Trading With Scoop Candlestick Pattren.

Scoop Candlestick Pattern: A Trading Guide

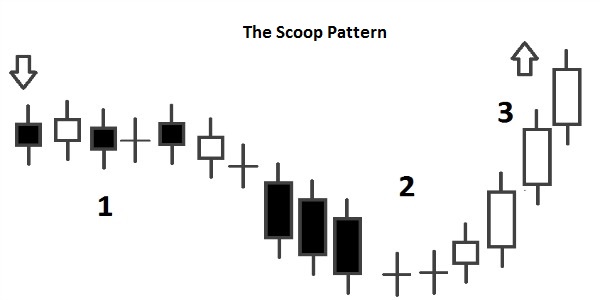

1. Introduction to Scoop Candlestick Pattern: Scoop candlestick pattern ek price action pattern hai jo market sentiment aur potential trend reversals ko indicate karta hai. Is pattern mein ek specific candlestick formation ko dekhte hue traders entry aur exit points tay karte hain.

2. Identifying Scoop Candlestick Pattern: a. Candlestick Formation: Scoop pattern ek single candlestick formation hota hai jismein candle ki body ko dekha jata hai. b. Characteristics: Scoop pattern mein candle ki body bottom aur top ke beech mein chhoti si range mein hoti hai, resembling a scoop shape.

3. Trading Strategies with Scoop Candlestick Pattern: a. Bullish Scoop Pattern: Jab ek bullish scoop pattern form hota hai, yani candle ki body ke bottom aur top ke beech mein ek scoop shape dikhayi deta hai, toh traders consider karte hain ke market mein buying pressure hai aur price ka trend upward shift hone wala hai. Is situation mein traders long positions enter karte hain. b. Bearish Scoop Pattern: Jab ek bearish scoop pattern form hota hai, yani candle ki body ke bottom aur top ke beech mein ek scoop shape dikhayi deta hai, toh traders consider karte hain ke market mein selling pressure hai aur price ka trend downward shift hone wala hai. Is situation mein traders short positions enter karte hain.

4. Entry and Exit Points: a. Entry Points: Scoop candlestick pattern ke formation ke baad, traders entry points tay karte hain. Agar bullish scoop pattern hai to entry point candle ke high par set kiya jata hai aur agar bearish scoop pattern hai to entry point candle ke low par set kiya jata hai. b. Exit Points: Stop loss aur target levels traders ke risk appetite aur market conditions ke according tay kiye jate hain. Stop loss candle ke opposite side aur target levels resistance ya support levels ke near set kiye jate hain.

5. Confirmation and Risk Management: a. Confirmation: Scoop candlestick pattern ko confirm karne ke liye traders doosre technical indicators aur price action ko dekhte hain jaise ki volume, trend lines, aur oscillators. b. Risk Management: Traders apne risk management rules follow karte hain jaise ki position sizing, stop losses, aur risk-reward ratio maintain karna.

6. Examples of Trading with Scoop Candlestick Pattern: a. Bullish Scoop Pattern Example: Agar ek bullish scoop pattern form hota hai near key support level par, aur volume bhi increase ho raha hai, toh traders long positions enter kar sakte hain. b. Bearish Scoop Pattern Example: Agar ek bearish scoop pattern form hota hai near key resistance level par, aur volume bhi increase ho raha hai, toh traders short positions enter kar sakte hain.

7. Conclusion: Scoop candlestick pattern ek powerful tool hai jo traders ko market sentiment aur potential trend reversals ke bare mein indicate karta hai. Lekin, is pattern ko istemal karte waqt traders ko proper confirmation aur risk management ka dhyan rakhna zaroori hai taake accurate aur profitable trades kiya ja sakein.

Scoop Candlestick Pattern: A Trading Guide

1. Introduction to Scoop Candlestick Pattern: Scoop candlestick pattern ek price action pattern hai jo market sentiment aur potential trend reversals ko indicate karta hai. Is pattern mein ek specific candlestick formation ko dekhte hue traders entry aur exit points tay karte hain.

2. Identifying Scoop Candlestick Pattern: a. Candlestick Formation: Scoop pattern ek single candlestick formation hota hai jismein candle ki body ko dekha jata hai. b. Characteristics: Scoop pattern mein candle ki body bottom aur top ke beech mein chhoti si range mein hoti hai, resembling a scoop shape.

3. Trading Strategies with Scoop Candlestick Pattern: a. Bullish Scoop Pattern: Jab ek bullish scoop pattern form hota hai, yani candle ki body ke bottom aur top ke beech mein ek scoop shape dikhayi deta hai, toh traders consider karte hain ke market mein buying pressure hai aur price ka trend upward shift hone wala hai. Is situation mein traders long positions enter karte hain. b. Bearish Scoop Pattern: Jab ek bearish scoop pattern form hota hai, yani candle ki body ke bottom aur top ke beech mein ek scoop shape dikhayi deta hai, toh traders consider karte hain ke market mein selling pressure hai aur price ka trend downward shift hone wala hai. Is situation mein traders short positions enter karte hain.

4. Entry and Exit Points: a. Entry Points: Scoop candlestick pattern ke formation ke baad, traders entry points tay karte hain. Agar bullish scoop pattern hai to entry point candle ke high par set kiya jata hai aur agar bearish scoop pattern hai to entry point candle ke low par set kiya jata hai. b. Exit Points: Stop loss aur target levels traders ke risk appetite aur market conditions ke according tay kiye jate hain. Stop loss candle ke opposite side aur target levels resistance ya support levels ke near set kiye jate hain.

5. Confirmation and Risk Management: a. Confirmation: Scoop candlestick pattern ko confirm karne ke liye traders doosre technical indicators aur price action ko dekhte hain jaise ki volume, trend lines, aur oscillators. b. Risk Management: Traders apne risk management rules follow karte hain jaise ki position sizing, stop losses, aur risk-reward ratio maintain karna.

6. Examples of Trading with Scoop Candlestick Pattern: a. Bullish Scoop Pattern Example: Agar ek bullish scoop pattern form hota hai near key support level par, aur volume bhi increase ho raha hai, toh traders long positions enter kar sakte hain. b. Bearish Scoop Pattern Example: Agar ek bearish scoop pattern form hota hai near key resistance level par, aur volume bhi increase ho raha hai, toh traders short positions enter kar sakte hain.

7. Conclusion: Scoop candlestick pattern ek powerful tool hai jo traders ko market sentiment aur potential trend reversals ke bare mein indicate karta hai. Lekin, is pattern ko istemal karte waqt traders ko proper confirmation aur risk management ka dhyan rakhna zaroori hai taake accurate aur profitable trades kiya ja sakein.

تبصرہ

Расширенный режим Обычный режим