazar ka khaka paish kya jata hai. tijarti mansoobah taajiron ko nazam o zabt barqarar rakhnay aur apni hikmat e amli par markooz rehne ke qabil banata hai, jazbati intikhab ko rokta hai jis ke nateejay mein kharidari aur farokht ke jazbati faislay ho satke hain. Swing Trading o farokht ke liye tijarti mansoobah banatay waqt, sarmaya karon ko un anasir ko yaad rakhna chahiye jin mein market ka tajzia, set up ke mayarat mein tabdeeli, rule sayzng ki tajaweez, rissk control ke qawaid, aur majmoi karkardagi ka jaiza lainay ke liye jaizay ke amal shaamil hain. wazeh ahdaaf tay karkay aur aik mabni mansoobay par amal karkay, Swing tajir apni Trading o farokht ki taknik mein mustaqil mizaji barqarar rakh satke hain aur bazaar ke halaat ko sahih tareeqay se tabdeel karne ke mutabiq dhaal satke hain. musalsal taraqqi aur Swing trading mein taweel mudti kamyabi ke liye majmoi karkardagi aur market ki harkiyaat ki bunyaad par trading plan ka baqaidagi se jaiza lena aur usay adjust karna bohat zaroori hai.

تبصرہ

Расширенный режим Обычный режим