Forex Trading

Introduction

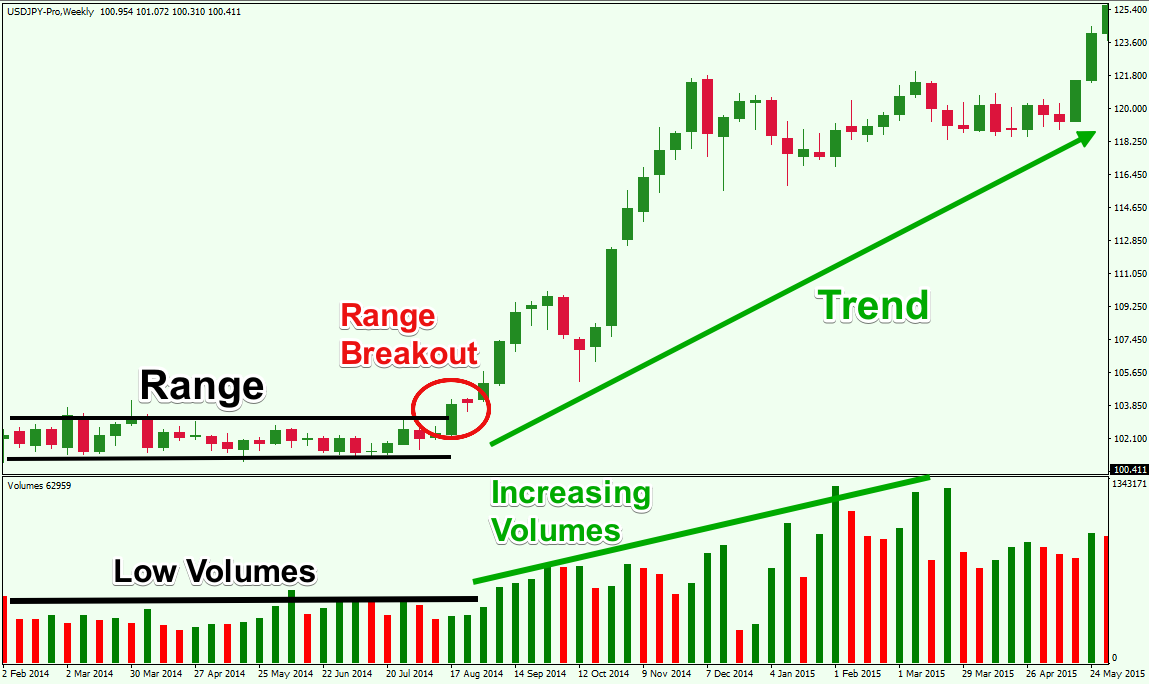

Forex trading ek aise shobha hai jahan investors currencies (mudraayein) ko kharidte hain aur bechte hain, ummidwar un currencies ki keemat mein izafa dekh kar faida uthate hain. Yeh ek bohot bada market hai jahan har kism ke traders mojood hote hain. Forex trading ke mukhtalif range hai, jo neeche bayan kiye gaye hain.

Intraday Trading

Intraday trading mein traders ek din mein hi kuch transactions karte hain. Yeh traders short-term profit hasil karne ki koshish karte hain aur din bhar ke market fluctuations ka faida uthate hain. Intraday trading mein jhatpat faislay aur tezi se kharidari aur farokht ki jati hai.

Swing Trading

Swing trading mein traders market ke fluctuations aur trend ko dekhte hue positions ko kuch din ya hafton ke liye hold karte hain. Yeh traders medium-term ke liye positions hold karte hain aur market ke chhote aur bade trends ka faida uthate hain.

Positional Trading

Positional trading mein traders long-term positions hold karte hain, jo kuch hafton se lekar mahino tak chal sakte hain. Yeh traders market ke lambay trend ka faida uthate hain aur mudraon ke moolya mein bade tabdeeliyon ka intezar karte hain.

Scalping

Scalping mein traders chhoti chhoti mudraayein kharidte hain aur unhe jald bechte hain, chunanche unka maqsad chhote profit karna hota hai. Yeh traders market ke chhoti fluctuations ka faida uthate hain aur tezi se multiple trades execute karte hain.

Automated Trading

Automated trading mein traders computer programs aur algorithms ka istemal karte hain jo unke liye khud tijarat karte hain. Yeh programs market ki analysis karte hain aur bade transactions ko bina insan ke interference ke execute karte hain.

Social Trading

Social trading mein traders online platforms ka istemal karte hain jahan wo dusre traders ki strategies aur trades ko dekhte hain aur unki copy trading karte hain. Yeh tarika un traders ke liye faida mand hota hai jo naye hain aur market ke hawale se kam ilm rakhte hain.

Algorithmic Trading

Algorithmic trading mein traders computer algorithms ka istemal karte hain jo market ki data aur patterns ko analyze karte hain aur khud ba khud trades ko execute karte hain. Yeh tarika tezi se trades ko execute karne aur market ke patterns ko samajhne mein madadgar hota hai.

Har tarah ki forex trading apne faide aur nuksan ke saath aati hai, aur har ek trader apne risk tolerance aur trading style ke mutabiq apni pasandeeda trading range ko chunta hai. Samajhdari se range chunna aur market ki analysis karna zaroori hai taake traders apne maqsad aur expectations ko pura kar sakein.

Introduction

Forex trading ek aise shobha hai jahan investors currencies (mudraayein) ko kharidte hain aur bechte hain, ummidwar un currencies ki keemat mein izafa dekh kar faida uthate hain. Yeh ek bohot bada market hai jahan har kism ke traders mojood hote hain. Forex trading ke mukhtalif range hai, jo neeche bayan kiye gaye hain.

Intraday Trading

Intraday trading mein traders ek din mein hi kuch transactions karte hain. Yeh traders short-term profit hasil karne ki koshish karte hain aur din bhar ke market fluctuations ka faida uthate hain. Intraday trading mein jhatpat faislay aur tezi se kharidari aur farokht ki jati hai.

Swing Trading

Swing trading mein traders market ke fluctuations aur trend ko dekhte hue positions ko kuch din ya hafton ke liye hold karte hain. Yeh traders medium-term ke liye positions hold karte hain aur market ke chhote aur bade trends ka faida uthate hain.

Positional Trading

Positional trading mein traders long-term positions hold karte hain, jo kuch hafton se lekar mahino tak chal sakte hain. Yeh traders market ke lambay trend ka faida uthate hain aur mudraon ke moolya mein bade tabdeeliyon ka intezar karte hain.

Scalping

Scalping mein traders chhoti chhoti mudraayein kharidte hain aur unhe jald bechte hain, chunanche unka maqsad chhote profit karna hota hai. Yeh traders market ke chhoti fluctuations ka faida uthate hain aur tezi se multiple trades execute karte hain.

Automated Trading

Automated trading mein traders computer programs aur algorithms ka istemal karte hain jo unke liye khud tijarat karte hain. Yeh programs market ki analysis karte hain aur bade transactions ko bina insan ke interference ke execute karte hain.

Social Trading

Social trading mein traders online platforms ka istemal karte hain jahan wo dusre traders ki strategies aur trades ko dekhte hain aur unki copy trading karte hain. Yeh tarika un traders ke liye faida mand hota hai jo naye hain aur market ke hawale se kam ilm rakhte hain.

Algorithmic Trading

Algorithmic trading mein traders computer algorithms ka istemal karte hain jo market ki data aur patterns ko analyze karte hain aur khud ba khud trades ko execute karte hain. Yeh tarika tezi se trades ko execute karne aur market ke patterns ko samajhne mein madadgar hota hai.

Har tarah ki forex trading apne faide aur nuksan ke saath aati hai, aur har ek trader apne risk tolerance aur trading style ke mutabiq apni pasandeeda trading range ko chunta hai. Samajhdari se range chunna aur market ki analysis karna zaroori hai taake traders apne maqsad aur expectations ko pura kar sakein.

تبصرہ

Расширенный режим Обычный режим