Trading With Scoop Candlestick Pattren.

Scoop Candlestick Pattern: Trade Karne Ka Aik Tareeqa

Introduction (Tashreeh): Scoop candlestick pattern ek mukhtasir lekin ahem technical analysis tool hai jo traders ko market trends ka pata lagane mein madad karta hai. Is pattern ki pehchaan, price action analysis ke zariye hoti hai.

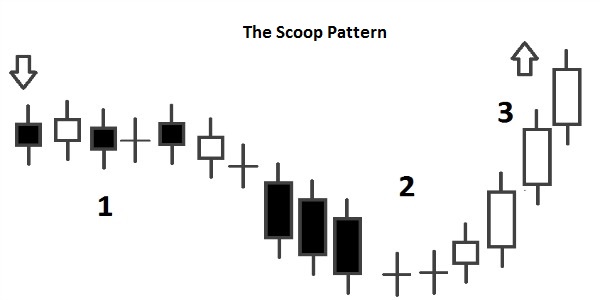

Scoop Candlestick Pattern (Scoop Mumkir Mumlikat): Scoop candlestick pattern ek bullish reversal pattern hai jo market mein bearish trend ke bad aata hai. Is pattern mein, do candlesticks hoti hain: pehli candlestick downtrend ke doran form hoti hai aur doosri candlestick ise follow karti hai, jo bullish reversal indicate karti hai.

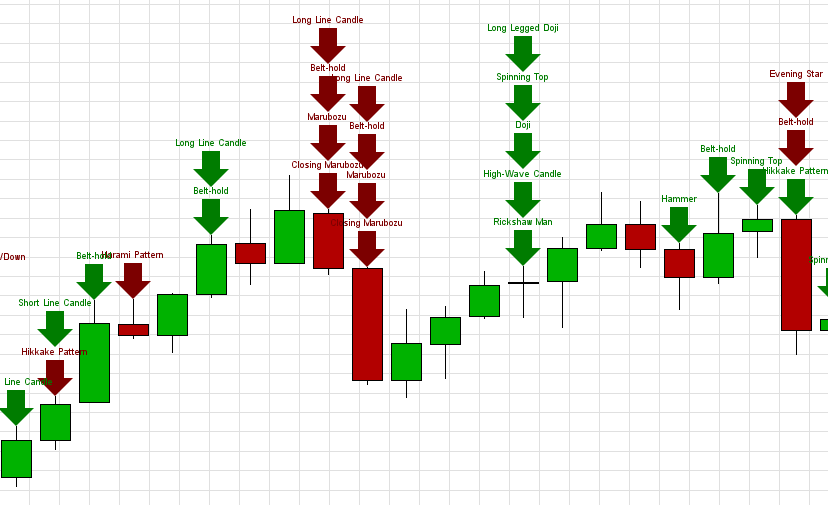

Kaise Pehchanein (Identification): Scoop candlestick pattern ko pehchanne ke liye, pehle downtrend mein ek long bearish candlestick dekhi jaati hai. Fir, doosre candlestick mein price gap down hoti hai, lekin candlestick ka range chhota hota hai aur woh doji ya small body candle hoti hai, jo bullish sentiment ko darust karti hai.

Trading Strategy (Trade Karne Ka Tareeqa): Scoop candlestick pattern ko trading ke liye istemal karne ka tareeqa simple hai. Jab market mein scoop pattern nazar aaye, traders long positions le sakte hain. Entry point candlestick ke high par rakha jaata hai, aur stop-loss order low ke neeche lagaya jaata hai.

Risk Management (Khatra Nigrani): Har trade mein risk management ka khayal rakhna zaroori hai. Stop-loss order ki sahi jagah par lagana, jisse nuksan kam ho sake, mahatvapurna hai.

Conclusion (Nateeja): Scoop candlestick pattern, market trends ko samajhne aur profitable trading opportunities dhundhne mein madadgar hai. Isko samajhne aur istemal karne se pehle, traders ko iski sahi tashreeh aur practical application ko samajhna zaroori hai.

Scoop Candlestick Pattern: Trade Karne Ka Aik Tareeqa

Introduction (Tashreeh): Scoop candlestick pattern ek mukhtasir lekin ahem technical analysis tool hai jo traders ko market trends ka pata lagane mein madad karta hai. Is pattern ki pehchaan, price action analysis ke zariye hoti hai.

Scoop Candlestick Pattern (Scoop Mumkir Mumlikat): Scoop candlestick pattern ek bullish reversal pattern hai jo market mein bearish trend ke bad aata hai. Is pattern mein, do candlesticks hoti hain: pehli candlestick downtrend ke doran form hoti hai aur doosri candlestick ise follow karti hai, jo bullish reversal indicate karti hai.

Kaise Pehchanein (Identification): Scoop candlestick pattern ko pehchanne ke liye, pehle downtrend mein ek long bearish candlestick dekhi jaati hai. Fir, doosre candlestick mein price gap down hoti hai, lekin candlestick ka range chhota hota hai aur woh doji ya small body candle hoti hai, jo bullish sentiment ko darust karti hai.

Trading Strategy (Trade Karne Ka Tareeqa): Scoop candlestick pattern ko trading ke liye istemal karne ka tareeqa simple hai. Jab market mein scoop pattern nazar aaye, traders long positions le sakte hain. Entry point candlestick ke high par rakha jaata hai, aur stop-loss order low ke neeche lagaya jaata hai.

Risk Management (Khatra Nigrani): Har trade mein risk management ka khayal rakhna zaroori hai. Stop-loss order ki sahi jagah par lagana, jisse nuksan kam ho sake, mahatvapurna hai.

Conclusion (Nateeja): Scoop candlestick pattern, market trends ko samajhne aur profitable trading opportunities dhundhne mein madadgar hai. Isko samajhne aur istemal karne se pehle, traders ko iski sahi tashreeh aur practical application ko samajhna zaroori hai.

تبصرہ

Расширенный режим Обычный режим